Helios Towers: The Best REIT In Africa

Helios Towers (HTWS / HTWSF) has been one of our best-performing investments of 2025. In just a year, it more than doubled our money, and because it was one of our largest positions, it really materially moved the needle for us. Today, it represents roughly 11% of our International Portfolio.

That strong performance did not just validate the thesis; it also pushed me to go deeper. Earlier this year, I traveled across several African countries to study the region’s listed real estate market firsthand and meet with local real estate professionals. The goal was simple: identify whether Helios was an exception or part of a broader opportunity set.

The conclusion was clear. As I explained in a recent article, most African REITs remain poorly managed, structurally inefficient, and unable to fully capture the economic growth taking place across the continent. In many cases, governance issues, weak capital allocation, and misaligned incentives negate what should otherwise be attractive long-term tailwinds.

You can read that article on African REITs by clicking here.

Against that backdrop, Helios Towers continues to stand apart. It remains, in my view, the best publicly listed real estate vehicle to gain exposure to Africa’s long-term economic development. In this article, I will provide an update on the company and explain why, even after its strong rally, Helios remains an attractive investment opportunity that we expect to keep holding for many years to come.

Helios Towers: Investment Thesis for 2026

When most investors think about REITs in Africa, they picture exposure to shopping malls, offices, or residential properties in a popular destination like Cape Town:

Those asset classes benefit from population and GDP growth, but they also face significant challenges: small local tenants, weak currencies, poor governance, and concentration risk.

Helios Towers is different. It is not a local landlord of such traditional properties. Instead, it owns and operates cell towers across Africa and the Middle East, and that makes it the single best REIT opportunity on the continent. Here are all the reasons why.

Structural Growth Far Beyond GDP

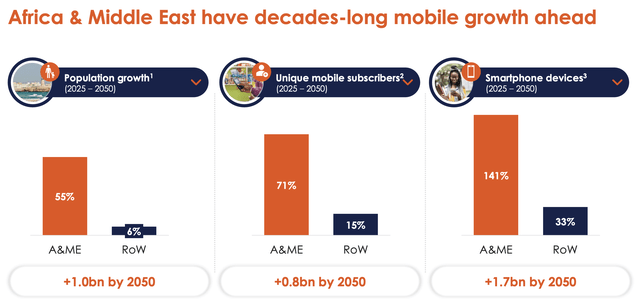

Africa’s economy and population are growing rapidly, but mobile penetration is growing even faster. Just look at how fast Africa is growing on this front relative to the rest of the world:

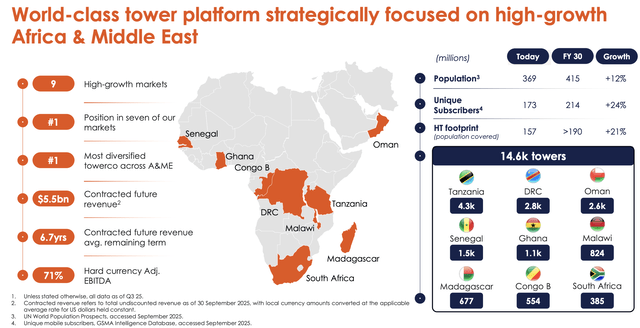

Helios is uniquely positioned to capture this structural shift. Over the next five years alone, its markets are expected to add nearly 80 million new mobile connections, and supporting this demand will require more than 30,000 new Points of Service. This is expected to result in rapid organic growth with its co-tenancy going from 2.2x today to 2.5x within the next 5 years, resulting in significant cash flow growth.

While most African REITs are tied to slow-changing demand for physical retail, residential or office space, Helios is tapping into the fastest-growing segment of the entire African economy: digital connectivity.

High-Quality, Hard-Currency Rents

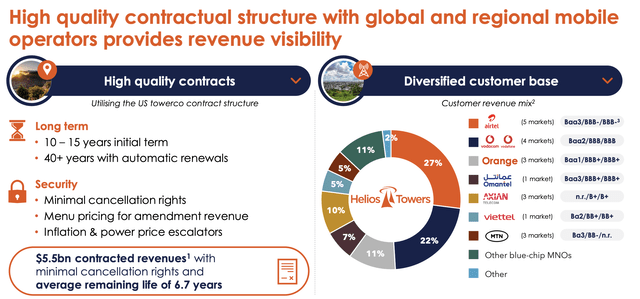

One of the biggest risks for African REITs is collecting rent in volatile local currencies from small, often undercapitalized tenants. This is where Helios truly stands apart.

More than 70% of its EBITDA is denominated in hard currencies, primarily U.S. dollars.

99% of its revenues come from blue-chip multinational mobile network operators, not small local businesses.

Strong leases with long average remaining lease terms and inflation protection.

>$5 billion of already contracted future revenues with the region’s major mobile operators. That’s more than twice its current market cap.

This combination of hard-currency rents and world-class tenants is unmatched among African REITs.

Diversification Across Countries

Most African REITs are highly concentrated in just one or a few countries. That leaves investors exposed to single-market political, currency, and regulatory risk.

Helios is the most geographically diversified REIT in Africa. It operates in nine countries, with market leadership in seven of them. This scale and breadth provide resilience that no traditional African REIT can match.

Proven Management and Capital Allocation

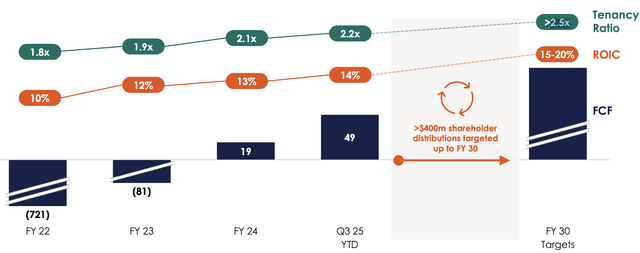

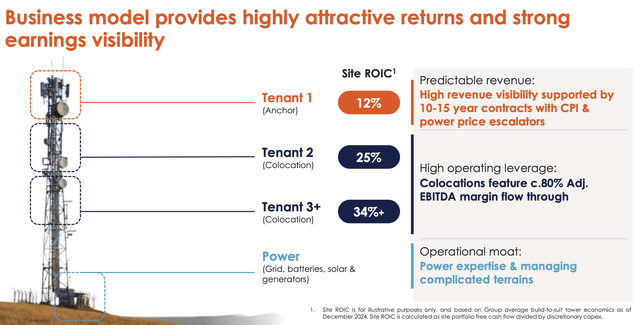

Helios is led by a team with a long track record of navigating complex markets and creating value through disciplined shareholder-friendly capital allocation. The focus today is primarily on organic growth as the REIT is enjoying rapidly growing demand for its assets and is able to earn great returns by adding new tenants to its existing assets: 12% on the first tenant, 25% on the second, and 34% on the third.

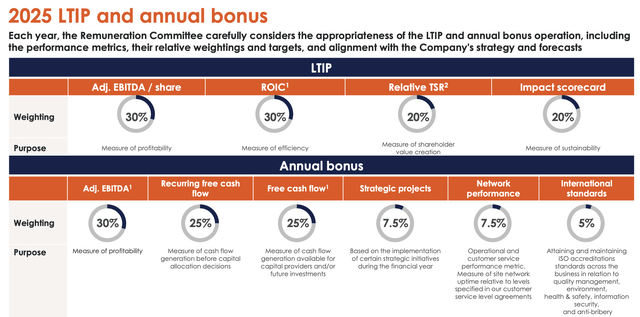

Helios is not seeking to just grow for growth’s sake. They are seeking to grow in a way that grows their FCF per share and creates value, as their compensation plan is heavily tied to long-term total returns:

This stands in stark contrast to many African REITs, where governance is questionable, strategy is unclear, and capital is often misallocated.

A REIT That Delivers Both Growth and Stability

Investors in Helios gain access to:

The fastest-growing segment of the African economy: mobile connectivity.

Long-term, inflation-linked leases with blue-chip multinational tenants.

Rents predominantly in hard currencies, reducing FX risk.

A diversified portfolio across multiple high-growth countries.

A management team with a clear and disciplined growth strategy.

Simply put, Helios offers compounding, hard-currency cash flows with strong visibility, which is a rare combination in Africa.

Low Valuation and Catalysts for Upside

Its valuation has risen following the doubling of its share price, but not as much as you may think.

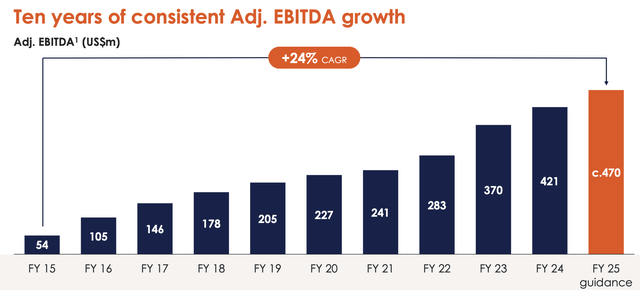

A big part of that jump in valuation is simply the result of growing cash flow, declining leverage, and the start of a major share buyback plan.

In Helios’s reporting, RFCF is the closest thing to AFFO, and it is expected to earn about $170 million of it in 2025, which puts its valuation at just about 13x AFFO.

That’s not expensive for a high-quality REIT with strong secular growth prospects and a low 3.5x Debt-to-EBITDA. I understand that Africa is riskier, and this warrants a lower multiple, but Helios has done an exceptional job at mitigating those risks by building a geographically diverse portfolio with long-term leases primarily in hard currencies and inflation protection with investment-grade rated multinational telecom companies.

And now there is a clear catalyst for moving the multiple to a higher level.

The company just recently laid out a new 5-year plan.

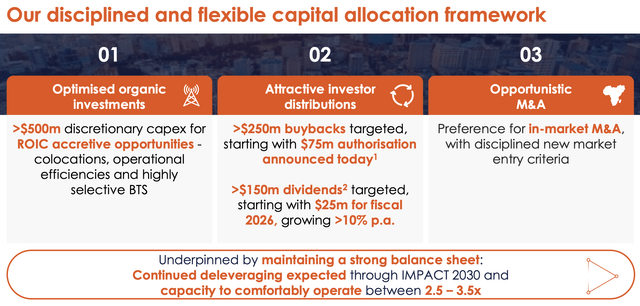

They expect to earn >$1.3 billion of cumulative RFCF over the next 5 years, and they plan to return over $400 million of that through 2030 via dividend payments and share buybacks.

That’s very significant relative to their current market cap of $2.3 billion.

The first dividend will be relatively small at $25 million in 2026, resulting in a 1.1% dividend yield, but it is set to grow at >10% from there on.

The point of doing this is to start building a dividend growth track record, which will make Helios a lot more compelling to income-oriented investors and also open the door to it being added to many income-oriented funds.

This should increase the demand for the stock and potentially push it to higher levels over time.

Bottom Line

Most REITs in Africa depend on GDP and population growth, but face weaker tenants, local-currency rents, poor diversification, and governance concerns.

Helios Towers is different. It is the only African REIT that gives investors direct exposure to the explosive growth of mobile connectivity, backed by multinational tenants and hard-currency rents.

That is why Helios Towers stands out as the single best REIT opportunity in Africa today. Despite that, its valuation remains very reasonable, and there are now also catalysts on the horizon with the commencement of dividend payments and share buybacks.

Finally, please note that we have exceptionally posted this article without a paywall. If you found it valuable, consider joining High Yield Landlord for a 2-week free trial.

We expect to share a Trade Alert with our paid members tomorrow, and by starting your free trial today, you will also gain access to it. You will also get immediate access to my entire REIT portfolio, our exclusive REIT CEO interviews, and much more. We are the largest and highest-rated REIT investment newsletter online, with over 2,000 paid members and more than 500 five-star reviews.

We spend thousands of hours and over $100,000 per year researching the market for the most profitable investment opportunities, and we share the results with you at a tiny fraction of the cost.

Get started today - the first 2 weeks are on us:

Analyst’s Disclosure: I/we have a beneficial long position in the shares of all companies held in the CORE PORTFOLIO, RETIREMENT PORTFOLIO, and INTERNATIONAL PORTFOLIO either through stock ownership, options, or other derivatives. We also own a position in FarmTogether. High Yield Landlord® (’HYL’) is managed by Leonberg Research, a subsidiary of Leonberg Capital. All rights are reserved. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. The newsletter is impersonal and subscribers/readers should not make any investment decision without conducting their own due diligence, and consulting their financial advisor about their specific situation. The information is obtained from sources believed to be reliable, but its accuracy cannot be guaranteed. The opinions expressed are those of the publisher and are subject to change without notice. We are a team of five analysts, each contributing distinct perspectives. Nonetheless, Jussi Askola, the leader of the service, is responsible for making the final investment decisions and overseeing the portfolio. We do not always agree with each other, and an investment by Jussi should not be taken as an endorsement by other authors. Past performance is no guarantee of future results. Our portfolio performance data is provided by Interactive Brokers and believed to be accurate but its accuracy has not been audited and cannot be guaranteed. Our portfolio may not be perfectly comparable to the relevant index. It is more concentrated and may at times use margin and/or invest in companies that are not typically included in REIT indexes. Finally, High Yield Landlord is not a licensed securities dealer, broker, US investment adviser, or investment bank. We simply share research on the REIT sector.

>2x tenancy is impressive. Can’t say the same for many other emerging markets. Would you know why that’s the case? Also curious to know how high is the regulatory/NIMBY barriers for a competitor to place a tower next to Helios and undercut on price?

@jussiaskola Have you ever looked at Texaf on the Brussels stock exchange?

They are a Kinshasa, DRC holding but the majority from their revenue comes from Kinshasa quality real estate.

Biggest risk is off course single-point-of-failure (99% of their revenue or so is tied to Kinshasa). Second largest risk is low share liquidity.

I like Helios most in Africa, but I like Texaf also a lot, especially from a dividend growth perspective.