Canadian REIT Opportunities - Part 3 (Incl. Trade Alert)

Canadian REIT Opportunities - Part 3 (Incl. Trade Alert)

Important Note: In case you missed the introduction to our Canadian field trip, you can read it by clicking here.

---------------------------------------------------------------------------------

Over the last two weeks, I have done a lot of research on Canadian REITs and my first takeaway is that most Canadian REITs aren't worth buying because:

They lack a clear strategy/specialization,

They suffer significant conflicts of interest,

And they are not pricey enough to profit from accretive growth, or cheap enough for you to profit from repricing potential.

History has shown that such REITs do relatively poorly over time, and yet, most Canadian REITs suffer from at least one of the above factors. They own diversified portfolios, lack specialization, are often externally managed, and their valuations end up in a range that limits their ability to raise capital and grow.

At High Yield Landlord, we typically look for the polar opposite: we want to buy REITs that are highly specialized and shareholder-friendly at the cheapest price possible. If you look at our top holdings, they all have something uniquely attractive about them and a clear path to long-term outperformance.

Unfortunately, such opportunities are relatively rare in Canada and most Canadian REITs lack the 'hit factor' that we typically find in our selection.

But exceptions exist!

In Part 1 of this series, we introduce members to this new series and provide general information on the Canadian REIT market.

In Part 2, we present Northwest Healthcare Properties (NWH.UN), which is our favorite Healthcare REIT opportunity in Canada.

And in today's part 3 article, we focus on RioCan (REI.UN / RIOCF), which is our favorite Canadian retail REIT opportunity.

Note that we first invested in RioCan back in November last year and have already covered it here at High Yield Landlord.

Instead of repeating the same facts, we will simply provide a quick recap of our thesis and then discuss my main take-aways from visiting several of their properties in Toronto.

Recap of Our Investment Thesis

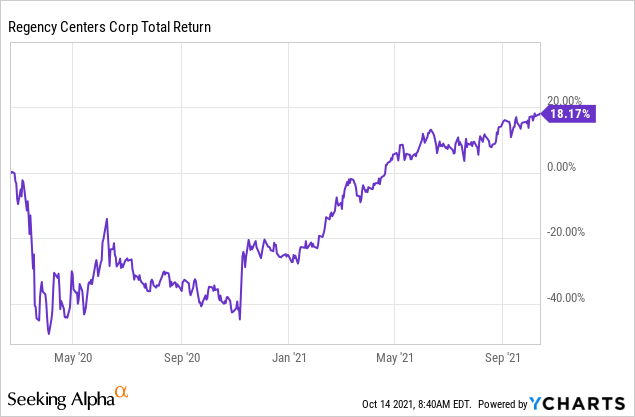

By now, most US shopping center REITs have fully recovered. This is particularly true for those REITs that own highly urban service-oriented properties such as those of Regency Centers (REG):

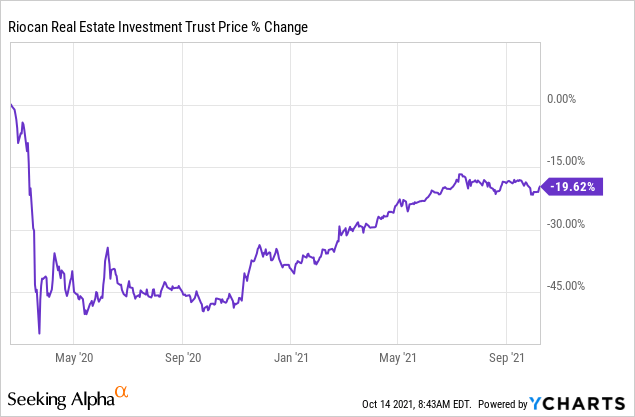

RioCan is similar but owns arguably even better properties. Yet, because it is traded in Canada, it is still priced at a 20% discount to pre-covid levels and offers ~25% upside potential just to return to where it was in early 2020, and ~40% upside potential to close the performance gap with its US peer, Regency Center:

We think that this discount is especially spectacular when you consider that RioCan owns mostly highly urban service-oriented shopping centers in Toronto, which is one of the strongest real estate markets in the world.

That's because its population is growing rapidly, but most locations are already developed, creating a supply/demand imbalance that benefits existing property owners. Here is how Toronto compares to other major US cities in terms of vacancies and expected future growth:

Not surprisingly, RioCan has outperformed its US peers from a fundamental perspective during the pandemic with its occupancy rate remaining as high as 96% (vs. ~92% for US peers), and its releasing spreads staying at 8.1% (vs. ~4 for US peers).

RioCan also has a large pipeline of residential development projects which represent 11% of its total portfolio. We think that the cap rates of these properties have kept drifting lower, increasing the value of its pipeline even further, but since the market sees RioCan as a retail REIT, it is not giving it much credit for its residential program.

So in a nutshell, you are getting stronger fundamentals at a discount when buying RioCan, and that is why we are so bullish on it. We expect it to fully recover, just like its US peers already have, unlocking at least 25% upside, and while you wait, you collect a 4.3% dividend yield. Considering that this is coming from a REIT that owns defensive properties in some of the strongest markets in the world, we like the risk-to-reward and sleep well at night knowing that these properties are likely to keep gaining value in the long run.

You can read our full investment thesis by clicking the link below:

In what follows, we highlight the two main takeaways from our boots-on-the-ground research:

1) The Quality of the Properties is Even Better Than I Had Imagined

I spent most of my Canadian field trip in Toronto because that's where most Canadian REITs and other investment firms are based.

I would work during the days and then tour properties by night, and since RioCan generates over 50% of its revenue from Toronto, I got to visit many of their properties.

I stayed right in the center of the city and the first thing that jumped to me is that RioCan's properties are extremely well located.

Most often, I could walk or take a bike to RioCan's properties, but needed to take an uber to those of other REITs.

Below, I highlight some of RioCan's properties on a map to show you what I mean:

Below, I also add pictures of RioCan Hall, Kingly, and The Well because they illustrate perfectly what I mean:

I like these locations because they are urban, in-fill, highly walkable neighborhoods with good public transport, a great live-work-play atmosphere, and they are near the center and other attractions.

The barriers to entry in these locations are substantial because most sites are already built, and therefore, the potential for adding more capacity is limited. It gives some a moat to existing property owners.

Meanwhile, the demand for these locations is rising rapidly.

Canada is the fastest-growing of the G7 countries and most of these people are moving to big cities, with Toronto being one of the top choices:

Over the next 3 years alone, Canada is expected to welcome another ~1.2 million new immigrants.

Since Toronto is already built out, it will continue to densify.

Developers will keep building on top of other buildings and/or replace existing buildings with larger and taller ones to add more capacity, especially for housing.

When you walk around Toronto, you see such projects all over the place because people want to live in central live-work-play type locations and it is the only way to add the needed capacity.

This is very beneficial to RioCan's retail properties. Its neighborhoods are becoming denser and more populated, but there isn't much new supply of retail space, making the existing properties more valuable.

The proof is in the numbers:

Its rents have kept growing consistently, despite the "retail apocalypse" which started in 2016, and the pandemic, which began in 2020. The fact that RioCan grew organically even through this period proves our point that these are great retail properties.

2) The Real Story That The Market Is Missing is Residential Densification

RioCan does not just benefit from the densification projects of others. It also has its own and these projects are expected to create substantial value that the market is still overlooking.

RioCan has a whole webpage dedicated to these projects because it has so many of them. Here is a quick overview:

It expects to have developed over 10,000 residential units (!!!) in the next two years. 75% of them will be in Toronto, which once again, it one of the strongest real estate markets in the world with high rents, rapid growth, and low cap rates.

In the first quarter, RioCan sold a 50% JV interest in one of its new residential buildings in Toronto at a 3.6% cap rate based on normalized NOI, and an even lower cap rate based on current NOI. Today, based on the conversations that I had in Toronto, it appears that residential cap rates are already pushing into the low 3s / high 2s - just like in Vancouver.

You can do some very rough math here and capitalize 1,000s of units earning ~$1,500 a month at ~3% cap rates and you will see how these projects are expected to create significant value for shareholders in the coming years, and yet, the market isn't paying much attention to it.

Perhaps, the market might be concerned that RioCan will struggle to finance these projects? After all, its equity is still discounted and its balance sheet cannot take much more leverage. Opposite of that, RioCan would like to reduce its LTV from ~48% to ~40%. So, it is a legitimate concern: where is all the money going to come from to build 1,000s of units in just a few years?

Fortunately, RioCan has a great solution and it has already proven its efficacy.

It will finance these projects by selling JV interest in its existing residential towers at extremely low cap rates, and also sell condo/townhouses at historically expensive (some would say 'bubbly') prices, to then recycle this capital into new development projects.

This strategy is very attractive because it unlocks permanent equity capital at very low rates. In previous investor presentations, I remember them mentioning that they are building at nearly 6% yields, but these assets are worth a ~3.5% cap rate. In other words, each dollar invested creates $1.5 to $2 of value for shareholders. Add some leverage to the mix, and you get fantastic returns.

But it actually goes beyond that. The densification projects also benefit RioCan in several other ways:

It will boost the sales and traffic of its retail properties. (Remember that the residential towers are built next to or above the retail properties)

It will ultimately boost the NOI of the retail properties. The higher the sales, the higher the rents.

It will also reduce the cap rates of its retail properties because it reduces their risk and increases their growth prospects.

Therefore, there are great synergies between the residential densification projects and the underlying retail portfolio.

The residential densification projects may represent just 11% of the total portfolio, but they actually impact a much larger percentage of the portfolio.

The Bottom Line Is This:

Rents Are Rising.

Cap Rates Are Compressing.

And Riocan Is More Valuable Than Ever.

The pandemic caused temporary pain to all retail properties, but since then, rents have recovered and cap rates have compressed further for desirable assets such as those owned by RioCan. That's why companies like Regency are priced at new all-time highs, and RioCan is likely to get there too.

Its recovery may have been somewhat delayed by stricter covid restrictions affecting Canada, but that was only temporary, and it is now starting to reverse. As an example, Canada has now reopened its borders to most European countries, but the US still hasn't.

Final Note

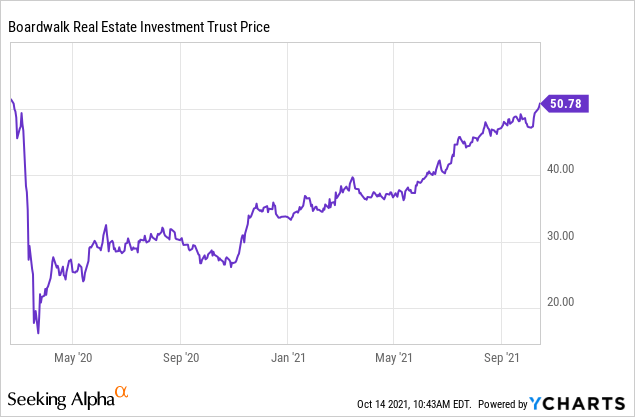

As a final note, we think that the performance of Canadian residential REITs may also serve as a telling sign of what to expect for RioCan.

Canadian residential REITs recovered much slower than their US peers, but eventually, the market recognized this discrepancy, and Canadian residential REITs end up recovering. This delay allowed us to pick up shares of Boardwalk REIT as low as C$20 per share, doubling our money in less than one year:

We think that the same thing is happening with Canadian Shopping Center REITs. They are recovering slower than US peers, but eventually, the market will recognize this discrepancy and correct the mispricing, causing REITs like RioCan to surge in value.

We expect ~25-40% upside and while you wait, you earn a safe 4.3% dividend yield. Today, we bought another 50 shares to slightly increase our existing position:

==============================

How to Invest:

RioCan is mainly traded on the Toronto Stock Exchange. Its ticker is REI-UN and it trades in Canadian Dollars. This is one of the few Foreign REITs that you can also buy through the US stock market (Ticker: OTCPK:RIOCF).

To learn how to invest abroad, please read the following article:

Course to REIT Investing: Investing in Foreign REITs

Good investing from your HYL Research Team,

Jussi Askola