Buy Farmland: It Is The Best Hedge Against Russia's Invasion Of Ukraine

Buy Farmland: It is The Best Hedge Against Russia's Invasion Of Ukraine

Right now, a lot of investors appear to be fleeing the stock market and relocating their capital into safe havens like gold (GLD) and silver (SLV). Here is the performance of the S&P500 (SPY) vs. the metals since the beginning of the year:

Data by YCharts

This is of course the result of Russia's invasion of Ukraine.

It is creating extreme uncertainty with investors asking themselves:

Could this escalate into a 3rd world war?

Would Putin really use nukes on his adversaries?

What impact will the sanctions have on the world's economy?

Obviously, this is all very bad news for the stock market. A 3rd world war may have seemed impossible just a few weeks ago, but now it has become a possibility, albeit a small one. Moreover, the risk of a nuclear war has also risen considerably because Putin's latest moves put his mental well-being into question.

Finally, and perhaps most importantly in the immediate term, the war and its resulting economic sanctions are already having a significant impact on businesses worldwide. Many investors appear to mistakenly think that only a small number of European businesses are impacted, but in reality, the impact goes way beyond that.

Russia is the biggest country in the world and Ukraine is Europe's biggest country. They are huge exporters of natural resources and since they are cut off from global markets, it is causing significant inflation.

Furthermore, Russia and Ukraine are also big consumer markets for many of our biggest companies. As an example, McDonald's (MCD) generates nearly 10% of its revenue from Russia/Ukraine, but now its ~1,000 restaurants are all closed and losing money. Similarly, KFC (YUM), Starbucks (SBUX), Meta (FB), Apple (AAPL), and Coca-Cola (KO) are all leaving Russia and its profits behind.

It then isn't surprising that stock prices are taking a hit and this may well be just the beginning. So far, gold and silver have served as good hedges against this crisis, but we think that US farmland will serve as an even better hedge going forward.

Farmland is often described as "gold with a dividend" because its value is resilient to most crises, but unlike gold, it also generates rental income while you wait for long-term appreciation.

Below, you can see that farmland kept gaining value through the dot-com crash, the great financial crisis, and even the pandemic. Beyond that, it also generated high total returns, outperforming stocks, bonds, gold, and real estate:

That, on its own, makes farmland a worthy addition to your portfolio. It generates exceptionally attractive risk-adjusted returns and provides diversification benefits to your portfolio.

But especially today, you should consider a farmland allocation because Russia's invasion of Ukraine is a huge catalyst for farmland in the USA.

Russia and Ukraine are some of the world's biggest producers and exporters of major crops like wheat, corn, and soybeans, but now they are being cut off from the rest of the world and as a result, the global food supply is severely disrupted and it is causing an unprecedented surge in prices. Here are a few recent headlines from Seeking Alpha:

Russia is cut off from global trade because of all the sanctions.

Ukraine is cut off because it is fighting for its survival.

The sanctions on Russia will likely last for quite a while even after the war is over, and it will also take some time for Ukraine to rebuild its infrastructure before it is ready to resume global trade.

This leaves US farmland owners in a strong position because if you remove a huge amount of farmland from the global market, then naturally, the remaining farmland becomes a lot more valuable.

That's exactly what's happening right now.

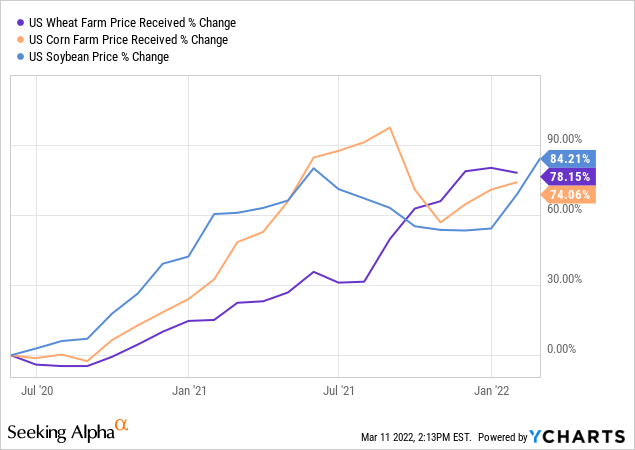

Crop prices are surging and so are farmers' profits, which then results in substantial rent hikes, and land value appreciation. Year-over-year, farmland is already up 20% according to February 2022 publications of the Federal Reserve Banks of Chicago and Kansas City. In comparison, major crop prices are up far more than that:

It demonstrates that farmland can serve as an effective hedge against the war in Ukraine.

I would expect farmland to do well in the long run anyway, but it could also offer extraordinary upside in the near term if the war carries on.

It stabilizes the value of my portfolio, improves its risk-adjusted returns, and ultimately, it helps me sleep better at night during these times of extreme uncertainty.

Today, I have about 10% of my net worth invested in farmland if you count my VC investment in a farmland crowdfunding platform. Below, I highlight my two favorite investment opportunities in this space:

Farmland Partners (FPI)

Farmland Partners (FPI) is our favorite opportunity that's publicly listed. It is one of only two farmland REITs and it owns 160k acres of farmland across the US:

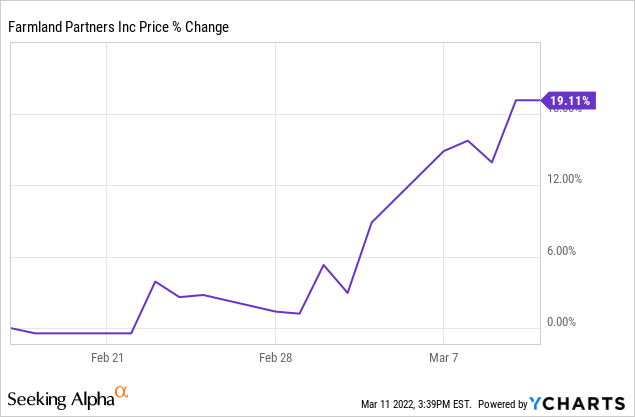

We shared our investment thesis in mid of February and shortly after, it rose by 20% as Russia invaded Ukraine:

We think that this surge is well-justified given what we explained earlier. Already prior to the war, FPI's was hiking its rents by 10%+ and it had guided for even faster growth in 2022, noting that today's farm economy was the strongest since the 2012-2014 era. Now add to that the war in Ukraine, and we could well see 20%+ rent hikes in 2022. We also think that FPI's asset management business should benefit from this crisis as it will only increase the demand for farmland investments.

This is very bullish for the company, but despite that, it is still priced at a 5-10% discount to our net asset value estimate.

We think that this discount is likely to turn into a large premium as increasingly many investors realize that farmland is an effective hedge against this crisis. Meanwhile, the value of its farmland is also likely to keep rising at a rapid rate and the rent payments keep flowing in.

All in all, we expect to earn ~20% annual returns from FPI in the next 2-3 years and that's why it is one of our largest holdings at High Yield Landlord.

We are increasing our Buy Under Price to $16 and maintaining our Strong Buy rating. You can read our investment thesis by clicking here.

FarmTogether

My second favorite option to invest in farmland is through a crowdfunding site called FarmTogether.

Let me start off by saying that I am generally not a big fan of crowdfunding sites because in most cases, I would expect publicly listed REITs to provide better returns with lower risk. That's why I have been critical of sites like Fundrise in the past.

However, in the case of farmland, I think that crowdfunding makes a lot of sense because it is still an unpenetrated asset class with very few investment options for individual investors.

Today, there are only 2 publicly listed REITs and each of them presents issues that may make them uninvestable and/or distort the investment characteristics of farmland.

The first one, Gladstone Land (LAND), is currently priced at an estimated 95% premium to NAV, which essentially means that for each dollar invested in the company, you only get ~50 cents of farmland. Because you are overpaying for the farmland, you are also only getting a 1.5% dividend yield.

The second one, Farmland Partners (FPI), isn't a pure-play farmland investment since it also has a brokerage and asset management business, and beyond that, its legal troubles still eat most of its cash flow, leaving investors with a mere 1.4% yield.

For these reasons, LAND isn't particularly attractive, and while we like FPI, there are good reasons why some investors may want to skip it, or at the very least, seek greater diversification to complete their farmland allocation.

That's where FarmTogether comes in.

It is the leading crowdfunding platform that specializes in farmland investments with nearly $200 million of assets under management. It allows individual investors to easily invest in farmland deals that are cherry-picked and managed by professionals, and they are able to keep their fees reasonably low by embracing technology in raising capital and acquiring farmland:

It only takes a few minutes to create an account on their site and you are then ready to review their farmland offering and invest in them directly through their site.

Typically, their deals enjoy far higher yields than what you would get from LAND/FPI because you are not paying a large premium to NAV, the fees are reasonable, and most importantly, FarmTogether structures deals that prioritize income generation.

They are often able to earn yields of up to ~8% by targeting higher-yielding permanent crops, taking cheap mortgages, and accepting some development/operational risk. As an example, instead of signing a long triple net lease that would provide steady cash flow, they may sign a profit-sharing agreement with the tenant, which leads to more volatile cash flow, but higher yield on average. Similarly, they may at times target farmland with trees and bushes that are approaching the end of their life cycle and replant them to boost yields and add value.

Here is an example of a deal with an 8%+ yield that will go live on their site next week:

(If you want to review the details of the deal, you can create an account by clicking here)

Needless to say that higher yields also come with higher risks, but FarmTogether is very selective about their deals, and you can diversify risks by investing in many deals across their platform:

You can review their selection process by clicking here, but I can tell from my many conversations with the founder & CEO of the company that they are very diligent. They have built a tech-powered sourcing and underwriting AI-tool that they call "Terra" to pull data from 150+ sources to feed their pipeline and identify superior deals to pursue. This includes even things like satellite imagery and death deeds to get off-market deals.

The principals have experience working for some of the world's largest and most innovative farmland institutional funds, such as Prudential and Ontario Teachers’ Pension Plan.

I have personally known the founder, Artem Milinchuk, for many years and this led me to become an angel investor and advisor of the company in 2021. If I didn't believe in their investment process, I wouldn't have done so. The senior investment team of FarmTogether also personally invests in all their deals to align interests.

For all these reasons, I think that FarmTogether is the best private farmland investment option, at least from all of those that I have studied.

They know what they are doing, they take reasonable fees, and they allow you to easily invest and diversify through their site. It also helps that I have known Artem for years, hold him in very high regard, and have an insider look in the company as an advisor.

What are some of the downsides of FarmTogether?

Nothing is perfect. The main downside of FarmTogether is that their deals are illiquid, have investment minimums, and there are of course fees to take into account.

Most of their deals have a 10-year term. This makes sense since farmland is a long-term-oriented investment, but if you need to sell earlier, you may be stuck with it. FarmTogether is working on a secondary marketplace to allow you to sell your stake earlier if needed, but there can be no assurance of it.

Typically, the investment minimum is also $15,000 and you have to be an accredited investor so it is not for everybody. You would need to commit a decent amount of capital to diversify properly.

Moreover, since FarmTogether is a private equity style asset manager, it will earn fees on its assets under management. It incentives them to grow their asset base, which may lower their investment discipline. Personally, I am not too worried about this one because I know that the executives, including Artem, personally invest in each deal; and I also know that they could have far more assets under management if they wanted to, but they have passed up on $10s of millions of deals that were in advanced stages of negotiation in the last quarter alone.

Depending on your investment objectives and horizon, these may not be downsides, but they are still risks to keep in mind.

Why haven't I previously talked about FarmTogether at High Yield Landlord?

I probably should have given how much farmland has appreciated over the past year, but the main reason why I have kept silent is that there are some conflicts of interest that I feel a bit uncomfortable with.

Since I am an angel investor and advisor of the company, I benefit from FarmTogether's growth and therefore, I may not be perfectly objective about the company.

I always do my best to avoid potential conflicts of interest as I make recommendations at High Yield Landlord, and therefore, I have preferred to avoid discussing FarmTogether.

To be clear, I am not paid to write about it, but since I own a small piece of the company, I benefit if the company is growing. Obviously, I believe in what they are offering, but I also have a lot of my own money on the line so I may not be fully objective.

Bottom Line

Farmland is very hot right now and rightfully so.

I think that it is the best hedge against the war in Ukraine, which could still potentially turn into a 3rd world war.

I hold a farmland allocation in my portfolio because it helps me sleep better at night. I see it as a form of insurance/diversification against such black swan events. It helps me stabilize the value of my portfolio, protect it against inflation, generate income, and still provide competitive total returns in the long run.

I gain my exposure through FPI and FarmTogether. In the future, if new farmland REITs are created, I would not mind adding another one to the mix.

Finally, please note that this is a free article from High Yield Landlord. If you found it valuable, consider joining our service for a 2-week free trial. You'll gain immediate access to my entire REIT portfolio, real-time trade alerts, exclusive REIT CEO interviews, and much more. We are the largest and highest-rated REIT investment newsletter online, with over 2,000 paid members and more than 500 five-star reviews.

We spend 1000s of hours and over $100,000 per year researching the market for the most profitable investment opportunities and share the results with you at a tiny fraction of the cost.

Get started today - the first 2 weeks are on us:

Sincerely,

Jussi Askola

Analyst's Disclosure: I/we have a beneficial long position in the shares of all companies held in the CORE PORTFOLIO, RETIREMENT PORTFOLIO, and INTERNATIONAL PORTFOLIO either through stock ownership, options, or other derivatives. I am also long FARMTOGETHER. High Yield Landlord® ('HYL') is managed by Leonberg Research, a subsidiary of Leonberg Capital. All rights are reserved. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. The newsletter is impersonal and subscribers/readers should not make any investment decision without conducting their own due diligence, and consulting their financial advisor about their specific situation. The information is obtained from sources believed to be reliable, but its accuracy cannot be guaranteed. The opinions expressed are those of the publisher and are subject to change without notice. We are a team of five analysts, each contributing distinct perspectives. Nonetheless, Jussi Askola, the leader of the service, is responsible for making the final investment decisions and overseeing the portfolio. We do not always agree with each other and an investment by Jussi should not be taken as an endorsement by other authors. Past performance is no guarantee of future results. Our portfolio performance data is provided by Interactive Brokers and believed to be accurate but its accuracy has not been audited and cannot be guaranteed. Our portfolio may not be perfectly comparable to the relevant index. It is more concentrated and may at times use margin and/or invest in companies that are not typically included in REIT indexes. Finally, High Yield Landlord is not a licensed securities dealer, broker, US investment adviser, or investment bank. We simply share research on the REIT sector.