Earnings Update: Retail REITs (Q1 2025)

Subscriber Meet Up in NYC

Before diving into today’s article, I wanted to let you know that I’m currently in New York City and planning to organize a casual meetup this Friday for any subscribers who would like to connect in person.

If you’re interested in joining, feel free to email me at jaskola@leonbergcapital.com, and I’ll follow up with the time and location.

Also, my apologies to those of you who hoped to meet me in other cities during my U.S. trip. My plans shifted more than expected, and I didn’t get the chance to respond to everyone. I truly appreciate your interest and hope to meet you on a future visit!

-------------------------------------------------------

Earnings Update: Retail REITs (Q1 2025)

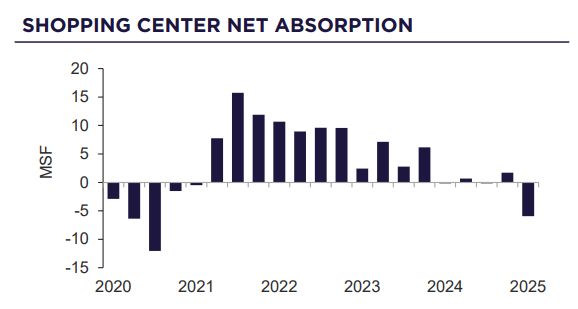

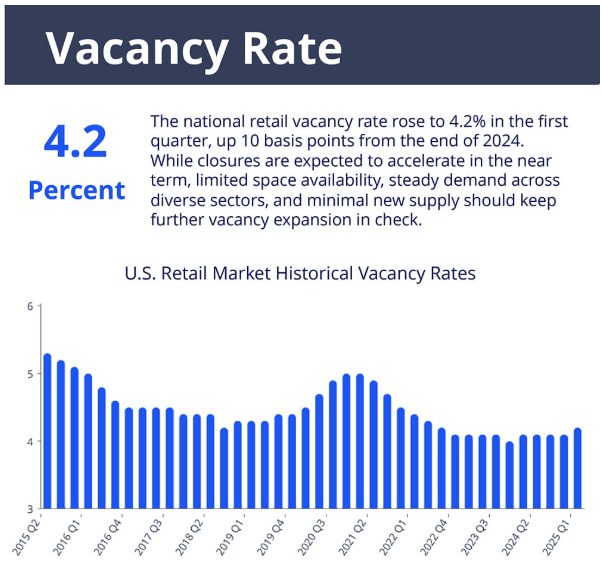

The US retail real estate sector was distinctly softer in Q1 2025 than it has been in previous years. Net absorption turned negative for the first time since 2020, and the vacancy rate, although still historically low, ticked up a bit. This was driven by a handful of struggling or bankrupt retailers, such as Walgreens, Family Dollar, Advance Auto Parts, Bed Bath & Beyond, and Big Lots.

To be clear, this was the continuation of a multi-year trend.

To quote a recent report from CRE brokerage Lee & Associates:

United States’ retailers shuttered 7,089,219 SF of space in the first quarter, which follows the net absorption of 23.1 million SF in 2024, one of the weakest annual totals in a decade. Despite the sharp upturn in retailer bankruptcies and store closures, availability across U.S. retail space markets remains within 10 basis points of the historic low of 4.8% as new development is constrained. Deliveries for the five years prior to Covid was twice the total five years since the lockdown. In total, just 19 million square feet of retail space delivered since 2020 is available for lease across the U.S.

Then along came tariffs, which have been putting increased pressure on retailers, especially smaller ones.

As the National Retail Federation recently put it:

These tariffs are making it harder for small retailers to thrive and even survive.

If tariffs on China are not lifted soon, or if higher tariffs go into effect on other Asian countries, the damage in the retail sector will continue to mount.

Already, before the tariffs, announced store closures outnumbered store openings by a wider margin than 2024, and tariffs may very well widen that gap.

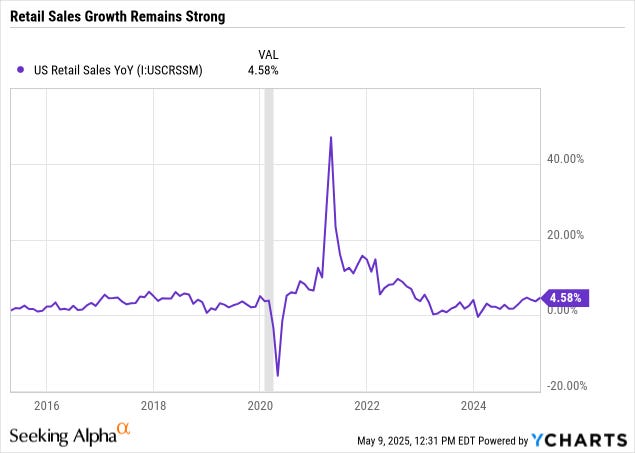

Up through April, retail sales have remained robust, driven by pre-tariff stockpiling by both businesses and consumers.

However, much of this burst in spending is best thought of as future spending pulled forward, which means consumption (including in the retail space) could inflect downward over the next few quarters.

After all, whether you're a business or consumer, if you've stocked up on inventory now, you won't need to buy as much for a while as you drawn down your inventory.

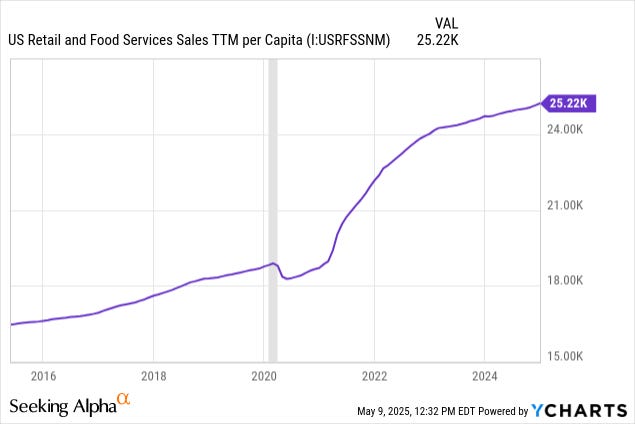

Here's another chart that helps to clarify the story. During the pandemic, retail and food service (restaurant & bar) sales per capital dipped for almost a full 12-month period, then roared back to ultra-strong growth in 2021-2022. But starting in 2023, the growth rate settled down to a slower, more gradual trend.

Whether this trajectory will continue, begin to stagnate, or turn down depends greatly on the direction of the broader economy.

If unemployment stays low, Americans will continue to spend. The US personal saving rate continues to sit at an ultra-low level of about 4%, which means that Americans are spending 96 cents of every dollar of income.

You can see the surge in retail spending feed through into shopping center net absorption in 2021 and 2022.

But you can also see how the drop-off in growth of retail spending in 2023-2024 (as well as the dwindling supply of available retail space) translated into a sharp decline in net absorption.

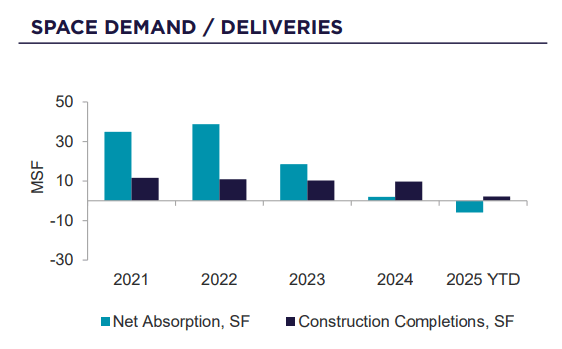

Looking at all retail space (including malls), we can see how annual net absorption has trended over the last several years:

On the positive side, however, deliveries of new retail space have also declined to a very low level, and all industry forecasts show that retail real estate construction should remain muted for at least the next several years.

To quote a report from Cushman & Wakefield:

The supply pipeline, already extremely thin by historical standards, will be further constrained by rising construction costs. This will help limit fluctuations in vacancy rates, which we expect to rise nationally to the 6.0-6.5% range by early 2026.

Another positive point, as mentioned above, is that the retail sector vacancy rate remains near record low levels, which keeps lease negotiations favorable toward landlords.

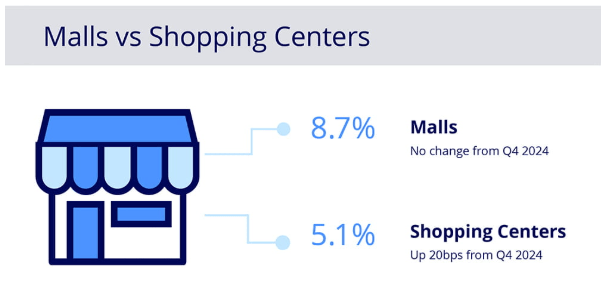

It's also worth noting, as we have done in past retail sector earnings updates, that there continues to be a divergence between the vacancy rates of shopping centers and those of malls.

The average mall has an 8.7% vacancy rate, while the average shopping center has a 5.1% vacancy rate.

However, even within the mall space, there is a significant gap between the highly trafficked Class A malls and the struggling Class B and C malls.

For example, high-end mall landlord Simon Property Group's (SPG) US vacancy rate as of the end of 2024 was a mere 3.5%.

Meanwhile, at the end of 2024, Macerich's (MAC) vacancy rate stood at 5.9%.

In short, then, the outlook for US retail real estate is softening, but from an extremely strong level. Well-located and/or essential retail space should continue to perform well over the course of 2025, although tenant turnover may increase in the second half of the year if tariffs continue to restrict trade with China.

With that said, let's take a look at the Q1 2025 earnings updates from our four retail REITs: