An Update On Our Farmland Investments

An Update On Our Farmland Investments

One of our best-performing investments this year has been farmland:

It performed so well, relatively speaking, because of three main reasons:

Reason #1 - Safe-Haven Asset Class: People always need to eat and there is a persistent imbalance between the slowly declining supply of farmland (other use conversions) and the growing demand for food (growing population and rising living standards in emerging countries). This explains why farmland kept gaining value through the dot-com crash, the great financial crisis, and even the pandemic. The cash flow is stable in most years, but the demand for farmland as an investment often also grows when investors become fearful about the future.

Reason #2 - Russia's Attack on Ukraine: Secondly, Russia's invasion of Ukraine increased the value of US farmland. Russia and Ukraine are some of the world's biggest producers and exporters of major crops like wheat, corn, and soybeans, but now they are in parts cut off from the rest of the world. Ukraine is fighting for its survival and Russia is heavily sanctioned. As a result, US farmland has become even more needed to feed the world.

Reason #3 - High Inflation: Finally, inflation is high and while it hurts some investments, it is a positive catalyst for farmland since it is limited in supply, but essential to our society. You cannot inflate it away and as food prices increase, crop yields rise as well, and with that, the value of the farmland.

This explains why US farmland gained significant value in 2022 even as stocks and bonds experienced significant downside.

This has led some of you to ask me via direct messages whether now would be a good time to buy more farmland as we head into increasingly uncertain times.

Below, we provide an update on our two farmland investments: Farmland Partners (FPI), which is a REIT, and FarmTogether, which is a crowdfunding platform. At the bottom of the article, I also provide a quick review of FarmTogether's latest deal which is now available on their website (Note that their last deal was fully funded in ~48 hours so it probably won't last for long).

Farmland Partners (FPI)

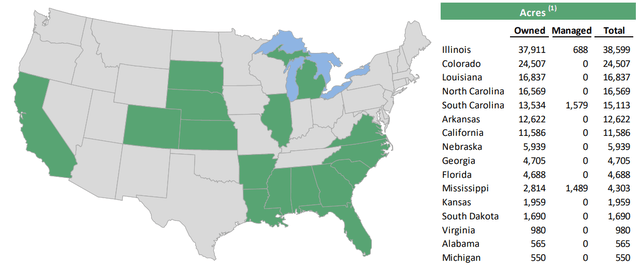

Farmland Partners (FPI) is our favorite farmland investment opportunity that's available on the public market. It is the largest farmland REIT by acreage, owning over 160,000 acres of farmland across the US:

We initiated a position in February because we thought that it was on the cusp of rapid growth, but it was still priced at a 20% discount to net asset value.

The market was pricing FPI at a discount because it was concerned about some legal issues that were draining most of its cash flow. It is a long story, but in short, FPI was the victim of a fraudulent short attack and it led to some frivolous lawsuits that it had to defend in court.

We recognized that these legal costs would only be temporary and would soon be forgotten. Soon, the focus would shift to FPI's rapidly growing rents, the appreciation of its farmland, and its new asset management business, which had the potential to unlock substantial fee income for the company.

Today, we are pleased to note that this is precisely what has happened. As a result, our investment gained 10%, even as the rest of the REIT sector dropped by 14% - resulting in nearly 25% of outperformance in short period of time:

We think that this surge is well-justified given what we explained earlier.

But what about now?

Is it still a good time to accumulate more shares?

I am not so sure.

I think that FPI remains undervalued, but it is not as cheap as it once was relative to other REITs. This shouldn't come as a surprise after 25% of outperformance.

But more importantly, I am not particularly pleased with the latest development at the company.

After announcing their move into the asset management business, I had high hopes which still haven't materialized. They haven't made much or any progress in growing their third-party assets under management, and they appear to have instead focused on growing their own portfolio.

This is not necessarily a bad thing, especially if you are a more conservative investor, but it is not what I was looking for. I was hoping that they would start to rapidly scale up their assets under management, which would result in rapid growth in fee income, and FFO per share since this is a capital-light business.

Instead, they are buying more farmland for their own portfolio and at times, they have had to issue equity at a discount to close these deals. This reminds me that during my last call with the CEO of FPI, he explained to me that they will at times close deals that are dilutive to NAV per share, but accretive to FFO per share since this is what the REIT market appears to care about. After thinking a bit more about it, I am not sure that this is the right approach because it essentially means that we won't fully participate in the upside of farmland in the long run.

But to be perfectly clear, I am not turning bearish either. I am still bullish on FPI and there are also a lot of positive things to talk about.

Rent growth remains exceptionally strong with 15%+ hikes as leases renew.

Moreover, farmland continues to rapidly appreciate in value and this explains why today, FPI is still priced at a discount to NAV even after all its rencet appreciation. Here is what the CEO commented on the recent earnings call:

"Land appreciation has been extremely strong over the past 9 months and was even stronger in 2021. We think, in 2023, the rate of appreciation may slow but it will continue to be a strong year for farmland values."

The CFO added the following:

"Nationwide, farm real estate values went up 12.4% in the last year, 20.3% in the last 2 years. So these are -- just a couple of reminders, these stats are really for all types of farm real estate so all quality tiers. And our anecdotal evidence that we see in the marketplace is that perhaps the upper tiers of farmland values and quality are actually appreciating even at that faster than that."

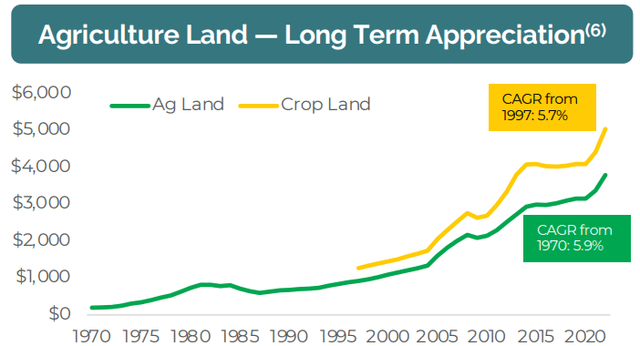

FPI owns mainly high-quality farmland so its portfolio has likely appreciated even more than that. FPI is also leveraged so the impact on its equity value is amplified. Farmland is also expected to keep growing in value in 2023 and the CEO has guided for its portfolio to appreciate by 5-6% per year on average over the coming decade. This is roughly in line with historic averages:

So there are good reasons to remain bullish.

The discount relative to other REITs is not quite as large as it used to be, and the external growth from the asset management business may take longer to materialize, but the company is still priced at a discount to NAV and the organic growth is strong on its own.

The main reason why I don't plan to add to my position is that other REITs are today even more opportunistic. We expect to soon reach out to the management to learn more about their plan to grow the asset management business and hope to share more thoughts with you in the near future. You can read our investment thesis by clicking here.

FarmTogether

My second favorite option to invest in farmland is through a crowdfunding site called FarmTogether.

Unfortunately, there haven't been many deals on their site lately because they couldn't find undervalued properties in today's hot market. But now they are finally back with a new deal so I figured it would be a good time to give you an update on the company since we have discussed it previously.

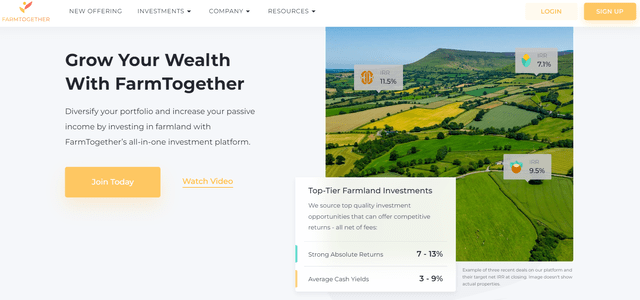

FarmTogether is the leading crowdfunding platform that specializes in farmland investments with $160 million of assets under management. It allows individual investors to easily invest in farmland directly through their website. The deals are cherry-picked and managed by professionals, and they are able to keep their fees reasonably low by embracing technology in raising capital and acquiring farmland:

It only takes a few minutes to create an account on their site and you are then ready to review their farmland offerings and invest in them directly through their site.

Typically, their deals enjoy far higher yields than what you would get from public farmland REITs because you are not paying a large premium to NAV, the fees are reasonable, and most importantly, FarmTogether typically structures deals that prioritize income generation.

They are often able to earn yields of 5-8% by targeting higher-yielding permanent crops and accepting some development/operational risk.

As an example, instead of signing a triple net lease that would provide steady cash flow, they may sign a profit-sharing agreement with the tenant, which will lead to more volatile cash flow, but higher yield on average. REITs typically don't do that because they must report quarterly results and investors want to see consistent results. This consistency comes however often at the cost of long-term profits.

Needless to say that higher yields also come with higher risks, but FarmTogether is very selective about its deals, and the selection is made by people who have experience working for some of the world's largest and most sophisticated farmland investment firms like Prudential and the Ontario Teachers’ Pension Plan:

I have personally known the founder, Artem Milinchuk, for many years and this led me to become an angel investor and advisor of the company in 2021. The senior investment team of FarmTogether also personally invests in all of their deals to align interests.

For all these reasons, I think that FarmTogether is the best private farmland investment option, at least from all of those that I have studied.

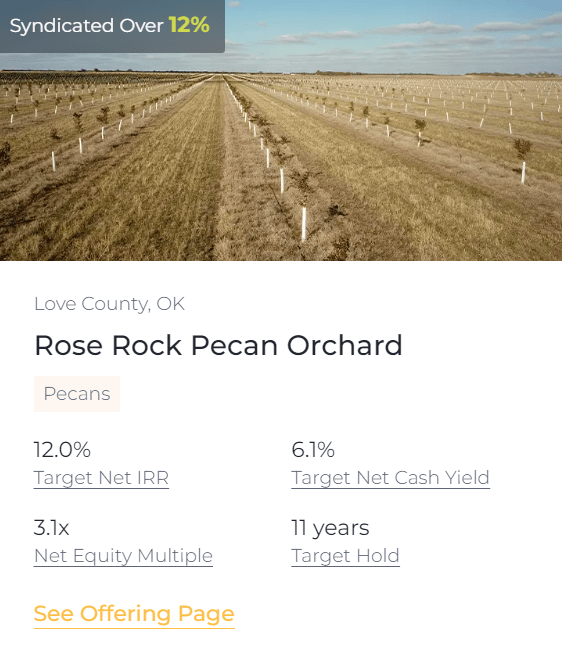

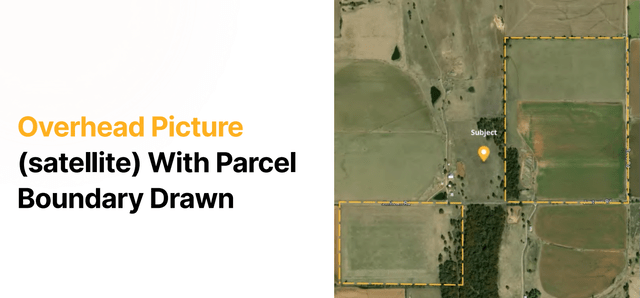

After taking a break for most of 2022, they are now finally back with a new deal on their website. I suspect that it won't take long to fill out since its last deal was fully syndicated in about 48 hours:

I like this specific property because of the following reasons:

It's an off-market deal with competitive pricing.

It offers a high yield of over 6% per year.

The targeted IRR is 12% per year, which is above average for pecan farmland. The equity multiple is 3.1x over the 11-year holding period.

This is achieved with zero debt.

The property has excellent water and natural resource endowment.

It is located near 3 other FarmTogether properties, which may allow them to sell the property as part of a portfolio at a premium valuation.

It is in the heart of pecan country, 85 miles northwest of Dallas and 105 miles south of Oklahoma City.

Pecan consumption has been growing steadily at around 5% per year since 2015 and this growth is expected to continue.

The operator, Raptor Ag, has been FarmTogether's partner on 12 previous properties and they have a great track record working together.

FarmTogether's team is personally investing in this deal as well.

There are risks of course, but I like the risk-to-reward, especially given all the benefits that it provides my portfolio in terms of diversification, inflation protection, recession resistance, and higher income generation.

You can study all the details of the property by creating an account here.

Bottom Line

Farmland is very hot right now and rightfully so.

I think that it is the best hedge against the war in Ukraine, which could still potentially turn into a 3rd world war.

I hold a farmland allocation in my portfolio because it helps me sleep better at night. I see it as a form of insurance/diversification against such black swan events. It helps me stabilize the value of my portfolio, protect it against inflation, generate income, and still provide competitive total returns in the long run.

I gain my exposure through FPI and FarmTogether. In the future, if a new farmland REIT is created, I would not mind adding a third vehicle to the mix.

Finally, please note that this is a free article from High Yield Landlord. If you found it valuable, consider joining our service for a 2-week free trial. You'll gain immediate access to my entire REIT portfolio, real-time trade alerts, exclusive REIT CEO interviews, and much more. We are the largest and highest-rated REIT investment newsletter online, with over 2,000 paid members and more than 500 five-star reviews.

We spend 1000s of hours and over $100,000 per year researching the market for the most profitable investment opportunities and share the results with you at a tiny fraction of the cost.

Get started today - the first 2 weeks are on us:

Sincerely,

Jussi Askola

Analyst's Disclosure: I/we have a beneficial long position in the shares of all companies held in the CORE PORTFOLIO, RETIREMENT PORTFOLIO, and INTERNATIONAL PORTFOLIO either through stock ownership, options, or other derivatives. I am also long FARMTOGETHER. High Yield Landlord® ('HYL') is managed by Leonberg Research, a subsidiary of Leonberg Capital. All rights are reserved. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. The newsletter is impersonal and subscribers/readers should not make any investment decision without conducting their own due diligence, and consulting their financial advisor about their specific situation. The information is obtained from sources believed to be reliable, but its accuracy cannot be guaranteed. The opinions expressed are those of the publisher and are subject to change without notice. We are a team of five analysts, each contributing distinct perspectives. Nonetheless, Jussi Askola, the leader of the service, is responsible for making the final investment decisions and overseeing the portfolio. We do not always agree with each other and an investment by Jussi should not be taken as an endorsement by other authors. Past performance is no guarantee of future results. Our portfolio performance data is provided by Interactive Brokers and believed to be accurate but its accuracy has not been audited and cannot be guaranteed. Our portfolio may not be perfectly comparable to the relevant index. It is more concentrated and may at times use margin and/or invest in companies that are not typically included in REIT indexes. Finally, High Yield Landlord is not a licensed securities dealer, broker, US investment adviser, or investment bank. We simply share research on the REIT sector.