Interview With Easterly Government Properties (Strong Buy Upgrade)

Important Note

Before going into today's article, I wanted to let you know that we will soon conduct interviews with the management teams of the following REITs:

Farmland Partners (FPI)

BSR REIT (HOM.U:CA / OTCPK:BSRTF)

Safehold (SAFE)

Canadian Net REIT (NET.UN:CA)

Let me know if you have any questions for them, and I will make sure to ask them for you. You can put your questions in the comment section below.

Thanks!

=============================

Interview With Easterly Government Properties (Strong Buy Upgrade)

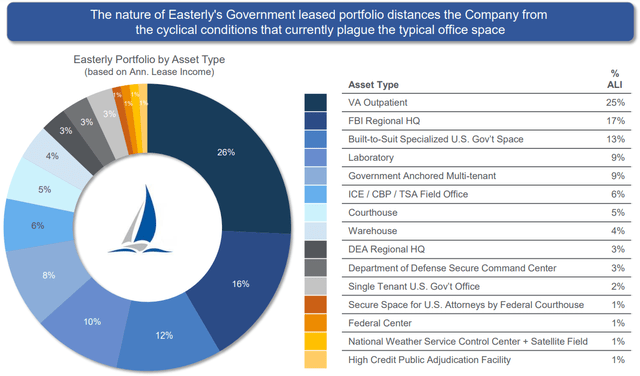

Easterly Government Properties (DEA) is a unique REIT that focuses on specialty government properties such as FBI headquarters and VA outpatient properties:

Last year, we interviewed their CEO and noted that there was a lot to like about the company. In short:

Their leases are long, at 10 years, and backed by the full faith and credit of the US government, resulting in highly secure rental income.

The office fears appear overblown because they own highly specialized and mission-critical government buildings.

They anticipate strong releasing spreads as leases expire because the replacement cost of their properties has increased significantly.

The management was confident in their growth prospects and believed they could maintain their dividend, despite not fully covering it.

Finally, their valuation had become historically low relative to their net lease peers, potentially offering an opportunity for upside.

Even then, we still didn't initiate a position, in part because we feared that it would end up cutting the dividend.

Here is what we wrote back then:

"The REIT has a bit more leverage than average, its payout ratio is high, and interest rates have surged in recent years, putting the company at high risk of cutting its dividend, which would likely cause its market sentiment to suffer."

He also warned about a potential dividend cut in separate public articles here, here, and here.

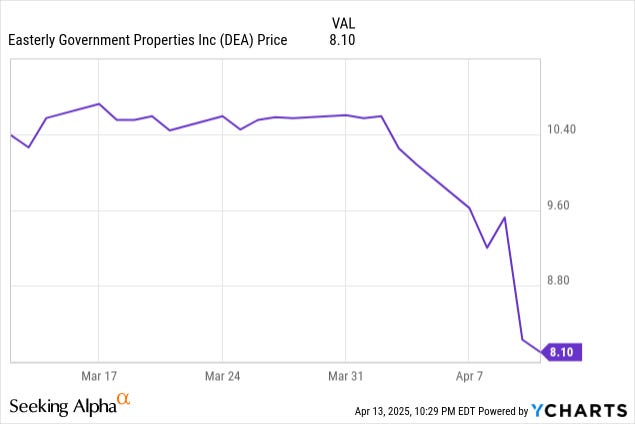

Well... The dividend has now finally been cut, and it has caused the share price of the REIT to crash down to lower levels:

Cutting the dividend is never a popular action, but we believe that it makes DEA far more attractive as an investment opportunity, especially following the recent dip.

Its dividend has now been reset at a sustainable level with a 60% payout ratio, which should allow it to self-fund its acquisition pipeline with retained cash flow.

This comes at a time when opportunities for government-owned properties are expanding, driven by the DOGE initiative, which has prompted the government to sell more assets in an effort to unlock value.

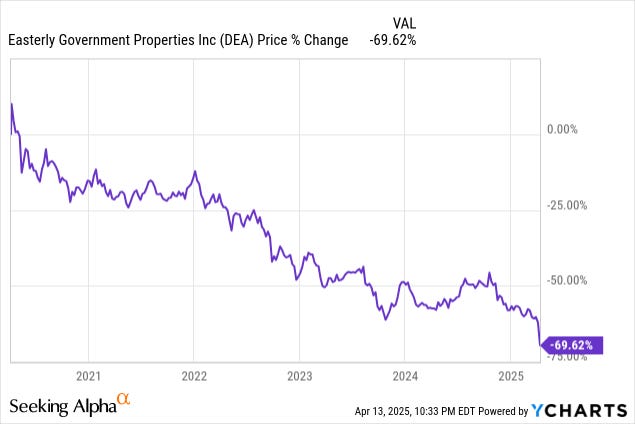

Moreover, its valuation has now dropped to its lowest level ever. Its share price is down an astonishing 70% over the past 5 years:

Its FFO multiple is just 6.7x, which is one of the lowest in the entire REIT sector, and even post-cut, its dividend yield is still nearly 9%.

Is it now time for us to initiate a position?

To learn more, we reached out to Darrell Crate, CEO of Easterly Government Properties (DEA), to discuss their future prospects.

Below, we share the main takeaways from our conversations:

Takeaway #1: Recession and Tariff Resistant

The first thing that's interesting to point out in today's environment is that DEA is one of the most recession and tariff-resistant companies in the world.

The vast majority of its properties are specialty government assets like FBI headquarters, VA outpatient facilities, ICE field offices, and even courthouses.

Its leases are long at 10 years on average, and the rent is pre-set for that entire period, so a recession or a trade war shouldn't have any impact on DEA.

On the contrary, if a recession brings a recession, it could benefit DEA if it results in lower interest rates.

This is exactly the type of cash flow that would gain the most value from lower interest rates, and right now, the debt market is pricing in cuts of up to 100 basis points later this year.

Despite that, DEA has sold off with the rest of the market due to fears of a trade war and a potential recession.

Takeaway #2: No Major DOGE Impact

Another factor behind the decline in DEA's share price is the concern that the DOGE initiative could negatively impact the REIT, as increased government efficiency may lead to workforce reductions and the cancellation of leased office space.

But this is mostly just fear according to DEA's CEO.

First of all, the vast majority of DEA's leases cannot be cancelled and have 10 years left on them on average.

Secondly, President Trump has issued a mandate to bring back government workers to the office, ending remote work policies. This has increased the physical occupancy of DEA's properties and made them even more essential as the government has come to the realization that remote work can hurt productivity. This news seems to have gotten overlooked by the market, and yet, it greatly strengthens the thesis for DEA.

Third, these are mission-critical, highly specialized assets, not just some generic office buildings that the government can live without. Take the example of the FBI headquarters. These are very specialized buildings and must be constructed with anti-ballistic glass, SCIF rooms equipped with national intelligence security standards, including radio frequency shielding and duct work to prevent infiltration. The landlord must account for things like blast protection, security screening, and other structural requirements that are essential to agencies like the FBI. So these properties are unique and mission-critical. The government is highly dependent on them and cannot just move to whatever other empty office building. These properties must be built specifically for the government, and their replacement costs have increased significantly over the years.

Finally, despite making a lot of noise, the actual cuts have been very underwhelming when compared to what was planned, and it appears that the DOGE efforts may be winding down, with Elon Musk possibly even stepping away in the near term.

This would be a strong catalyst for DEA as it would likely reduce the noise and help its market sentiment. Right now, Elon Musk is using his loudspeaker and bringing a lot of attention to DOGE, but for how much longer? There are rumors that he could be out of it in a few months already.

Takeaway #3: Significant Pipeline Growth

The DOGE efforts have also reaffirmed that leasing is more efficient than owning for the government, and therefore, private/public partnerships will only grow in the future. As an example, in a recent congressional hearing, David Winstead of the Public Buildings Reform Board stated it costs the government over 10x more to maintain its buildings per employee compared to the private sector.

This is resulting in more opportunities to acquire assets from the governments and to develop new properties.

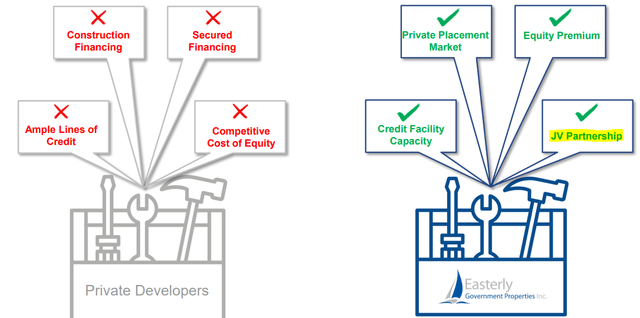

Until recently, DEA wasn't able to act on most of these opportunities because its cost of capital was too high, and it wasn't retaining enough cash flow.

But following its dividend cut, it now retains about 40% of its cash flow.

Moreover, the CEO told me that they also have a JV partner that's ready to step in and provide capital to acquire properties. In such cases, DEA would earn fees in exchange for its management services.

All in all, they expect to grow their FFO per share by 2-3% per year going forward. That is not a particularly rapid growth rate, but keep in mind that the company is today trading at just 6.7x FFO.

Typically, companies that are priced so cheaply are experiencing severe headwinds and declining cash flows.

This is not the case of DEA.

Bottom Line

Just like every other investment, DEA has pros and cons.

The pros are that:

It owns recession and tariff-resistant properties.

Its rental income is backed by the full faith of the US government.

It expects to grow steadily by 2-3% per year.

It trades at an ultra-low valuation. It could double from here, and its multiple would still be very reasonable.

It pays a 9% dividend yield that's well-covered and sustainable.

The cons are:

Their leases don't include rent escalators for the most part, resulting in slower growth than most of their peers.

Their LTV is a bit high at around 50%. This is still reasonable given that they have no risk of credit loss, but it could still negatively impact them over the long run if interest rates remain higher for longer. Fortunately, they don't have major debt maturities in 2025 and 2026.

Its market sentiment could suffer for a while due to its recent dividend cut.

Overall, I really like the risk-to-reward given how cheaply it has gotten. The low valuation is the result of a perfect storm, starting with the office fears of the pandemic, then the surge in interest rates, the DOGE efforts, and more recently, the tariff sell-off.

As we explained earlier, we think that most of these fears are the result of misconceptions and/or are overblown.

All these factors have pushed DEA's valuation so low that it couldn't raise equity anymore to fund its growth, forcing it to cut the dividend to self-fund some of its acquisitions going forward.

The past is the past, and the future now looks brighter for DEA. It is one of a few REITs that now offers everything in one package:

A high dividend yield

Steady growth

Safety

Upside potential

And for this reason, we are upgrading DEA to a Strong Buy rating and have it now high on our watchlist.

============================

Access Our Course to REIT Investing

Don't forget to take our 10-Module Course on REIT investing! The entire course is available to members for free as part of your membership.

============================

Access Our Portfolios Via Google Sheets

Our three portfolios are available through Google Sheets. These sheets provide detailed information on position sizes, risk ratings, and key metrics to help you make well-informed investment decisions:

============================

Access Our REIT Market Intelligence Sheet

This exclusive tool includes a list of all equity REITs grouped by property sector, providing all the information you need to make better decisions: FFO multiple, dividend yield, payout ratio, credit rating, and much more.

============================

Access Our Portfolio Tracker

The HYL Portfolio Tracker is a Google Spreadsheet designed specifically for members of High Yield Landlord. It helps you track all your HYL investments in one place with a simple format. It is very easy to use, so don't miss out on this free feature!

============================

Access Our Live Chat

Our live chat room is where the HYL community comes together to share market news, discuss investment ideas, and help new members get started. Members can post questions and receive prompt answers from other real estate investors and our team.

============================

Finally, feel free to contact us anytime. You can send me a direct message on the chat or email me at jaskola@leonbergcapital.com

Sincerely,

Jussi Askola

Analyst's Disclosure: I/we have a beneficial long position in the shares of all companies held in the CORE PORTFOLIO, RETIREMENT PORTFOLIO, and INTERNATIONAL PORTFOLIO either through stock ownership, options, or other derivatives. High Yield Landlord® ('HYL') is managed by Leonberg Research, a subsidiary of Leonberg Capital. All rights are reserved. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. The newsletter is impersonal and subscribers/readers should not make any investment decision without conducting their own due diligence, and consulting their financial advisor about their specific situation. The information is obtained from sources believed to be reliable, but its accuracy cannot be guaranteed. The opinions expressed are those of the publisher and are subject to change without notice. We are a team of five analysts, each contributing distinct perspectives. Nonetheless, Jussi Askola, the leader of the service, is responsible for making the final investment decisions and overseeing the portfolio. We do not always agree with each other and an investment by Jussi should not be taken as an endorsement by other authors. Past performance is no guarantee of future results. Our portfolio performance data is provided by Interactive Brokers and believed to be accurate but its accuracy has not been audited and cannot be guaranteed. Our portfolio may not be perfectly comparable to the relevant index. It is more concentrated and may at times use margin and/or invest in companies that are not typically included in REIT indexes. Finally, High Yield Landlord is not a licensed securities dealer, broker, US investment adviser, or investment bank. We simply share research on the REIT sector.