Earnings Update: Industrial REITs (Q4 2024)

Dear Landlords,

I want to extend a warm welcome to all our new members! We recommend that you start by reading our Welcome Letter by clicking here. It explains why we invest in real estate through REITs and how to get started.

As a reminder, our most recent "Portfolio Review" was shared with the members of High Yield Landlord on February 4th, 2025, and you can read it by clicking here.

You can also access our three portfolios via Google Sheets by clicking here.

New members can start researching positions marked as Strong Buy and Buy while taking into account the corresponding risk ratings.

If you have any questions or need assistance, please let us know.

============================

Earnings Update: Industrial REITs (Q4 2024)

The real estate market moves in predictable cycles over time. These cycles do not necessarily correspond to the overall economic cycle because of lags between supply and demand.

It takes anywhere from 9 months to several years to bring new commercial real estate space to market. Development projects typically increase when tenant demand is high, but they may be completed at a time when the economy has slowed down and tenant demand has fallen.

That has been the case with industrial real estate over the last ~5 years.

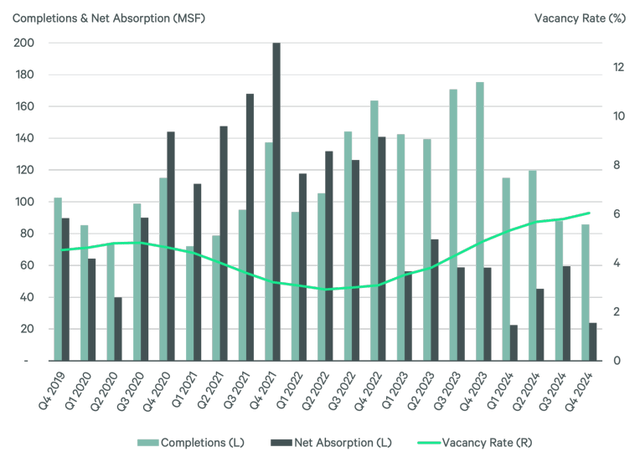

From late 2020 through mid-2022, demand for industrial space (as measured below by net absorption) significantly outpaced new supply additions due to huge demand from e-commerce and 3rd party logistics providers.

But as you can see above, the new industrial properties that broke ground in 2021 as a result of this huge demand did not begin to come to market until the second half of 2022.

From 2H 2022 through Q4 2024, industrial completions have meaningfully outpaced tenant demand. In retrospect, it now appears that industrial tenants were simply pulling forward a lot of leasing volume that would have otherwise come in later years.

In 2021-2022, developers built as if COVID-era tenant demand growth would never stop. Hence the dramatic mismatch between deliveries and net absorption in 2023-2024 as well as the steady uptick in vacancy rates.

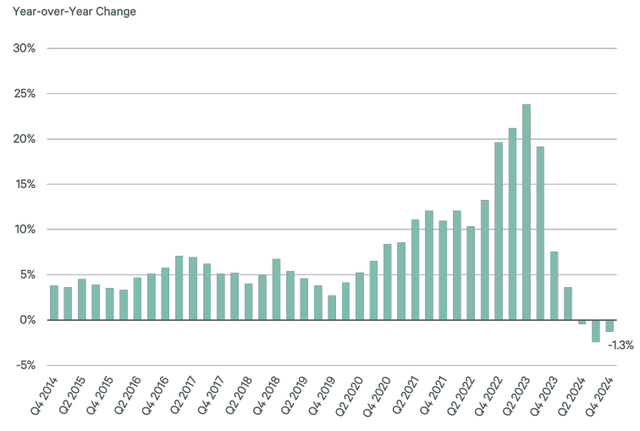

This rise in vacancies is having the predictable effect on industrial property performance. Rent rates declined for three consecutive quarters from Q2 to Q4 2024, the first time this has happened since the Great Financial Crisis.

Year-Over-Year Industrial Rents:

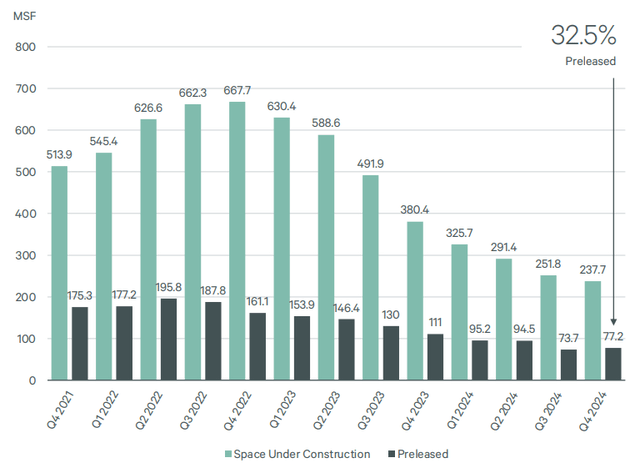

On the other hand, developers have taken the hint from the market as well.

The industrial property construction pipeline has continued to shrink since its peak in late 2022:

The level of construction volume in the industrial sector is now at its lowest level since Q3 2019.

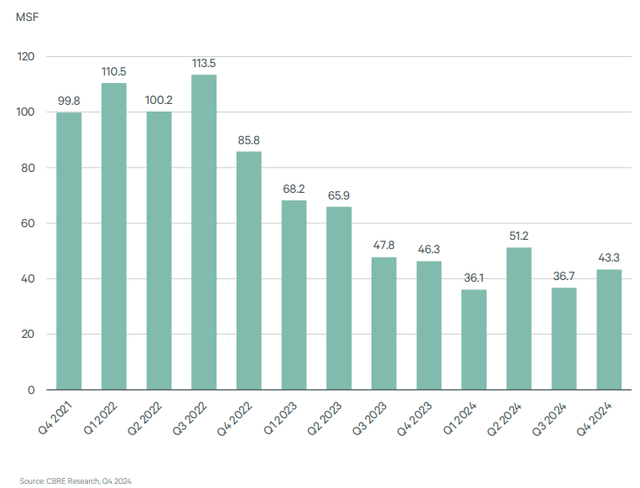

However, it does appear as though industrial construction starts have bottomed and plateaued.

Industrial Construction Starts:

In addition to a relatively subdued construction pipeline, more good news for industrial real estate is that the fundamental long-term outlook remains very strong.

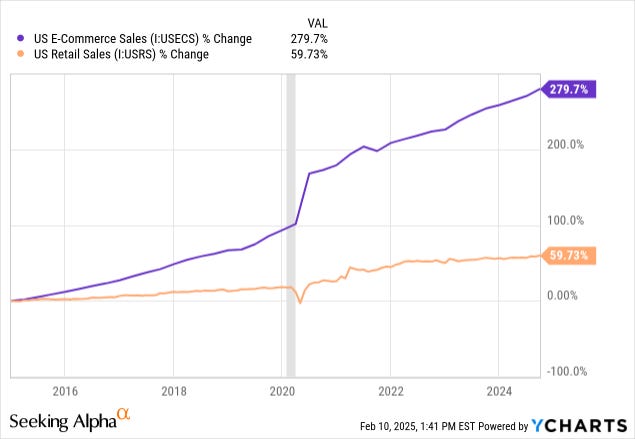

One major reason for this is that e-commerce sales, which require a significant logistics infrastructure footprint, continue to grow at a rapid clip.

Absorption of the available space on the market today is less a matter of "if" but of "when."

Here's an excerpt from Cushman & Wakefield's Q4 2024 industrial market report:

Overall absorption is projected to increase to around 200 msf in 2025 as leasing picks up steam and tenant consolidations moderate. Tailwinds, such as e-commerce, strong consumer confidence, and nearshoring and onshoring should propel the marketplace, especially in the second half of the year and into 2026.

On the subject of onshoring, Cushman & Wakefield note that tariffs could act as a temporary headwind to industrial real estate as they raise costs for US manufacturers and retailers. But if the ultimate result of the tariffs is more onshoring (repatriation of manufacturing), this should increase overall demand for warehousing and logistics space.

Let's now turn to the Q4 2024 results of our three industrial REITs: