Earnings Update: Net Lease REITs (Q2 2025)

Dear Landlords,

I want to extend a warm welcome to all our new members!

As a reminder, our most recent "Portfolio Review" was shared with the members of High Yield Landlord on July 7th, 2025. You can read it by clicking here.

You can also access our three portfolios on Google Sheets:

New members can start researching positions marked as Strong Buy and Buy while considering the corresponding risk ratings.

============================

Earnings Update: Net Lease REITs (Q2 2025)

In our Q1 2025 Earnings Update for Net Lease REITs, we argued that, contrary to popular belief, net lease REITs are actually less vulnerable to a higher-for-longer interest rate environment than the average REIT.

That is because net lease REITs typically do a good job of matching their long-term lease structure with long-term, fixed-rate debt.

Moreover, net lease cap rates tend to follow the 10-year Treasury yield, albeit with a lag, which allows well-capitalized net lease REITs to maintain their all-important investment spread between acquisition yields and cost of capital.

Net lease REITs are also less vulnerable to economic weakness than the average REIT, given the stability of their long-term, contractual revenue streams.

And as one final point to note, net lease REITs are also cheaper than the average REIT, trading at about a 12x AFFO multiple compared to the broader REIT sector's ~14x.

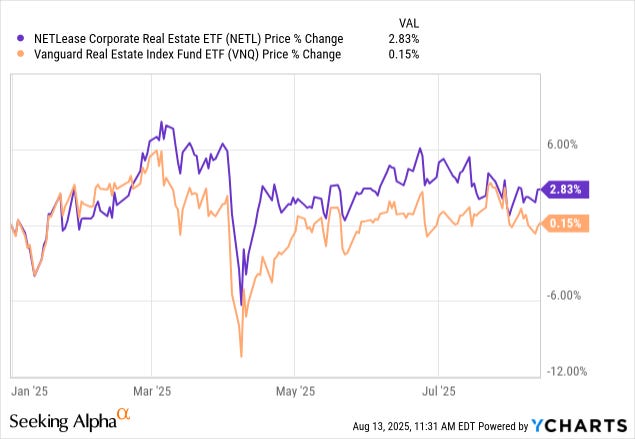

Notice that so far this year, net lease REITs (NETL) have performed better than the real estate sector as a whole (VNQ) on a price basis alone. (Total returns have been even better for net lease REITs.)

The current environment may not be the halcyon days of 2020-2021, when net lease REITs gorged on cheap equity and debt capital to expand their portfolios at huge margins, but it has been favorable enough for net lease REITs to maintain some level of growth.

Given how much cap rates have risen over the last few years, even a slight dip in long-term interest rates would significantly increase net lease REITs' investment spreads and facilitate faster growth rates.

While we do expect long-term rates to remain somewhat elevated for a little while longer due to the short-term inflationary impact of tariffs, we continue to believe that we are ultimately headed back to a low inflation, low interest rate environment that will greatly benefit net lease REITs.

Lastly, we would be remiss not to mention arguably the biggest recent development in the net lease sector, being Starwood Property Trust's (STWD) $2.2 billion acquisition of the net lease platform Fundamental Income, which invests directly in sale-leaseback properties and also manages the Net Lease ETF (NETL).

Fundamental Income's portfolio spans 467 properties with a weighted average remaining lease term of 17 years and a weighted average annual rent escalation of 2.2%. The portfolio is mostly industrial and service-oriented properties with a small minority in retail, similar in many ways to the portfolios of Essential Properties Realty Trust (EPRT) and the former STORE Capital (now owned by Blue Owl Capital (OWL)). In fact, the 28 employees of Fundamental Income include many who previously worked at STORE Capital and Spirit Realty.

Starwood Capital's Barry Sternlicht is an extraordinary real estate investor, and this major acquisition is a meaningful vote of confidence in net lease as a long-term investment.

With that said, let's get to the Q2 2025 earnings reports for our four net lease REITs: