Asian REIT Opportunities: Hong Kong, China And Japan - Part 5

Asian REIT Opportunities: Hong Kong, China and Japan at a Discount - Part 5

Important Note: we recently launched a new series entitled “Asian REIT Opportunities” to outline the investment theses of our strongest picks among Asian REITs. This series is best adapted to investors who want to diversify their portfolio and lower volatility.

Today, in Part 5, we present our third Top Pick: Mapletree North Asia Commercial. It has been added to our International Portfolio with a “Strong Buy” recommendation, “High” risk rating, and “Small” allocation.

===

A Quick Note on Our Research Efforts in Asia

Today, we have the pleasure to introduce HYL members to our third Asian REIT opportunity. Over the past 2 months, I have been traveling Singapore, Indonesia, and Thailand in search of the best opportunities. In the process, I have met with >10 REIT executives, private equity manager, and local REIT investors. I have toured all the major malls of Singapore and spent a considerable amount of time behind my laptop – going through annual reports and talking with the investor relation departments of various REITs.

Unfortunately, we quickly came to the conclusion that most Asian REITs were uninvestable. Many appear opportunistic on the surface, but once you dig a bit deeper, you quickly realize that investors are poorly treated, and conflicts of interest can be very significant. The Asian REIT market is still very young and management teams get away with things that investors would never tolerate in the US market. As an example, it is common for Asian REITs to buy / sell assets directly from their sponsor. A sponsor may develop properties and sell them off to the REIT at hefty prices to cash out. Obviously, the acquisition is not negotiated on an arm’s length basis and may lead to substantial value destruction. Yet, this “asset dumping” practice is very common still to this day in Asia.

There are roughly 50 REITs in Singapore, which is the largest REIT market in Asia. By cutting down poorly managed companies, our list is down to ~20 names. Then as we screen down further for the companies offering attractive risk-to-reward prospects at the current valuations, we are left with just 3 companies.

We already presented Cromwell European REIT in Part 3 and Suntec REIT in Part 4. In today’s report, we will cover Mapletree North Asia– a REIT that specializes in Hong Kong, China and Japan. It trades in Singapore Dollars (S$) on the Singapore Stock Exchange (SGX). Its ticker is RW0U and it recently traded at S$1.16 per share.

Mappletree North Asia: Opportunity in Hong Kong

Coming to Singapore, I knew already that most REITs suffered from significant conflicts of interests which made them uninvestable. Therefore, the first thing I did when I arrived in town was to set up meetings with local investors who were familiar with management teams.

Very quickly, it was clear that the 3 blue-chip managers were: CapitaLand, Frasers, and Mapletree. They run the largest REITs and have the best track records. Unfortunately, this is no secret to anyone and so their managed REITs will commonly trade at hefty premiums to NAV and low dividend yields.

Today, there remains one exception, and that is Mapletree North Asia, or MNA in short.

MNA is Mapletree’s flagship REIT for Hong Kong, China and Japan property investments. Everything to it spells “blue-chip”: its assets, balance sheet, manager, track record… However, because of the 2019 Hong Kong protest, the share price is down from nearly $1.50 in July to just $1.16 today. At the same time, the dividend yield expanded from low 5s to 6.4%; and the 5% premium to NAV turned into a ~20% discount.

Blood is on the streets… and we believe that now is an attractive time for contrarian investors to buy one of the best managed REITs in Asia at a deep discount to fair value. As we will explain below, MNA has what it takes to weather the storm and quickly return to its former glory.

Hong Kong Heavy Portfolio

MNA owns 9 properties valued at S$7.7 billion. Despite owning only 1 property in Hong Kong, it represents 62% of the total portfolio value. The rest is divided between China and Japan:

With one property making up such a large portion of the NAV, it is interesting to take a closer look at it.

