Earnings Update: Residential REITs (Q1 2025)

Residential real estate in the US is in the midst of a normalization after several years of disruption, first from the pandemic and then from a 50-year high in delivery of new housing.

At the present, renter demand remains robust while supply deliveries are finally tapering off. In lieu of a recession, residential REITs should settle back into low but stable growth over the course of this year.

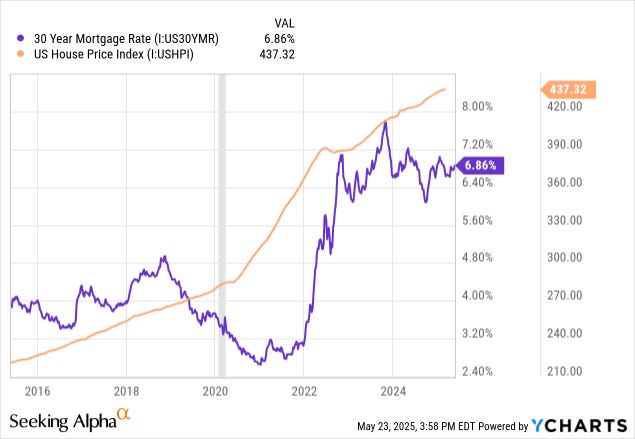

Arguably the biggest factor supporting rental demand in the face of massive supply growth has been the unaffordability of buying a home.

The average US home price has risen by over 50% since the beginning of 2020, while mortgage rates have surged along with other interest rates in the wake of the post-COVID inflation.

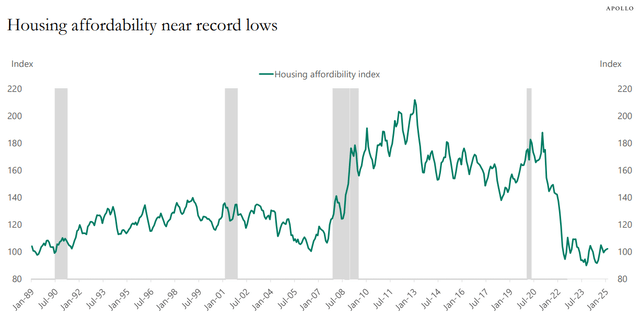

Between higher home prices and the highest mortgage rates in decades, homebuying affordability has sunk to an extremely low level.

Even after a slight rebound in affordability due to mortgage rates coming slightly down from their highs, it remains around the 2007 and pre-1990 lows.

There has been an incredible whipsaw over the last four years from the 2021 era of high homebuying affordability to the 2022-2025 era of very low affordability.

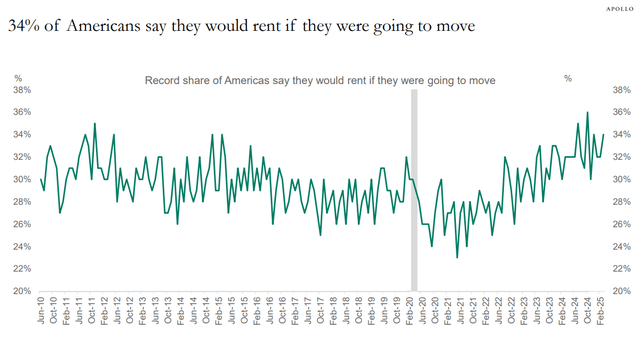

Unsurprisingly, this has resulted in a very large cohort of renters by necessity. What's more, the huge gap in affordability between renting and buying has resulted in a large number of renters by choice as well.

Hence we find the steady increase in Americans saying that they will rent the next time they move:

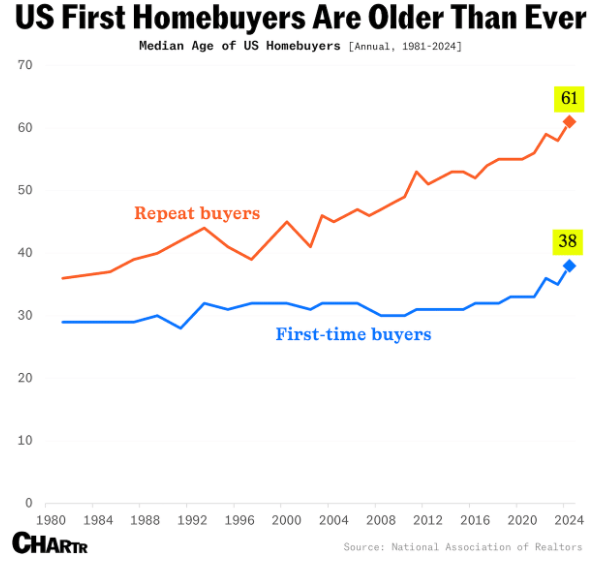

Another consequence of the sharp decline in homebuying affordability has been the continued rise in average age of homebuyers, both repeat buyers and first-time buyers.

While repeat buyers are likely to be Baby Boomers or Gen Xers who have owned homes for a long time and benefited from the growth in home values, the Millennial and Gen Z generations often lack such established equity and cannot put up huge down payments to make a home purchase affordable.

The average age of first-time buyers of 38 in 2024 is far higher than the longstanding average age of around 30.

This means that even though Millennials are entering their prime single-family years of life, those who don't already own homes are highly likely to remain renters for the foreseeable future.

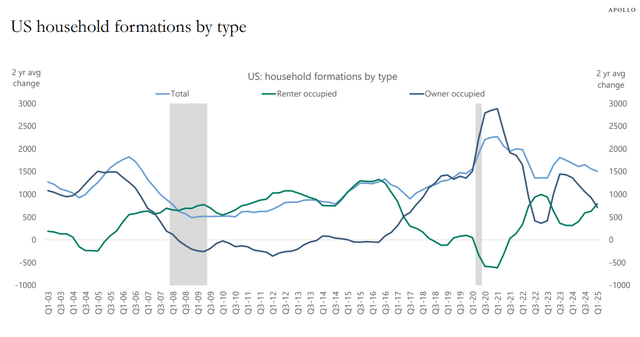

We see this showing up in the data on household formation. Since its recent peak in the second half of 2023, owner-occupied household formation has slid while renter-occupied household formation has rebounded.

It is a clear trade-off caused by the unaffordability of homebuying.

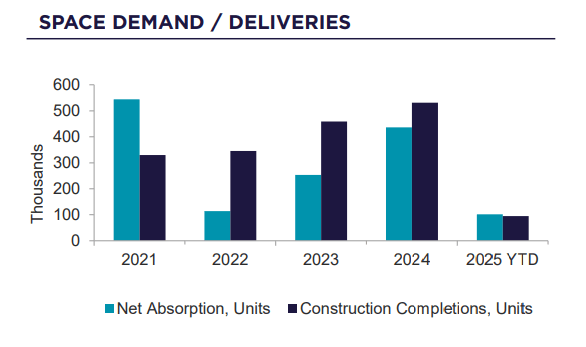

In the first quarter of 2025, Cushman & Wakefield reports that net absorption of multifamily housing was greater than supply deliveries for the first time since 2021.

If this trend continues, then the pandemic-related period of disruption to residential real estate will truly be over, and stability will be regained.

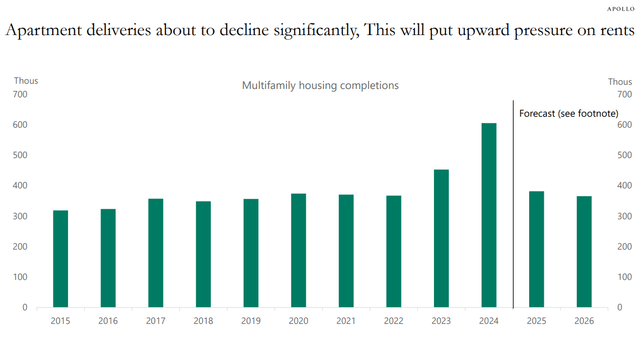

Among the biggest reasons why this trend should continue is the fact that apartment deliveries are set to decline considerably over the next few years.

Unless there is a dramatic increase in homebuying affordability (due to lower home prices or mortgage rates or both), renter demand should remain strong for the foreseeable future.

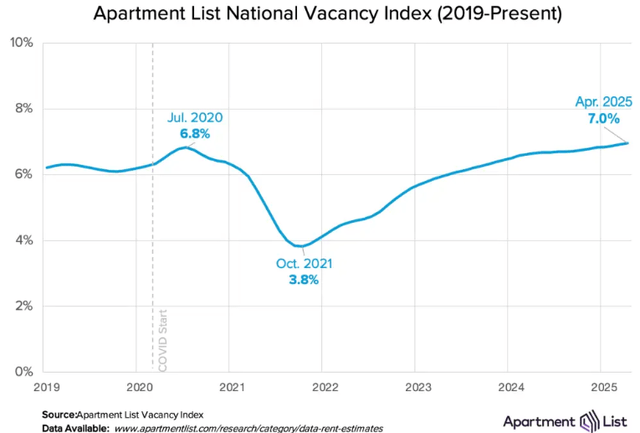

As such, the nationwide average apartment vacancy rate is likely at or near its peak level:

Low home affordability and, therefore, high renter demand have prevented the 50-year high in apartment deliveries from becoming a doomsday event for the residential real estate sector. A peak vacancy rate of 7% is by no means a sign of weakness. If this is the worst it gets, then the next few years of recovery should be very strong.

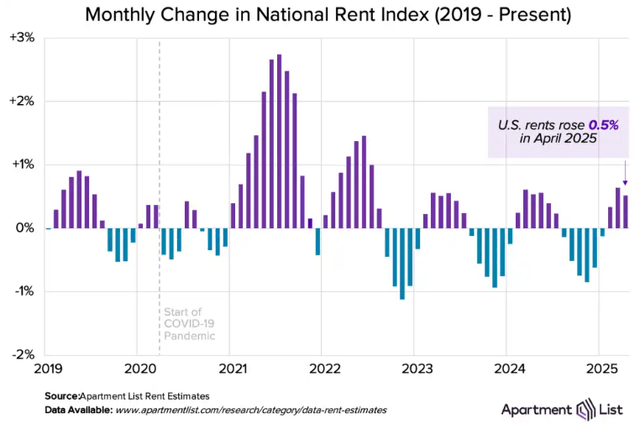

So far in the Spring leasing season, the seasonal rent growth has been about as strong as the last two years, though not as strong as the pre-COVID years.

Again, if this is the worst it gets, then it demonstrates the fundamental resilience and defensiveness of this sector.

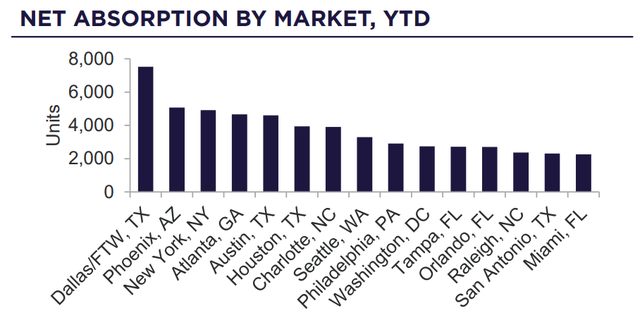

Finally, we note that net absorption continues to be strongest in the Sunbelt. In fact, 11 of the top 15 markets for net absorption so far in 2025 are located in the Sunbelt.

To quote the Cushman & Wakefield report:

The South continues to see the strongest demand in the nation, driven by outsized population growth. The region accounted for 53% of nationwide move-ins in the first quarter.

This is very good news for our predominantly Sunbelt-focused residential REIT portfolio.

Note also that New York City is showing robust net absorption as well, which is good news for our NYC residential REIT, Clipper Realty (CLPR).

With that said, let's take a look at the Q1 2025 earnings reports for our five resi REITs: