Billionaires Are Buying Farmland (And You Should Too)

Billionaires love farmland.

Bill Gates owns 275,000 acres.

Ray Dalio reportedly owns 556,000 acres, mostly in Australia.

Jeff Bozos has amassed 420,000 acres.

'The Big Short' Michael Burry has noted that his farmland holdings are "substantial".

Warren Buffett also owns farmland, but we don't know much.

The latest billionaire to invest in farmland is the founder of the investment firm, WisdomTree. They just acquired the farmland investment firm, Ceres, managing $1.85 billion worth of farmland.

Why are all these billionaires so eager to invest in this asset class?

I think that it comes down to three key reasons:

Reason #1: Exceptional Risk-to-Reward Prospects

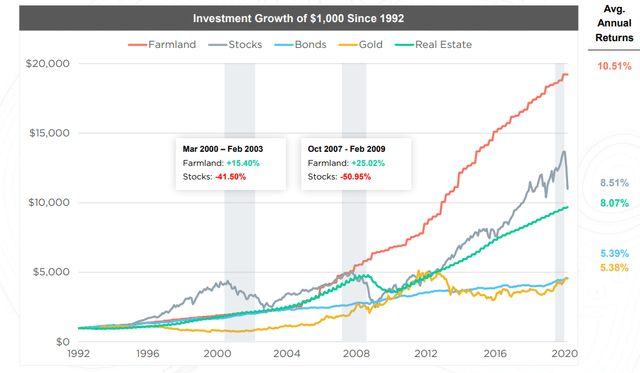

Historically, farmland has been one of the best investments, outperforming even stocks, bonds, and real estate:

Even more impressive is that it achieved these superior returns with very low volatility.

Typically, you need to take higher risk to earn high returns, but in the case of farmland, investors have earned higher returns with lower risk, which is very unusual.

Here is what Warren Buffett said about his farmland investments in a 2014 Berkshire Hathaway (BRK.B) shareholder letter:

“In 1986, I bought a 400-acre farm 50 miles north of Omaha. I knew nothing about farming. But my son, who was then just starting college, and I visited the farm, and I learned from the tenant farmer what the land could produce. Since purchase, productivity has improved and crop prices have risen. The farm now earns about three times what it did when I bought it... I needed no unusual knowledge or intelligence to conclude that the investment had no downside and potentially substantial upside. There would, of course, be bad years and good years, but that was the way farming worked. I liked that probability.”

Essentially, he saw it as a safe investment with attractive return prospects relative to its risk profile, and that's exactly what farmland is all about.

It offers exceptional risk-to-reward, and that is why it is so popular amongst wealthy investors.

Its returns come from the rental yield and the value appreciation. Tenants pay you rent for your land, and unlike other real estate investments, landlords do not have to deal with any maintenance costs. There are no leaking roofs, clogged toilets, or problem tenants that refuse to move out. Occupancy rates are also quasi-100% and rents are usually paid in advance, all of which makes farmland a great income investment.

But beyond the yield, farmland has also steadily appreciated in value over time, and it is easy to understand why.

It all comes down to the simple laws of supply and demand.

The supply of farmland is strictly limited because we simply aren't making any more of it. On the contrary, the supply goes down each year a little more due to better-use conversions and climate change.

Even then, the demand keeps steadily rising due to the growing global population and rising middle class in emerging markets, which leads to protein-rich diets, requiring more farmland. According to estimates of the UN, we could be nearly 10 billion people by 2050, a much larger share of that will be in the middle class.

Rising demand coupled with declining supply results in value appreciation, which, coupled with the yield, and a little leverage, has historically allowed farmland investors to earn 10-15% annual total returns.

This may drop a bit in the future due to the compression in cap rates and higher interest rates, but the return prospects remain very attractive relative to the risk profile of the asset class.

Reason #2: Inflation Protection

Beyond that, a lot of billionaires worry about inflation risk, especially given how heavily indebted the world has become.

Farmland is arguably the best inflation hedge in the world, given that it is limited in supply, but absolutely essential to our survival and prosperity. Everyone needs to eat, regardless of how the economy is doing or the underlying currency.

That makes it resilient to inflation and major potential monetary black swan events. If you think that we are at risk of facing a major monetary event someday in the future, then you want to own timeless investments like farmland.

Reason #3: Valuable Diversification in an Uncertain World

Finally, we live in a very chaotic world today with major wars and conflicts unfolding across many regions, and experts fear that things could get a lot worse.

Regardless of where you stand, you will probably agree that the current geopolitical world stage is extremely dangerous, and in the event of a third world war, most stocks and other investments would likely crash in value.

However, farmland has historically been quite resilient to such black swan events. Many call it "gold with dividends" for this reason.

These billionaires don't want to just grow their wealth. They are just as concerned about simply preserving their wealth under various scenarios, and farmland can help with that.

If you also worry about such potential dramatic events, you may also want to allocate at least a portion of your portfolio to farmland.

How to Invest in Farmland?

That's the tricky part.

Most of us understand that farmland can be a compelling investment, but few know how to actually invest in it.

Billionaires can afford to hire professionals and build large, well-diversified portfolios.

But most individual investors don't have these resources. If they tried to invest in farmland, they would end up with a risky portfolio that's not diversified by crop type, geography, or weather.

So direct ownership is rarely a good solution for most investors as it would require $10s of millions to build a diversified portfolio.

Fortunately, new solutions have emerged in recent years.

Those are REITs and crowdfunding, and both have unique pros and cons.

REITs (VNQ) are liquid, diversified, and professionally managed. They allow you to easily get exposure to a diversified portfolio and share the upside in it. I have previously owned Farmland Partners (FPI) and would be happy to invest again in it someday in the future, if and when its valuation becomes more attractive and/or its growth accelerates.

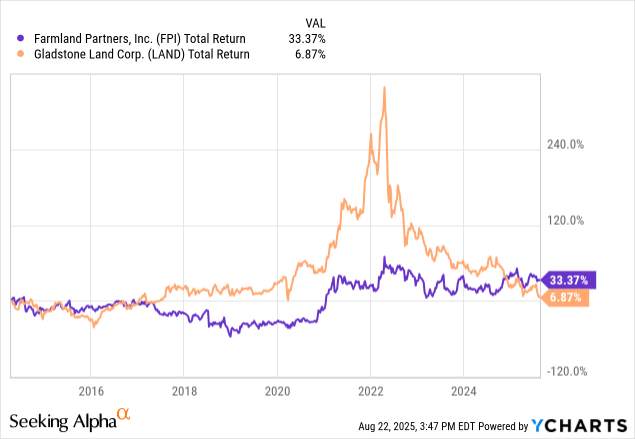

Unfortunately, there are only two farmland REITs today, and they both suffer from some issues.

Farmland Partners (FPI) is quite heavily leveraged, has a relatively poor track record of growth on a per-share basis, and also operates a brokerage business, which increases risks relative to traditional farmland investments.

Gladstone Land (LAND), on the other hand, is externally managed, also has quite a bit of leverage, and it is heavily exposed to challenged markets.

As a result, both have done poorly since they went public and failed to provide investors "farmland-like" steady returns:

It, of course, does not help that REITs have now been in a bear market for 3+ years and remain out of favor.

Maybe someday, they will prove to be attractive and recover. But as of right now, the public market does not seem to be ready for farmland investments.

The other option is crowdfunding.

In recent years, a number of platforms focusing exclusively on farmland investments have emerged, seeking to open the market for smaller individual investors.

The advantages here are that you are getting real private market farmland exposure, selected and managed by professionals, and earn the real farmland returns, minus the fees they charge. They also allow you to diversify with a relatively small amount. They may also offer tax benefits not available through traditional stock investments.

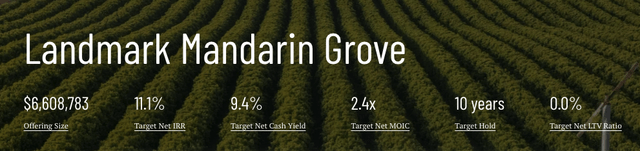

The downside is that these investments are not liquid, so they would only make sense if you are a long-term oriented investor and are willing to hold that investment for 10 years. Fortunately, many of these deals pay significant income, which helps to remain patient. FarmTogether, as an example, which is one of the biggest farmland crowdfunding platforms, is currently offering a deal with a 9.4% yield:

(You can review the deal by creating an account. It takes just a minute. Click here to sign up)

They achieve such high yields by buying the right crops in the right markets, and often making improvements to the property to enhance its productivity.

But as you see here, the term is 10 years, so again, you need to be long-term oriented, as you may not be able to sell prior to that.

Closing Note

Smart money is buying farmland hand over fist, and you probably should consider it too.

It is a timeless investment in a world of uncertainty, and it has historically offered some of the best risk-adjusted returns of any asset class.

In the past, these investments might have been reserved for high-net-worth individuals, but not anymore. At High Yield Landlord, we monitor both farmland REITs and crowdfunding platforms.

Finally, please note that we have exceptionally posted this article without a paywall. If you found it valuable, consider joining High Yield Landlord for a 2-week free trial.

You will also gain immediate access to my entire REIT portfolio, real-time trade alerts, exclusive REIT CEO interviews, and much more. We are the largest and highest-rated REIT investment newsletter online, with over 2,000 paid members and more than 500 five-star reviews.

We spend thousands of hours and over $100,000 per year researching the market for the most profitable investment opportunities, and we share the results with you at a tiny fraction of the cost.

Get started today - the first 2 weeks are on us:

Analyst's Disclosure: I/we have a beneficial long position in the shares of all companies held in the CORE PORTFOLIO, RETIREMENT PORTFOLIO, and INTERNATIONAL PORTFOLIO either through stock ownership, options, or other derivatives. We also own a position in FarmTogether. High Yield Landlord® ('HYL') is managed by Leonberg Research, a subsidiary of Leonberg Capital. All rights are reserved. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. The newsletter is impersonal and subscribers/readers should not make any investment decision without conducting their own due diligence, and consulting their financial advisor about their specific situation. The information is obtained from sources believed to be reliable, but its accuracy cannot be guaranteed. The opinions expressed are those of the publisher and are subject to change without notice. We are a team of five analysts, each contributing distinct perspectives. Nonetheless, Jussi Askola, the leader of the service, is responsible for making the final investment decisions and overseeing the portfolio. We do not always agree with each other and an investment by Jussi should not be taken as an endorsement by other authors. Past performance is no guarantee of future results. Our portfolio performance data is provided by Interactive Brokers and believed to be accurate but its accuracy has not been audited and cannot be guaranteed. Our portfolio may not be perfectly comparable to the relevant index. It is more concentrated and may at times use margin and/or invest in companies that are not typically included in REIT indexes. Finally, High Yield Landlord is not a licensed securities dealer, broker, US investment adviser, or investment bank. We simply share research on the REIT sector.

You make a compelling argument for owning farmland but the options for doing so presented in this article all seem a bit problematic. It sounds like Farm Together is the best option presented here? Are there any other options out there that would work better? I assume if there were you would have mentioned them in the article. I like the idea of a monetary black swan hedge as it's no secret that the US has too much debt and has printed too much money and seems incapable of reining in it's deficits.

Fees on Farm Together investments seem pretty steep. Can you provide some color on this?