Earnings Update: Residential REITs (Q3 2025)

Important Announcements

Just a quick heads up:

We will do a live Webinar this weekend. I expect to announce it later today or tomorrow. Let me know if there are any specific topics that you would like me to cover.

We expect to have a Trade Alert later this week.

We will share our fifth Top Pick for 2026 early next week.

--------------------------------------------------------

Earnings Update: Residential REITs (Q3 2025)

Although 2025 has been a difficult year for residential real estate, especially the multifamily sector, there is plenty of good news to report.

Completions of residential units are down over 25% year-over-year, and new supply additions are projected to continue declining for the foreseeable future. As such, the peak in supply-related headwinds are definitively behind us.

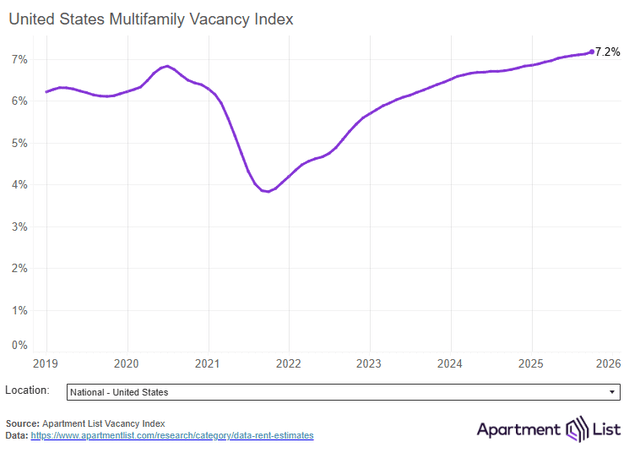

Meanwhile, amid ultra-low homebuying affordability and a steady economy, leasing demand from renters remains at a historically high level. According to Cushman & Wakefield, this year’s multifamily net absorption is on track for its third highest level since 2000. The nationwide vacancy rate of a little over 7% is likely at or near its peak, as the long as the economy and jobs market hold up.

The upshot of all this is that 2026 should show some green shoots of recovery in occupancy and rent growth, and 2027 should bring a robust residential bull market -- again, as long as the broader economy holds up.

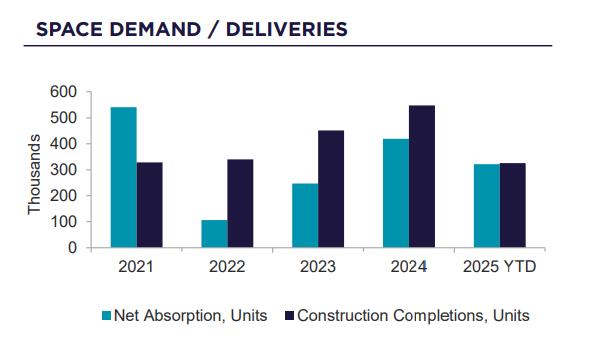

Take a look at this chart:

Cushman & Wakefield

In 2021, amid a red-hot economic rebound after the pandemic, net absorption greatly outpaced supply growth, which catalyzed a major construction boom. But as demand growth cooled in the following years, the construction boom delivered a 50-year high in apartment completions amid a relatively soft leasing environment.

From 2022 through 2024, completions outpaced net absorption, leading to an increase in vacancies.

Apartment List

But this year, completions and net absorption are roughly equal, which has caused the national average vacancy rate to slow its climb.

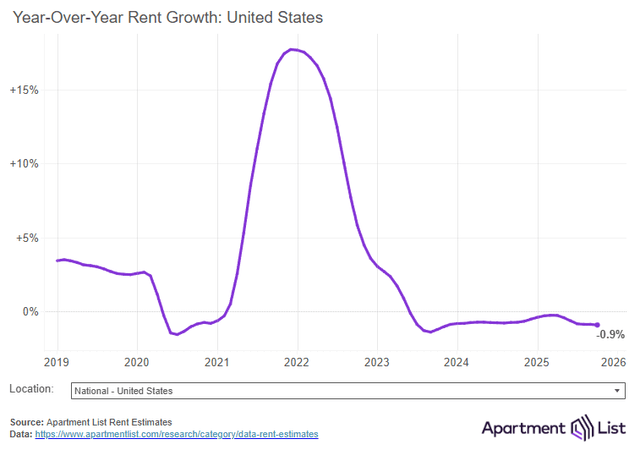

At the same time, landlords have prioritized occupancy over rent growth, which has resulted in flat to negative rent growth over the last few years.

Apartment List

Brand new apartments tend to be listed at premium market rent rates but also some amount of rent concessions. The greater the oversupply in a given market, the larger these rent concessions tend to run. This suppresses rent growth for all market-rent apartments in that market, including existing communities with lower asking rent rates.

Once the available supply begins to be absorbed, bringing the vacancy rate down, rent concessions will ease and rent growth will firm up.

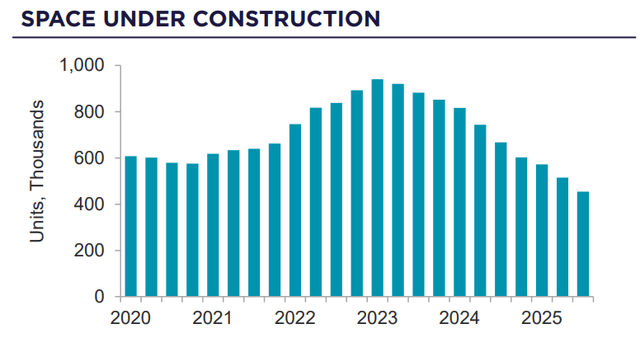

As you can see in the chart below, the amount of multifamily units under construction has fallen steadily since the beginning of 2023.

Cushman & Wakefield

To quote Cushman & Wakefield’s Q3 2025 Multifamily Market Report:

The decline in starts has translated to a falloff in the overall construction pipeline. Around 450,000 units remain under construction, the lowest level in a decade, and further declines are expected in the quarters ahead. The overall pipeline is down more than 50% from the peak and sits 17% below the pre-pandemic (2017-2019) average.

Mathematically, the outcome of below-average supply deliveries and above-average demand (due largely to homebuying unaffordability) is higher occupancy and rent growth.

Either home prices or mortgage rates would need to materially decline to cause a major shift from renting to buying.

RSM

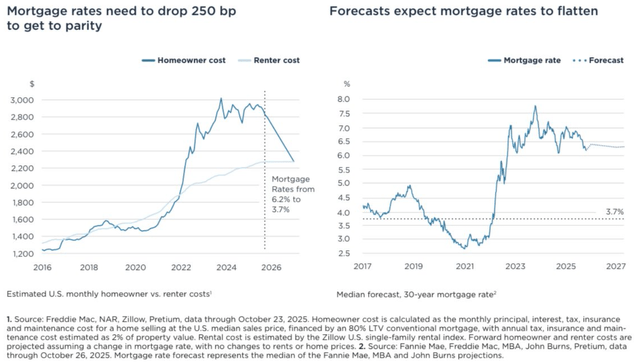

This chart shows that at current home prices, mortgage rates would need to decline to 3.7% to make homebuying equal in monthly costs to renting. But the forecast is for mortgage rates to remain above 6% for the foreseeable future.

And this is truer of the Sunbelt region of the US, where both population growth and residential construction has been high, than it is of any other part of the country.

To quote the Cushman & Wakefield report again:

The recovery momentum is building across the Sunbelt as supply pipelines empty. The Sunbelt has rarely had a demandside issue; it continues to be the fastest-growing area in the U.S. across nearly every metric that underpins housing demand. The issue has been an overwhelming wave of new supply: Since 2019, the Sunbelt’s inventory has grown by 24%, ~500 bps faster than any other region. Now that the region no longer leads the U.S. in construction activity as a share of inventory, these hot spots are beginning to see vacancy rates compress. Should demand remain robust, this compression should accelerate through 2026, setting the stage for a resurgence in rent growth.

This is great news for our two Sunbelt-focused residential REITs, Camden Property Trust (CPT) and BSR REIT (BSRTF), as well as for UDR Inc. (UDR), Armada Hoffler (AHH), and Sun Communities (SUI), which have significant exposure to parts of the Sunbelt.

Let’s now turn to our Q3 2025 residential REIT earnings reports: