Earnings Update: Net Lease REITs (Q3 2025)

Things tend to move slowly and with a lag in the net lease sub-sector of commercial real estate.

Property cap rates (net operating income yields) generally follow long-term interest rates, but only slowly after multiple quarters. Sellers are always reluctant to reduce prices when rates are rising, and buyers are always reluctant to pay more when rates are falling.

In 2022 and 2023, the critical spread between cost of debt and cap rates narrowed as interest rates rose but cap rates only slowly nudged upward. However, over the course of 2023 and 2024, sellers finally capitulated, and cap rates increased meaningfully.

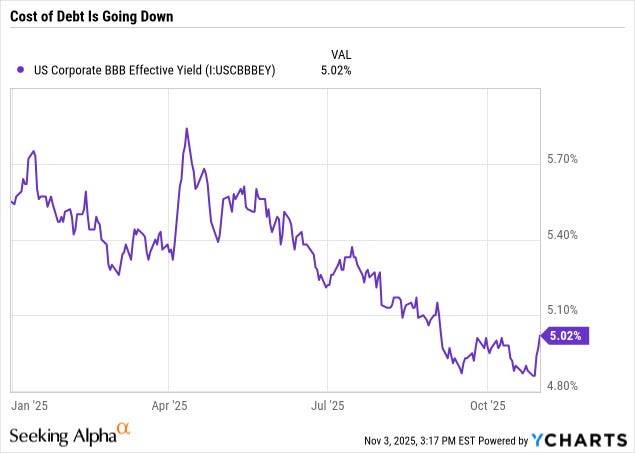

Now, in 2025, net lease REITs are in the sweet spot. Cap rates have stabilized, but their cost of debt has fallen considerably:

Some net lease REITs have credit ratings stronger than BBB, while others have weaker ratings, but the average effective yield for BBB bonds acts as a good proxy to cost of debt.

Generally speaking, a 50 basis point (or more) drop in the cost of debt, combined with stable cap rates, means wider investment spreads and faster AFFO per share growth.

Obviously, this is especially true of net lease REITs with higher than BBB ratings like Agree Realty (ADC) at A-/BBB+ and NNN REIT (NNN) and W.P. Carey (WPC), both with BBB+ ratings.

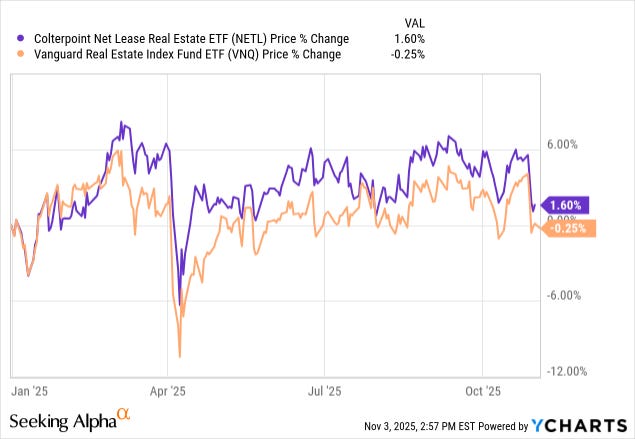

Perhaps this favorable macro environment explains why net lease REITs (NETL) have outperformed the broader real estate index (VNQ) so far this year, even if only by a little.

While some sectors of commercial real estate currently struggle with oversupply and weak to moderate demand, net lease is mostly insulated from those supply-demand headwinds.

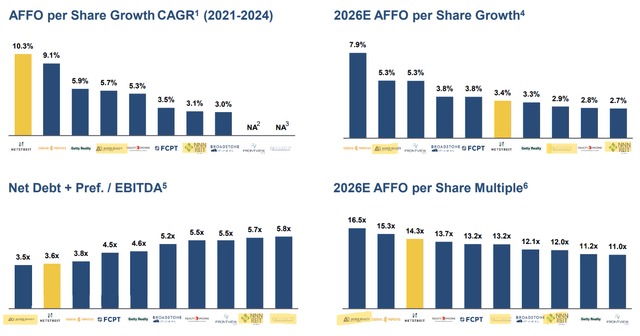

And while share price performance has been by no means spectacular, the fundamentals remain strong and resilient, while valuations are quite reasonable and leverage is at low to moderate levels. (Click on the image below to enlarge it on your screen.)

NetStreit Q3 Presentation

We’ve highlighted our three traditional net lease REITs in the comparison graph above.

Here is another interesting slide courtesy of ADC:

Agree Realty Q3 Presentation

In the top graph, ADC is showing off its peer-leading low in retail rent per square foot, indicating future rent upside as well as low downside in re-tenanting situations.

But the bottom left graph also illustrates the difference in investment strategies, as ADC heavily emphasizes credit strength whereas WPC and NNN both target sub-investment grade tenants that may have credit rating upside. Many of these two REITs’ investment grade tenants were originally sub-IG at the time of property acquisitions and later achieved upgrades.

Within the net lease space, different investment strategies can work.

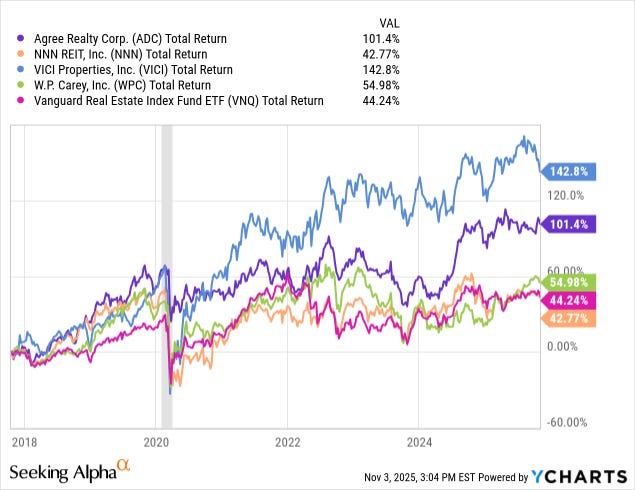

In the chart below, you can see that before COVID-19, all of our net lease REITs were outperforming the broader real estate index by a significant margin.

Over the last several years, however, ADC has pulled far ahead of their peers, while WPC and NNN have both performed more or less in line with the real estate index.

While WPC and NNN both have strong balance sheets themselves, some of their financially weaker tenants have struggled amid the higher interest rate environment, which has stunted these two REITs’ overall performance.

In theory, all three of our net lease REITs should perform even better as the Fed continues to cut rates and long-term interest rates decline further. But WPC and NNN should disproportionately benefit the more interest rates decline.

With that said, let’s get to the Q3 2025 earnings reports for our three net lease REITs: