Earnings Update: Industrial REITs (Q2 2025)

Dear Landlords,

I want to extend a warm welcome to all our new members!

As a reminder, our most recent "Portfolio Review" was shared with the members of High Yield Landlord on July 7th, 2025. You can read it by clicking here.

You can also access our three portfolios on Google Sheets:

New members can start researching positions marked as Strong Buy and Buy while considering the corresponding risk ratings.

============================

Earnings Update: Industrial REITs (Q2 2025)

After the tumultuous first quarter that saw trade policy uncertainty skyrocket and leasing demand rapidly decelerate, the US industrial real estate market has now entered a transitional period.

Before 2025, demand for industrial space was already decelerating as a result of slowing job growth, soft consumer spending, and muted business investment. Then, in the first half of 2025, an aggressive and chaotic series of tariff rate changes and trade negotiations caused industrial demand to decelerate further.

The common motif repeated on conference calls was that tenants were delaying leasing decisions due to the "cloud of uncertainty."

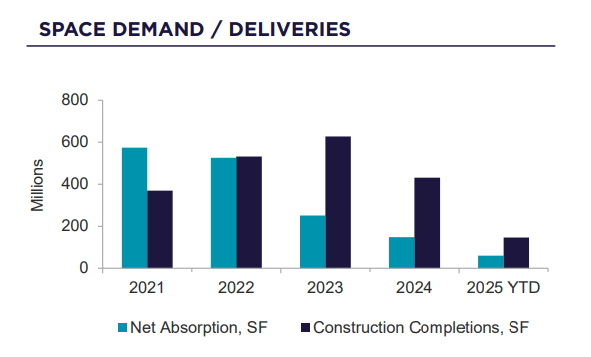

Meanwhile, the burst of industrial building projects that were initiated during the red hot, ultra-low interest rate environment of 2020-2021 came online from the second half of 2022 through 2024:

The bulk of the COVID-era industrial construction projects were delivered into a market already experiencing slowing tenant demand.

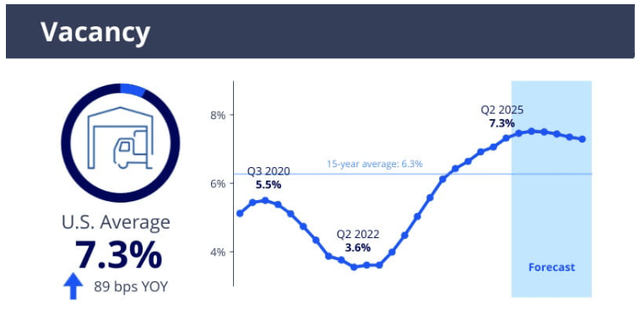

That has caused the industrial vacancy rate to ascend from a sub-4% level in 2022 to somewhere between 7.0% and 7.5% as of midyear 2025. This is having predictable effects on industrial real estate, including the lowest increase in asking rent (2.6% in Q2 2025) since Q1 2020.

On the other hand, resulting from the drop in tenant demand as well as higher interest rates and construction costs, the development pipeline has shrunk considerably as starts fall off. According to JLL, the industrial real estate development pipeline is the lowest it has been since Q3 2016.

As things stand in August 2025, though, it appears as though the industrial real estate sector is entering a transitional period between the post-COVID slowdown and a new industrial bull market to come in 2026-2027.

There are several catalysts for this new bull market.

Persistently low deliveries of new supply over the next few years.

Increased trade policy certainty as trade deals are reached with most of the US's major trading partners.

Legislative changes that reward near-term investment into US manufacturing and construction.

On that last point, we quote from Avison Young's Q2 2025 industrial market report:

One of the most transformative forces on the horizon is the Big Beautiful Bill, which introduces 100% expensing for both production equipment and the buildings that house them. This sweeping tax incentive is expected to catalyze a wave of U.S. manufacturing and complementary supplier demand on an aggressive timeline, especially in markets with pad-ready land and available labor. With over $2.7 trillion in manufacturing commitments already announced in 2025, the groundwork is being laid for a new era of industrial expansion.

However, even if the OBBBA succeeds in inducing a meaningful burst of new manufacturing development, this will be a multi-year process that likely won't be felt for a while.

The Q2 2025 industrial market report from Colliers forecasts that industrial vacancy will tick slightly higher over the next quarter or two as the last of the post-COVID construction boom gets delivered.

Starting in 2026, though, Colliers foresees the vacancy rate steadily sliding downward as demand outpaces supply.

Cushman & Wakefield's report agrees, projecting the industrial vacancy rate to peak in the high-7% area by 2026 and falling thereafter.

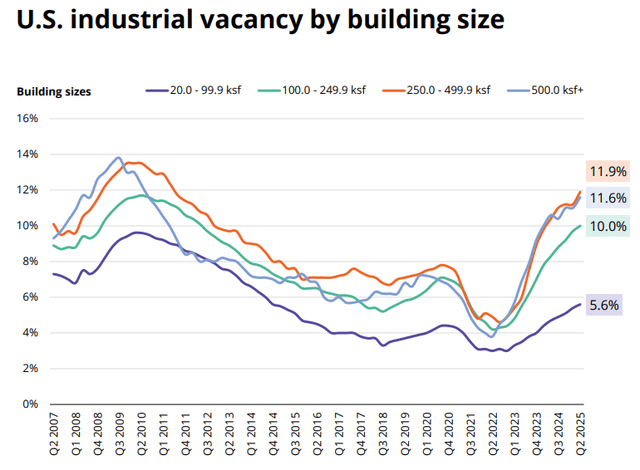

Another interesting point to note, as we have in previous earnings updates, is that industrial vacancy is highly bifurcated between large and small buildings. Most of the recent construction has been of large buildings, which is why the large building vacancy rate has increased far more and at a faster pace than for smaller buildings.

This is good news for EastGroup Properties (EGP) and Rexford Industrial (REXR), which both own smaller footprint, infill industrial buildings (typically multi-tenant) in urban areas with high barriers to entry and little available land.

If and when we do see a rebound in industrial tenant demand, we think the small-footprint landlords like EGP and REXR should enjoy the fastest and largest benefits from it.

With that said, let's now turn to the Q2 2025 earnings results of our three industrial REITs: