Earnings Update: Healthcare REITs (Q1 2025)

There are three major points to discuss related to healthcare real estate today:

The potential for Medicaid cuts from the congressional budget bill.

The long-awaited arrival of the "silver tsunami" appears to finally be here and is showing up in the numbers for senior housing REITs.

The pullback in life science leasing activity.

Let's address each one.

Potential Medicaid Cuts' Effect on Healthcare Real Estate

The US Senate is currently considering how to modify a House-passed bill that proposes significant changes to Medicaid spending, and as things stand today, it appears as though there will be changes to the House's aggressive cuts.

The House of Representatives' "One Big Beautiful Bill" included substantial cuts to Medicaid to the tune of about $800 billion over a ten-year period. The primary vehicle for these cuts would be by instituting work requirements for able-bodied beneficiaries.

Most of the Medicaid cuts would be concentrated in the adult, under-65, able-bodied population, not in the more vulnerable groups that Medicaid was originally designed to target. These groups include single parents, children, and the elderly.

However, a number of moderate Republican senators are opposed to these Medicaid cuts, so it seems likely that the senate will lessen the degree of spending cuts or reduce the strictness of the work requirements.

What's the worst case scenario for healthcare real estate?

Well, by some estimates, between 5-10 million individuals will lose coverage if the House bill's cuts prevail.

The bulk of the damage from such cuts would be borne by hospitals, which often provide care regardless of insurance and then bill the appropriate government program on a post-hoc basis. Loss of Medicaid coverage will either result in a reduction of care or an increase in uncompensated care by hospitals, clinics, and outpatient medical facilities.

This would likely strain the financials of many healthcare providers and limit their leasing activity or perhaps even cause them to shrink their leased space footprint. Some smaller hospitals in rural and/or poor areas that are heavily reliant on Medicaid reimbursements may even be forced to close.

Again, though, it is unclear at this point how exactly the Senate will modify the spending bill as it relates to Medicaid. We will monitor this and keep our members apprised.

The Silver Tsunami Is Showing Up In Senior Housing Facilities

During the 2010s, supply of senior housing properties surged in anticipation of aging demographics, but it turned out to be premature, because demand only grew slowly during this period.

The situation today is reversed. Supply is growing much slower, driven by high construction costs, while demand is surging.

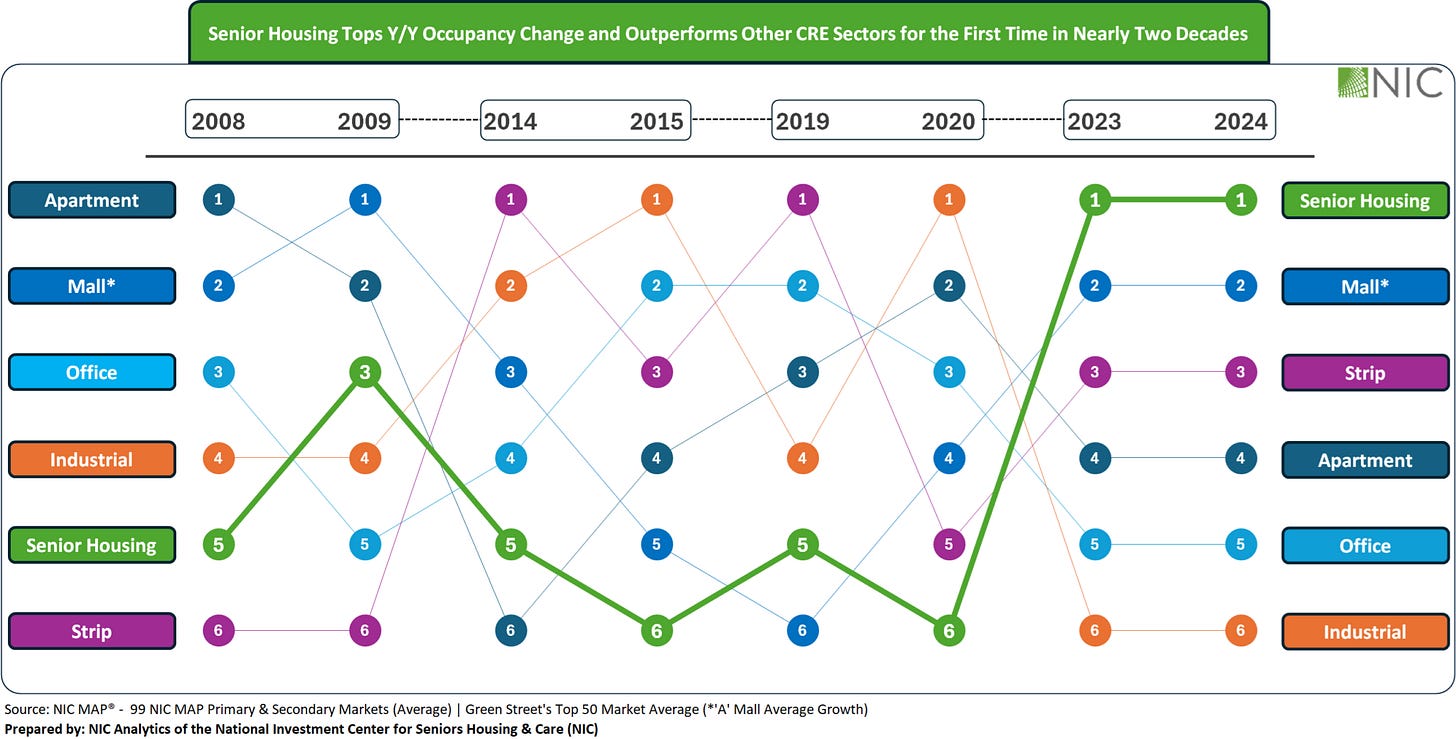

According to a recent report from NIC, occupancy growth for both needs-based and lifestyle senior housing facilities is now faster than any other sector of commercial real estate. In fact, NIC asserts that occupancy growth for senior housing has not been this fast in 20 years and has bested all other CRE sectors from 2023 to the present.

According to the NIC, occupancy levels "continue to grow steadily, with no signs of a demand cliff."

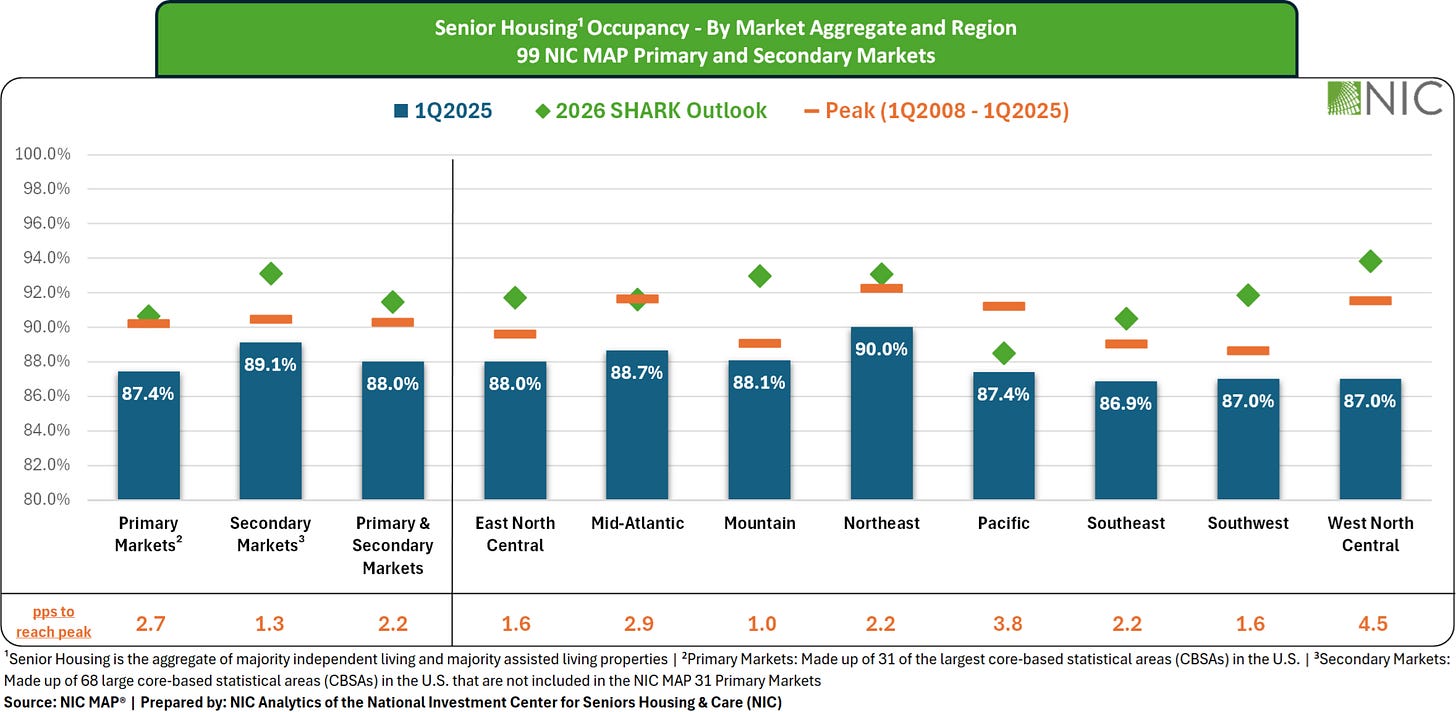

The senior housing industry group even projects average occupancy to surpass their previous peak levels by next year.

Importantly, with the population of 80+ individuals forecast to grow at a rapid pace for the next few decades, this burst of demand is unlikely to be temporary. Leasing activity may wax and wane somewhat, but the overall trajectory should be definitively upward.

Life Science Leasing Demand Remains Subdued

Even with aging demographics and the inevitability of rising demand for pharmaceuticals in the coming decades, life science leasing volume has been subdued this year.

Part of this is a normalization of demand after the feverish leasing activity during the stimulus-fueled boom during the pandemic.

But venture capital has also slowed its funding of biotech startups, which has in turn slowed leasing. In Q1 2025, VC funding of life science companies fell 27% YoY. In New York City, VC funding slid 45% YoY in Q1 to a level 60% below the 5-year average.

Loss of NIH funding and grants as a result of government budget cuts has also played a significant role in the drop in leasing activity.

Likewise, the leadership of Robert F. Kennedy Jr. at the Department of Health & Human Services has created significant uncertainty for the industry. Between layoffs of FDA employees, including some involved in the drug approval process, and a general environment of skepticism toward Big Pharma, sentiment in the life science space has become much more subdued.

On top of weak demand, supply growth reached its highest level ever over the last few years as the pandemic-era boom led to a surge in speculative (not pre-leased) development projects across the country.

At this point, life science vacancy rates are basically at the same level as for traditional office. According to Globe Street (citing a Colliers report), the biggest R&D hub in the nation, Boston, saw its vacancy rate reach 26.9% in 2024, and this "trend isn't expected to get much better this year."

Average vacancy rates across all life science hubs in the nation are three times higher, on average, today than in 2021.

However, like the traditional office space, there is a significant bifurcation between high-quality and low-quality buildings. Purpose-built Class A life science buildings, such as the campuses owned by Alexandria Real Estate (ARE), continue to attract the most leasing demand, while older or less well-located properties struggle to attract tenants.

ARE's scale and reputational quality are undoubtedly competitive advantages in the current life science bear market.

With that said, let's look at our four healthcare REITs' Q1 2025 earnings updates: