Earnings Update: Industrial REITs (Q3 2025)

Industrial real estate in the US continues to endure the flattish, transitional period that has characterized it for the last two years.

The huge growth in leasing demand in 2021 and 2022 gave way to huge growth in the supply of space in 2023 and 2024. Meanwhile, incremental demand for space has been relatively soft since 2023, which has pushed up vacancy rates, dramatically slowed rent growth, and led to a sharp drop in the construction pipeline.

Cushman & Wakefield

You can see the big gaps between net absorption (demand) and construction completions (supply) in the chart above. Supply has grown faster than demand for almost three years.

That has naturally led to an increase in the industrial vacancy rate from about 3.5% at the beginning of 2023 to around 7.5% today.

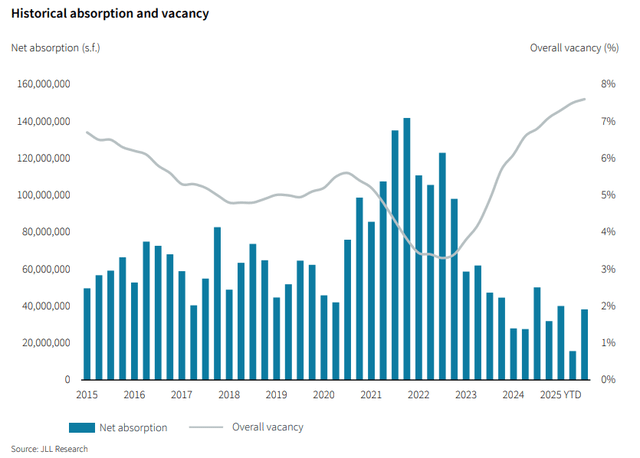

JLL Research

After the big surge in absorption of industrial space from mid-2020 through 2022, incremental demand for space has slowed to an average level in 2024-2025 below the average pace of leasing demand experienced during the 2010s.

This has created the incredible whipsaw between red-hot and ice-cold you see in the chart above. Rarely ever has the industrial vacancy rate dropped as fast as it did from late 2020 to mid-2022 or risen as fast as it did in 2023.

But as is always the case with a market as broad and diverse as industrial real estate, the headwinds have hit some parts of the sub-sector harder than others.

To quote the Q3 Industrial Market report from Lee & Associates:

High vacancies have hit larger buildings in recent years. Since 2022, vacancy in buildings larger than 100,000 SF is up 380 basis points to more than 8%. Buildings from 50,000 SF to 100,000 SF have seen a more gradual rise, increasing 240 basis points, to 5.7%. Buildings smaller than 50,000 SF are in most demand and with vacancy typically at less than 5%.

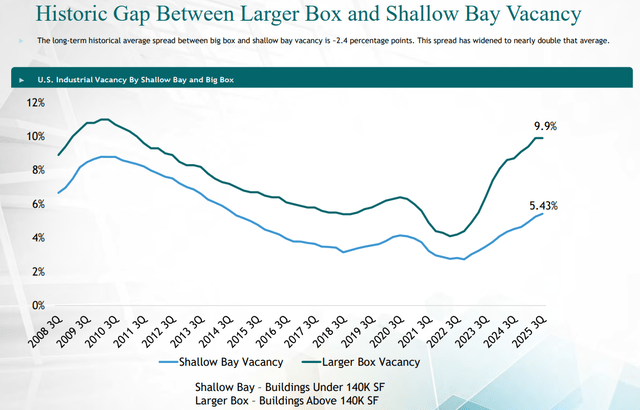

EastGroup Properties (EGP), a Sunbelt industrial REIT that focuses on smaller, “shallow bay” buildings in close proximity to population centers, corroborates this point in its most recent investor presentation.

EastGroup Properties

This chart shows that for owners of shallow bay, infill industrial properties like EGP and the Southern California-concentrated Rexford Industrial (REXR), the recent headwinds have not been nearly as significant as they have for owners of big box warehouses.

Shallow bay vacancy is as high as it has been since late 2014 and will likely go a little higher before topping out. But the big box vacancy of ~10% has not been this high since the Great Financial Crisis.

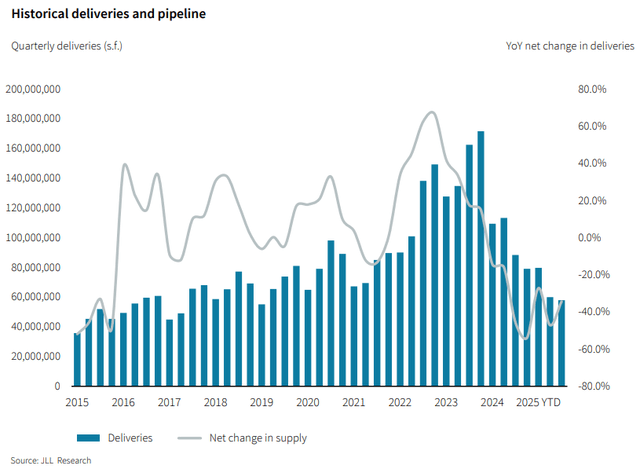

Fortunately, as construction and capital costs have increased to prohibitive levels in recent years, the construction pipeline has steadily shrunk.

JLL Research

The industrial development pipeline has now decreased for 12 consecutive quarters, the longest streak experienced yet in the 21st century.

Quoting JLL Research:

Elevated construction costs and challenging financing conditions are further constraining development activity. This disciplined development strategy, combined with lengthy permitting and construction timelines, suggests that meaningful supply additions will remain constrained well into 2026, supporting the ongoing market rebalancing despite the modest pipeline growth.

JLL Research

Over the last year or so, the amount of speculative development has come back down to a fairly healthy portion of the total development pipeline.

And, as has been the case for a long time now, the demographic tailwinds supporting the Sunbelt region of the US, which has also experienced the most growth in supply, are quite strong.

To quote JLL Research again:

Regional powerhouses across the Southeast, Texas and other sunbelt markets are capitalizing on their competitive advantages more aggressively than anticipated. These markets are drawing industrial users who prioritize locations with strong labor markets, affordable housing, and business-friendly policies. The demographic tailwinds supporting these regions show no signs of abating, creating a self-reinforcing cycle of investment and job creation that positions them as long-term winners in the industrial landscape.

This should ensure that both the supply-constrained markets in coastal cities and the fast-growing markets in the Sunbelt enjoy a robust rebound in bottom-line growth in the coming years.

With that said, let’s now turn to the Q3 2025 earnings results of our three industrial REITs: