A New Top Pick [Revealed]

Last Chance to Join High Yield Landlord at the $399 Introductory Rate – Price Increases to $499 Any Day Now!

Act now to secure your $100 introductory discount before it disappears for good. We’re making this change to limit new sign-ups and dedicate even more of our time and attention to serving our 2,000 existing members. That means this is your final opportunity to join High Yield Landlord at a reduced rate.

When you join today, you’ll gain immediate access to our Top Investment Picks for July 2025, detailed real estate strategies, and a community of like-minded investors — all backed by thousands of hours of research and over $100,000 invested annually into finding the best opportunities in the REIT market.

$100 off your first year

Trusted by 2,000 members

500+ five-star reviews

If you’ve been thinking about joining, now is the time. With our 14-day free trial, you have nothing to lose and everything to gain!

Our New Top Pick

Late last year, we sold our position in Regency Centers (REG) at nearly $75 per share and made the following note:

"Great REIT, but at these levels, there is little upside left and the yield is too low at just 3.7%. The goal of the Retirement Portfolio is to maximize safe income and we can do that better than that, especially in today's market. Retail is a hot asset class right, but as Warren Buffett has famously said: you should aim to "buy from the fearful and sell to the greedy". We think that there are better opportunities in other property sectors so we sold our entire position. We more than doubled our money on this investment."

Even then, we were sad to let go of it.

Grocery-anchored service-oriented strip centers are performing very well today. They enjoy high occupancy rates and steady rent growth, and this is unlikely to change anytime soon.

There has been very little new supply built over the past decade, and given how expensive it has become to build new properties, rents would need to rise by an estimated 65% on average for new development projects to become economically feasible:

Therefore, these REITs are likely to keep enjoying steady 3-5% same property NOI growth for years to come. Best of all, these necessity-based properties offer great inflation protection and are recession-resistant.

The problem is the valuation.

REG has come down a bit since we sold it, but it is still not in our buy range.

However, one of its close peers has recently caught our attention…

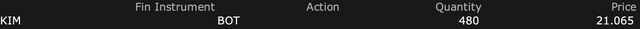

We are today initiating a position in Kimco Realty (KIM). We just bought 480 shares of the company for our Retirement Portfolio:

Nearly all of its properties are anchored by a grocery store and focus on essential services and necessity-based goods. Moreover, its properties are very well located, in high-barrier-to-entry first-ring suburbs of key sunbelt and coastal markets.

Its properties are currently enjoying a very high occupancy rate of nearly 96%. For retail real estate, this is effectively full occupancy, as some level of tenant turnover is always expected, and certain spaces, such as corner or "elbow" units with limited visibility or access, are notoriously difficult to lease.

Its same property NOI growth was nearly 4% in the last quarter, aided by 48.7% releasing spreads on new leases - the highest in over 7 years!

This 3-5% same property NOI growth is expected to continue for a long time to come as its leases enjoy contractual rent bumps, and its leases are deeply below market, allowing for large upward rent adjustments as its leases gradually expire.

In addition to that, the REIT retains about 40% of its FFO and maintains a fortress A-rated balance sheet with significant capacity to take on new debt to reinvest in growth at a positive spread. It also has great opportunities to recycle capital at a positive spread in its portfolio because it owns lots of ground leases, generating about 9% of its total rents, which could be sold to raise capital and reinvested. This ground lease portfolio also has a huge 70% mark-to-market.

The REIT also has several development and redevelopment opportunities in its portfolio, with targeted initial yields of 8-10%:

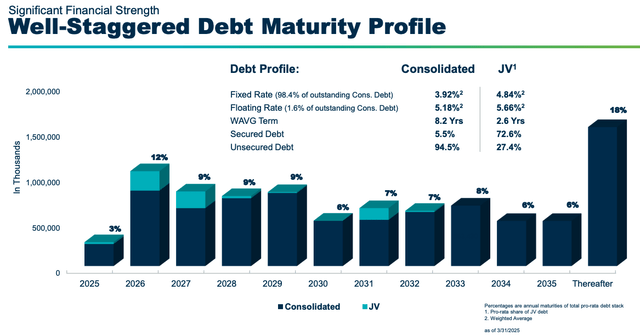

The REIT's debt-to-EBITDA is a conservative 5.5x, and its maturities are long at 8.2 years on average and well-staggered. This has earned it an A- rating from Fitch (1 of just 11 REITs) and a BBB+ rating with positive outlook from S&P and Moody's. The REIT has recently raised new debt with an 11-year maturity at a 5.3% interest rate.

So the REIT has great assets, a strong balance sheet, great long-term organic growth prospects, and an opportunity to create significant value by selling ground leases and/or raising new debt to reinvest at a positive spread.

Typically, such REITs trade at high valuations, especially since this is a fairly defensive, recession-resistant property sector.

Yet, KIM is currently trading at an estimated 25% discount to its NAV and 12x FFO. As a result, its management has been buying back shares this year. In April, they bought back 3 million shares at just shy of $20 per share, a 5% lower share price than today, citing its low valuation as the motivation.

Why is it so cheap then?

Firstly, just like our Core Portfolio holding, Kite Realty (KRG), KIM is also dealing with some bad debt in 2025, which will result in slower same-property NOI growth. It has guided for 2.5% same-property NOI growth this year, which is below average. The market is very focused on short-term results, and therefore, it is disappointed in this. However, we think that it is a case of short-term pain for long-term gain. Yes, they will suffer about 100 basis points of credit losses in 2025, but this will allow them to redevelop and release the freshly vacated space to stronger tenants at higher rents, benefiting them in 2026.

Secondly, because of these credit losses, plus rising interest expense, they have guided to grow their FFO per share by "just" 4.5% at the mid-point in 2025. That is a solid growth rate, but it is not that impressive.

I think that as KIM's organic growth accelerates in 2026 due to the lack of similar credit losses, and/or it stops facing the headwind of rising interest expense, its FFO per share growth will accelerate to the 6-8% annual range. As this happens, the market is likely to price it at closer to 15-18x FFO, resulting in about 30% upside from here.

While we wait, we earn a near 5% dividend yield, and the REIT will keep creating another 6-8% of value with its rent growth, reinvestment of retained cash flow, and capital recycling.

So even ignoring any multiple expansion, we should be well-positioned to earn double-digit total returns. On top of that, we enjoy strong margin of safety and potential upside in the future.

That makes KIM a very compelling REIT for our Retirement Portfolio. It is essentially a safer, but potentially slightly less rewarding version of Kite Realty, which we hold in our Core Portfolio.

Closing Note

To recap, KIM is a great fit for our Retirement Portfolio because:

It is a large REIT with a $14 billion market cap.

It has an A- rated balance sheet with long debt maturities.

Its grocery-anchored properties are enjoying 3-5% same-property growth.

The REIT retains 42% of its FFO to reinvest in growth.

Despite having a low payout ratio, it offers a near 5% dividend yield.

Its yield is so much higher than that of REG because it trades at just 12x FFO, compared to 16x for REG.

Your timing is perfect! We’ve just released our latest top investment picks for July, and by joining today, you’ll gain immediate access to these exciting opportunities.

We invest thousands of hours and over $100,000 annually into researching the most profitable investment opportunities—all to bring you real estate strategies at just a fraction of the cost.

Our approach has earned us 500+ five-star reviews from satisfied members who are already seeing the benefits.

For a limited-time, we are offering a $100 discount to new members. Don’t miss out—join now and start maximizing your returns!