Earnings Update: Residential REITs (Q4 2024)

Important Note

Before going into today's article, I wanted to let you know that we will soon conduct interviews with the management teams of the following REITs:

Farmland Partners (FPI)

Easterly Government Properties (DEA)

NewLake Capital Partners (OTCQX:NLCP)

BSR REIT (HOM.U:CA / OTCPK:BSRTF)

Safehold (SAFE)

Canadian Net REIT (NET.UN:CA)

Let me know if you have any questions for them, and I will make sure to ask them for you. You can put your questions in the comment section below.

Thanks!

=============================

Earnings Update: Residential REITs (Q4 2024)

When it comes to residential real estate, there is a vast gulf between today's situation and the outlook for the next several years.

As we have explained in the past, the COVID stimulus resulted in a massive boom in 2021 and 2022 as pent-up savings were deployed into the economy. Household formation surged as people moved out of their parents' house or split with their roommates to move into their own place.

But this boom, combined with ultra-low interest rates, also spurred a massive residential construction boom, especially for multifamily housing. Once these apartments began coming to market en masse, the post-COVID boom was fading, and the result was an overabundance of units on the market.

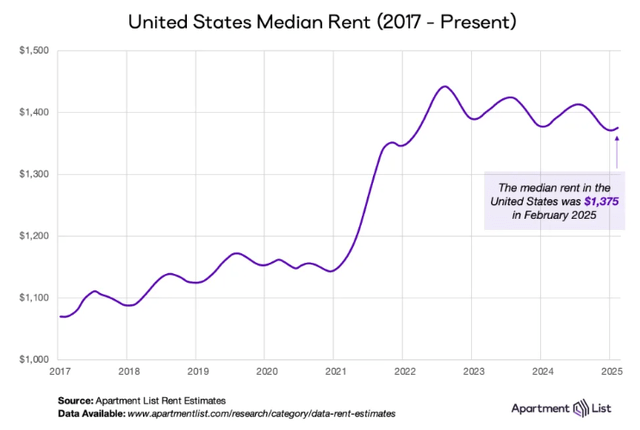

Hence we find that over the last few years since the peak in renter demand in 2022, the national average apartment rent rate has slid downward.

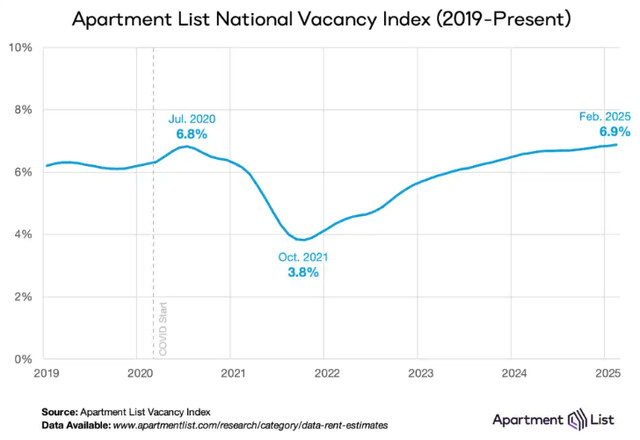

Meanwhile, despite above-average renter demand in 2023 and 2024, the sheer level of new supply hitting the market has caused the apartment vacancy rate to creep back up to its pandemic high.

This has rendered a soft environment for multifamily, especially from 2024 through the first half of 2025.

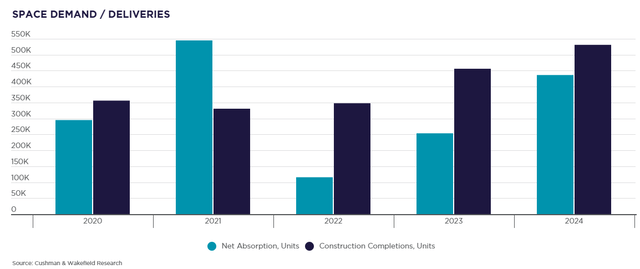

What is remarkable, though, is that despite a 50-year high in apartment deliveries, the multifamily vacancy rate has only risen to 6.9%. According to Cushman & Wakefield, multifamily absorption in 2024 came in 72% above 2023's level and was 56% above the 2017-2019 average.

For three years in a row now, apartment deliveries have outnumbered net absorption (move-ins minus move-outs).

That is what explains the malaise residential REITs have experienced over the last year or so.

But the future (at least the next 2-3 years) looks a lot more bright.

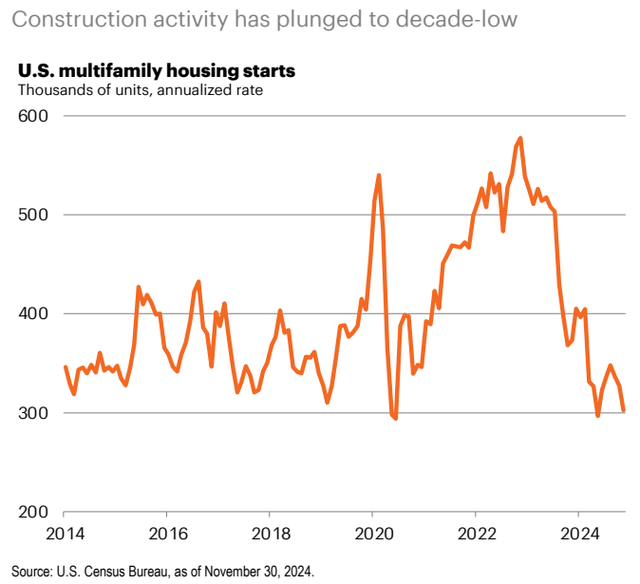

The environment that fostered a huge construction boom in 2021-2022 completely reversed into a hostile environment from 2023 to the present. Interest rates have surged, construction costs have soared, and the economy has cooled.

That has led to a major collapse in multifamily starts to its lowest level in a decade.

Apartment deliveries should decline considerably over the course of 2025 and be extremely minimal in 2026-2027.

What about single-family housing?

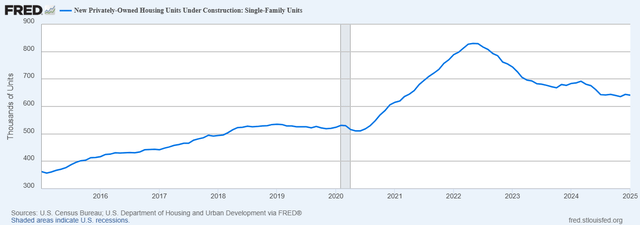

New single-family homes under construction have dipped from their Spring 2022 high but remain well above pre-pandemic levels.

Single-Family Units Under Construction:

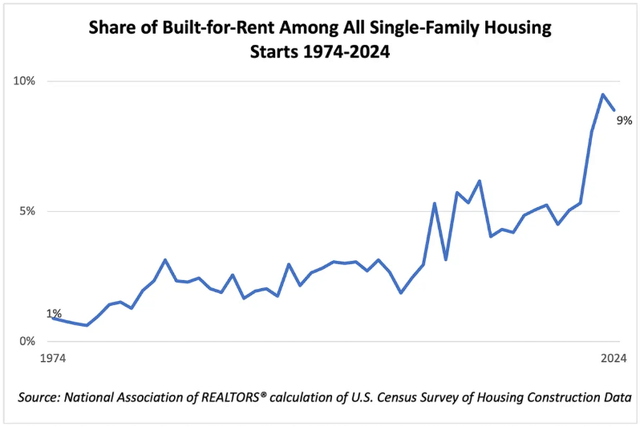

However, a growing share of these single-family homes are being built specifically to act as rentals. Companies like American Homes 4 Rent (AMH) are combining the amenities of apartment communities with the single-family format to build entire neighborhoods of rental homes. Camden Property Trust (CPT) has dipped its toe into these waters as well with a few BTR communities in Texas.

In 2024, 9% of all single-family housing starts were build-to-rent homes.

Given the continued low affordability of homebuying and the significantly cheaper cost of renting, we think this trend is likely to continue.

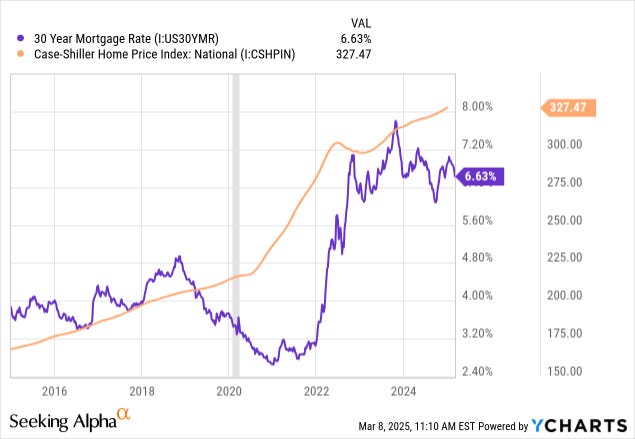

Between a 30-year mortgage rate still well above 6% and home prices continuing to creep up, homebuying should remain out of reach for most Americans for at least the next few quarters, if not longer.

This will keep more would-be homebuyers in the rental market and ensure that net absorption of both single-family and multifamily rental housing remains robust.

And now, let's turn to the Q4 2024 earnings updates for our residential REITs: