Earnings Update: Industrial REITs (Q1 2025)

Dear Landlords,

I want to extend a warm welcome to all our new members! We recommend that you start by reading our Welcome Letter by clicking here. It explains why we invest in real estate through REITs and how to get started.

As a reminder, our most recent "Portfolio Review" was shared with the members of High Yield Landlord on April 4th, 2025, and you can read it by clicking here.

You can also access our three portfolios via Google Sheets by clicking here.

New members can start researching positions marked as Strong Buy and Buy while taking into account the corresponding risk ratings.

If you have any questions or need assistance, please let us know.

============================

Earnings Update: Industrial REITs (Q1 2025)

Industrial real estate is the backbone of the economy. It is the mostly invisible infrastructure that facilitates the functioning of all kinds of economic activity, from e-commerce to business-to-business supplies to residential and commercial construction.

There are almost no areas of the economy that don't touch industrial real estate in some way, whether they realize it or not.

The first quarter of this year was a fairly wild ride for industrial property landlords.

After the election in November 2024, there was a burst of optimism in the business community as the consensus expectation for the new administration was tax cuts and an easier regulatory/antitrust environment. This optimism translated into a spike in business capex intentions, which in turn led to a rebound in industrial leasing activity in Q1 2025.

But as you can see in the chart above, that business optimism proved short-lived, and businesses' capex plans have since plunged to recessionary levels.

In Trump's first term, big tax cuts came first, then relatively small tariffs came after. In Trump's second term, this sequence has been reversed: Big tariffs have been implemented almost immediately, and the expected tax cuts won't come until next year and will likely be minimal compared to the 2017 Tax Cuts And Jobs Act.

The regulatory and antitrust environment has also been decidedly more mixed than was expected, but the biggest factor at play is undoubtedly trade policy.

As shown in the chart below, trade policy uncertainty has absolutely soared to record levels this year:

And, notably, the data in the chart above was compiled before the April 2nd "Liberation Day" announcement.

How has this affected demand for industrial real estate?

Here's Tim Arndt, CFO of industrial REIT giant Prologis (PLD), from the Q1 2025 conference call:

Prior to April 2, industrial fundamentals were improving, and had it not been for the recent uncertainty from global tariffs and their downstream impacts, we would have raised our expectations for 2025. Instead, we are electing to maintain earnings guidance as there are no policy conclusions right now to plan differently and our severe stress test to core FFO supports the existing range.

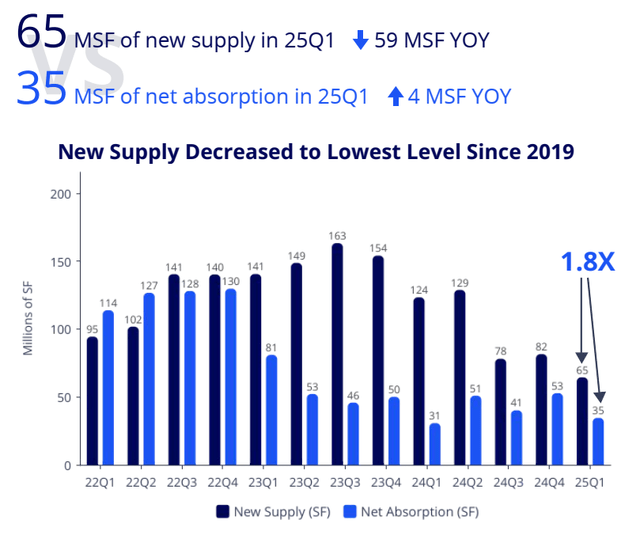

We can see this show up in Q4 2024 and Q1 2025 industrial leasing volume:

Industrial leasing volume had been falling for three years until the slight rebound in the last two quarters, but that rebound is now unlikely to continue apace.

At the same time, you'll notice that even Q1 2025's rebounded leasing volume remains at or below the average level during the late 2010s.

To quote the Q1 industrial report from Lee & Associates:

U.S. net absorption in the first quarter totaled 9.5 million SF and only 129.4 million SF of growth in 2024 – the least since the great recession in 2010. Year-over-year rent growth has decelerated significantly over the past 12 months to 2.1%, which is less than half the five-year average before Covid.

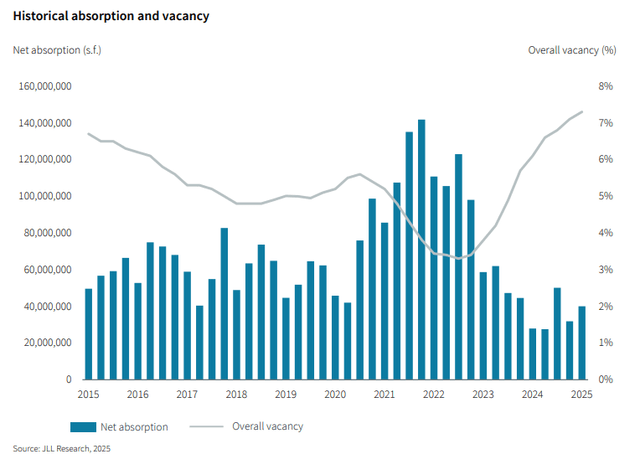

Zooming out to the last 10 years, we find that the sharp rise in industrial vacancy off of the COVID-era lows continued into Q1 2025:

Huge demand for space during and immediately following the pandemic catalyzed an equally huge boom in development of new industrial buildings, which began hitting the market in 2023-2024 and will continue coming to market over the course of this year.

So, the bad news is that the uncertainty-fueled drop in demand is occurring at the same time as a historically high level of new supply is coming to market.

But the good news is that the industrial property construction pipeline has been shrinking for two straight years as starts have declined further and further.

And every industry expert forecast we have seen shows this decline in construction activity continuing through at least the end of this year.

Extrapolating this development slowdown, we can surmise that industrial real estate will turn from a "tenants' market" to a "landlords' market" in 2026-2027, as supply of newly delivered space dries up -- assuming, of course, we don't suffer a prolonged recession that significantly reduces demand.

At the same time, it is important to note that most of the current oversupply is concentrated in the big box space -- buildings over 100,000 square feet in size.

To quote Lee & Associates again:

While new deliveries have peaked, several Sunbelt and Midwest markets with fewer development constraints are still posting a record supply of new space that could take more than two years to absorb. Austin, Indianapolis, Phoenix, Greenville/Spartanburg and San Antonio stand out as markets with risks of prolonged elevated availabilities, particularly among logistics buildings from 100,000 SF to 500,000 SF.

... The stock of logistics properties 100,000 SF and larger has grown 20% in the last four years. The vacancy rate among these buildings has surpassed 9%, the most since 2012. The small-space market remains a bright spot. Occupancy in buildings smaller than 50,000 SF has fallen about 0.3% in the last 12 months. But because of chronically low levels of development of product in this range, the sub 4% vacancy rate is near pre-Covid record levels. Some of the most acute shortages of small space can be found in Nashville, Jacksonville, Orlando, Tampa and Charlotte.

Fortunately, two of our three industrial REITs…