Argentina Is Becoming A Compelling Investment Opportunity

Please note that this is a free article of High Yield Landlord. If you find it valuable, consider joining our service for a 2-week free trial. You'll gain immediate access to my entire REIT portfolio, real-time trade alerts, exclusive REIT CEO interviews, and much more.

Argentina Is Becoming A Compelling Investment Opportunity

Don't cry for me, ArgentinaThe truth is, I never left youAll through my wild days, my mad existenceI kept my promiseDon't keep your distance

A hundred years ago, Argentina was one of the top 10 richest nations on Earth as measured by GDP per capita. In the 1920s, the country was richer even than Italy and France and on par with developed nations like Canada and Australia.

The Argentinian economy soared mightily from 1880 to 1929 as agricultural exports skyrocketed and European immigrants flowed into the country, changing its cultural landscape into a hybrid of Europe and Latin America.

And then the Great Depression hit, causing economies around the world to slump. Larger economies, most notably the United States, turned against international trade in hopes that reducing foreign competition would revive domestic production.

In 1930, a military coup overthrew the democratically elected government, quickly transforming Argentina from one of the most stable countries into among the most unstable.

In response to foreign trade barriers, the new military government retaliated with import substitution policies that aimed to replace almost all imports with domestically produced goods. Argentina's agricultural sector waned while its industrial sector grew. But it was inefficient to manufacture most goods within the country. Wages, commodities, and ultimately consumer prices soared. These anti-import policies continued for four decades, triggering frequent bouts of inflation.

After another military coup in 1943, the leftist Juan Perón took power, thus beginning almost eight consecutive decades of Peronist governance in Argentina. Rather than a "free market," Perón believed in a "social market" that would pursue the dual ends of "social justice" and "social help." Perón nationalized several major industries such as the railways, the central bank, the import-export industry, utilities, and public transportation. He also extended social security and healthcare coverage to the entire population.

Another military coup led to more instability in the 1970s and 1980s, by which time Argentina's debt to GDP reached 80%.

The 1990s and 2000s saw more chaos as the nation sought to privatize certain industries and reengage in international trade only to reverse these policies after a severe recession in the early 2000s.

Argentina Today

Today, the Argentinian economy remains in a pitiable state.

The second largest economy in South America (behind only Brazil) boasts a well-educated population, robust agricultural exports, and abundant resources like natural gas, lithium, and copper.

And yet, the country is languishing under crushing hyperinflation and the poverty rate had risen over 40% as of the first half of 2023. The non-independent central bank has facilitated the government's constant deficit spending with money-creation policies and peso devaluation. Rolling recessions and debt crises have crippled the economy, and foreign creditors are now looking at yet another debt restructuring agreement -- the third in the last two decades.

On top of all that, China has become among the last of Argentina's foreign lenders still willing to extend credit in recent years, which has enabled China to exert increasing amounts of influence over the South American nation.

Argentina frankly seems to have no good options to begin the economic healing process.

It is during these times of extreme economic pain and hyperinflation that radical politicians tend to be elected. That is exactly what we saw in Argentina in the Fall of 2023.

In the November presidential election, the Argentinian people overturned decades of left-leaning Peronist governance and elected the ultimate outsider: an eccentric and flamboyant libertarian economist (also former tantric sex coach) Javier Milei.

Milei was inaugurated as president of Argentina in December 2023.

Here are some of the highlights of Javier Milei's economic agenda:

Potentially dollarize the Argentinian economy

Slash government spending by up to 5% of GDP

Balance the government budget by the end of 2024

Entirely eliminate 9 of 18 federal ministries (departments)

Cut regulations

Lift import controls and increase international trade

Reject membership in BRICS and move to align with the United States and its allies

Eliminate restrictions on oil & gas production to allow more drilling

Negotiate a ~$45 billion debt restructuring with the IMF

Privatize certain industries such as air travel

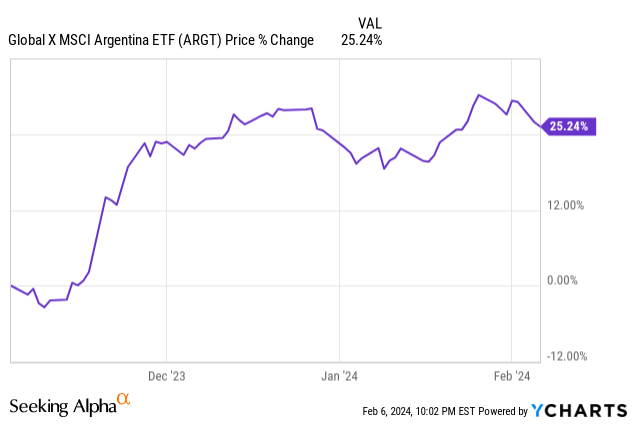

Milei has won widespread support from Argentina's business community. The Argentinian stock market soared 25% in the wake of his electoral victory in November.

But Milei's supporters would do well to temper their enthusiasm. After all, the new president's economic agenda has plenty of obstacles standing in its way.

The first and foremost obstacle is the Argentinian congress, almost half of which in both the upper and lower houses is populated by leftist politicians who were part of the former Peronist coalition. Milei's libertarian party controls only about 10% of senate seats and 15% of "chamber of deputies" seats.

But it is not a case of all or nothing.

Just recently, Milei overcame the first obstacle in Congress to his reform bill.

After long negotiations, it had to give up on almost half of its original measures to gain the necessary support, but it still managed to gain the approval of Congress for a majority of its proposed measures.

It is quite encouraging that Milei was able to gain 144 votes in favor of the bill versus 109 against. It could well be that it was even part of Milei's strategy to ask for much more than he was expecting to get through and to then negotiate a compromise that gains sufficient support.

Now, it will still need to get the Senate's approval to pass into law.

Another potential obstacle is the voters. Like the US, Argentinian presidents serve 4-year terms and can only serve a maximum of two terms. If Milei wants to be reelected to advance his pro-markets, pro-trade, anti-government agenda for 8 years instead of 4, he will need to maintain the support of the people.

It is an open question whether the Argentinian populace voted him in because they were won over by his agenda and charisma, or if they primarily wished to express their dissatisfaction with the ruling Peronist status quo.

If Milei only serves a single, 4-year term, then whatever reforms he pushes through may simply be reversed with the next Argentinian president.

Reasons for Cautious Optimism

We approach this subject from the perspective of investors who are always interested in compelling international investment opportunities. We do not wish to engage in politics, especially when it concerns a foreign country on a different continent!

That said, from an investment standpoint, we are cautiously optimistic about the Argentinian economy for at least three reasons:

1. Debt Restructuring Should Make The Debt More Manageable

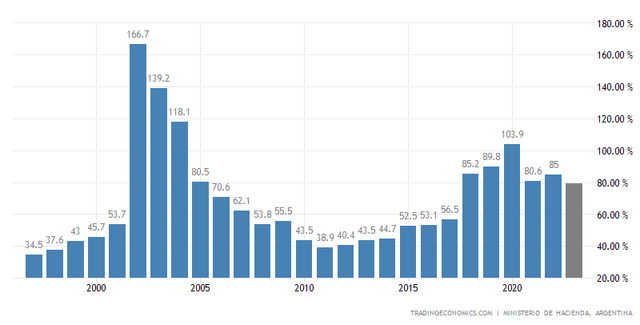

Since reaching around 80% debt-to-GDP in the 1980s, Argentina's government debt ratio has vacillated wildly.

In the late 1990s, after the implementation of several reforms, debt-to-GDP hit a low of about 34%. Then, after the early 2000s recession, it reached a massive 167% in 2002 before a debt restructuring deal was reached in the mid-2000s. By the mid-2010s, debt-to-GDP slid back down to around 45% before surging again to a peak of 104% in 2020. That year, Argentina secured another debt restructuring deal that cut its debt-to-GDP back down to about 80% of GDP.

Reducing debt ratios will be a good thing for the Argentinian economy, in our view.

A 2022 study put out by the IMF looked at 190 countries between 1970 and 2020. While there are exceptional cases, the study found that swiftly increasing debt levels "tend to be followed by weaker economic growth and persistently lower output."

Quoting the study summary:

This is particularly the case if the economy is already operating with a large positive output gap. Debt surges also tend to be followed by weaker economic growth if the initial debt levels are high, especially for private debt surges. Our results also show how debt surges impact future growth. Public debt surges are associated with especially weaker private and public investment, although both private and public consumption are also negatively affected.

While there is no magic threshold of debt-to-GDP above which economic growth mechanically falls, as the IMF admitted in 2014, there have been a multitude of economic studies that have shown a deleterious effect on growth from high national debt levels.

To quote a summary of the last decade's economic research on this subject (emphasis ours):

A large majority of studies on the debt-growth relationship find a threshold somewhere between 75 and 100 percent of GDP. More importantly, every study except two finds a negative relationship between high levels of government debt and economic growth. This is true even for studies that find no common threshold. The empirical evidence overwhelmingly supports the view that a large amount of government debt has a negative impact on economic growth potential, and in many cases that impact gets more pronounced as debt increases.

As such, debt restructuring that results in a lower debt-to-GDP will most likely be a positive development for the Argentinian economy.

2. Government Spending Cuts Should Ultimately Boost The Economy

In the wake of the Great Financial Crisis, there was a fierce debate about the effectiveness (or lack thereof) of fiscal austerity measures.

On one side, you had Keynesian economists like Paul Krugman and Mark Blyth (author of Austerity: History of a Dangerous Idea) who argued that austerity measures don't work and cause lower economic growth.

On the other side, you primarily had a group of Italian economists, most notably Alberto Alesina, who argued that austerity based on government spending cuts are effective at boosting long-term growth and reducing debt ratios, while austerity policies based on tax increases are self-defeating by burdening the economy without actually reducing debt ratios.

Alesina and a few colleagues detailed their research in Austerity: When It Works And When It Doesn't. We find their analysis and rationale compelling.

In short, they find that austerity measures based on indefinite tax increases have less effect on GDP in the short term but are more costly in the long term, while government spending and tax cuts are more pro-growth and less likely to result in recessions. A mixed approach that combines temporary tax hikes with permanent spending cuts tends to accomplish multiple goals: lower debt ratios and increased growth.

The reasoning is that austerity measures based on government spending cuts, rather than indefinite tax hikes, make for a more attractive environment for investors and increase consumer confidence.

More balanced budgets and falling government debt ratios also frees up capital to flow into the private sector while simultaneously attracting more capital inflows from foreign investors.

Javier Milei appears to be following Alesina's playbook for austerity measures that tend to work. While Milei is cutting spending and hopes to balance the government budget by the end of 2024, he is also attempting to temporarily increase export taxes on certain agricultural products. His economy minister Luis Caputo recently said: "Once this emergency is over, we are going to move forward with the elimination of all export duties."

We believe these measures, if enacted, will create a more attractive environment for investors (both domestic and foreign) and give a boost to the Argentinian economy.

3. Increased International Trade Should Fuel A Long-Term Economic Rebound

The benefits of international trade are numerous, especially for a resource-rich nation like Argentina.

The whole Latin American region (with the exception of Mexico) severely lags most of the rest of the world in international trade, both on the intra-regional level and intercontinentally.

The IMF asserts that the Latin American region could greatly increase economic growth by lowering trade barriers and instituting policies that make their home countries attractive investment destination.

A 2013 study on Argentina's international trade also found that many domestic manufacturers were hurt when the country increased trade with China and that the country could see greater benefit by increased trade with the United States and European Union.

This appears to be exactly what Milei's Argentina is now doing by lowering trade barriers and rejecting membership in the China-dominated BRICS economic alliance. Milei explicitly seeks to strengthen relations with the United States and its allies.

This is good news for investors in multiple ways.

First, consider that Argentina accounts for an astounding 1/5th of all known global lithium reserves. The country's lithium mining production is set to rapidly expand in the coming years, which should prove beneficial for Western countries' electrification and decarbonization plans.

After Chile's leftist president partially nationalized Chile's lithium mining industry, Argentina may become a more attractive environment for foreign investment in lithium. Certainly, Milei seems intent on making it so, including by announcing plans in late December to deregulate and lower costs for miners.

Second, consider that increasing exports promotes faster overall economic growth for countries like Argentina. One study found that "middle-income countries that are more export-oriented grow faster than relatively less export-oriented economies."

If this holds true for Argentina, then it will become a more attractive environment for investments over the next few years.

Bottom Line

We are cautiously optimistic about the recovery of Argentina from here. Although we believe that, even if Milei's policies do pass through Congress and do prove successful in the long run, the country has more pain to endure during the economic "shock therapy."

In a future article, we will highlight a compelling real estate investment opportunity in Argentina that we are considering.

Finally, please note that this is a free article from High Yield Landlord. If you found it valuable, consider joining our service for a 2-week free trial. You'll gain immediate access to my entire REIT portfolio, real-time trade alerts, exclusive REIT CEO interviews, and much more. We are the largest and highest-rated REIT investment newsletter online, with over 2,000 paid members and more than 500 five-star reviews.

We spend 1000s of hours and over $100,000 per year researching the market for the most profitable investment opportunities and share the results with you at a tiny fraction of the cost.

Get started today - the first 2 weeks are on us:

Sincerely,

Jussi Askola & Austin Rogers

Analyst's Disclosure: I/we have a beneficial long position in the shares of all companies held in the CORE PORTFOLIO, RETIREMENT PORTFOLIO, and INTERNATIONAL PORTFOLIO either through stock ownership, options, or other derivatives. High Yield Landlord® ('HYL') is managed by Leonberg Research, a subsidiary of Leonberg Capital. All rights are reserved. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. The newsletter is impersonal and subscribers/readers should not make any investment decision without conducting their own due diligence, and consulting their financial advisor about their specific situation. The information is obtained from sources believed to be reliable, but its accuracy cannot be guaranteed. The opinions expressed are those of the publisher and are subject to change without notice. We are a team of five analysts, each contributing distinct perspectives. Nonetheless, Jussi Askola, the leader of the service, is responsible for making the final investment decisions and overseeing the portfolio. We do not always agree with each other and an investment by Jussi should not be taken as an endorsement by other authors. Past performance is no guarantee of future results. Our portfolio performance data is provided by Interactive Brokers and believed to be accurate but its accuracy has not been audited and cannot be guaranteed. Our portfolio may not be perfectly comparable to the relevant index. It is more concentrated and may at times use margin and/or invest in companies that are not typically included in REIT indexes. Finally, High Yield Landlord is not a licensed securities dealer, broker, US investment adviser, or investment bank. We simply share research on the REIT sector.