Blackstone and Brookfield Are Hunting Self-Storage REITs

Important Announcements:

Just a quick heads up:

We will share our third Top Pick for 2026 on Friday. Stay tuned!

We expect to interview the management of HASI very soon. Let us know if you have any questions for them.

I will host another live Webinar in a few weeks. Let me know if there are any specific topics that you would like me to cover.

--------------------------------------------------------

Blackstone and Brookfield Are Hunting Self-Storage REITs

We recently bulked up two of our self-storage REIT investments, noting that the sector had recently caught the eye of Blackstone (BX), which is rumored to be attempting to buy out Big Yellow Group (BYG / BYLOF), our largest investment in this space. (You can read our Trade Alert by clicking here)

Now, just two weeks later, Brookfield (BAM) is attempting to buy out National Storage REIT (NSR / NTSGF), our Australian self-storage REIT:

That’s now two self-storage REIT buyout attempts affecting our holdings over a short period of time.

It is also very interesting that this is coming from the two largest and most sophisticated alternative asset managers in the world: Blackstone and Brookfield.

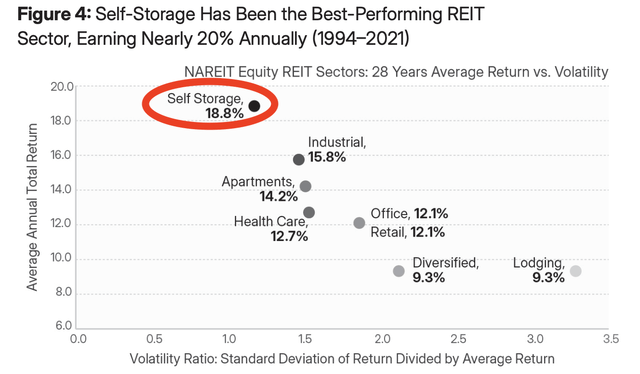

I think that it strongly reaffirms our thesis for investing in foreign self-storage REITs, which are still 10-20 years behind the US in terms of supply, and offer an opportunity to replicate the strong historical returns of US self-storage REITs as the concept grows in popularity and they develop new properties to meet the demand:

Should we sell, hold, or buy more?