Important Announcement! Join Us In Madrid For RE-THINK 2019

Important Announcement! Join Us in Madrid for RE-THINK 2019

During our first year of operation, we traveled to one investment conference to provide you access to the latest insights of leading experts in real estate investing.

For our second year, we have much bigger plans and expect to participate to one investment conference every quarter at the very least.

Our next conference is already planned for September 12, 2019 - as we will attend RE-THINK 2019 which is hosted at the Westin Palace Hotel in Madrid, Spain.

RE-THINK is one of the leading real estate investment conference in Europe – bringing together REIT executives and other private equity leaders to discuss future trends and opportunities in real estate markets.

We will provide exclusive coverage of the entire investment conference to members of HYL who are not able to attend. We are currently eyeing several exciting REIT investment opportunities in Europe and we expect this conference to result in new investment ideas.

We are particularly excited about three REITs that will attend the conference:

KlePierre: European Malls at a 30% Discount and 6.7% Yield

KlePierre (OTCPK:KLPEF) is a French REIT that specializes in high-quality class A malls throughout the European Union. We believe that the European mall markets is better positioned than the American one with lower risk and higher future reward potential. Its NOI is growing, occupancies are high, and there are no signs of trouble. Yet, the shares are exceptionally cheap trading at a 25% discount to NAV, and the management is buying back aggressively. The 6.7% dividend yield is well-covered with a 76% payout ratio and a new increase is expected soon.

Dream Global: German Office Properties with a 5.6% Yield

Dream Global (DUNDF) is a Canadian REIT that specializes in real estate investing on the European continent. The majority of its properties are located in Germany – a market that has significantly appreciated over the past 10 years. Dream Global participated in the upside, but not fully and continues to trade at a discount to peers. We believe that this is because its investor base is different (Canadian investors) and not as knowledgeable about the European market. The company is positioned for further growth and the dividend yield is attractive at 5.6%.

Unibail Rodamco Westfield: European Giant With a Fat 8% Yield

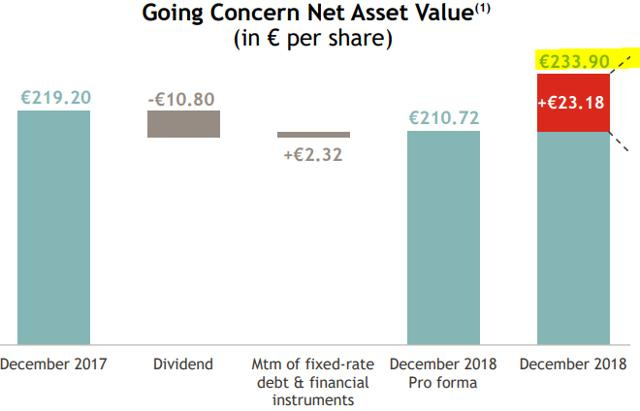

Unibail Rodamco Westfield (UNBLF) is a massive REIT – the biggest in Europe with a market cap exceeding $20 billion. In many respects, it is similar to Simon Property Group (SPG) in the US. It owns a vast portfolio of Class A malls on the European and US continents, has a strong balance sheet, but currently trades at a +8% dividend yield due to the negative retail headlines. Risks are real, but with the share price dropping by over 30% over the past year, we believe that the risks are more than priced in. Over time, as the market stabilizes, the upside could be significant in a recovery. While you wait, you earn a +8% dividend yield that is fully covered. Even despite the low share price, the fundamentals remain fairly attractive with a rising NAV:

In addition to these 3 REITs, there are several other companies that we are excited meet. This includes:

Brixmor: One of our Core Portfolio holdings.

Intu Group: A heavily discounted retail REIT in the UK.

Citycon: A Nordic mall REIT.

...

Join Us in Mardid!

If you are based in Europe, or even in the USA or elsewhere, and have the time to attend, I invite you to join me in Madrid for this event to learn more about latest trends and opportunities. I would be glad to meet as many of you as possible and to show you around the city of Madrid after the conference.

If you have interest in attending the conference, please get in touch with me at jaskola@leonbergcapital.com so that we can coordinate where and when to meet on the 12th of September.

Hope to see you in Madrid!

For more information, take a look at the program and speakers at https://www.epra.com/events/conference-1

Good investing from your HYL Research Team,

Jussi Askola

Disclaimer: High Yield Landlord® ('HYL') is managed by Leonberg Capital - All rights are reserved. The newsletter is impersonal and does not provide individualized advice or recommendations for any specific subscriber or portfolio, as we do not have knowledge of the investor's individual circumstances. Subscribers/readers should not make any investment decision without conducting their own due diligence, and consulting their financial advisor about their specific situation.