Festival Walk was once the biggest mall in Hong Kong and remains to this day one of the biggest retail complexes of the entire city. It was built in 1998 and MNA acquired it in 2011 for HK$18.8 billion (~US$2.4 billion) – which was the biggest global retail real estate deal in 2011:

Festival Walk comprises some one million square feet of retail space. It has ~220 shops, restaurants, and other entertainment including a multiplex cinema and even an ice rink. Located above the mall, there are also four floors of offices – showing you once again that today’s Class A malls have become mixed-use destinations with entertainment, services, and other uses. The office component represents up to 30% of the space today - making it a diverse mixed use destination.

The property uses retail as a catalyst to create a vibrant social hub with a lot of entertainment and other uses that pull in the crowds. Whether you want to go ice skating, watch a movie, eat at a restaurant, or even take singing classes, you are visiting the properties. While you are there, you are passing by all the stores which lure you in to shop.

The property is located in the Sham Shui Po District, north-west of Downtown area and is directly connected to the Transit Railway system. Hong Kong is one of the most densely populated places in the entire world and so it has enormous demographics in its surrounding.

It is a premier shopping, dining, and lifestyle destination that is strategically located – and the proof of that is its 100% occupancy since completion in 1998!

Why Hong Kong

Right now, Hong Kong is in crisis and everything looks very bleak. Protests are still on-going and it is impacting consumer sentiment and causing uncertainty. Retail sales were down by over 10% this Summer and more of the same is expected as long as the protest continue.

Now, we are not politicians and won’t go too deep into the reasons behind the protests, but we will simply note that historically, it has been a good time to invest when blood is on the streets.

With the protests still on-going, uncertainty is high and investors hate it. The media is also famous for exaggerating negative stories because it sells way more than stories about rainbows and flowers. But eventually, the protests are likely to dampen, just as happened with the Yellow Vest crisis earlier this year in France. It is not Hong Kong’s first protest against China’s influence (2003 & 2014), and probably not its last one either.

The cause for this wave of protests was a bill that would have amended HK’s extradition law. Critics worried that China would take advantage of this law to arbitrarily detain Hongkongers and so they took the streets to protest. This proposed amendment has since then been first suspended and later fully withdrawn, essentially giving protesters what they wanted.

Critics weren’t satisfied and now ask for more. Again, we are not here to talk politics, but given that major concessions have already been made, protests are likely to gradually slow down. The government has shown its willingness to work with the people and make compromises.

It is not in the best interest of anyone to continue as is. Hong Kong is already officially in a recession as of October and the disruptive protests may hurt Hong Kong’s status as an attractive financial capital.

It is not in China’s best interest to mess up Hong Kong either. They certainly want it to remain a reputable financial center that brings west and east together to fund investment opportunities. The entire world is watching and if China was to do something radical, it would shoot itself in the foot.

As an example, using outside troops to subdue Hong Kong could likely trigger an exodus of talent and capital from Hong Kong. Such a move would worsen China’s already difficult relationship with the USA and trigger further economic sanctions. If it resulted in civilian casualties, it could very well bring even more people into the streets, and a prolonged occupation would do permanent damage to Hong Kong’s image as “Asia’s World City”.

Therefore, we believe that compromises will be found, people will calm down, and everything will return to normal. It is in everybody’s interest to be reasonable.

Ignoring the temporary turmoil for a second, there are a lot of good reasons for contrarian investors to think long term and invest in Hong Kong at today’s discounted prices:

Hong Kong was ranked the world’s richest city in 2017 with the most billionaires per capita. (Fun fact: there are more Rolls Royce per capita than in any other city in the world).

It is the world’s freest economy in 2019 according to Economic Freedom Index.

It is usually voted the best business city in the world.

It has the lowest tax rate in Asia and some of the lowest in the world.

It is regularly the most visited city in the world. It varies from one year to another. In 2018, about 65 million visitors arrived to HK.

It attracts a ton of talent. A recent survey showed that HK has the highest average IQ in the world.

It has the more skyscrapers than any other city. There are more than 8,000 buildings higher than 14 stories; almost double that of New York.

Mongkok, a district of HK is the most densely populated area in the world. The entire city is densely populated as demonstrated by the amount of skyscrapers.

