Don’t Miss This Historic Opportunity – Net Lease REITs

Don’t Miss This Historic Opportunity – Net Lease REITs

Historically, REITs have been some of the most recession-resistant investments in the stock market. This greater resilience comes from long term leases that continue to generate steady cash flow even during recessions. As a result, they have provided nearly 2x times better downside protection during the average recession since 1991:

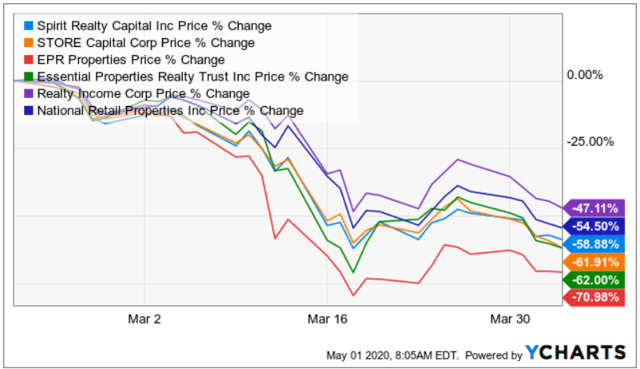

However, this time around, we have seen the opposite happen: REITs have dropped much more than the rest of the market. At the lowest, REITs were down by 44%, and some sub-sectors of the REIT market dropped even more than that.

What is unique about today’s bear market is that it was caused by a global health concern that is forcing people to stay at home. The market quickly interpreted this as a doomsday scenario for everything brick and mortar because if we cannot get out, we won’t need office buildings, retail shops, or anything else.

We believe that this sell-off presents a historic opportunity for long-term oriented real estate investors who understand that buying real estate at pennies on the dollars is simple and effective investment strategy.

We are undergoing a severe, but temporary crisis, and sooner than you may think, we will be back to living normal lives. Missing a few months of rents has minimal impact on long term value – yet – most REITs are now greatly discounted.

But not every REIT is worth buying!

Some REITs are really going through an existential crisis today. Mortgage REITs, Hotel REITs, and lower quality Mall REITs are hit particularly hard because they are heavily leveraged and suddenly see their earnings plummet. They may eventually turn around and richly reward investors, but they clearly also have a speculative nature. We are not very interested in that.

However some other REIT property sectors are better protected, have conservative balance sheets, and yet, they have dropped to historic lows. Today, we highlight one of our favorite property sectors to play offense in this bear market:

Historic Mispricing: Net Lease REITs Offer >7% Yield and 100-200% Upside Potential

Net lease REITs are real estate investment firms that specialize in the ownership of freestanding single tenant retail properties such as:

McDonald’s (MCD) quick service restaurants

7/11 convenience stores

Walmart (WMT) grocery stores

L.A Fitness gyms

Advance Auto Parts (AAP) shops

Etc…

Most of these properties are service or value oriented. They are located close to major highways or intersections with high visibility to attract customers. Think about the local Starbucks (SBUX) on your way to work:

These properties are called “Net Lease” because the lease agreement with the tenant is different from most other properties. Net leases are structured more in favor of the landlord:

No Landlord Responsibility: The tenant is responsible for all property expenses: utilities, insurance, taxes, cleaning, and anything else.

No Capex: The tenant is also responsible for the maintenance of the property: leaking roof, cracking parking lot, cloaked toilet, etc…

Longer Leases: The lease is much longer than average. The typical term starts at ~15 years and includes several 5 year extensions.

Strong Rent Coverage: The properties serve as the profit-center of the tenant, and the rent is typically covered by 2 to 3 times, leaving ample margin of safety even if fundamentals deteriorate in a recession.

No Co-Tenancy Issues: Because these are single tenant properties, the landlord does not have to worry about co-tenancy clauses. This is today a problem for shopping center and mall REITs.

Predictable Growth: Finally, the landlord is protected against inflation by including automatic rent increases in the lease agreement. The norm is a 2% hike each year or 10% every 5 years.

Therefore, net lease properties are commonly perceived to be bond-like investments with inflation protection. They are low on management-intensity and generate very steady and predictable cash flow, even during recessions.

Tenants make significant capital investments to these properties and rely on them to generate profits. They are very unlikely to risk disrupting an established customer base to save moderate amounts of rent in new location. As a result, vacancy rates are very low in this sector, even during recessions.

Finally, net lease investments have a high land value component. The sites are very valuable for their strategic locations, but the construction itself has low build out costs. So even in a worse case scenario where the property turns dark and is difficult to release, you can always tear it down and start all over again.

The main downside is that these are illiquid investments. However, by investing in publicly traded net lease REITs, you get to enjoy all the positive attributes of net lease investments, with the added benefit of daily liquidity, diversification, and professional management.

REITs Put the “Net Lease” Fundamentals on Steroids

Realty Income (O) is the largest and most established net lease REIT. It has a track record of generating 16.4% annual total returns since its IPO in 1994; and it has never missed a dividend payment. Not even the worst real estate crash in history (2008-2009) could stop dividends. Occupancy rates have never dipped below 96% and cash flow only decreased by 2% in 2008-2009:

Clearly, owning a diversified portfolio of net lease properties is a very resilient business model. Leases are very long and the strong rent coverage allows tenants to keep making steady payments even during recessions.

For this reason, net lease REITs have historically been perceived as some of the most defensive and recession-resistant REIT investments. During the great financial crisis, they were some of the best performers – dropping by only ~20% and quickly recovering all the losses in the following years.

“This Time is Different…”

As pandemic fears hit the market, net lease REITs dropped more than ever since I became a professional REIT analyst.

Prices have recovered a little from these lowest levels but they still remain exceptionally low.

Something is seriously wrong, or this is the opportunity of a lifetime.

We believe that this is the opportunity of a lifetime. Here are four reasons why:

This is a temporary crisis: Net lease REITs dropped by ~50% or more. This indicates that there will be a severe and permanent deterioration in fundamentals. However, this appears very unlikely to us. The pandemic is a serious crisis, but it is temporary. We are talking about months, not years or decades. Many Asian and European countries are already opening up economies and the US will soon follow. Some anti-viral drugs are already in use, better ones are in late phase of development, and vaccine could be ready as early as January 2021. The point here is that there is an end in sight. Net lease REITs will take a hit in 2020, and possibly 2021 because of deferred rent payments, increased vacancy and outright tenant defaults. However, this is only a temporary issue and as the economy opens up, these properties will remain highly desirable profit centers that tenants will want to occupy just as they did before.

The temporary crisis is not as bad as it looks: The bears are scared about the stores being closed down and rents not being paid. We get that. It is a serious concern. However, it is important to note that a large portion of net lease properties are service oriented (quick service restaurants, convenience stores, gas stations, banks, etc…) and they remain in business because they provide essential services. Then there is also a good portion of closed business that have good credit and continue to make rent payments according to their leases. So we are not talking about 100% of missed rents. We are talking about a manageable portion, generally 30-40% depending on the REIT, and even then, we are talking about rent deferrals, not rent cancellations. Therefore, most rents will be paid sooner or later. Meanwhile, the tenants who don’t pay their rent remain responsible for all property expenses such as utilities, taxes, insurances, etc… So it is not as bad as malls for instance, for which landlords pay all expenses and may not receive the rent.

Net Lease REITs have enormous liquidity: The key to success in a temporary crisis with disrupted revenue streams is to have enough liquidity and a strong enough balance sheet to weather the storm. Fortunately, net lease REITs are increasingly conservative with financing and they are today sitting on a lot of cash that will allow them to survive the crisis. As an example, EPR Properties (EPR) has well over a $1 billion in cash. It has so much cash on hand that it could take the role of the government and bail out its tenants with bridge loans if it needed to. EPR is not an exception. Major net lease REITs have so much liquidity that they would survive even if they earned 0 rents in 2020 and 2021.

We are now in a 0% interest rate world: Finally, we are now in a yieldless world, which makes net lease REITs more valuable than ever before once the panic is over. Historically, companies like O, NNN and STOR traded at 3-4% dividend yields when interest rates were at 1-2%. But now that interest rates were to cut to 0%, we expect the same companies to experience even further yield compression and gradually reprice at 2-3% yields, once the panic is over and we return to normal. Today, you can buy some of these companies at 6-12% dividend yields. This means that there could be up to 100-200% upside potential across the sector once the crisis is over.

We are not alone to see the opportunity…

Insiders are Loading up Like Never Before

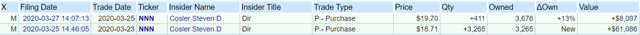

National Retail Properties (NNN): has not had a single insider purchase over the past 3 years and now finally it has seen two purchases over the past weeks:

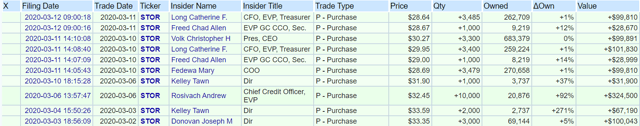

STORE Capital (STOR): the CEO has been vocal about its share price being deeply discounted and we can count 9 different insiders making sizable purchases in March:

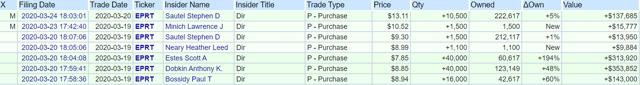

Essential Properties (EPRT): same thing happening here. The entire board of directors is making sizable additions in March following the market crash:

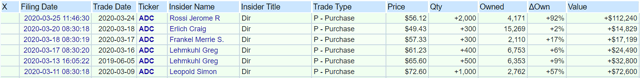

Agree Realty (ADC): once again, they are all loading up in March:

Spirit Realty Capital (SRC): we see sizable additions from 3 excutives:

EPR Properties (EPR): in the midst of this crisis, the company CEO announced a $150 million buy back plan, representing 10% of the company, in response to the “extraordinary dislocation” in the company’s share price.

Anyways, I think that you get the point. All insiders are screaming that their shares are deeply undervalued. I have never such a clear buying signal from a sector. Almost every company has sizable insider purchases right at the same time following a market crash.

Our analysis suggests that net lease REITs are deeply undervalued, and insiders are conforming our thesis with millions of their own dollars.

What Are We Buying?

Over the past weeks, we have been busy accumulating more shares of discounted net lease REITs. We bought more shares in nearly every Trade Alert since the beginning of the bear market.

We currently own four different net lease REITs and each have a unique orientation:

The upside presented here is if these REITs return to their previous highs when interest rates were at 1.5%. With interest rates now at 0%, we would not be surprised if these REITs go much higher in the coming years as we put this crisis behind us and yield-starved investors rush back to net lease REITs.

Combined together, these net lease REITs now represent nearly 25% of our Core Portfolio. The net lease sector is by far our largest exposure:

Needless to say that we are very bullish. We believe that net lease REITs provide some of the best risk-to-reward in the entire financial market.

This belief is backed by countless REIT executives and directors who are currently loading up on their own shares. We have never seen so many insider purchases since the launch of High Yield Landlord.

Don't miss this historic opportunity. Do your own research. Buy in many phases. And hold patiently through the volatility. We believe that a few years from now you will be glad that you bought net lease REITs when others were fleeing the market.

Good investing from your HYL Research Team,

Jussi Askola