Earnings Update: Healthcare REITs (Q3 2025)

In case some of you missed it, here is the recording of our most recent members-only Q&A webinar:

About 100 of you joined us live, and I want to thank you for taking the time and asking such thoughtful questions.

Here is a list of topics with timestamps for your convenience:

0:45 - Whitestone REIT (WSR)

2:50 - EPR Properties (EPR)

6:05 - Alexandria Real Estate (ARE)

8:25 - Helios Towers (HTWS / HTWSF)

9:50 - Favorite Foreign REIT Markets

11:12 - International Workplace Group (IWG / IWGFF)

13:30 - My Favorite Property Sectors for 2026

21:27 - My Favorite Picks for 2026

24:20 - My Background

28:20 - REITs and Interest Rates

31:30 - Canadian Net REIT (NET.UN:CA)

33:53 - Blue Owl Capital (OWL) and Patria (PAX)

37:35 - How to Value REITs

39:03 - Core vs. Retirement Portfolio

40:54 - EPR Properties Preferred Shares (EPR)

42:10 - Helios Towers (HTWS / HTWSF)

43:35 - Gladstone Land Preferred Shares (LAND)

45:00 - Helios Towers (HTWS / HTWSF)

45:30 - How I Would Invest New Capital Right Now

46:46 - Inflation vs. Deflation

50:12 - My Favorite Strip Center REITs

52:00 - VICI Properties (VICI)

54:40 - European Self Storage REITs

56:40 - Sila Realty Trust (SILA) vs. Global Medical REIT (GMRE)

57:40 - Crown Castle (CCI)

59:24 - WeWork vs. IWG

1:01:52 - REITs vs. Private Real Estate

1:04:20 - Clipper Realty (CLPR) and NewLake Capital Partners (NLCP)

1:05:45 - Safehold (SAFE)

1:07:02 - US vs. European Self Storage REITs

1:08:40 - Deep Value vs. Quality Value REITs

1:10:30 - Debt Crisis

1:12:20 - How to Estimate NAVs

1:13:30 - Different Opinions Between HYL Analysts

1:14:42 - IWG US Listing

1:15:30 - My Favorite High-Yielding REITs

1:17:30 - OTC Stocks

1:18:20 - RCI Hospitality (RICK)

We plan to host similar webinars on a regular basis, so stay tuned for the next one!

Earnings Update: Healthcare REITs (Q3 2025)

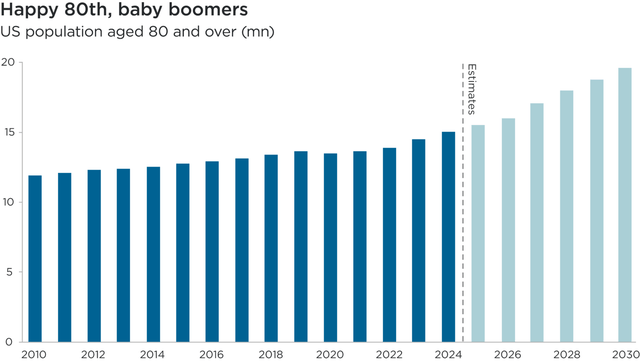

As we have explained in previous healthcare sector updates, all sub-sectors of healthcare real estate enjoy significant and sustained tailwinds from aging demographics.

People have greater and greater healthcare needs as they age, and the population of 80+ individuals is projected to increase at a rapid rate as far out into the future as the eye can see.

Impax Asset Management

This should translate into a progressive swell in demand for all kinds of medical real estate, from outpatient facilities to hospitals to senior housing.

It should also indirectly benefit life science facilities, because higher demand for pharmaceutical products should, all else being equal, translate into more demand for lab space.

At the same time, aside from the life science sub-sector, which our members should be well aware is currently overbuilt, occupancies are fairly high across the healthcare real estate space, and supply headwinds are minimal or nonexistent.

Let’s briefly run through each healthcare real estate sub-sector to provide a high-level overview.

Medical Outpatient

Outpatient, which includes both multi-tenant medical office buildings and various single-tenant facilities, is the most stable and defensive sub-sector of the healthcare space. Tenant demand tends to remain fairly steady. Occupancies tend not to fluctuate much. Cap rates are fairly low, typically ranging from 5.5% to 6.5%.

Medical outpatient enjoys a secular tailwind from the long-term shift from inpatient/hospital care to the same services at outpatient facilities. Whether it’s tests, elective surgeries, urgent care, or physical therapy, more and more services that used to be done in hospitals are shifting to outpatient.

On the other hand, medical outpatient also has a mild headwind from the “medtail” trend of providers opting to lease space in retail centers and mixed-use developments instead of designated medical outpatient buildings.

To be clear, though, there is enough demand to allow some providers to move to medtail without shedding occupancy at medical outpatient facilities. On-campus or hospital-adjacent MOBs will continue to enjoy high and sustained demand.

Hospitals

Although hospitals are an integral part of the healthcare system, the health systems that lease hospital buildings are in the midst of a strategic repositioning as they shift non-core and administrative activities off-site while focusing on core acute care services.

Moreover, the largest and strongest health systems, whether for-profit or nonprofit, tend to own most of their real estate, which means that private equity-backed operators are disproportionately represented in the hospital tenancy pool. As we’ve seen with PE-backed operators like Steward Health, these types of hospital tenants often, though not always, have weaker and more debt-laden balance sheets.

Senior Housing

After years of being overbuilt in the 2010s, this sub-sector now enjoys a robust recovery in occupancy and rent rates as supply deliveries fall while demand rises. The “silver tsunami” has arrived, and it is only going to continue going forward.

Senior housing fundamentals have already recovered to pre-pandemic levels and are all but certain to keep getting better in the future.

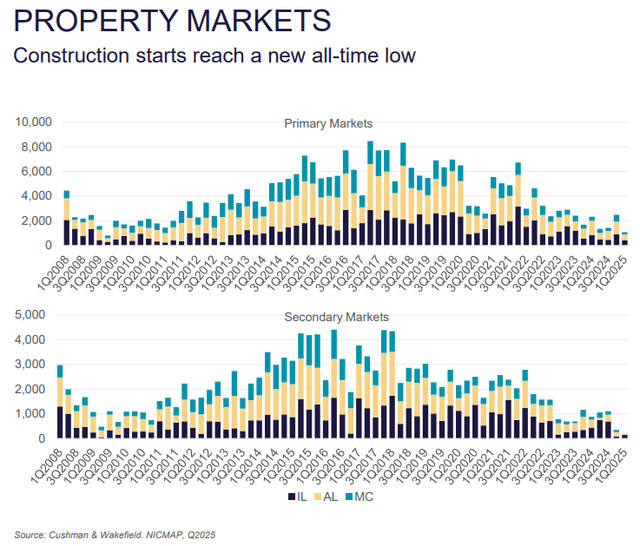

Earlier this year, Cushman & Wakefield put out a report showing that senior housing construction starts have fallen to ultra-low levels for both primary and secondary metro markets:

Cushman & Wakefield

Construction costs have made new development projects untenable in recent years, and both occupancy and NOI will have to rise further to rejuvenate the development pipeline.

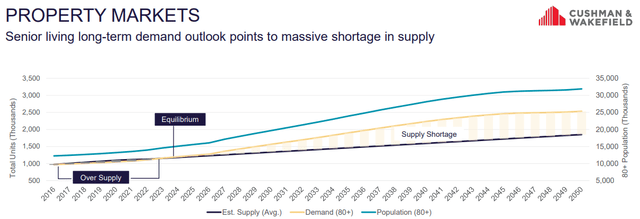

Cushman & Wakefield do expect supply to grow in the future, but they project demand from seniors to progressively expand beyond expected levels of supply.

Cushman & Wakefield

By the early 2040s, this forecast envisions the United States being about 500,000 senior housing units short of demand.

Even if developers are drawn back to the space and return to steady construction of new supply, the supply-demand balance still looks heavily favored toward landlords going forward.

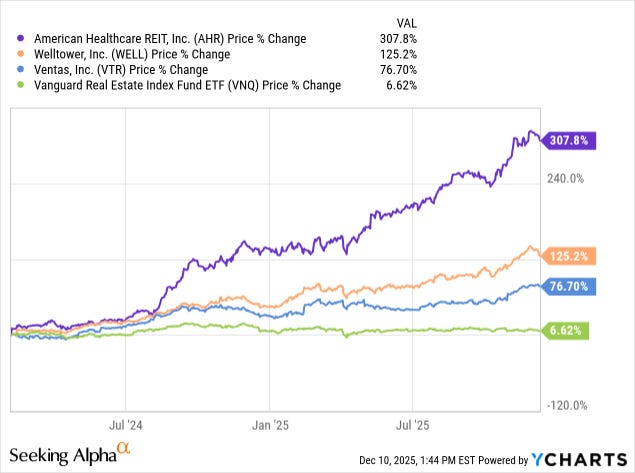

Hence why senior housing REITs like American Healthcare REIT (AHR), Welltower (WELL), and Ventas (VTR) have massively outperformed the broader real estate sector (VNQ) over the last few years:

We wish we had foreseen how bullish the market would become on senior housing REITs over such a short span of time. But at this point, a lot of future growth is already priced in.

WELL trades at about a 39x AFFO multiple. AHR trades at about a 28x NFFO multiple (slightly different metric; its AFFO multiple is likely above 30x). VTR trades at about a 23x NFFO multiple (putting its AFFO multiple around 26x).

This variation in pricing makes sense to us, as WELL boasts the highest quality facilities and lowest debt, followed by AHR and then VTR with the lowest quality facilities and highest debt.

Life Science

As we’ve covered in multiple articles at this point, the life science sub-sector is in the midst of a “perfect storm” of headwinds, including oversupply and soft demand due to government policy uncertainty.

However, in the long run, we continue to believe that demand for top-tier, state-of-the-art, amenity-rich life science buildings should remain robust. In an AI-saturated future, we believe demand for specialized, tech-enabled lab space should only grow, even if AI reduces the need for more generic, lower-quality lab space.

With those sub-sector summaries out of the way, let’s now turn to the Q3 2025 earnings updates for our four healthcare REITs: