Earnings Update: Net Lease REITs (Q3 2024)

Dear Landlords,

I want to extend a warm welcome to all our new members! We recommend that you start by reading our Welcome Letter by clicking here. It explains why we invest in real estate through REITs and how to get started.

As a reminder, our most recent "Portfolio Review" was shared with the members of High Yield Landlord on November 6th, 2024, and you can read it by clicking here.

You can also access our three portfolios via Google Sheets by clicking here.

New members can start researching positions marked as Strong Buy and Buy while taking into account the corresponding risk ratings.

If you have any questions or need assistance, please let us know.

==============================

Earnings Update: Net Lease REITs (Q3 2024)

As we've explained in the past, net lease REITs tend to be among the most defensive but slow- to moderately-growing sectors of commercial real estate.

Leases are usually very long, starting at 10-20 years, and have contractually fixed rent increases of 1-2% in most cases, which limits organic growth.

At the same time, net leases obligate the tenant to pay for all or most property expenses, such as maintenance, taxes, and insurance. This shelters the landlord from operating expense inflation.

Given these strengths and limitations, the best managed net lease REITs typically align their debt maturities with their lease term durations so that debt costs are also fixed for long periods of time.

Net lease REITs tend to play defense well during rising rate environments, and they play offense well during falling rate environments. That's a big reason they command our largest sectoral exposure in our Core Portfolio.

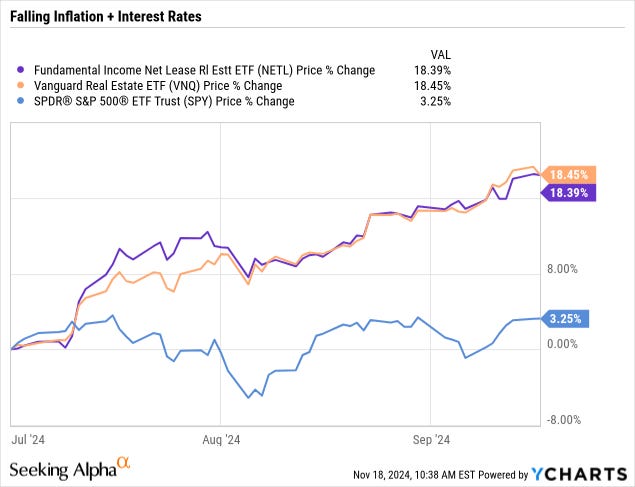

When the June CPI report came in showing a marked disinflationary trend, all REITs (VNQ), including net lease REITs (NETL), began to dramatically outperform the market:

An environment characterized by falling inflation and interest rates is ideal for REITs and especially net lease REITs.

The Big Tech-heavy stock indices like the S&P 500 (SPY) perform just fine in higher inflation/interest rate environments, because they are overwhelmingly weighted toward mega-cap companies with little to no debt, large cash positions, and ample free cash flow.

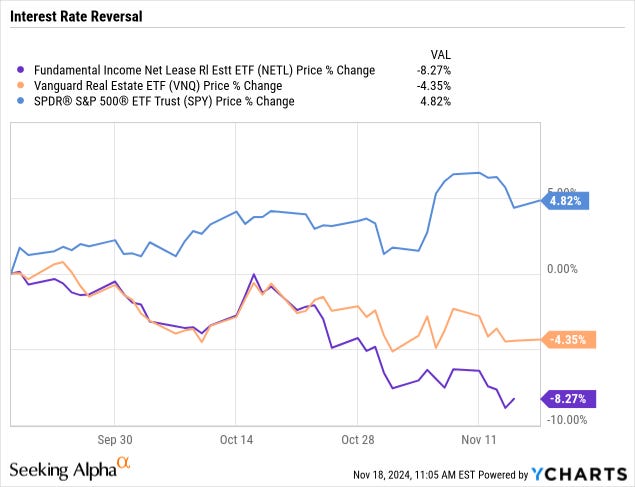

When long-term interest rates began to reverse in mid-September, then, REITs' outperformance over SPY reversed:

Net lease REITs in particular have been ravaged by this trend reversal in rates.

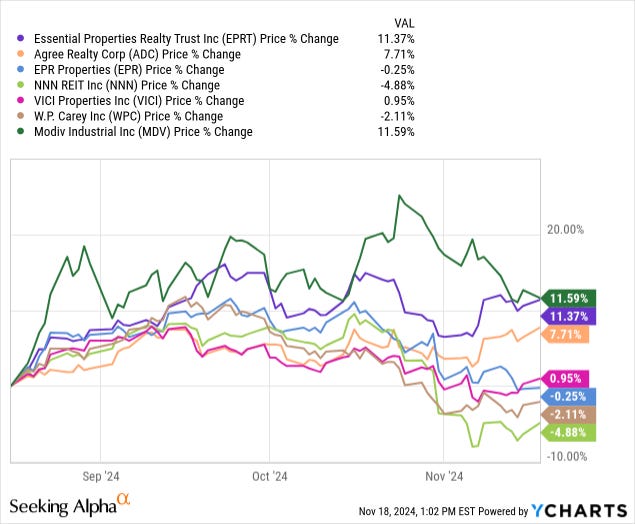

At the same time, there has been a wide dispersion of performance between various net lease REITs in recent months, offering a reminder that the only commonality that these REITs share is lease structure.

Some of our net lease REITs have performed dramatically better than others:

On one hand, the micro-cap Modiv Industrial (MDV) surged in the lead-up to the election as it became more likely that the pro-US manufacturing candidate would win. But in the wake of the election, some of those gains have been given back as investors reconsider just how much MDV will actually benefit from a Trump presidency.

The other two big winners have been Essential Properties Realty Trust (EPRT) and Agree Realty (ADC), which both enjoy low-leveraged balance sheets, thoughtful investment strategies, and uniquely skilled management teams.

The market perceives them to be both recession-resistant and relatively insulated from short-term interest rate volatility, and we think that's an accurate perception.

On the other end of the spectrum, NNN and WPC both underperformed based largely on persistent tenant issues in the sub-investment grade category.

With that said, let's get to the Q3 2024 earnings updates from our net lease REITs: