Interview With Agree Realty Corporation (Buy Rating Reaffirmed)

Dear Landlords,

I want to extend a warm welcome to all our new members! We recommend that you start by reading our Welcome Letter by clicking here. It explains why we invest in real estate through REITs and how to get started.

As a reminder, our most recent "Portfolio Review" was shared with the members of High Yield Landlord on November 6th, 2024, and you can read it by clicking here.

You can also access our three portfolios via Google Sheets by clicking here.

New members can start researching positions marked as Strong Buy and Buy while taking into account the corresponding risk ratings.

If you have any questions or need assistance, please let us know.

==============================

Interview With Agree Realty Corporation (Buy Rating Reaffirmed)

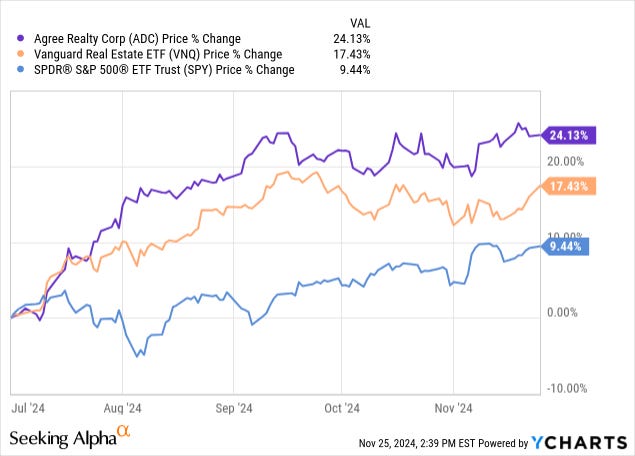

Since the major shift in macroeconomic outlook at the beginning of July from Fed tightening / "higher for longer" to continued disinflation / Fed loosening, the stock price of Agree Realty Corporation (ADC) has outperformed both the real estate index (VNQ) and the S&P 500 (SPY):

With this stock price outperformance has come a cost of capital that is much more favorable for equity issuance to purchase net lease real estate.

Our last few interviews with Joey Agree, the CEO of ADC, have occurred at a time when the REIT was significantly undervalued. Now that the stock price has rebounded, ADC's investment machine is humming again at full capacity.

We wanted to speak with Joey again to get an update on the business and what lies ahead for this high-quality, defensive net lease REIT.

High Yield Landlord: We have enjoyed seeing the rebound in ADC's stock price over the last several months. It seems like whether the 10-year Treasury is rising or falling, ADC has kept rallying. What do you attribute that to?

Joey: It's a few things. Some macro headwinds have been scaring people. You see the Fed's first few cuts, and even though the 10-year hasn't responded accordingly, the market is pricing in more rate cuts and lower rates overall. I think you see the market's recognition of our tremendous liquidity and that we don't need to raise another dollar next year, given that we've equitized the balance sheet.

I think the consistency of doing what we say we'll do and sticking with that and not deviating and going up the risk curve, while others went in various directions like international investments or riskier tenants or mortgages.

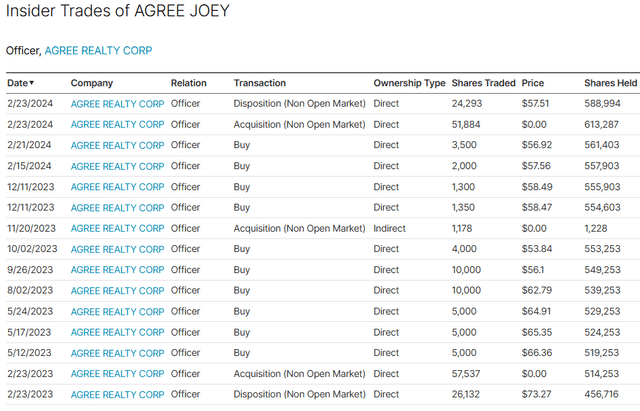

It's a variety of things. I mean, there's a reason I've bought $10 million of stock over the last few years.

These things move in cycles, and you can see the shifts in institutional investors including Cohen & Steers that moved into the stock.

[Cohen & Steers increased their position in ADC by ~45% in Q3, equivalent to about $162 million in market cap.]

Institutional investors are comped against benchmarks, so once a few of them start moving, they all seem to start moving. And then there are those that follow the crowd and pile into it.

We've known exactly what we want to do every step of the way, and we've executed.

Sometimes, the tide goes out and everybody goes out with it, but a rising tide doesn't lift all boats equally. Put all those factors together and you get the rally. Our valuation didn't make sense where it was for a long time, and now we're in the strike zone of making sense, certainly nowhere near its peak, certainly not as aggressive as shopping centers.

So I think it's just a normalization.

HYL: It seems like the shift really started in early July with the June CPI report that showed continued disinflation. The prevailing attitude in the market seemed to be that tightening is now definitively done and we're going to move to easing for the foreseeable future.