Activist REIT Investor Bets Big On Senior Housing

Dear Landlords,

I want to extend a warm welcome to all our new members! We recommend that you start by reading our Welcome Letter by clicking here. It explains why we invest in real estate through REITs and how to get started.

As a reminder, our most recent "Portfolio Review" was shared with the members of High Yield Landlord on July 3rd, 2024, and you can read it by clicking here.

You can also access our three portfolios via Google Sheets by clicking here.

New members can start researching positions marked as Strong Buy and Buy while taking into account the corresponding risk ratings.

If you have any questions or need assistance, please let us know.

==============================

Important Note

Earlier this week, we mentioned in our Portfolio Review that we were doing research on National Health Investors (NHI) at the moment. It is a senior housing REIT that popped on our radar after we noticed that a famous activist investor had built a large position in it.

We are still not done with our research and will likely wait for Q2 results before making an investment decision. Here is our preliminary research. Stay tuned for more.

=============================

Activist REIT Investor Bets Big On Senior Housing

Senior living and care facilities are an interesting sector of real estate.

For most of the 2010s, the narrative of a coming demographic wave of senior citizens -- a "silver tsunami" -- would soon create massive demand for senior housing. However, the bulk of this demand remained in the future, while a swell of new supply of senior housing properties steadily entered the market.

Developers weren't waiting for the silver tsunami to arrive.

Today, though, as the memory of COVID-19's devastating effect on senior housing facilities fades, demand is returning while construction has collapsed.

New construction starts are over 50% below their historical average at about 1.5% of existing inventory. Given high interest rates and construction costs as well as occupancy still recovering, new senior housing starts are unlikely to make another resurgence anytime soon.

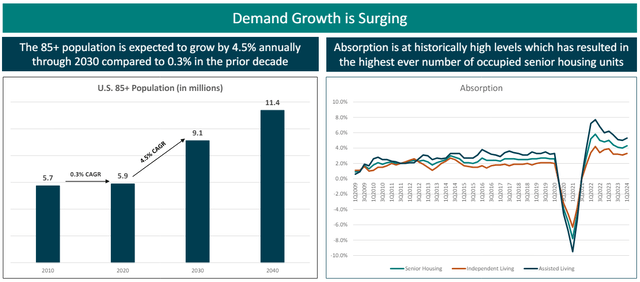

Meanwhile, resident demand is in the midst of a sustained tailwind as the population of 85+ year-olds in the US is projected to increase by 4.5% annually through 2030.

While there was very little growth in the over-85 population from 2010 to 2020, this segment of the population is expected to nearly double over the next few decades.

That's where National Heath Investors (NHI) comes in.