EPR Properties: The AMC Risk Is Misunderstood

Please note that this is a free article of High Yield Landlord. If you find it valuable, consider joining our service for a 2-week free trial. You'll gain immediate access to my entire REIT portfolio, real-time trade alerts, exclusive REIT CEO interviews, and much more.

EPR Properties: The AMC Risk Is Misunderstood

EPR Properties (EPR) is one of the most hated REITs in today's market, and yet, it is one of our largest holdings at High Yield Landlord.

The disparity between the market's perception of the company and ours is very significant and this is almost entirely because of its lease with AMC (AMC).

The market fears that AMC is headed for bankruptcy and that this will cause significant pain to EPR.

But having looked deeply into this issue, we disagree and think that the pain should be limited and that this is more than priced in.

In today's update, we will first give you a quick reminder of why we like EPR and we will then discuss the "AMC risk" in greater detail. This is an important topic because it is the number #1 reason why the company is today so heavily discounted.

Overview of our investment thesis

EPR is what I would describe as a great REIT.

It is not just blindly following the footsteps of other real estate investment firms and buying traditional assets.

It is instead following a very unique approach that truly creates value for shareholders.

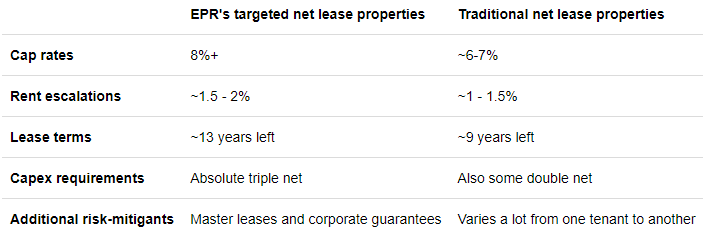

This unique approach is to target experiential net lease properties such as movie theaters, water parks, golf complexes, hot springs, amusement parks, and so on:

EPR recognized decades ago that these properties were receiving little interest from most investors and that this presented an opportunity for them.

Most investors would rather buy a Walgreens net lease pharmacy than a TopGolf complex because Walgreens operates a more defensive business and if it decided to vacate the property or failed to pay its rent, other tenants could probably replace it. On the other hand, the prospects of a TopGolf property may be less predictable and in case of vacancy, it may prove challenging to release such a property since you cannot easily convert it into another use.

Most net lease property investors own less than 10 properties so this higher risk is a big issue for them since they will don't enjoy enough diversification to make up for it.

But this is a great opportunity for EPR because it has left a clear void for capital in this segment of the net lease market and it has allowed EPR to earn above-average risk-adjusted returns by buying these properties at cheap prices and then structuring strong leases and including them as part of a well-diversified portfolio to mitigate risks.

This has resulted in significant "alpha" over the long run:

So there is true "alpha" in following this strategy and EPR has perfected it over the years. In many ways, the company is today better positioned than ever:

Its portfolio is larger and better diversified than ever with 363 properties in 44 states and Canada.

As a result, EPR has more relationships than ever. It also has better data than ever. And its addressable market is bigger than ever.

Their average rent coverage ratio is now higher than prior to the pandemic. Their non-theater properties are very profitable enjoying a 2.7x rent coverage ratio compared to 2.0x prior to it. This is because the whole "experience economy" is booming in the post-COVID world as people prefer to spend on experiences rather than things.

The pandemic proved to the people that high-quality theaters are here to stay and won't be replaced by streaming. This wasn't as clear prior to the pandemic. More on this later.

Its balance sheet is in good shape with a 40% LTV, only fixed-rate unsecured debt, only tiny maturities until 2025, and plenty of liquidity.

The dividend payout ratio is also historically low at 70% allowing the company to organically reinvest in its growth.

The management made it through the pandemic with minimal damage, which just adds to its credibility given that this was the worst possible crisis that they could have faced. The few lease renegotiations that occurred were very favorable to EPR, only making limited concessions and always getting something else in return. It shows that the REIT is very well managed and they own great properties. Otherwise, the pain would have been a lot greater.

But despite that, EPR remains priced today as if they were facing an imminent threat that could bring the company down.

This threat is the fear of a future AMC bankruptcy.

Today, EPR generates about 14% of its rental income from it and so it is not negligible. It explains why the market is pricing EPR today at such a low valuation:

But here are 5 important elements that the market appears to have missed about AMC:

#1) The Lease With AMC Has "Already" Been Renegotiated

Our member, Robbadob, recently made the following comment on our chat board:

I keep seeing various SA authors warn EPR investors that an AMC bankruptcy was possible and could result in a lease renegotiation... However, AMC has already gone to that well with EPR and if they were to enter bankruptcy, the route of renegotiating myriad leases is not available to them; there is now a single master lease.

He added the following statement from EPR's Q2 2020 results:

"Restructured AMC Leases - In exchange for agreeing with AMC to place 46 of the Company's 53 AMC leased theatres into a new master lease that reduces future restructuring risk and increases the average lease term by 9 years, the Company agreed to reduce annual fixed minimum rents by approximately 21%."

EPR also added that:

"The Company believes that the AMC restructuring significantly improves the Company’s long-term position with respect to AMC, while providing AMC with deferrals it needs during the pandemic and better performing theatres in the future. Specifically:

The Master Lease was designed with the intention that the parties will respect the master lease characterization at all times, which the Company believes will enhance its position in the event of a reorganization proceeding regarding AMC."

So put simply, the lease has already been renegotiated in a way that allowed AMC to survive the initial pain of the pandemic in exchange for greater safety for EPR in case it still needed to restructure its finances someday in the future.

#2) The Recent Bankruptcy Restructuring of Regal Led to Higher Rents

AMC's lease was renegotiated during the early days of the pandemic before we even had a vaccine when uncertainty was at its highest.

AMC was losing tons of money and it was at high risk of bankruptcy. This was also before the whole meme stock craze which allowed AMC to raise a bunch of equity.

If there was a time for AMC to get huge concessions from its landlords, this was it.

But since then, things have changed significantly. We have moved past the pandemic, business has returned to normal, and the box office has begun its recovery with major hits like Barbie and Oppenheimer.

Therefore, even if AMC would file for bankruptcy, its position to negotiate would be very different today.

It is worth remembering that when Regal recently went through bankruptcy, it really didn't get much from EPR as it renegotiated its lease.

EPR actually raised the rent on most of the properties, restructured them into a safer master lease, and gained a safer tenant with better finances. In return, it agreed to let Regal off a minority of its properties that it decided to not continue operating. Overall, EPR expects to earn 96% of the rent from Regal in year one, and the rest will be made up over time as it releases/operates/sells the vacated properties.

Would AMC have more to gain in a renegotiation?

It would likely have even less bargaining power than Regal given that it has already renegotiated its lease and we are now already further in the recovery of the theater industry.

#3) EPR Owns The Most Productive Theaters In The Nation And They Are Already Profitable

People tend to forget that we are talking about real estate investments.

EPR is the landlord, not the tenant.

An investment into EPR is an investment into its real estate and not an investment into AMC or any other tenant.

In case AMC disappeared, EPR would still own the real estate of the theaters, and these theaters happen to be some of the most productive in the nation. EPR owns 3% of the country's theaters, but they generate 8% of its box office.

This means that these are good properties that are well-located and could attract other tenants if needed or even be reconverted into other uses.

The movie theater industry may be oversupplied today, but it is not these higher-quality theaters that are likely to close down.

This lowers any bargaining power that AMC may have even further because it knows that these exact theaters are essential to its long-term survival and prosperity and other operators would gladly take them over if the opportunity presented itself.

Already today, these theaters are profitable at the property levels, enjoying a 1.3x rent coverage ratio and this will rise further as the box office continues its recovery.

#4) AMC Just Raised a Bunch of Capital And Will Likely Raise Some More of It. Meanwhile, It is Also Approaching Profitability

AMC has raised a lot of equity to pay off some of its debt and just recently it raised yet another $325 million through its ATM program.

This may hurt AMC's shareholders as it dilutes them, but it is very good news for EPR because it provides AMC with the liquidity that it needs to reduce its leverage and pay its rent. If you follow AMC's CEO on Twitter, he makes it clear that he would have no problem raising even more equity if needed to make sure that they survive to see the recovery.

Moreover, something that appears to have been overlooked is that AMC just recently reported its first profitable quarter since the beginning of the pandemic.

This quarter also didn't include the impact of Barbie and Oppenheimer, which bodes well for the coming quarter.

Finally, AMC just recently landed a historic deal with Taylor Swift to distribute its film straight to its theaters, bypassing Hollywood. The Swift family will fund the entire movie and AMC will receive 43% of the proceeds for distributing it. The pre-sale event for the movie grossed $27 million on its first day and broke the 103-year-old record by $9 million. This deal can really move the needle for AMC.

#5) Theaters Are Here To Stay and AMC is Playing The Long-Term Game

The final point that I want to make here is that high-quality movie theaters are here to stay.

If you like to watch new blockbusters, then these theaters are needed to monetize them because you cannot do it in any better way.

It is as simple as that.

Already in 2019, about half of US households had a Netflix account, and yet, the box office was at a near-all-time high. The reality is that streaming services offer a very different experience and therefore, they cannot replace theaters.

Streaming is mainly for shows and older movies.

Theaters are for new blockbusters like Barbie for the most part.

Apple and Amazon just recently committed to investing billions into producing movies for theatrical release and all major studios have by now also recognized that theaters remain essential to monetize their movies.

The takeaway here is that high-quality theaters are here to stay and the recent Barbie and Oppenheimer successes are proof of that.

Some of the lower-quality theaters are of course in trouble but that's not what EPR owns. As those close down, it should lead to traffic consolidation, ultimately benefiting the remaining higher-quality theaters owned by EPR.

AMC wants to operate these assets because it knows that it can profit from them over the long run.

Bottom Line

The AMC risk is misunderstood and it is causing EPR to trade at a lower valuation than it really should.

We will continue to accumulate more shares for as long as it remains discounted and expect to keep EPR as one of our largest holdings at High Yield Landlord.

Finally, please note that this is a free article from High Yield Landlord. If you found it valuable, consider joining our service for a 2-week free trial. You'll gain immediate access to my entire REIT portfolio, real-time trade alerts, exclusive REIT CEO interviews, and much more. We are the largest and highest-rated REIT investment newsletter online, with over 2,000 paid members and more than 500 five-star reviews.

We spend 1000s of hours and over $100,000 per year researching the market for the most profitable investment opportunities and share the results with you at a tiny fraction of the cost.

Get started today - the first 2 weeks are on us:

Sincerely,

Jussi Askola

Analyst's Disclosure: I/we have a beneficial long position in the shares of all companies held in the CORE PORTFOLIO, RETIREMENT PORTFOLIO, and INTERNATIONAL PORTFOLIO either through stock ownership, options, or other derivatives. High Yield Landlord® ('HYL') is managed by Leonberg Research, a subsidiary of Leonberg Capital. All rights are reserved. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. The newsletter is impersonal and subscribers/readers should not make any investment decision without conducting their own due diligence, and consulting their financial advisor about their specific situation. The information is obtained from sources believed to be reliable, but its accuracy cannot be guaranteed. The opinions expressed are those of the publisher and are subject to change without notice. We are a team of five analysts, each contributing distinct perspectives. Nonetheless, Jussi Askola, the leader of the service, is responsible for making the final investment decisions and overseeing the portfolio. We do not always agree with each other and an investment by Jussi should not be taken as an endorsement by other authors. Past performance is no guarantee of future results. Our portfolio performance data is provided by Interactive Brokers and believed to be accurate but its accuracy has not been audited and cannot be guaranteed. Our portfolio may not be perfectly comparable to the relevant index. It is more concentrated and may at times use margin and/or invest in companies that are not typically included in REIT indexes. Finally, High Yield Landlord is not a licensed securities dealer, broker, US investment adviser, or investment bank. We simply share research on the REIT sector.