Access My Entire REIT Portfolio For Free:

You can learn more by clicking here.

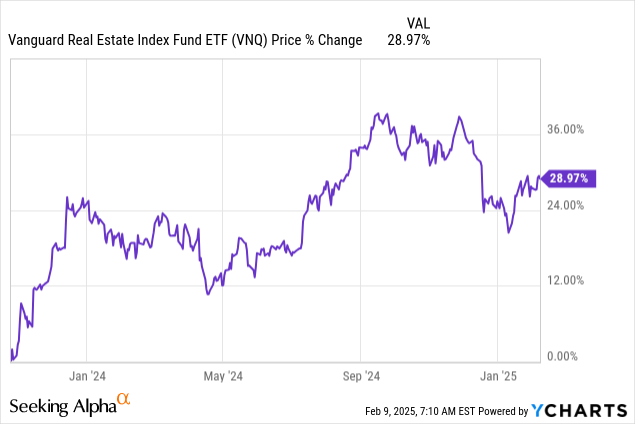

The US REIT market (VNQ) still presents a lot of opportunities, but it has already surged by ~30% on average since October 2023:

But many foreign REIT markets missed out on this rally and as a result, they are now historically cheap relative to US REITs in many cases. Moreover, the US Dollar is also historically strong relative to most other major currencies like the Euro at the moment.

Therefore, I have spent a lot of time studying new international opportunities in recent weeks. Here are two of our favorite opportunities at the moment:

Top Pick #1 for 2025: Big Yellow Group

Some REIT business models are just superior to others.

Certain REITs enjoy competitive advantages that allow them to consistently earn superior returns with less risk.

Big Yellow Group (BYG / OTCPK:BYLOF) is a great example of that.

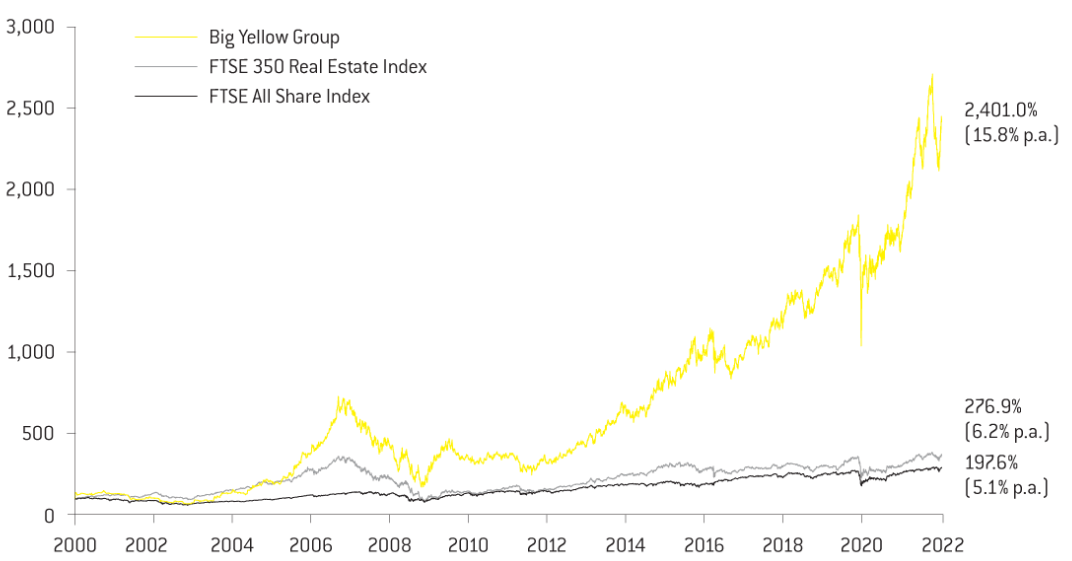

It went public in the year 2000 and it has since then managed to earn ~15% average annual returns and that's despite suffering a major setback during the great financial crisis when banks stopped working. Adjusted for that extraordinary period, its average annual total returns would have been closer to 20% per year:

These high returns were the result of the REIT's rapid growth.

It has managed to grow its FFO per share by 13% per year on average since 2004. Add to that the dividend and you get to 15-20% average annual total returns.

Best of all, we think that the REIT can keep generating similar strong returns for another decade or two because the REIT is still small in size and the self-storage market is still in its infancy in Europe with less than 1 square foot of storage space per capita compared to ~10 in the US. That is the main reason why I prefer Big Yellow when compared to its US peers like Public Storage (PSA) and Extra Space Storage (EXR):

But the concept is now rapidly growing in popularity.

The same demand drivers exist in Europe (divorce, deaths, downsizing, relocation, etc.), but people live in even smaller residences in more densely populated cities.

Moreover, the pandemic was a huge catalyst for the sector, especially in Europe, because people suddenly wanted to make space for a home office, and many businesses decided to downsize their offices, often leading to demand for storage space, at least temporarily.

As a result, today over half of Big Yellow's tenants are first-time users.

The concept of self-storage is finally becoming more mainstream in the UK and Big Yellow is one of just a few investors of scale in this space that's capable of developing new properties to bring additional supply to the market.

Today, it has 13 projects underway, which should expand its portfolio size by ~20% in the coming years.

Historically, it has managed to earn an 8-10% stabilized yield on its new development projects, which represents a huge spread over its cost of capital.

And I think that it will be able to keep developing new properties for a long time to come, resulting in significant growth for many more years.

Typically, when a REIT enjoys such strong growth prospects, the market prices it accordingly with shares trading at high valuations.

This has been true for Big Yellow for most of its history with shares commonly trading at 25-35x FFO. This is not unreasonable for a REIT with rapid growth prospects, a defensive business, and low leverage.

Yet, today, it trades at just 16x FFO. Its valuation multiple has been cut in half since 2022 because its share price has dropped by ~40% even as it grew its cash flow by 20%. Interestingly, its valuation compressed even as its leverage also dropped from 22% down to an all-time low of just 11%, which would normally warrant a higher multiple.

We think that this is an opportunity.

The company's valuation crashed because self-storage is going through a post-COVID normalization period.

The pandemic first led to a surge in growth for self-storage REITs because people wanted to work from home, they were moving around, and many older generations passed away. At the same time, there was very little new supply hitting the market.

It led to unusually rapid growth for a few years, but this then attracted a lot of new developers who started building new properties to meet the growing demand right as demand started to normalize. Some people began to gradually return to the office while the vaccines reduced COVID-related deaths. High interest rates have also reduced housing affordability, leading to decreased mobility among people.

Declining demand in the face of growing supply then led to slightly declining occupancy rates and stagnating rents.

This caused Big Yellow to crash.

Why pay 35x FFO for a REIT that's not even growing?

It is a fair point.

But as usual, the market worries too much about the short term and is forgetting about the bigger picture.

The pandemic led to some near-term bumpiness but it does not change the long-term growth outlook of the company.

If anything, it will improve it because it greatly increased the consumer awareness for self-storage as a solution.

2024 and 2025 will be slower years, but going into 2026, demand and supply conditions should normalize right as many of Big Yellow's new development projects will hit the market.

This will then lead to a strong acceleration in its growth and I expect it to push its stock a lot higher.

Just like when growth decelerated and its multiple crashed, I now expect its multiple to expand as growth reaccelerates.

And the upside potential could be significant because its valuation multiple has rarely been this low. Even following the initial pandemic crash, the stock wasn't this cheap.

Simply recovering to the low end of its typical valuation range would result in about 50% upside from here.

While you wait, you earn a ~5% dividend yield and the company is expected to enjoy 8-12% annual growth over the long run.

Hard to beat that coming from a blue-chip REIT that owns recession-resistant properties, has just 11% leverage, and has one of the best track records in the entire REIT sector.

I have owned it since 2016 and have never regretted buying more of it when it was this cheap.

Top Picks #2-10:

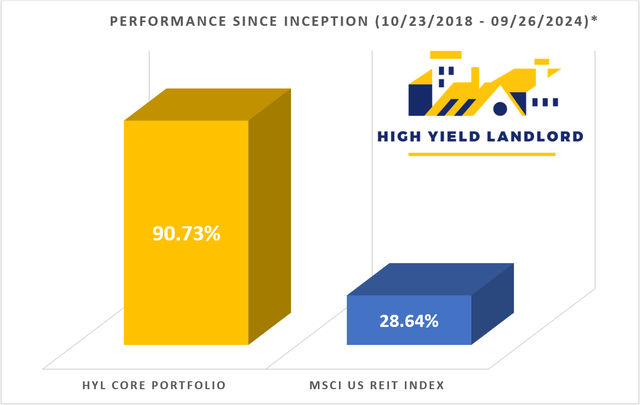

If you’re ready to access a portfolio that has consistently outperformed the market and explore all our current Top Picks, join us for a 2-week free trial at High Yield Landlord. You won’t pay a penny during your free trial, so there’s absolutely nothing to lose—but everything to gain.

We’re proud to be the largest and top-rated real estate investing community, with 2,000+ members and an impressive 4.9/5 rating from over 500 reviews.

Click here to start your 2-week free trial and elevate your investing!