Hong kongers enjoy very high quality of life and live the longest in the world at 84.5 years, on average.

It has some of the best transportation infrastructure in the world, from its airport to its metro system.

Finally, it is China’s gateway city. When you invest in Hong Kong, you invest in China’s growth – which is expected to easily surpass that of most other developed nations in the coming decade.

Essentially, it is a highly entrepreneurial city with top talent, infrastructure and growth ahead of it. Most importantly for real estate investors, it is extremely dense and most land is already developed. It makes it one of the best places to invest in property because of the scarcity of new supply, combined with expected growth in demand.

Moreover, since we are investing in a mall property, it is interesting to note that HK is one of the world’s most touristic cities and this is because it has the reputation of offering world-class shopping. According to Shopper's Survey in 2016, HK is the best city to shop at in the Asia Pacific Region. It is comfortably ahead of the other cities in their estimation with everything from entertainment and attractions to services to the quality of malls and shops to prices being among the best.

Finally, if all these reasons weren’t enough to convince you that there is potential in Hong Kong, you should consider that Hong Kong is the world's third largest recipient of Foreign Direct Investment, only behind the U.S. and China, taking in $116 billion in 2018. Money moves to mainland China through Hong Kong's stock exchange, which was the world leader in IPOs last year with 135 companies raising a collective $36.5 billion. If you believe in China’s long-term potential, owning a property in HK is a great way to benefit from it.

Festival Walk, Hong Kong Property owned by MNA:

The other properties outside of HK represent nearly 40% of the portfolio. They provide valuable diversification away from HK and a platform for future growth as the REIT continues to diversify its portfolio across Northern Asia.

This includes 3 properties in China and 6 properties in Japan:

China (27%): 2 Properties – Mainly Office

Sandhill Plaza, Shanghai

Gateway Plaza, Beijing

Japan (11%): 6 Properties – Office

IXINAL Monzen-nakacho Building, Tokyo

Higashi-nihonbashi 1- chome Building, Tokyo:

TS Ikebukuro Building, Tokyo

ABAS Shin-Yokohama Building, Yokohama

SII Makuhari Building, Chiba

Fujitsu Makuhari Building, Chiba

Some of these properties may need a bit of a face-lifting but they are well located in desirable markets. Proof of that is the 98.9% average occupancy rate. Year to date, rents have been on the rise across the entire portfolio, at the exception of Gateway Plaza, Beijing which was hit by weaker demand due to the escalating trade war.

Even despite the recent weakness in China (trade war) and Hong Kong (protests), MNA has historically done very well thanks to a combination of rising rents and accretive acquisitions:

Up until the recent drop in share price, the REIT had managed to provide a ~100% total return to its shareholders since the IPO in 2013.

The near term outlook for growth is negative but as the protests ease up in Hong Kong, we expect retail sales to surge back up and tourism to return to the city. Note that Festival walk is temporarily closed down for maintenance (repairs caused by riots) and so there is no doubt that MNA will suffer in the near term – but more important to us – it has the assets and balance sheet to weather the storm and recover stronger than ever once it is all said and done. (Note also that the insurers have been notified, and the assessment of claims is underway. Festival Walk is covered by insurance for damages and loss of income.)

Conservative Balance Sheet to Weather the Crisis

Mapletree is famous for being a rather conservative manager that sticks to the ~30-40% LTV range for its REIT entities.

MNA is no different with its 37% LTV. Most of the debt is fixed rate debt and it enjoys a low 2.5% average interest rate.

The Manager

Now comes the real reason why we believe that MNA is the best pick for Hong Kong, China and Japan property investments.

Mapletree, the manager of MNA, is second to none in the Asian market. While most Asian REITs commonly take advantage of their shareholders and treat them poorly, MNA is designed to align interests as closely as possible.

First off, the manager is the largest owner of the shares at nearly 1/3 of the company. That’s over S$1 billion that they have on the line and it forces them to think like owners, rather than fee-driven managers.

Secondly, they are the First Singapore REIT with a management fee structured based on Distributable income and Dividend per share growth.

