Asian REIT Opportunities: Introduction – Part 1

Asian REIT Opportunities: Introduction – Part 1

Unique to High Yield Landlord is our International approach to real estate investing. Having lived and worked in many different countries (Finland, France, Germany, Wales, Estonia, and the USA…), I always try to bring an international perspective to our investment decision-making.

We are constantly looking at opportunities across many countries and comparing them with each other to seek the best risk-adjusted returns. To give you an example: despite currently living in Europe, I have favored US REITs over the past years because I see much more opportunities in the American continent. Cap rates are greater, NOI is growing faster, there is more appreciation potential and you could easily make the argument that it is also a safer market.

Greater reward potential… with more limited risks… is what has driven our large allocation to US REITs so far. We have identified a few opportunities in Europe, but they have been few and irregular.

A 3rd continent that could present very promising investment opportunities is Asia. Unfortunately, because we lack “boots in the ground”, we have not been able to identify any Asian REIT opportunities so far.

In an effort to finally dig deeper into Asian REITs, I committed to a 3-months long field trip to Asia. I am here to meet with REIT management teams, discuss market trends with local experts, tour properties, and ultimately, identify the Top 5 Best Asian REIT opportunities for members of High Yield Landlord.

The Asian REIT Market

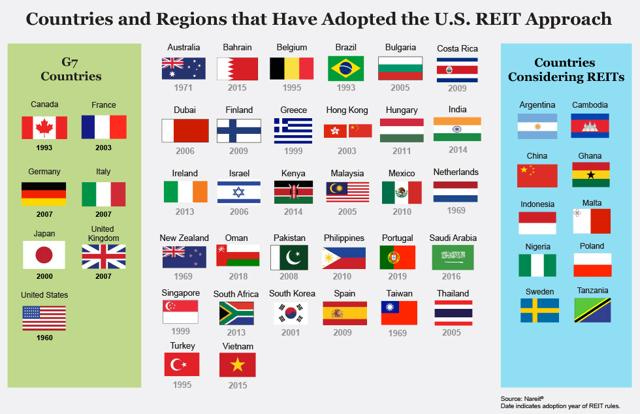

The REIT market has grown rapidly in Asia. Many countries have adopted the REIT regime over the past 10 years and they are very similar to those in the US in that:

They force to payout a large portion of net income in dividends.

They are structured as tax-advantaged vehicles.

They primarily own stabilized properties producing cash flow.

Investing in Asian real estate is all about the demographics and growing middle class. Consider that in the below circle lives more people than outside of it:

The living standards of many Asian nations are quickly converging closer to those enjoyed in other more developed nations. The Asia Pacific region is adding 380,000 people to its middle class… every day! That’s the equivalent of New York City in just 22 days. It does not take a genius to understand that this should lead to exponentially rising property prices and rents in the long run.

That said, not all of these Asian countries are created equal. Some are riskier than others. Some impose greater withholding taxes on foreign investors. And others may be outright dangerous due to poor shareholder protection, corruption, and conflicting interests.

The country that stands out as the preferred Asian REIT destination is Singapore:

The small island-city state off southern Malaysia has become a global financial center with a tropical climate and multicultural population.

In less than two decades, Singapore has also become a global hub for REIT listings, often also called S-REITs (S stands for Singapore).

Singapore’s first REIT CapitaLand Mall Trust was listed in 2002 following the establishment of the sector’s regulatory regime in 1999. As of 31 May 2019, the city-state had 44 REITs and property trusts - which is the highest amount of any other country in the region.

But why did this small country become the REIT Captial of Asia?

It has clear rules and tax incentives. Most importantly, dividends from S-REITs have a 0% withholding tax and so structuring your REIT in Singapore makes a lot of sense if you have a global investor base.

Singapore is also one of the richest countries on earth. The regulatory and financial environment is well-tested. Corruption is low. It is one of the few remaining countries with a triple AAA credit rating (The US is lower at AA+). The Singaporean passport ranks 1 st in the world…

In short, this is a jurisdiction that ticks all the boxes of an attractive foreign market that REIT investors can trust.

Why Invest in S-REITs?

I am interested in investing in S-REITs for 5 reasons:

(1) High Income: REITs in Singapore offer some of the highest dividend yields in the entire world. The average yield is at roughly 6% and many of them are paying over 8%. In comparison, most REITs in the US trade at 3-4% dividend yields at the moment:

(2) Access to Emerging Nations: The great majority of S-REITs also invest in properties outside of Singapore and therefore, they allow investors to gain exposure to emerging countries with the added security of actually holding shares of a Singaporean REIT and no withholding tax. As an example, I probably would not directly invest in Indonesia through an Indonesian REIT. I feel much more comfortable investing in a Singaporean REIT that then buys properties in Indonesia. I have much greater trust in its regulatory and financial environment. Here are some of the countries in which S-REITs invest:

(3) Long Term Growth: as already mentioned in our introduction, this is a region of the world where economic growth is expected to remain above average as they catch up to the living standards of other developed nations. High quality properties in desirable locations will enjoy rapidly growing demand from an exploding middle class – whether it is apartments, hotels, malls or even offices. Prices have already increased a lot, but they still have a long way to go in the long run.

(4) Diversification: Real estate is a local man’s game. Demand and supply cycles vary greatly from one continent to another. Rather than put everything into one basket (or country), I prefer to overweight one country (USA) and then opportunistically diversify into other regions of the world (Asia and Europe). I believe that this reduces the risk in the long run, and may also boost returns as it allows us to look for opportunities in a much greater universe of securities.

(5) Tax Benefits: As already mentioned, Singapore does not charge any withholding tax on dividends paid to foreign holders (applies to most developed countries). This is very attractive when combined with the fact that S-REITs pay some of the highest dividend yields in the entire world. It is simple, transparent, and friendly to investors.

Higher-income combined with superior growth prospects and tax benefits has the potential to result in market-beating returns in the long run. As part of an overall portfolio, it may also result in risk mitigation.

I am committed to gradually building up my Asian real estate investments and expect this portion of my real estate portfolio to reach a ~10% allocation in the future.

S-REIT Opportunities: Top 5 Picks (In-Progress)

We are currently going through the list of >40 S-REITs and gradually screening it down to our Favorite investment ideas.

In Part 2, 3, 4, 5, 6 (and potentially more) – we will present HYL members all the Top Picks of the region and make new additions to our International Portfolio. In these reports, we will also provide guidelines on “how to invest” with relevant information on specific symbols and foreign exchanges.

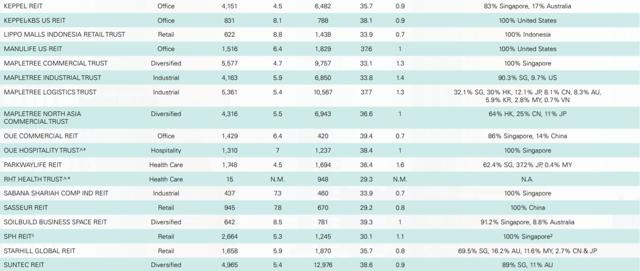

For those of you who are impatient and want to already start digging into individual names, here is a list of S-REITs classified by property type, geographical focus, dividend yield and other important metrics:

I have been in Indonesia over the past weeks and have gotten to do some research on the local property market (hotels and resorts in particular). On Sunday, I will be flying to Singapore and stay there for a full-month to meet management teams and tour properties.

You can expect several investment ideas in November. Stay tuned!

Our International Portfolio – as of 10/23/2019

Our International Portfolio is optional and intended for investors who desire greater diversification with the potential to boost risk-adjusted returns even further. Invest in European, Asian, and Canadian properties with strong upside potential from the comfort of your own home.

Currently, it holds only 7 investments and it is heavily weighted towards European REITs with:

2 British REITs:

British Land (OTCPK:BTLCY): Class A Office and Retail in London

Big Yellow Group (OTC:BYLOF): European Self-Storage Pioneer

1 German REIT:

DIC Asset (DIC): Diversified Office Portfolio

1 French REIT:

KlePierre (OTCPK:KLPEF): Geographically Diversified Class A Malls

And then we complement these European names with…

2 Canadian REITs:

Northview Apartment REIT (OTC:NPRUF): 1000s of Rental Properties

Dream Industrial (OTC:DREUF): Class B+ Industrial Portfolio

1 New Zealand REIT-like entity:

Auckland International (OTCPK:AUKNY): Airport Property

Bottom Line

Our objective is to build a well-diversified portfolio and expand the number of positions to 10-15 by the end of 2019. The new investments are expected to be mostly Asian REITs from Singapore.

We believe that one of our competitive advantages at High Yield Landlord is our international background. While most investors are limited to US markets, we have extensive experience working in different parts of the world – allowing us to look for opportunities where others don’t. We expect to present our first Asian idea next week!

Good investing from your HYL Research Team,

Jussi Askola