Earnings Update: Residential REITs (Q2 2025)

Dear Landlords,

I want to extend a warm welcome to all our new members!

As a reminder, our most recent "Portfolio Review" was shared with the members of High Yield Landlord on July 7th, 2025. You can read it by clicking here.

You can also access our three portfolios on Google Sheets:

New members can start researching positions marked as Strong Buy and Buy while considering the corresponding risk ratings.

============================

Earnings Update: Residential REITs (Q2 2025)

Residential rental real estate has experienced both tailwinds and headwinds this year.

On one hand, slower economic growth and a weaker jobs market have decelerated renter demand.

On the other hand, the highest level of homebuying unaffordability since the early 1980s has naturally led to more would-be homeowners in the rental market, thereby resulting in higher-than-otherwise demand for rental housing.

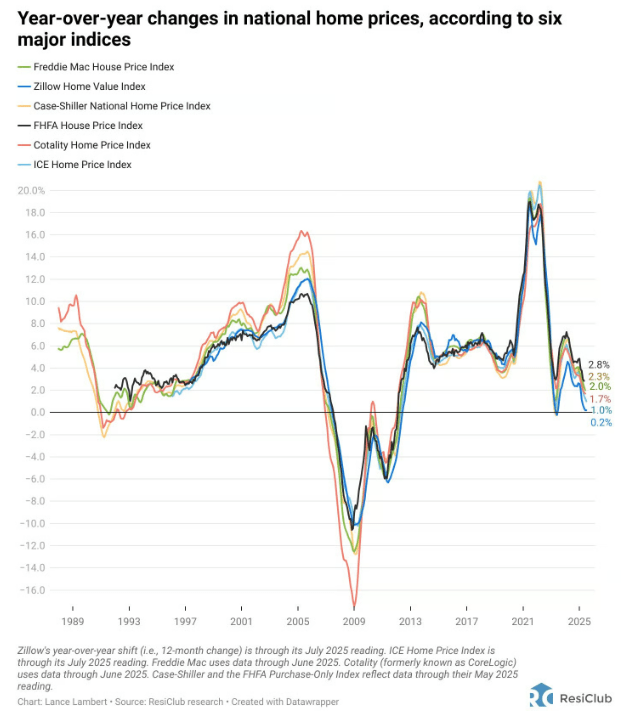

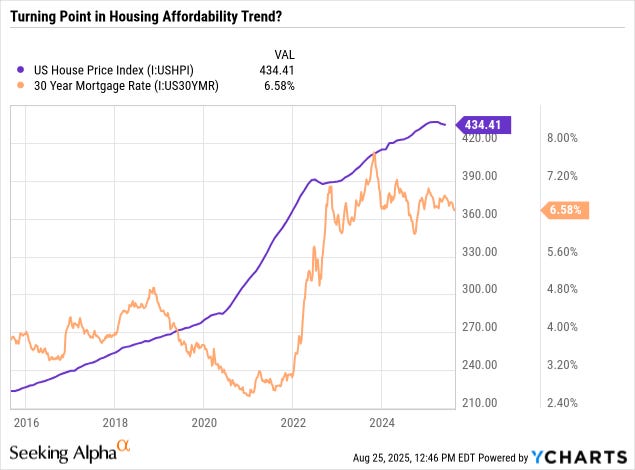

There has been some discussion in the financial media lately about whether we have reached a turning point in the housing market that will bring a new trend of greater affordability. Home prices appear to be peaking (or have already peaked), and mortgage rates have been gradually declining since their peak from a few years ago.

Even so, it's worth keeping in mind that either home prices or mortgage rates or a combination of both would need to decline considerably to bring homebuying affordability anywhere near that of renting.

Renting will highly likely remain significantly cheaper than buying for the foreseeable future.

And even though homebuying unaffordability is keeping buyers away, it is also locking potential sellers into their homes longer, diminishing the level of inventory on the market.

As such, despite the lowest homebuying affordability in over four decades, the average home price is still flat to slightly growing.

If current trends continue, then home prices may dip slightly into the negative in the coming quarters and years. But again, this alone would not be sufficient to make homes affordable to the vast majority of renters.

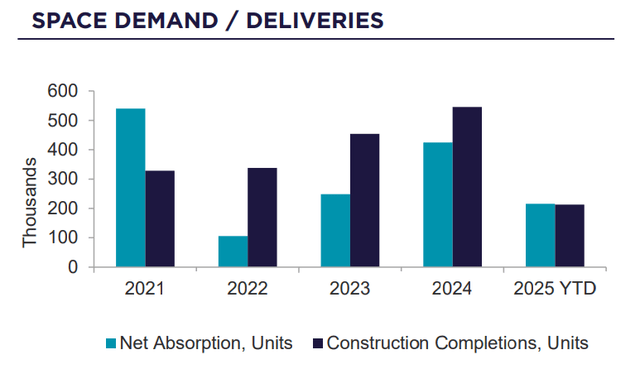

Hence we find that absorption of multifamily units has slightly exceeded deliveries of new units in the first half of the year.

Multifamily Net Absorption/Deliveries:

And as we have covered in previous residential updates, a major tailwind to the sector for the next few years is the rapid decline in the development pipeline. Given high financing and construction costs as well as weak job growth, a rebound in residential construction is inconceivable anytime soon.

To quote Cushman & Wakefield:

The bulk of the previous cycle’s construction surge has already run its course, and given current financing constraints, development activity will likely remain muted into the foreseeable future.

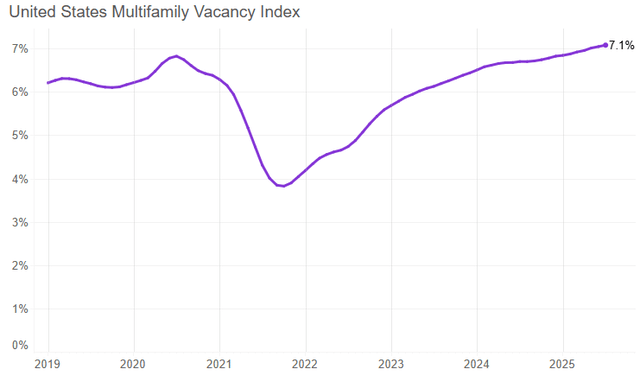

This should go a long way in alleviating oversupply problems in many markets and bringing vacancy rates down from their current level of about 7.1% nationwide.

On the other hand, the residential bull market may not be quite as robust as we have previously envisioned because of a few recent macro developments.

First, previous forecasts for strong net absorption and rent growth in 2026-2027 assumed more or less stable levels of population growth, but US population growth is going to be significantly lower for the foreseeable future than previously thought.

As reported by the Wall Street Journal, net immigration, which is the biggest factor in total population growth, is poised to be flat or negative this year, due to deportations and a cessation of border crossings. And since the US fertility rate has been declining since 2008, native-born population growth has waned to very low levels. The CBO estimates that the natural increase in the native-born population (births minus deaths) will fall until turning negative in the early to mid-2030s.

This basically means that US population growth, which obviously matters greatly to residential demand, is likely to be very low or even flat this year and next year.

Second, consider the recent downward revision of the Bureau of Labor Statistics' jobs report, which shows that the US labor market is far more stagnant than previously thought. Fewer jobs created means less leasing demand for residential real estate, all else being equal.

If net immigration and job growth pick up from the currently depressed levels, then we should get the robust residential rebound in 2026-2027. But if they don't, then the residential sector bull market should be more muted.

With that said, let's get to our Q2 2025 residential REIT earnings reports.