With a lot of skin in the game and a compensation structure that incentives “per share” growth – MNA is the gold standard of interest alignment in Asia.

Then when you consider the manager’s track record and accolades (incl. 240 awards…), it is a no brainer to go with MNA for Greater China and Japan investments. There is no other Asian REIT manager that I trust more than Mapletree.

Relative Valuation

Unfortunately, because MNA is managed by Mapletree – which is broadly perceived as the “Blue-Chip” manager in Asia – it will rarely trade at a cheap valuation.

Today is the exception. The Hong Kong protests have sparked new fear among investors and MNA has sold off intensely since last Summer. The share price is down from nearly $1.50 in July to just $1.16 today. At the same time, the dividend yield expanded from low 5s to 6.4%; and the 5% premium to NAV turned into a ~20% discount.

Here is how the yield compares to various benchmarks:

The financial market is famous for being short term oriented and often overreacting to news. We agree that MNA will suffer from the protests and that its flagship property will see declining metrics over the coming quarters.

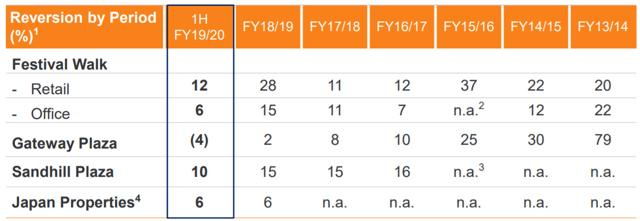

We believe however that the long term thesis for investing in these high growth market remains unchanged. Note that these assets have consistently reached enormous rent increases over the past years. Even year-to-date, the Hong Kong mall continues to grow its rents:

The near term outlook is negative and uncertain. We get that. But in the long run, we believe that this will just look like a bump in the REIT’s trajectory to further upside.

MNA and other Mapletree-entities commonly trade at sizable premiums to NAV. As an example, Mapletree Commercial, their largest REIT, is currently trading at a hefty 35% premium to NAV.

Long term, as MNA continues to diversify its portfolio through further accretive investments, we expect its pricing to resemble that of the above REIT because it is the same manager and same strategy – just in a different location.

Transforming a 20% discount to NAV into a 35% premium to NAV spells opportunity to us – and while you wait you earn a 6.4% dividend yield, which may slightly decline in the near term, but is set for further growth in the long run (>4% annual growth since IPO).

Risks

The biggest risk here is clearly the situation in Hong Kong. While we expect things to gradually cool down now that concessions have been made, we could be wrong and it may take much longer than expected.

Secondly, it is hard to quantify at this point what the real economic impact of these protests will be in the near term. We know sales at malls are falling and the broader economy is dipping into a recession.

How long will this last? Our guess remains just a guess. Investors should be ready to commit for the long term story and hold on patiently through the current uncertain times.

Finally, the dividend per share may decline in the near term. We have read several reports of potential relief being requested by tenants of malls in Hong Kong. MNA has not fallen for this pressure as of yet, but it is real possibly. Again, this is a contrarian investment and blood is on the street. For the long term driven investor, the price is very compelling. For the short term driven investor, the story is very risky.

Bottom Line

Most Asian REITs are uninvestable due to significant conflicts of interest which harm performance. Mapletree is one of the few exceptions and is commonly perceived as the gold-standard of REIT managers.

MNA – its flagship REIT for HK, China, and Japan investments has a fantastic track record but is currently under pressure due to concerns over the protests in HK.

The assets and balance sheets are conservative in nature and should allow the REIT to weather the storm with minimal long term damage.

Yet, because of the temporary concerns, the REIT has seen its share price drop from a premium to NAV to a deep discount to NAV.

There is enormous upside as the protests cool down and the market moves on. In the meantime, you earn a >6% dividend yield that is expected to grow in the long run.

We are adding MNA to our International Portfolio and initiated a “STRONG BUY” recommendation with a “High” risk profile and “Small” allocation.

Good investing from your HYL Research Team,

Jussi Askola