Earnings Update: Retail REITs (Q2 2025)

Dear Landlords,

I want to extend a warm welcome to all our new members!

As a reminder, our most recent "Portfolio Review" was shared with the members of High Yield Landlord on July 7th, 2025. You can read it by clicking here.

You can also access our three portfolios on Google Sheets:

New members can start researching positions marked as Strong Buy and Buy while considering the corresponding risk ratings.

============================

Earnings Update: Retail REITs (Q2 2025)

Overall, retail real estate in the United States remains in a solid position, but some challenges and headwinds represent a growing force in the sub-sector.

Occupancy is historically high, as vacancies in high-quality centers are quickly backfilled, typically at double-digit lease-over-lease rent increases. Essential retailers continue to enjoy steady sales growth, foot traffic, and rent coverage ratios. And the development pipeline for retail real estate remains extremely limited, as development economics remain unfavorable for new construction.

On the other hand, retail net absorption was negative in both Q1 and Q2 of this year.

Like the industrial sub-sector, new leasing demand has all but halted as retailers take a wait-and-see approach to rapidly changing trade and tax policy. A soft labor market and financial weakness among lower-income consumers also dampens demand for retail space.

As a result, the national average occupancy rate appears to have peaked and begun a slow, steady decline. Lease renewal rates are high, but in lower-quality centers, spaces that are vacated are taking longer to backfill.

The "boom times" of 2021-2023 are over. The balance has tilted from rising occupancy to falling occupancy.

The strongest area of retail real estate is the single-tenant freestanding space (what JLL calls "General Retail"), which continued to see positive net absorption in the first half of this year:

On the other hand, virtually all types of multi-tenant retail centers suffered negative net absorption in the first half of the year for the reasons cited above. The majority of store closures have been concentrated in shopping centers and malls.

Interestingly, the number of announced store openings has actually outpaced store closures this year, but closures have overwhelmingly been for larger spaces (10-50k square feet), whereas openings have overwhelmingly been for smaller spaces (up to 10k square feet).

Bigger stores closing and smaller stores opening translate into negative net absorption, despite the absolute number of openings outpacing that of closures.

This has unfortunately had the effect of slowing effective rent growth from about 4% at the beginning of 2024 to 2.3% on average in Q2 2025 (lower than the rate of inflation), according to Cushman & Wakefield.

Of course, that metric represents the national average, including both high-quality and low-quality centers. The retail REITs in our portfolio overwhelmingly fall on the higher end of the quality spectrum.

Some good news is that, despite negative net absorption and retailer leasing hesitancy, fundamentals for the retail sector remain solid.

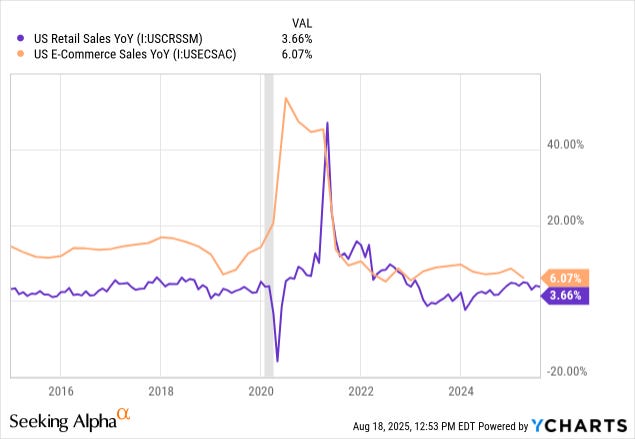

Total retail sales growth is outpacing inflation, while the growth in e-commerce has slowed considerably from its rapid pace during the 2010s and through the COVID pandemic.

After the pandemic, consumers stampeded back into brick-and-mortar stores. In 2021 and 2022, physical retail enjoyed some of its strongest years on record as virtually the entire spectrum of retailers and food service providers benefited from cash-rich consumers.

By 2023, however, the discretionary spending boom fizzled, and the majority of the population went back to more or less normal levels of spending.

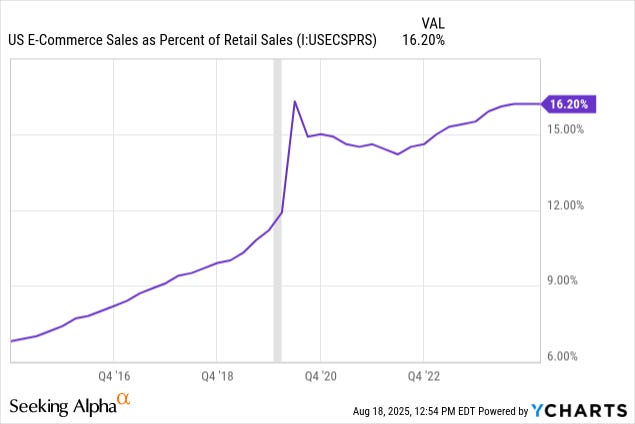

This new normal includes a larger allocation of the consumer wallet to e-commerce spending than before COVID-19, to be sure, but the e-commerce boom that peaked in 2020 now appears to have ended, E-commerce as a share of total retail sales has flattened out over the last year or so:

However, at this point, most retailers have honed their omnichannel strategies, and there is less of a cost discrepancy between e-commerce platforms like Amazon (AMZN) and the average retailer than there used to be.

Currently, the forward trajectory of retail real estate seems to be highly dependent on the broader economy, trade policy, and how retailers respond to a stabilization in tariff rates.

With that said, let's get to the Q2 2025 earnings reports for our five retail REITs: