Canadian Rental Properties With >100% Upside Potential

Canadian Rental Properties with >100% Upside Potential

Important Note: In September, we launched a new real-money Portfolio that will exclusively focus on International real estate opportunities. Right now, it holds 10 positions with exposure to:

France

Germany

UK

Canada

Singapore

Hong Kong

China

Japan

Australia

New Zealand

In today's article, we will discuss Boardwalk (BOWFF), which is a Canadian Apartment REIT. Please note that I recently invested in this company with some of my company's funds, and expect to soon add it to our International Portfolio. All figures below are in Canadian Dollars.

-----------------------------------------------------------------------------------

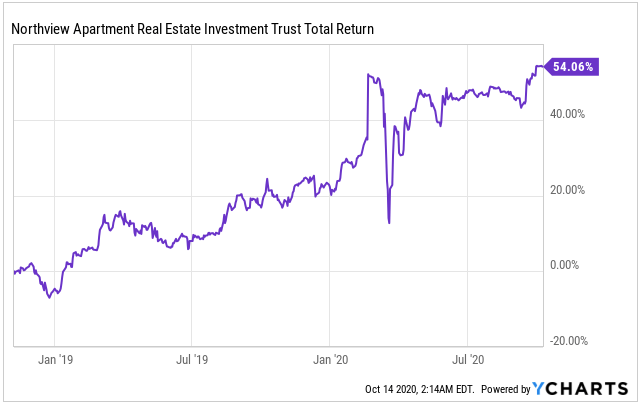

Over the past years, one of our best investments has been a Canadian Apartment REIT called Northview Apartment Real Estate (NPRUF). Since posting our thesis in November 2018, it has returned 54% even as we go through a severe crisis:

Today, the opportunity has greatly deteriorated. Northview is set to be taken private, and it offers little upside potential as you wait for the deal to close.

We wouldn’t buy Northview at this point anymore.

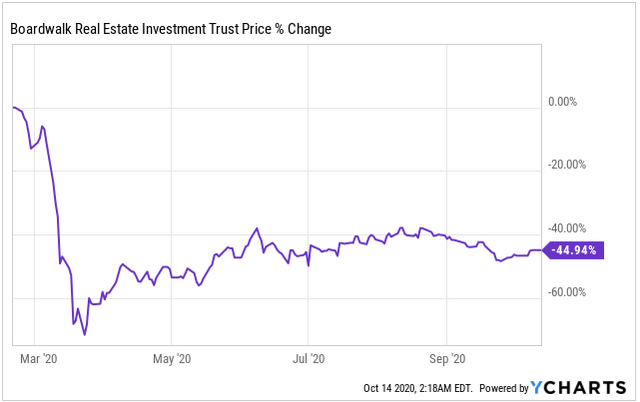

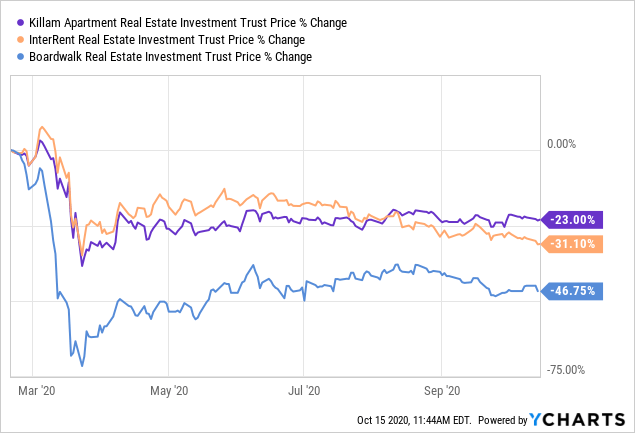

However, one of its close peers, Boardwalk (BOWFF) has recently become very opportunistic. It is down by 45% because of the covid crisis and now trades at one of its lowest valuations ever:

The market has become very pessimistic about the future prospects of Canadian Apartment REITs, and this is especially true for those that are exposed to energy-based economies. But as we will explain below, we think that the sell-off is way overdone and that Boardwalk is set for a strong recovery.

Boardwalk: a High-Quality REIT

What is a high-quality REIT?

That’s a very subjective question and the answer can drastically differ depending on who you ask. If you ask me, I would want:

Assets with predictable long-term prospects.

Stable and growing cash flow.

A <50% Loan-to-Value.

Well-aligned management with skin in the game.

Sustainable dividends and a low payout ratio.

And as you will see below, Boardwalk has it all.

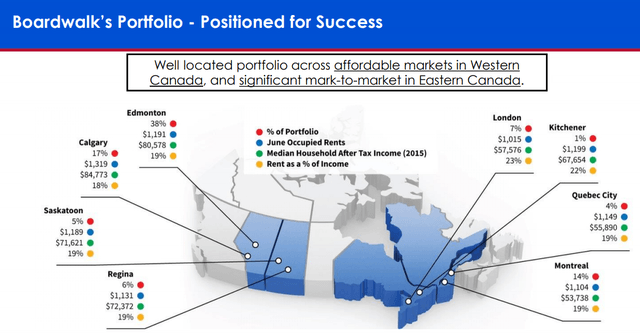

Boardwalk is a pure-play Apartment REIT with a well-diversified portfolio across Western and Eastern Canada:

As you already know from our previous articles, we like this asset class a lot.

Apartment communities are some of the most defensive property investments because shelter remains a vital necessity even during recessions, and you cannot replace a 2-room apartment with technology.

Because of this resilience, investors can typically use more leverage on apartment communities than other property types and earn superior returns. Historically, Apartment REITs have been some of the strongest performers in the entire REIT sector:

While we like the financial aspect of apartment communities, we hate to manage them because of the Ugly 3 Ts:

Tenants

Toilets

And Trash

Fortunately, we can delegate all of that to local experts by investing in a REIT like Boardwalk. It also provides us diversification and economies of scale which we could not achieve on our own.

Boardwalk owns over 30,000 units across 4 provinces. Below you will find a few notable assets from its portfolio:

Wesley Parks, Cambridge Ontario – Property owned by Boardwalk:

Infinity at 105, Edmonton Alberta – Property Owned by Boardwalk:

Kings Alley, Calgary Alberta – Property Owned by Boardwalk:

By investing in Boardwalk, you’ll own indirectly a small portion of these communities with the management included, financing pre-arranged, no personal liability issues, and passive income coming your way. That’s the appeal of REITs in a nutshell. But as you’ll see below, it gets even better.

How Has Boardwalk Performed During the Covid Crisis?

Remarkably well.

Boardwalk invests mostly in older, well-maintained, Class B communities with highly affordable rents in the $1,000 to $1,200 range. The rent as a percentage of income is generally below 20% and this affords great resilience during times of crisis.

These residents are mostly renters by necessity who are less likely to move away to buy their own home, but they make enough money to pay their rent and are unlikely to find better value elsewhere.

As a result, the communities owned by Boardwalk are particularly resilient and it shows in its recent results:

(1) First off, the rent collection rates have remained the same as pre-covid at around 98%:

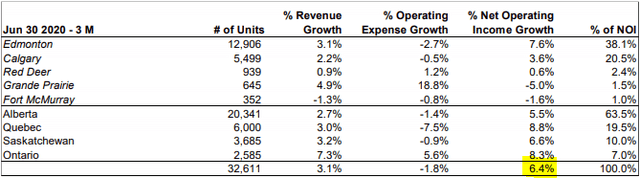

(2) Secondly, its communities continue to grow cash flow. They enjoyed 7.3% NOI growth in the first 6 months of the year, and 6% NOI growth at the heights of the crisis. That’s the best growth rate we know in the Apartment sector. It was achieved thanks to cuts in property expenses, and continued rent and occupancy growth:

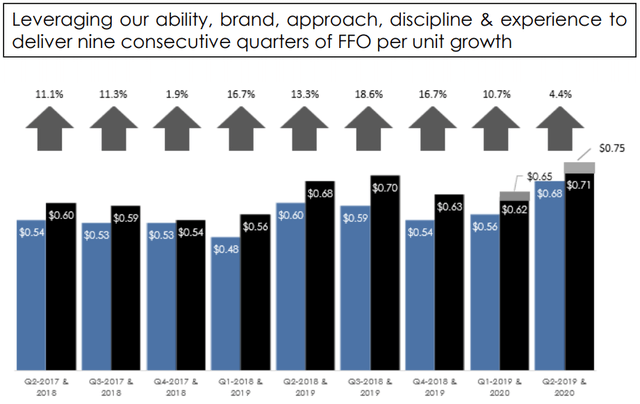

(3) Finally, all of this also shows in FFO per share, which is now up for 9 consecutive quarters. It grew by 4.4% in the second quarter and by 7.3% year to date, which is quite exceptional when you consider the severity of the crisis:

Essentially, Boardwalk’s performance during this recent crisis has been better than the great majority of Apartment REITs.

