Data Center REITs 2026 Update

Quick Note

Many readers have asked for our latest views on data center REITs and why we do not invest in them, despite the AI boom often being cited as a major tailwind for the sector. In this article, we explain why we continue to avoid data center REITs and why we believe the more attractive way to benefit from rising data center demand is through an asset-light alternative asset manager.

-------------------------------------------------

The last time we covered data center REITs in this August 2024 article, we reaffirmed our longtime view on this sub-sector.

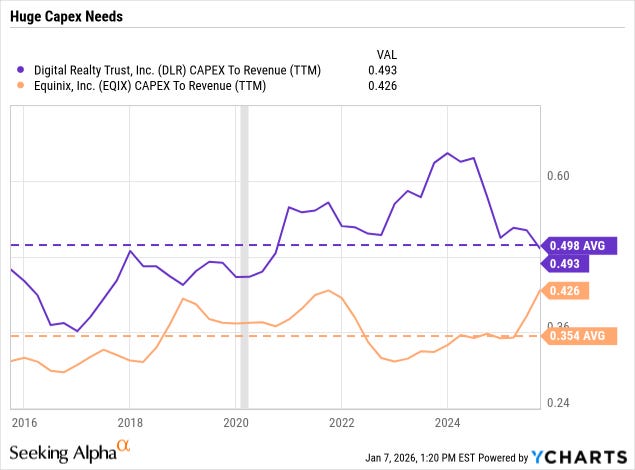

Our thesis was that data center REITs like Equinix (EQIX) and Digital Realty (DLR) do not generate attractive growth in free cash flow because of their ever-growing operating costs. Data center landlords have to continue upgrading their equipment and infrastructure not to grow their revenue but rather merely to remain competitive with new, state-of-the-art data centers coming to market.

These capex requirements have historically grown as fast as or even faster than total revenue, never allowing free cash flow (excluding true growth investments) to get up off the ground.

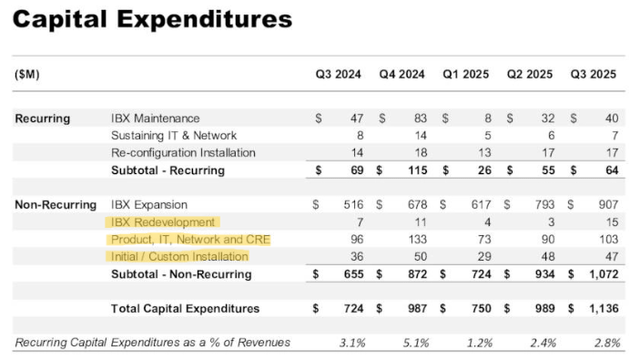

The two major data center REITs account for capex a little differently, with EQIX labeling most of its capex as “non-recurring” even though much of this is non-revenue-generating while DLR labels most of it as recurring (accurately, in our view).

Hence why EQIX’s reported AFFO per share has grown so much faster than that of DLR:

This is the main problem we see with our fellow REIT analyst Dane Bowler’s recent comparison between EQIX and DLR is that he doesn’t adjust for the two REITs’ different ways of accounting for capex when citing AFFO per share growth.

To be fair, EQIX operates interconnection/colocation data centers, which are the equivalent of multi-tenant buildings, while DLR largely operates enterprise/hyperscale data centers, which are the equivalent of single-tenant computer warehouses. Their business models do work a little differently, which causes their capex accounting to be a little different.

When a large tenant vacates an enterprise data center, DLR has to spend a considerable amount of money on tenant improvements to make the building ready for a new tenant. DLR properly accounts for this as non-revenue-generating.

But we believe EQIX excludes a lot of non-revenue-generating capex from its “recurring capex” calculation and thereby artificially boosts AFFO per share.

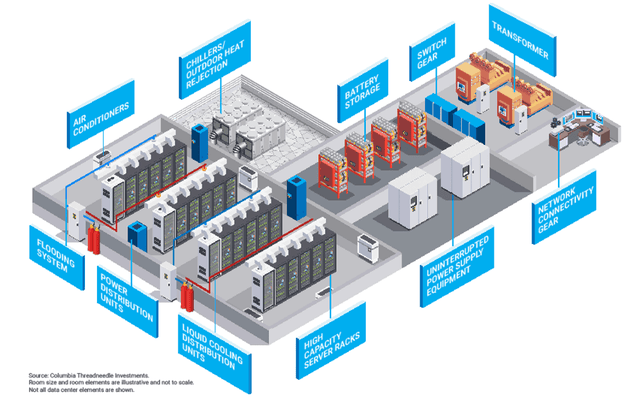

EQIX Q3 2025 Presentation

While expansion of “International Business Exchange” facilities (i.e. EQIX’s interconnection data centers) is clearly revenue-generating capex, much of what is categorized as IBX redevelopment; product, IT, network and CRE; and initial/custom installation is almost certainly not revenue-generating.

EQIX Q3 2025 Presentation

For example, a lot of equipment, cooling, and software spending is carried out to remain competitive with or superior to other state-of-the-art data centers. It is done for the sake of tenant retention, not to generate new revenues.

Likewise, capital spending on customer equipment installations should be categorized as recurring capex, in our view, because it would be necessary for any tenant of an interconnection data center. Every particular tenant is going to require a certain setup within the data centers where it is renting space.

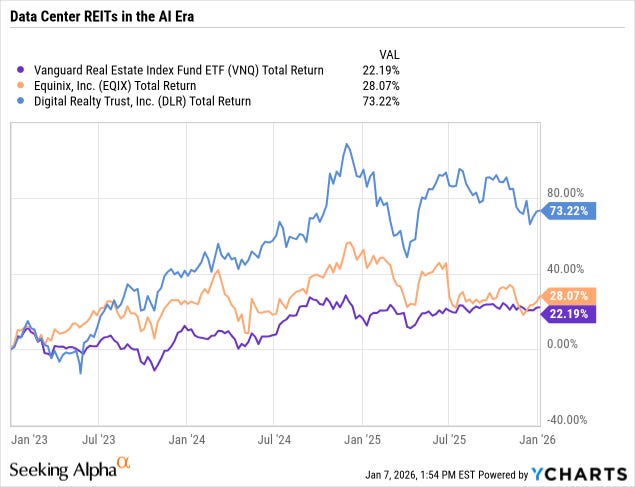

We think this is a major reason why DLR has greatly outperformed EQIX since the late-2022 launch of ChatGPT that began the current “AI era.”

In fact, astonishingly, in the last three years, EQIX has barely outperformed the real estate sector as a whole (VNQ).

Once you correct for what we believe to be artificially boosted AFFO in EQIX, the valuation differences between the two REITs disappear.

EQIX trades at a reported AFFO multiple of 19.5x, while DLR trades at a 22.2x multiple. But if you include non-revenue-generating capex in EQIX’s AFFO, then its multiple rises into the 20s as well.

On the other hand, one of Dane Bowler’s arguments for the superiority of EQIX over DLR is its wider development spreads.

Since DLR primarily develops big box data warehouses for the likes of Microsoft (MSFT), Amazon (AMZN), Meta Platforms (META), and Alphabet (GOOG, GOOGL), who could and often do build and own their own data centers, the yields on its long-term leases tend to be fairly low.

It’s the same reason why a big box net lease property leased to Walmart (WMT) would have a lower yield than a shopping center occupied by local and regional retailers.

We are skeptical of EQIX’s claim to generate 25% yields on stabilized development projects. (We know, for example, that this metric doesn’t include first-generation tenant equipment buildout/installation.) But if EQIX’s development yields are anywhere near this number, then it enjoys a vastly wider investment spread, making its returns on development investment much better.

This should, in theory, translate into stronger true AFFO per share growth in the future.

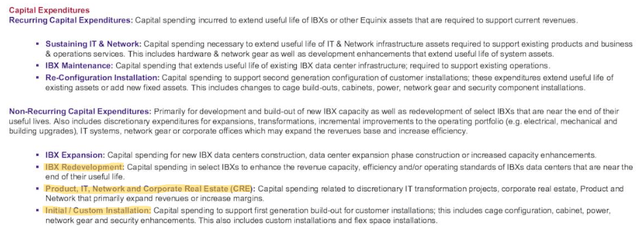

Another point in EQIX’s favor is the fact that AI inference (software customer usage) is projected to grow at a far faster pace than AI training (development of new AI models using massive datasets) going forward.

JLL Research

AI training is typically done in big box hyperscale facilities like those owned by DRL, while AI inference is usually the domain of interconnection/colocation facilities like those owned by EQIX.

So far, there has been far more need for hyperscale data centers to carry out the compute-intensive training of new AI models. And, to be sure, AI software developers will continue developing and honing new models over time.

But going forward, demand should grow much faster for the interconnection data centers that are located within population centers, where latency is reduced.

The Capex Treadmill

The risk we see with data center REITs, including EQIX, is that capex continues to outrun revenue growth.

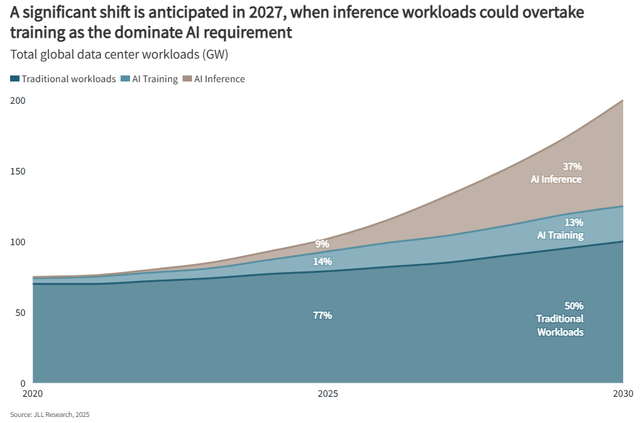

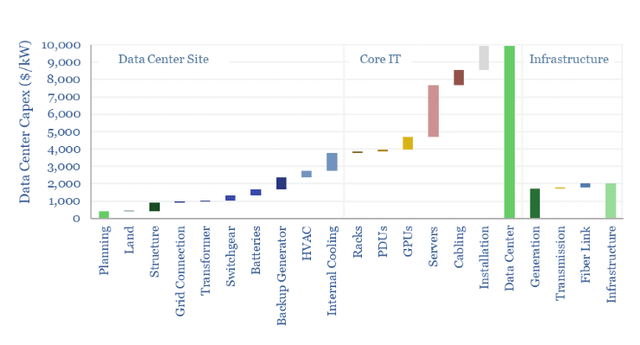

As explained in our prior article on data center REITs, the landlords like EQIX and DLR own and operate both the buildings and the extensive electrical and computer equipment within them. And there are many, many critical components within data centers.

Columbia Threadneedle Investments

Landlords also have to pay for their electricity and water usage as well as the onsite labor to keep the hardware running smoothly and the building secure.

The most recent estimate we have seen shows that construction of a new data center costs somewhere in the neighborhood of $10 million per megawatt (or $10,000 per kilowatt).

Thunder Said Energy

To quote the JLL 2026 Global Data Center Market Outlook:

Between 2020 and 2025, the average global data center construction cost increased from $7.7 to $10.7 million per MW, equating to 7% CAGR. For 2026, JLL is forecasting the average global cost will increase 6% to $11.3 million per MW.

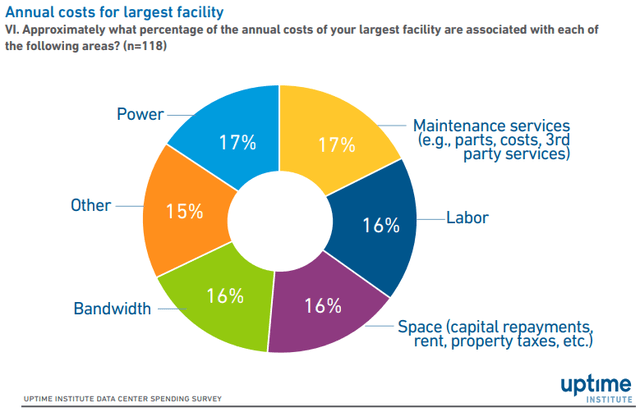

On top of that, data centers have among the highest operating costs of all commercial real estate sub-sectors, behind only hospitality and cold storage.

As demand for electricity grows far faster than the supply of new power generation going forward, data centers’ operating costs are likely to keep rising at a swift pace.

Uptime Institute

It can be very difficult for data center operators to cut costs, because all of these operating costs are necessary for the 24/7 functionality of these facilities.

Over the last decade, the capex-to-revenue ratios for both EQIX and DLR have trended upward:

But while DLR has recently cut back on capex by partnering with JV partners like Blackstone (BX) and Realty Income (O) as a capital providers on new development projects, EQIX has ramped up its capex on development projects as it seeks to prepare for the coming wave of AI inference.

For reference, industrial REITs Prologis (PLD) and EastGroup Properties (EGP) both spend about 10% of total revenue on capex on average.

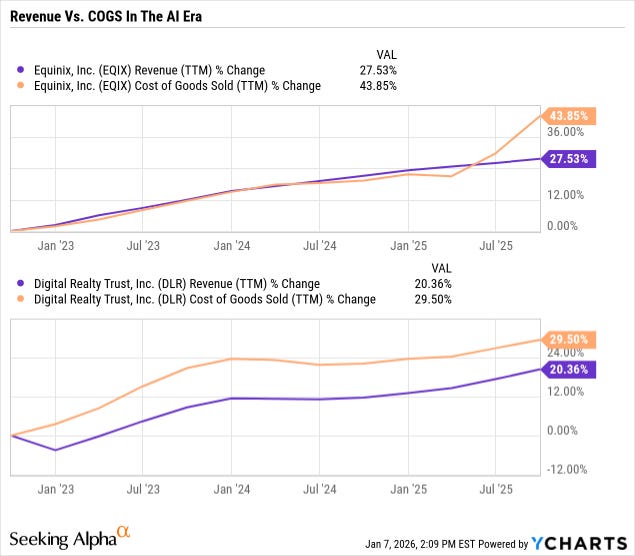

Another way to visualize this is by comparing trailing twelve month revenue to trailing twelve month cost of goods sold (a rough proxy for operating costs).

As you can see, since the initial release of ChatGPT in late 2022, both EQIX and DLR have seen their COGS rise faster than their revenue.

That may change going forward.

For example, in Q3 2025, DLR reported cash renewal rent rate increases of 8%, and EQIX’s adjusted EBITDA margin reached a record 50% in Q3 2025, up from 47% in 2024.

Especially as the wave of AI inference gets going, EQIX may see increased revenue growth and adjusted EBITDA margin expansion in the coming years.

The Overbuilding Risk

If the widely discussed “AI infrastructure bubble” thesis bears out, and it ultimately turns out that an excessive amount of data centers were built relative to AI inference demand, then which of these two REITs is most at risk?

The obvious answer is that DLR is most at risk, because most of the data centers under construction today are intended as hyperscale facilities to be used for AI training. Most of these are owned directly by the Big Tech hyperscalers themselves.

If there turns out to be an excess of capacity at these wholesale/hyperscale facilities, then the Big Tech corporations will likely vacate the capacity rented from the likes of DLR and focus instead on their owned facilities.

And if DLR is left with a lot of vacant hyperscale centers, these will be costly either to re-lease to a new tenant or develop for other, non-data center purposes.

If there is a data center supply glut coming, it is most likely to show up in these rural enterprise/wholesale/hyperscale facilities.

To be fair, though, about 80% of DLR’s development pipeline is preleased, which minimizes its risk for now.

On the other hand, EQIX is more insulated from the risk of data center overbuilding, because its facilities are necessarily located in population centers where land is more scarce and building permits are harder to obtain.

Ultimately, power supply and interconnection to the electrical grid act as the biggest bottleneck to development of all kinds of new data centers.

If and when the grid is sufficiently build out to accommodate all the new data centers under construction (probably sometime in 2027-2029), there could be a sudden rush of new data center supply that creates a glut. That’s when competition will really heat up for DLR.