Interview With Michael Fritzell – Insights On Asian Economies, Investment Trends, And REIT Opportunities

Today, I’m talking to Michael Fritzell, an expert on Asian stocks who writes on Substack. I came across Michael when doing research on the Asian REIT market, and I wanted to get his take on various Asian countries, their economies, and potential investment opportunities.

Make sure to check out his Substack by clicking here.

Let’s dig in.

Table of contents:

1. Background and current focus

2. The return of Donald Trump

3. U.S.-China decoupling

4. China’s regulatory environment

5. Geopolitical tensions in the region

6. China’s increasing control over Hong Kong

7. Biggest opportunity in Asia right now

8. Asian REITs

9. Favorite Asian real estate market

10. Contact details

1. Can you tell us briefly about your background and what you’re focusing on right now?

Sure. My name is Michael Fritzell, and I write a Substack called Asian Century Stocks.

I’m originally from Sweden, and lived there until finishing university. After my degree, I spent a few years in investment banking in the UK, before joining an emerging market fund based out of Shanghai. I had spent a year studying Chinese, so I fit the profile of what they were looking for.

The next few years, I travelled across China looking for ideas on behalf of the fund I was working for. It became somewhat of a crash course in emerging markets investing. I’ve seen stocks become tenbaggers, and others wiped out completely after being exposed as frauds. It’s a bipolar market and you need to exercise extreme caution.

In 2014, I joined a European family office and was sent to Singapore to manage their Asian portfolio. During those years, I invested in stocks in Southeast Asia, including in Indonesia, Thailand, Vietnam as well as South Korea. We also had a large exposure to the Philippines.

Since then, I’ve worked at two other firms, one a hedge fund another a mutual fund. I resigned from my then-position in April 2021 to write on Substack full-time. This was a huge bet on the growth of the Substack platform, and it’s turned out well so far. My publication Asian Century Stocks has now been live for about four years, and grown to 20,000 free subscribers and 550 paid. I focus on value stocks in the Asia-Pacific, and specifically East Asia and Southeast Asia.

2. How are investors in China and other parts of Asia viewing the return of Donald Trump and the implications for trade policy?

I think the return of Donald Trump is problematic for the region and many realize the threat. The reality is that East Asia became wealthy through the outsourcing of manufacturing capacity from Europe and the United States. Such outsourcing brought a variety of benefits, including the transfer of technological know-how, eventually enabling companies from this part of the world to compete on a global level.

I don’t think 10% tariffs are going to make much of a difference, because Asian supply chains are so competitive. East Asia has an educated, hard-working population. Asian manufacturing also benefits from a cluster effect. If you’re producing an iPhone, you’ll need hundreds upon hundreds of components. Many of those components are sourced from countries in close proximity to where the iPhones are assembled, allowing for lower shipping costs overall. To rearrange supply chains will be costly and take years, if not decades to complete.

But if tariffs end up at more than 30%, or if Trump is serious about reducing trade balances to zero, then Asian exports will certainly take a hit. The Chinese government will try to rearrange its trade towards like-minded countries, becoming a manufacturing hub for the global south. But I doubt the process will be smooth.

3. What’s your read on the long-term impact of U.S.-China decoupling efforts on Asian economies and equity markets?

Trump’s proposed tariffs on China are so high that a decoupling seems almost guaranteed. Unless those are lowered, I expect foreign direct investment into China to come to a standstill – even more than it already has. Multinational companies will instead set up manufacturing bases in allied countries such as Japan, Taiwan, India or Mexico.

The immediate impact on the Chinese economy will be brutal. We’re already seeing reports of much lower order volumes to Chinese factories. The Chinese Renminbi could well take a hit. FX reserves could be spent trying to defend the currency. And the government might be forced to introduce a stimulus program to offset the negative effects from weaker export demand, as has been rumored in recent weeks.

But due to economic linkages, other Asian countries will also take a hit. Taiwan, South Korea and Japan export goods and services to China, and will be affected by a generally weak economic environment.

Southeast Asia will be better protected, given a lack of manufactured goods exports. For example, the Philippines sells agricultural goods and services such as call centers and business process outsourcing. Thailand has a large tourism sector, and exports vehicles, but not to China and not to the United States. Indonesia is essentially a commodity exporter and won’t be affected materially. So I think Southeast Asia will come out of the trade war just fine.

4. Many global investors are cautious about China’s regulatory environment — do you think that fear is overblown or justified at this point?

I don’t think the fear is overblown. There are essentially two risks, as far as I’m concerned. One is the political and regulatory risk, which stems from the fact that the country is run by a communist party primarily concerned with its own survival. The second risk has to do with accounting irregularities and a lack of transparency.

I don’t think it’s generally recognized how competitive some of China’s companies are. The Yangtze- and Pearl River Deltas are developed, and close to the cutting edge in many technologies. I also think there’s something about Chinese culture that makes them predisposed to become entrepreneurs. Just look at the success of ethnically Chinese in Taiwan or Southeast Asia. Many of them are incredibly savvy.

There are plenty of strong companies in Mainland China that will continue to do well. For example, DJI drones, Hisense television sets, Haier appliances and miHoYo video games are doing well globally.

So many of them might be worth betting on. It’s just that incrementally, the environment has turned less business friendly in the past few years. I’m sure you’ve heard of the regulatory crackdown on companies such as Alibaba and Bytedance. In 2020, a new law started requiring private companies in China to implement Communist Party Committees. These committees will have the authority to replace CEOs, making the party itself more powerful than any private sector company. I suspect that these committees will weaken the entrepreneurial drive. Though so far, it’s unclear to what extent they’ve had a negative impact.

Let’s also not forget that the Communist Party nationalized all private property between 1949 and 1953. That could well happen again. General Secretary Xi is a self-proclaimed Marxist and reveres Chairman Mao. While he does seem to be pragmatic, he is not schooled in economics and doesn’t seem to be much in favor of the private sector.

The Soviet Union also went through a phase of economic liberalization and opening up-reform in the 1920s through Bukharin’s New Economy Policy. Once Stalin felt it had accumulated enough knowledge and technical know-how from the private sector, it nationalized all businesses. Entrepreneurs were sent to gulags. I encourage investors to read about that period, because it could happen again, not just in Russia but in China, too.

When it comes to investing, another problem is the lack of reliability when it comes to financial statements. The penalties for misdeeds are low, so there are strong incentives to fake the numbers and play “capital markets games”, to use a Chinese expression. That’s how I explain the poor historical return for Chinese equities since they opened up in the early 1990s. China and Vietnam are outliers in this respect.

So I don’t think the fears are overblown, and I would be selective when it comes to Chinese equities. Err on the side of caution and stick to the highest quality companies.

5. How are geopolitical tensions in the region (Taiwan Strait, South China Sea, etc.) factoring into investment decisions in Asia right now?

The Chinese leadership has a vision called a “Community of Shared Destiny for the Benefit of Mankind”. It’s essentially a rebranded version of the Soviet “Interncom”, which stands for International Communism. The Chinese Communist Party are trying to build up a coalition of like-minded nations that they have a certain degree of influence over, with whom they can trade without endangering their own grip on power within China.

I’m convinced that we’re going back into a cold war environment. The only question is which countries are going to align with the United States or Europe, and which countries are going to align with the Russia-Iran-China bloc. The Chinese Communist Party is courting the Global South — to use their own term – which has an overlap with Belt-and-Road Initiative (BRI) countries. If I had to guess, I think that Pakistan, Sri Lanka, Cambodia and Vietnam are likely to end up allied with China. Whereas Japan, South Korea, Taiwan, the Philippines and Singapore are more likely to stay neutral or lean towards the United States.

But we don’t know how aggressive the Chinese Communist Party will be in its attempt to build up an Asian co-prosperity sphere. Will the CCP launch a full-out invasion of Taiwan? I certainly don’t think so, but I can’t rule out a blockade or some other type of aggression either.

One of my favorite books on this topic is Barton Bigg’s Wealth, War & Wisdom. The key takeaway from that book is that you’ll want to invest in local listings in countries that are aligned with your own. After the war in Ukraine, holders of overseas-listed Russian equities saw their capital wiped out, whereas local investors in Moscow did just fine. I can picture a scenario where the VIE structure is ruled to be illegal, wiping out the value of overseas-listed Chinese American Depositary Receipts. So always stay aligned by investing locally.

You’ll also want to be prepared for a scenario where a new Iron Curtain — or a Bamboo Curtain, in the case of Asia — is introduced. I think we might see a return of capital controls in Europe. You could also see a reintroduction of exit bans in the Russia-Iran-China bloc. In fact, they’ve already become more common since 2019.

6. How do you see China’s increasing control over Hong Kong affecting its long-term appeal as a financial hub — both in terms of the stock market and real estate? And could this shift potentially benefit markets like Singapore, if companies and capital start to migrate there?

The negative effects have already been digested and I’m turning more positive now. Since 2020 when the National Security Law was introduced, roughly 4% of the population has migrated to the United Kingdom, Taiwan, Singapore, Australia and other countries in the region. Many of those who left were young, leaving mostly elderly back in Hong Kong.

We’ve also seen multinational companies leave Hong Kong. The presence of expats is lower than it used to be. That said, there’s also an influx of Mainland Chinese lured by the excellent education system, high salaries and wealth of job opportunities.

I think Hong Kong has many positives that will not go away even in the next few decades. For example, it’s a beautiful city with beaches and hiking trails nearby. The education system is fantastic. The healthcare system is better than almost anywhere in the world. The food is high quality and generally healthy. Taxes are among the lowest in the world with zero capital gains tax, zero GST, zero inheritance tax and zero wealth tax. I’d bet that there are tens of millions of Mainland Chinese that would love to move to Hong Kong if given a chance.

Hong Kong’s dominance as a financial hub is somewhat in question. The number of IPOs has come down in the past few years. I’m not sure to what extent this is driven by companies themselves, whether they’re avoiding the Hong Kong market due to its low valuation multiples. Or whether Beijing is purposefully trying to restrict Chinese companies from listing in Hong Kong. My base is that the explanation is more of the former, which would suggest an eventual rebound in IPO activity as the cycle eventually turns.

In any case, I think Hong Kong’s biggest asset is the Hong Kong Dollar. It’s freely convertible with the US Dollar, making Hong Kong the primary hub for Chinese companies wanting to raise overseas capital. So as long as the Hong Kong Dollar continues to exist, Shenzhen and Shanghai will find it difficult to compete with Hong Kong as a financial hub. And that’s fundamentally positive for Hong Kong.

7. For long-term investors, what’s the biggest opportunity in Asia right now — and what’s the biggest risk they should be paying attention to?

There are certain themes that I like right now. For example, I like companies earning their revenues in Japanese Yen, a currency that continues to be undervalued. Including, for example, Japanese software-as-a-service (SaaS) companies. What we’ve seen in the past two years is that Japanese institutions have crowded into exporter stocks benefitting from the weak yen. This has caused a sell-off of Japanese SaaS stocks, with many now trading at sub-2.0x EV/Sales multiples, despite growing 20-30% per year. I think many of them will be rediscovered by the investment community in the near future.

I also like Philippine equities. The market now trades at about 10x P/E. And many higher quality companies trade well below this number. The Senate just approved a new law called CMEPA, that will lower the stock transaction taxes from 60 basis points to just 10. Once the law has been signed by the President, retail investors will end up paying far less to buy and sell stocks. There are plenty of precedents. For example, when my home country of Sweden removed stock transaction taxes in the early 1990s, trading volumes went up multiple-fold in the following years. And the Philippines is a medium-to-high return on equity market that should in theory trade at a higher multiple than it does today.

The biggest risk in Asia is clearly geopolitics and the threat of US tariffs. Asia remains the manufacturing hub of the world, and these tariffs risk undoing the progress that has been made over the past eight decades. So I’d definitely be cautious about companies dependent on US demand. I’d much rather focus on local services companies that won’t be affected by whatever Donald Trump says or tweets.

8. If an international investor were looking to diversify into Asian REITs, what markets would you recommend starting with—and which would you avoid?

