Guest Report: REITweek Observations By Michael Boyd

Guest Report: REITweek Observations By Michael Boyd

Attending investor conferences can be very valuable to meet with management teams and gain a better understanding of different investment strategies.

Unfortunately, this year we were not able to attend REITweek because it was scheduled just 10 days before my CFA Level 3 exam. REITweek is one of the largest REIT investor conferences in the world and it provides an opportunity to gain the best insights on the latest REIT market developments:

Since we were not able to attend this year, we sought to collaborate and share research with other analysts who went there. Fortunately, Michael Boyd was kind enough to share a portion of his notes with us. It includes information on three of our holdings: RESI; FPI; BPR and two other companies that we keep on our watchlist: VICI, SKT.

Michael Boyd runs Industrial Insights here on Seeking Alpha. The focus from his Marketplace service is on finding small and mid-sized companies generating high levels of free cash flow. Emphasis is placed on seeking information that goes beyond the SEC fillings by talking with management teams and attending conferences. It isn't a surprise to see him bullish on many of the same names as us. If you want to gain access to further coverage of REITweek, you can take a look at his service here.

===

REITweek Observations By Michael Boyd

REITweek was quite fruitful and very, very busy on my end. With eleven meetings with management teams over two and a half days that ate most of my time but I did still manage to meet up with other senior executives informally and catch a few company presentations. Also gave me the opportunity to finally meet Brad Thomas in person.

I've got a long list of notes from this conference I'm working through and crafting into readable research content. I think there were will be three steps you see me go through over the next several days to get this out to you:

Two part series on REITweek meetings. There is a lot of data here so I wanted to break this into digestible pieces. While it includes data, including my subjective read on management is important here as not everyone gets a chance to interact with these teams.

General observations on the REIT market in general from attendants. Think "Where are we headed, major hurdles to overcome, industry trends" type of content.

Deep, in-depth research on a few names that caught my eye. I intend to make a couple of purchases off the back of my work here. I've noted those that really caught my eye below so the community knows what to expact.

Expect my focus to be in this area over the next week, gradually transitioning back to short side coverage in mid to late June and then working back into midstream energy ahead of the Citi MLP conference in August. This is something I've mentioned in the weekly updates but want to reinforce in order to set expectations. There will be of course some one-offs along the way but that is my view on overall trajectory of my time. Now, on to the good stuff.

VICI Properties (OTC:VICI)

My overall outlook on VICI Properties remains positive. Less than two years old, the new spin-off led by Edward Pitoniak has been hard at work. Casino gaming real estate, at least within the REIT sector, is a relatively new concept and has been slow to see acceptance from smaller retail shareholders. Whereas institutional ownership of VICI Properties has been improving even with the exit by hedge funds that received shares coming out of the Caesars (CZR) restructure, mom and pop knowledge remains light. That's a shame.

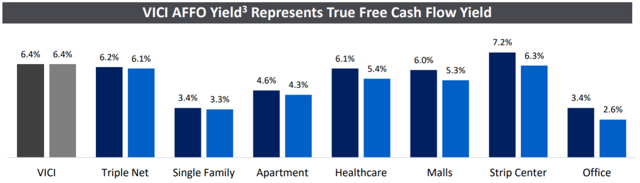

*Source: VICI Properties, 2019 REITweek Presentation, Slide 12

VICI Properties in its presentation pitch to investors has continued to emphasize the quality and durability of its cash flows as a triple net lease owner. I believe the above is an important slide that emphasizes the value proposition here, particularly against other asset classes that see redevelopment and sustaining capital expenditures flow through their income and cash flow statements. Given the trophy-like nature of the assets as well as the long term master lease agreement, its arguable that VICI Properties should trade at a premium to triple net peers and not a mild discount. That structure also lends itself to being very attractive to smaller shareholders focused on income and I fully expect the entire subsector to see a lot more interest in coming years.

As a triple net player, the company is very easy to model. My questions towards the team focused on the growth outlook and the total addressable market. While VICI Properties has aspirations to own other experiential real estate (the CEO has prior expertise at ski resorts for instance) gaming will be its bread and butter for some time. There has been $4-5,000mm in total rent that it believes it can acquire, a figure that excludes properties already operated through a sale/leaseback or where the casino operator has a REIT partner (e.g., MGM Growth Properties (MGP)). This also excludes tribal assets but includes larger players like Las Vegas Sands (LVS) or Wynn Resorts (WYNN). Given cap rates, this means there is about $50B in assets out there available for acquisition. Management will aim to take out $500mm-1,000mm of this annually, good enough to provide low single digit accretion on the bottom line FFO number. Unlike other REITs where issuing equity is not an option, it is here and I expect to see a mixed blend of debt and equity to make these deals happen.

I spoke to them at length about the nuance of investing in either strip and regional gaming. The conference timing came with some tough news on this front. The Illinois Gaming Bill, enacted quickly by a state hard up for cash, was another example of just how difficult it can be for regional gaming operators from a supply perspective. Delving further, Illinois upped the number of licenses from eight to fifteen, potentially doubling gaming supply in the state. That also has profound implications for gaming properties in surrounding states as well. To be fair, I would keep in mind that Pennsylvania – the last state to make a similar move – did not see full interest in all of the licenses. The state only sold five new licenses, including one which went to Penn National Gaming (PENN) who holds it as a protective measure with no intent to develop. Nonetheless, I still continue to favor Las Vegas as a market but the Strip in particular is dominated by MGM Resorts (MGM) so those properties are off the table. It is also unlikely major casino players like Las Vegas Sands or Wynn Resorts start with selling those kinds of assets as a means to raise capital.

On the balance of that, in the interim VICI Properties still has its call option rights on Harrah’s New Orleans, Harrah’s Laughlin, and Harrah’s Atlantic City. Together those properties represent $140mm in NOI so about $2,000mm in acquisitions. At 10% cap rates, management will not let those deals expire. That really only leaves room for one or two major deals before 2022 other than the call option properties. Time is instructive and yield a little more data on the trends in regional gaming a few years down the line and perhaps in 2023 forward VICI Properties will be better able to make more informed decisions on regional gaming acquisitions.

My subjective opinion is the firm remains in a great place. Management is solid, very easy business to model, and it is one of the few spots in the REIT universe where management can issue stock to grow accretively. Great growth play. I highly recommend for those that are more risk averse.

Farmland Partners (FPI)

Farmland Partners (FPI) was a relatively unknown play to me before seeing the short attack hit Seeking Alpha which tanked the shares. Reading through that, some of it had merit, some did not. Farmland Partners has never quite recovered from that event and it was pretty clear that CEO Paul Pittman is going to pursue the lawsuit against Seeking Alpha contributor Rota Fortunae for as long as it takes. The anonymity platform on Seeking Alpha still does not sit well with many senior executives at REITweek - something I encountered often when talking to management here. Obviously not an issue with me since I stand behind my work but it is an encumbrance for executives to embrace independent research. I personally would support a move to eliminating anonymity for contributors for those curious.

As far as Farmland Partners, farmland is a tough market and my bearishness is well-known on the agriculture space (Deere (DE), Lindsay Corporation (LNN)). While my concerns in this industry revolve around declining crop prices, higher farm leverage, and lower incomes, management does have some counterpoints. Arable hectares per capita globally has been falling for years, driving the need for efficient use of great cropland. Personally, I think this is a bigger driver internationally where yields per acre have more upside (increasing use of irrigation, fertilizer, high end equipment, etc.). What I did find important was that USDA reported net cash income per farm includes anyone that earns $1,000 per year. These are what management calls “hobby farmers”. Incomes from the major players remains elevated and profitable. I think it’s a great counterpoint particularly when framed against the historical returns of this asset class. It is hard to bet against:

*Farmland Partners, REITweek Presentation, Slide 22

The issue remains the illiquid nature of farmland coupled with the low going-in yields. At 3-4% cap rates there just is not much cash flow. Much of the growth in value comes in the value of the land – not the payments of farmers working it. With management believing net asset value is in the teens, the current share price is attractive and they are selling land to rebuy stock. The current $10mm/quarter in land sales are set to continue and management intends to keep putting that into rebuying the common and preferred after controlling for leverage. As the CEO is a major holder of the common stock, anyone that is a fan of capital allocation stories this is a good one in this regard. This could get taken private eventually.

Management admits the optics from their loan program was poor but it was viewed as a good way to pick up better cash yields (6-7%) collateralized by assets that they like. They view the loans as market rates that were not out of line despite them being related party deals. Ideally, given the low profitability I'd rather see these go away. They really have not underwritten many lately which should bring some comfort.

I’ll have a research piece out on this one in detail. I think the common stock arguably makes sense in a very limited fashion. I also think the preferreds have an interesting story to them that could be compelling if they remain weak. Paul Pittman has clear confidence here that, in my opinion, isn't just bluster and takes a long term view on farmland. Of note, this is one of the few REITs (Getty Realty (GTY) being the other) that I met that did not have a hotel suite to host meetings. I think that shows a willingness to clamp down on costs.

Front Yard Residential (RESI)

Obviously this is a big position for me in Front Yard Residential (RESI) so I felt it was important I got in front of this team. The thesis should be pretty well known to the Industrial Insights community but to recap this is a net asset value (“NAV”) play on a very liquid asset class: single family residential real estate. Due to the business being very tough one to achieve profitability, external management, and a very complicated initial business model, Front Yard Residential had been a capital destroyer for many years and been an outright avoid.

The risk/reward changed considerably over the past year. The balance sheet is remarkably clean of one-offs that used to plague it, primarily real estate owned (“REO”) homes and non-performing loans that came about via foreclosures in the old model. Management has executed on getting more scale, now well on its path to 15,500 homes or so in its core metros which includes a massive presence in the growing Atlanta market (3,000+ homes). Nonetheless, large hedge funds have become increasingly frustrated and have been pushing for partial sales of homes to fund buybacks or just an outright sale to a better entity. With the asset management agreement now having a viable path to elimination (3x trailing annual G/A cost at Front Yard Residential discretion) there should be no impediments to a sale.

I’ve worked with CEO George Ellison often and they’ve come to me to ask for opinions in the past. Just like them, I view this as an either/or story: the entire business gets sold or they continue on developing the model. Either way they go I believe there is a path to shareholder success.

I pressured them on the net operating income (“NOI”) margin goals which are above peer averages despite smaller scale. Executives view that 66% NOI margin goal as achievable as the company starts getting its internal property management business (acquired via Havenbrook late last year) up to speed. That isn't unachievable; we are talking about less than $2mm/quarter in property level expense savings at the current revenue rate. Granularly, doing more of the repair work and property turnover as tenants leave in-house will build margin. They are working on route optimization to make sure there technicians are being efficient with their time. This is an area where I will hold them to task over 2019.

I think they were a bit careful on explicitly stating full coverage of the dividend by year end but did maintain the $0.13-0.16/share funds from operations (“FFO”) run rate by Q4. I believe that is a big catalyst for them and one that should be attainable. Unfortunately, it is only one of a few tools left. I would characterize this meeting as one filled with lamentation over a lack of market respect versus their execution. The option to eliminate the Altisource Asset Management (AAMC) asset management agreement was viewed as a sure fire way to drive the share price higher by major shareholders. While it popped on that news, materially higher share prices just have not happened. Remember that Front Yard Residential can now cancel at 3x trailing G/A at its own discretion, a number that was reached independently via outside consult. So this isn’t George Ellison pegging a number that is to his benefit as a shareholder at AAMC in my view.

Versus our conversations six months ago, management increasingly views a sale as big potential driver. Insiders have been buying. I still view this as a compelling long opportunity into the end of the year and I still believe we see some news on the sales front. Private equity should be very willing here, or even perhaps a merger with publicly-traded alternatives that trade closer to NAV. With American Homes 4 Rent stating in its presentation that is “acquisitions are in the 5s [cap rates], development yield in the 6s”, current models on our end pointing to strong values are supportable. That also means Front Yard Residential should look attractive. Likewise, Invitation Homes (INVH) has a big presence in Atlanta; shouldn't adding another several thousand homes in that market be attractive to them? In my view, the NAV isn’t in question, it is just finding the right buyer at the right price. If not, the company can continue on the path it is on. This is still a buy in the $11s.

Brookfield Property Partners (BPR)

I’ve been a little cautious on Brookfield Property Partners – primarily due to the leverage. I agree with management that the issue there is not the actual debt itself. The company – rather painstakingly I might add – tries to match the duration of its debt with the length of its leases to align cash flows. By using non-recourse debt at the property level there ends up being little risk to the overall entity as a whole if a few assets underperform. Brookfield has been doing this a long time and there is no question from my time with them that there are some very intelligent financiers at the helm of this firm.

I hear arguments for and against this structure from management teams, but admittedly Brookfield is in a unique place. Other REITs tend to issue unsecured to appease the ratings agencies who look for that as a sign of credit access. Brookfield just has not had to do that to prove investment grade. Further, Brookfield gets a lot more leeway and discretion with its secured lending partners than others might when it comes to restrictions and terms on sells just given their track record. It really is rather unique in this way.

Leverage does impact net asset value (“NAV”) however and CEO Brian Kingston does acknowledge this. The trophy-like nature of the assets should insulate the portfolio from deep weakness in their opinion, particularly given the global diversity which is rather unique. That international presence is an aspect management has been pushing recently, trying to show that this is an atypical structure with some solid benefits. The move to buy back shares shows Brookfield Property Partners is willing to bank on the NAV; a number that by the way is based on independent third-party appraisals. Going back to that unique structure, Brookfield Property Partners reports under IFRS, not US GAAP. Unlike GAAP, IFRS allows the firm to mark its book to market so investors can track the NAV in real time.

*Source: Brookfield, 2019 REITweek Presentation, Slide 14

Despite buybacks, there is no guarantee that discount closes. However, management thinks it can generate same property growth of 2-3% coupled with significant tailwinds from the development pipeline. On a per unit basis, company funds from operations (“FFO”) per share has grown 8% per year from 2014 to 2018; the payout to shareholders has increased 6%. A continuation of that is viewed as attainable which would represent mid-teens annual stock appreciation (7% dividend + 8% per share FFO) assuming the trading multiple stays flat. That’s a compelling return profile. A common recurring theme from the battered REITs I spoke to just came down to execution. That is the case here. Management has a $10B+ development pipeline to work through over the next several years, all of which will contribute to driving that FFO per share metric higher. Delays or weaker than expected leasing (where the asset are not pre-leased) puts that at risk. I do not mind the investment here and this is clearly a smart group, just be aware of the leverage and how that might impact market perception. Unfortunately not very many new or unique insights with this one because management kept to the script and was careful in their words.

Tanger Factory Outlet Centers (SKT)

First off, I will say there is something special about being in the room with Steve Tanger. He has a presence about him that can’t really be described and he is very thoughtful and patient with his words. I’ve never been one to feel pressure in management face to face dialogue; to me they are just another person. There is something different at work with Steve and I can see why Brad Thomas – who really focuses on that je ne sais quoi of corporate management – is enamored with the firm. Although still skeptical of the outlet model, I walked out of this meeting firmly against ever betting against the guy.

I’ve been openly critical of the outlet model. I view it as it one that is often times characterized by out of place land with limited redevelopment opportunity. That isn’t the case for the entire Tanger portfolio – far from it – but it was the case for the recent dispositions and there are a few assets that remain that fit that iffy value proposition. The Mebane, NC outlets near me, for instance, are too far away from the Raleigh-Durham area to ever make sense for redevelopment. Mebane has a population of 15,000 and the 30 minute commute into Durham (and more than an hour into Raleigh) firmly puts it as too far to make sense to be a meaningful beneficiary of urban sprawl or a shift to higher and better land use. Expansion continues to be to the east and south of Raleigh-Durham; not the west.

As far as the change to made for outlet clothing, Steve Tanger is a big believer in the consumer focusing on the brand irrespective of the quality. In his words, they do not necessarily care about the intricate differences in quality present. A consumer sees a Nike shirt for $15 versus one for $50 as a deal, even if the quality and fit is not the same. When that customer opens their closet six months down the line, they are not going to care whether it came from an outlet or a real main-line store.

I get that, but at the same time brands are careful to not damage their image – particularly luxury. Steve takes a different view here; I used Coach as an example and he felt their problems from 2014-2016, which were blamed publicly on outlet overexpansion, instead fell on the designers. They did not innovate and Michael Kors ate their lunch. At the end of the day, what matters is if stores reduce their outlet footprint. Whether that occurs en masse or not depends on trends in traffic.

As far as bankruptcies, Steve Tanger views that as a natural progression in the REIT space. Retail is a space characterized by changing consumer perspectives. The Tanger top tenant list from even ten years ago is much different than it is today. Many of those former top tenants are now bankrupt. What matters is the real estate. What is "hot" comes and goes.

His approach to asset repositioning is much the same and is very different from the mall space. Rather than spending their own capital, a good chunk of Tanger Factory Outlet stores have seen experiential tenant development take place around them, the Charleston asset below being a great example:

*Tanger Factory Outlet, 2019 REITweek Presentation, Slide 18

Long story short, being long here is just a bet that that the company will weather the storm just as it always has. Recent events, such as the Dress Barn bankruptcy, do likely put some of the long-held quality metrics at risk (95% or greater tenant occupancy for instance) and might put pressure on comps again in 2020. This is not a quick reversion play in my view and management readily admits it will take some time. Many of the heavily-shorted REITs I spoke to said similar: its all about execution and the numbers.

Steve Tanger is very intent on proving the short float wrong. Him bringing it up on his own shows it is on his mind. On my side, I have no interest in stepping into a very crowded play on the short side, particularly given the balance sheet, but at the same time I see no near term drivers to move the share price higher. I view this as a wait and see play and I’m happy to revisit it again this time next year.

Takeaways

Have any questions on these REITs? I'm happy to provide more perspective on any of them based on my interactions and initial going-in research. Comment below and I'll answer directly. Anything I can't answer I now have their contact info directly so I can leap frog the Investor Relations departments and go straight to the source.

Good investing from your HYL Research Team,

Jussi Askola

Disclaimer: High Yield Landlord® ('HYL') is managed by Leonberg Capital - All rights are reserved. The newsletter is impersonal and does not provide individualized advice or recommendations for any specific subscriber or portfolio, as we do not have knowledge of the investor's individual circumstances. Subscribers/readers should not make any investment decision without conducting their own due diligence, and consulting their financial advisor about their specific situation.