Earnings Update: Retail REITs (Q1 2024)

Dear Landlords,

I want to extend a warm welcome to all our new members! We recommend that you start by reading our Welcome Letter by clicking here. It explains why we invest in real estate through REITs and how to get started.

As a reminder, our most recent "Portfolio Review" was shared with the members of High Yield Landlord on July 3rd, 2024, and you can read it by clicking here.

You can also access our three portfolios via Google Sheets by clicking here.

New members can start researching positions marked as Strong Buy and Buy while taking into account the corresponding risk ratings.

If you have any questions or need assistance, please let us know.

==============================

Earnings Update: Retail REITs (Q1 2024)

In our last retail real estate report, Earnings Update: Retail REITs (Q4 2023), we gave an in depth review of the state of the American consumer as well as the retail real estate landscape.

Given that it has only been a few months since we published that report, it remains highly relevant today.

To summarize:

Consumers, especially on the lower income end, are becoming increasingly stretched. That said, spending continues to hold up due to high employment.

Since the peak of retail store closings in 2020, store openings have continuously outpaced closures. That pattern persists into 2024.

Lack of available space is the biggest hindrance to leasing. Retail occupancy is around as high as it gets right now.

New supply of retail space is extremely limited, and the pipeline of new buildings under construction is likewise extremely small.

Retail landlords are enjoying the highest levels of rent growth in decades, especially in faster growing markets.

Class B and C malls remain by far the weakest area of retail, but Class A malls are thriving.

Let's review some up-to-date data on the retail sector from the first quarter of this year.

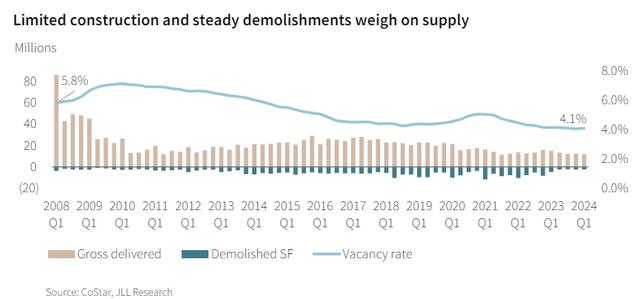

First, note that retail space deliveries remain very limited. Moreover, most of this newly delivered space are freestanding buildings that are net leased at long durations. Single-tenant retail generally doesn't compete with multi-tenant shopping centers.

Second, notice that the overall vacancy rate hovers right around 4%. It simply can't go much lower due to normal churn as well as the difficult to lease "elbow" spots that many centers have.

When it comes to that normal tenancy churn that retail always experiences, we find that the closure of certain dollar/discount stores (Family Dollar), drug stores (Rite Aid, Walgreens), and soft goods such as department stores, apparel, and shoe stores are more than offset by robust store openings by restaurants, other dollar/discount stores, grocery stores, and auto parts stores, among others.

Amid persistent strength from restaurants in the post-COVID era, food & beverage establishments are gobbling up available space, especially for smaller (less than 3,000 square feet) spaces.

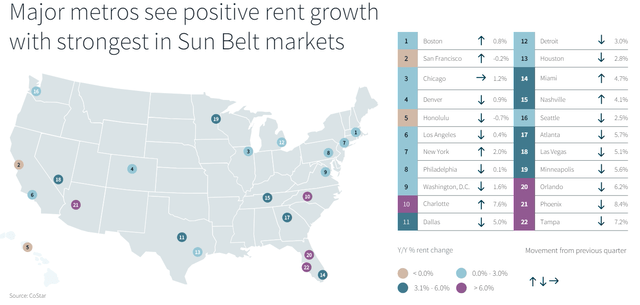

As for where retailers are leasing space, well, all you have to do is look at where people and jobs have gone the last several years. The markets enjoying the strongest momentum are overwhelmingly located in the Sunbelt.

Phoenix (the largest market of Whitestone REIT (WSR)), Charlotte, Tampa, and Orlando are especially strong right now as minimal available space allows landlords to push rents.

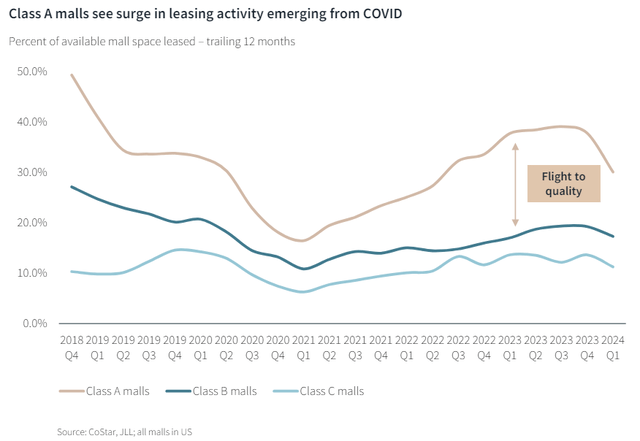

As for malls, as we have explained before, there is a huge divergence between the highest quality malls owned by the likes of Simon Property Group (SPG) and Macerich (MAC) and the lower quality malls that are largely dying a slow death.

Though leasing has cooled down this year for all malls, it is still interesting to note the gap in available space (vacant, soon-to-be vacant, and sublease) that is already leased between Class A and B/C malls.

Luxury retailers perform best in the most heavily trafficked, well-maintained, higher end malls, while Class B and C malls are mainly attracting lower quality retailers, gyms, and experiential tenants.

With that backdrop in mind, let's now look at the Q1 2024 earnings results for our 5 retail REITs: