EPR Properties: Amazon Should Buy AMC

EPR Properties: Amazon Should Buy AMC

Please Note: This update is related to EPR Properties (EPR). We have reasons to believe that its biggest tenant, AMC, could become the target of a buyout. We review this possibility and what it means for EPR.

----------------------------------------------------------------------------------

Lately, there has been some rumors of a potential takeover of AMC (AMC) by Amazon (AMZN). It is unclear how legitimate these rumors really are and whether the discussions are currently active. The source cites that the duo is said to have held talks recently.

Many were quick to dismiss this as fake news because of the nature of the business. People don’t understand the appeal of buying a movie theater chain in 2020.

We think that there could be some legitimacy to these rumors and that a deal could greatly benefit both companies. Amazon’s interest in movie theaters is not new, and at the right price, AMC could be a fantastic acquisition for them. Here is why.

Complementary to Streaming Businesses

Back in 2018, Amazon is reported to have considered buying Landmark Theaters, a 250-screen chain, but lost the deal to another buyer. Netflix (NFLX) is reported to also have been bidding to buy Landmark at the time.

Why are streaming businesses so interested in buying movie theaters?

Many perceive movie theaters as a dying industry. In reality, it is a resilient business with limited growth, but sustainable earnings. Box office is an important component for capturing downstream revenue before the movie goes for sale elsewhere (Digital rental, DVD, Streaming).

Despite all the fears, US box office revenue has been hitting new record highs nearly every year for the past 25 years:

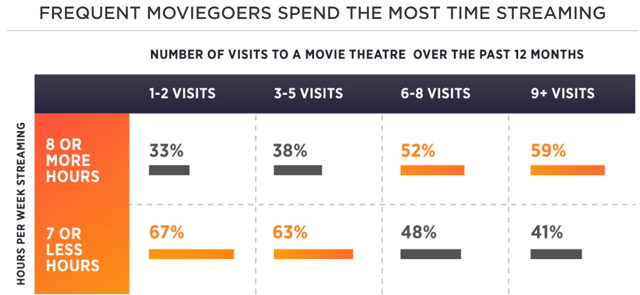

And now comes the interesting part: streamers are the best clients of movie theaters. The opposite is also true: those who stream the least are less likely to attend movie theaters.

It shows you that both can and will continue to co-exist. Streaming is more focused on TV shows while theaters premier the latest movies. If you enjoy one, you probably also enjoy the other.

And that is why Amazon, Netflix and others are interested in buying movie theaters. They are complementary to their streaming services. The company who makes the first move could have a long-lasting competitive advantage over other streaming services.

Competitive Advantage Against Netflix

Right now, Prime, Netflix, Hulu and others are under intense competition. They are all doing their best to offer a superior product and better value to the consumer.

If Amazon was to buy out AMC and offered some form of bundling between streaming and moviegoing, it would give it a big competitive advantage that Netflix couldn’t compete with. Amazon’s product would become superior and consumers would quickly take notice.

Example: You can watch one movie per month at AMC with your Prime membership. Netflix would not be able to compete with that.

Synergies and Upselling

If Amazon was to use its platform to upsell movie theater tickets and use its massive prime membership to drive traffic to AMC’s theaters, it could make these theaters more productive than ever before.

Movie theaters make their money by selling you food and drinks, an area where Amazon has been heavily investing though Whole Foods.

There are a lot synergies between food, streaming, theaters and e-commerce. It provides them to opportunity to upsell clients, drive traffic, and mitigate costs better than any other operator.

Finally, Amazon could use AMC’s 10,000 screens to promote all its other products and services before and after the movies, and also use the locations for delivery pick up.

Low Price Tag

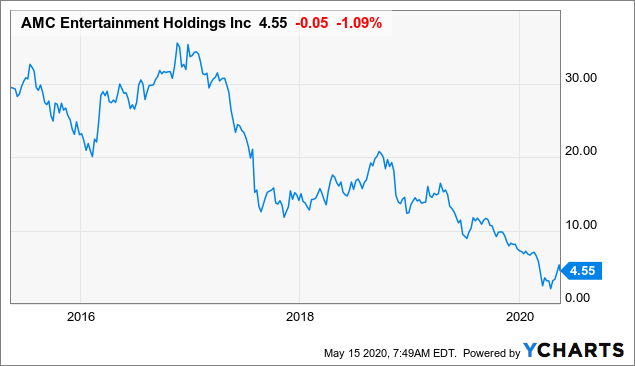

AMC is a good business in a mature industry with valuable assets, but an overleveraged balance sheet at the worst possible time.

It provides a rare opportunity for Amazon to buy it out for pennies on the dollar. Amazon has the finances to fix the balance sheet, improve operations, and use all the synergies to make it a worthwhile investment, especially at the historically low price:

AMC controls the most productive theaters locations in the nation and consistently outperforms its peers. These are very valuable locations that will thrive again in the long run.

Amazon has long had interest in buying movie theaters and now it can do so at a very opportunistic price.

Bottom Line

Before screaming at fake news, consider for a second that the last time we heard about such buyout rumors, Amazon bought out Whole Foods. Back then, this was a surprising move because it showed Amazon’s interest in buying non-digital businesses.

We believe that movie theaters are no different. If Amazon was interested in buying Landmark Theaters at a hefty price tag in 2018, it is probably also interested in buying AMC at a bankruptcy price in 2020.

We cannot know whether this happens or not, but Wall Street is clearly giving some legitimacy to it. AMC jumped up significantly on the announcement of the news.

And when you think about it, it just makes good sense for both companies to work together: AMC has a balance sheet issue. Amazon needs a competitive edge in its streaming business and could earn a great return given the low price and synergy potential.

Losers & Winners

The hidden loser here would be Netflix and we believe that it will push them to also consider buying out AMC. They sure do not want Amazon to have this competitive advantage.

The hidden winner would be EPR Properties (EPR), which is AMC’s largest landlord. It is today priced at a historically low price due to fears over AMC’s health. These fears would be removed if Amazon became EPR’s largest tenant. In fact, the fears could turn into excitement and result in a much larger valuation multiples. It would not only secure the AMC revenue, but it would also be a strong vote of confidence for the entire movie theater and entertainment industry, right when its sentiment is at its lowest.

Some worry that Amazon would push for aggressive rent cuts. While possible, here it is important to remember that EPR has >10 year leases on the properties.

Because the leases are so long, the level of the rents may at times be too low or too high relative to the real economic productivity of the property. Right now, the rent is arguably too high given that movie theaters are closed or operating at a limited capacity. However during regular times, the rent coverage has been near 2x, which means that these properties are very profitable. If Amazon was going to operate these assets, it would improve their profitability through synergies, which would over time justify higher, and not lower rents.

Therefore, just because your name is Amazon does not grant you a lower rent. The rent is mostly a function of profitability. Finally, even assuming a moderate rent cuts, the market appreciates "quality" just as much as "quantity". Having Amazon as your largest tenant is preferable than the overleveraged AMC.

We are bullish on both: AMC and EPR but we prefer to invest in EPR for superior downside protection. AMC could result in even greater returns, but it does not have EPR's balance sheet to survive a prolonged crisis.

Good investing from your HYL Research Team,

Jussi Askola