Fueling Future Growth

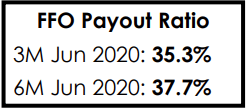

Something unique that we like a lot about Boardwalk is that its payout ratio is exceptionally low at 35 to 40%:

It allows it to fund its growth initiatives without having to raise new equity at highly dilutive prices. Most other apartment REITs are closer to a 60-80% payout so it is a competitive advantage in today’s environment.

It will fuel value-add improvements, new acquisitions, and property development in the coming years:

The approach is similar to that of Independence Realty Trust (IRT) in the US. They rarely develop their own assets. They prefer to buy older communities with value-add potential, and then improve them to grow rents and create value in the process (higher NOI and cap rate compression). Once the property is optimized, they retain it in their portfolio or sell it to buy another asset with more potential.

Boardwalk has a full presentation dedicated to its value-add program. You can access it by clicking here. Below we highlight a few Before / After pictures to give you an idea:

Renovation of the community room at Spruce Gardens in Calgary:

Renovation of leasing office at Vista Gardens in Calgary:

The improvements to a leasing office or a community area may not seem like a big deal, but since this is your first impression of the property, the returns are very strong. The yields-on-cost are commonly in the 10-15% range and that’s without considering any cap rate compression potential.

Boardwalk notes that it has great “mark-to-market” opportunities across its entire portfolio as it continues to improve assets and bump rents:

Solid Balance Sheet with Upside

Boardwalk currently has a 48% Loan-to-Value, which is ideal for defensive apartment communities in our opinion. It is enough to nicely boost returns, but it remains secure even during times of crisis.

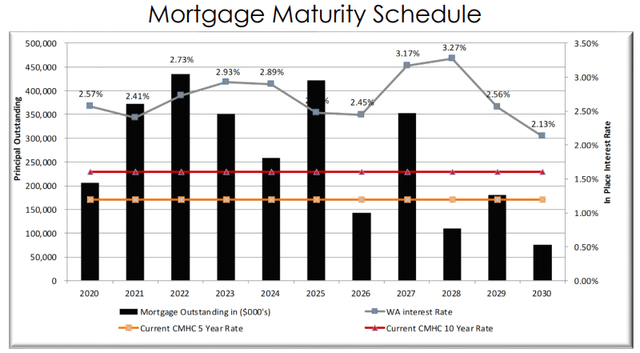

The interesting thing here is that its current interest rates are much higher than what it could get in today’s environment. Its current average interest rate is 2.71%, compared to 1.3% for 5-year debt and 1.7% for 10-year debt in the current marketplace:

It has about a quarter of its debt maturing in the coming two years and we think that this will result in significant cost savings for Boardwalk.

Every dollar saved on interest expense falls straight to the bottom line. It is a significant tailwind for the company.

Shareholder-Friendly Management

Our main concern with most Foreign REITs is that they are often poorly managed by conflicted and fee-hungry managers.

Boardwalk is the opposite.

It is still led by its original founder, Sam Kolias, who recently preferred to take no salary to instead create scholarships in the company’s name.

Other base salaries are below average, and insiders are required to put a lot of skin in the game. Right now, insiders own 25% of the equity.

We see no indications of conflicted interest. Opposite of that, Boardwalk appears to be particularly well-managed with the shareholder’s long term interest in mind. (Note that we are currently trying to arrange an exclusive interview of Sam Kolias for members of High Yield Landlord)

Lowest Valuation Ever

By now, we have established that Boardwalk is a high-quality REIT:

It has great assets that enjoy recession and technology resilience.

Its cash flow has remained stable and even grown through the crisis.

It has a simple but effective plan to achieve future organic growth.

It has a good balance sheet with upside potential.

And finally, it is managed by a shareholder-friendly management that owns a quarter of the equity.

It is posting better numbers than ever, and yet, it has seen its share price nearly cut in half:

As a result, it now trades at its lowest valuation ever:

~10x stable and growing FFO.

>50% discount to NAV based on recent transactions.

~7.5% implied cap rate compared to 4-5% observed in the market.

That’s extraordinarily cheap on an absolute basis, but it is also very cheap relative to other apartment REITs. Similar apartment REITs trade at >15x FFO and smaller discounts to NAV in the US, despite often suffering greater pain.

Most Canadian Apartment REITs also trade at materially higher valuations and have held up better during the recent sell-off:

Why has the market become so pessimistic on Boardwalk?

There are two main reasons:

The first one is obvious: the pandemic. The market fears that it will lead to lower rent collection rates, declining rents, and ultimately, lower cash flow for shareholders. This is yet to be seen. So far, rents are holding up very well.

The second reason is the more specific to Boardwalk: the lower oil prices.

Over the past years, Boardwalk has often traded as if it was an energy investment because it has high exposure to Alberta and Saskatchewan, which are energy-based economies. Boardwalk today generates 2/3 of its revenue from these two regions and so from this point of view, we can somewhat understand the fears. It will certainly affect Boardwalk’s fundamentals in the coming years.

However, we think that it is just plain wrong to paint Boardwalk as an energy investment.

An apartment community located in Houston, Texas, is not an energy investment, it is a real estate investment; and the same applies to Alberta in Canada. As already highlighted in the article, Boardwalk has performed remarkably well even despite the recent crisis. Its rents are highly affordable, and its class B communities attract great demand during recessions. Moreover, its current rents enjoy good margin of safety because they are below market.

It should also be noted that the Alberta region has evolved a lot over the past years. The weak oil price began already in 2014 and the quickest way to diversify an energy-based economy is for the energy sector to crash.

It initially led to rapidly rising unemployment in the region, but as jobs started to shift into the other industries, the unemployment fell from nearly 10% in 2016 to 7% in early 2020 (pre-covid).

Through the entire crisis, the net migration to the region also remained positive:

Since Boardwalk is picky about where it invests, the net migration to its locations was probably even superior.

The lower oil prices will again hurt the local economy, and lead to weaker fundamentals for apartment community owners, but it is far from being the end of the world. Net migration may turn negative for a while, but Boardwalk owns resilient communities with sustainable rents, organic growth potential, and it also has plenty of liquidity to push for external growth. In fact, it is now in the process of better diversifying its portfolio and this could serve as a catalyst to unlock value in the future.

Catalysts for Value Realization: Improved Diversification and/or M&A

We identify two potential catalysts that could lead to better market sentiment and future appreciation.

Catalyst #1: Improved Portfolio Diversification

Right now, Boardwalk is hated because it is too heavily invested in Western Canada. However, as it improves its diversification, its valuation multiple would likely expand, and this is exactly what the management is planning to do.

Its target is to achieve a 50 / 50 exposure between Eastern and Western markets.

To achieve that it will use its existing liquidity and retained cash flow to invest in new properties and development projects in Eastern Canada. Moreover, it may also occasionally sell assets in Western Canada and reinvest proceeds in Eastern markets to speed up the process.

This is a great catalyst because Boardwalk is in full control of it. By improving its portfolio structure, it will eventually earn a higher multiple. Before the weak oil prices, Boardwalk traded at a premium to NAV and it will get there again.

Catalyst #2: M&A

There has been a lot of M&A activity in the Canadian REIT market over the past years. As an example, our previous Canadian REIT investment, Northview, was bought out by a private equity player. It had a similar portfolio as Boardwalk and it was taken private at a 25% premium to NAV. If Boardwalk was bought out at a similar price, it would need to nearly triple from here.

Similarly, Pure Multi-Family (PMULFI), another Canadian Apartment REIT was also acquired. Dream Global (DUNDF) also. And there are several other examples.

There is a lot of appetite for discounted Canadian REITs and we would not be surprised if Boardwalk became the target of a buyout attempt.

With its latest IFRS NAV at $~62 and its share price at $27, it is the cheapest high-quality apartment REIT in Northern America.

Sustainable, Growing, Monthly Dividends

Boardwalk’s dividend is very attractive because:

It is secure with a low 35-40% payout ratio.

It is set for further growth.

And it is paid monthly.

The yield is not particularly high at 3.7%, but remember that the payout ratio is very low. It allows the company to reinvest in its future growth, which will ultimately lead to higher dividends and appreciation.

This is especially attractive for Foreign investors who suffer withholding taxes. Since they only pay the strict minimum to remain a REIT, you save taxes on dividends and enjoy stronger appreciation prospects instead.

How to Invest:

Boardwalk is mainly traded on the Toronto Stock Exchange. Its ticker is BEI-UN and it trades in Canadian Dollars. This is one of the few Foreign REITs that you can also buy through the US stock market (Ticker: BOWFF).

To learn how to invest abroad, please read the following article:

Course to REIT Investing: Investing in Foreign REITs

Bottom Line

Boardwalk is arguably the best apartment REIT opportunity in the current marketplace. It trades at 10x FFO compared to comparable opportunities that trade at over 15x FFO in the US.

I have started to build a position under my company's account and expect to soon add it to our International Portfolo. We give it a Strong Buy rating.

Good investing from your HYL Research Team,

Jussi Askola