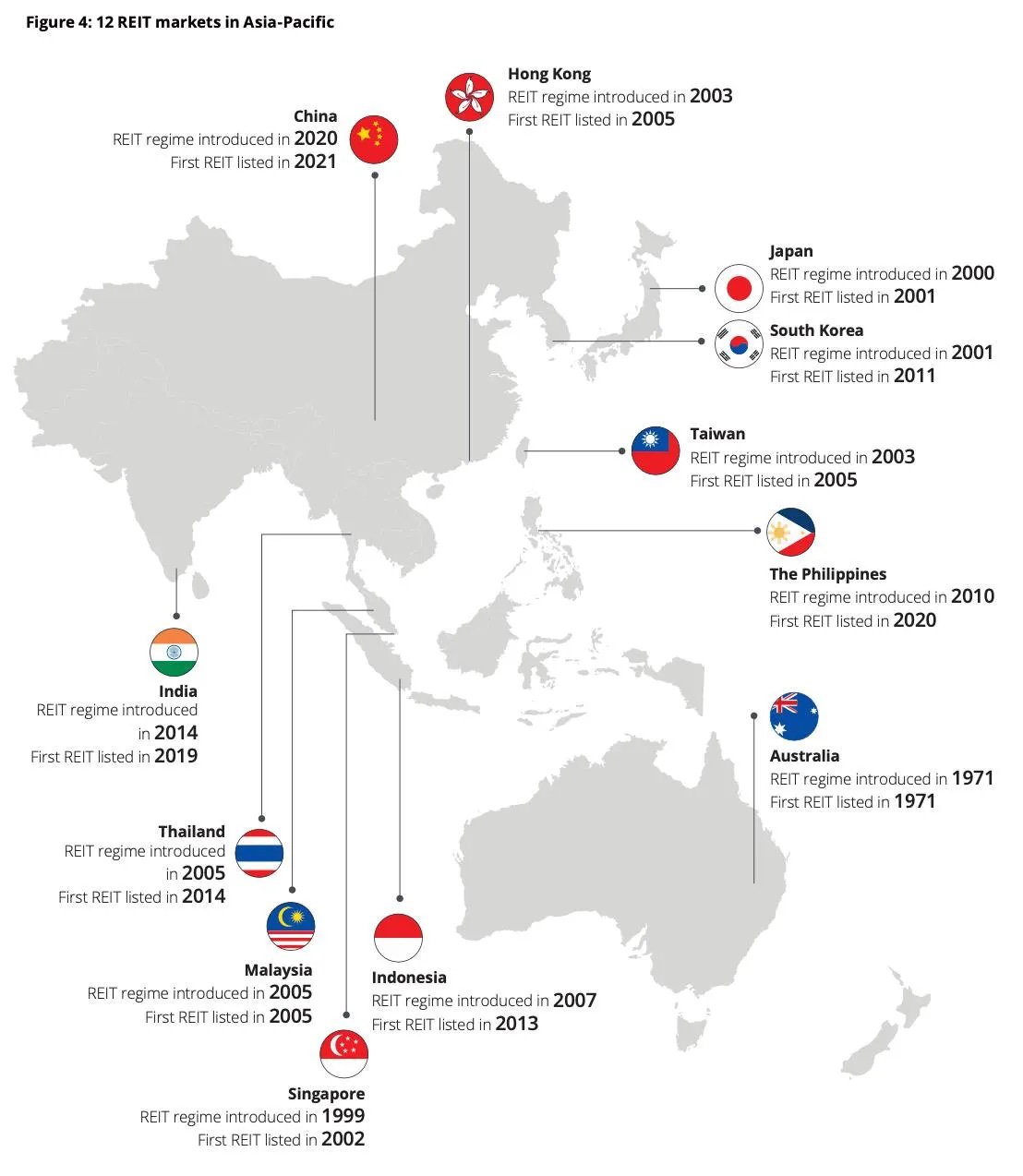

There are many REITs in the region. I think Singapore, Japan and Australia are the largest markets but you can buy REITs in most countries across Asia.

My personal preference is for internally managed REITs. If they’re externally managed, then I look at the sponsor to understand its incentives. I’ll also look at how the sponsor has behaved in the past. Asset injections are rarely positive for long-term DPU growth.

Most of the Australian REITs are internally managed, from what I understand. In Asia proper, the only internally managed one I can think of is Hong Kong’s Link REIT, which I wrote about here. I think Link REIT will soon be included in the Stock Connect program, which means that Mainland Chinese will be able to buy the stock and hopefully push up its price. Link REIT now trades at a 7% yield, a historically high level, though I will admit that this yield partly reflects the high interest rate environment.

I also have a preference for REITs with no gearing limits. For example, in Singapore during the Great Financial Crisis, falling property prices caused many S-REITs to hit the regulatory ceiling. They were forced to issue shares at low prices, diluting minorities in the process. To avoid this, I prefer investing in Japanese REITs and Australian REITs since they’re not subject to gearing limits in the first place.

I’ve been impressed by the DPU growth performance of retail REITs in the region, including not just Link REIT in Hong Kong but also CapitaLand Integrated Commercial Trust in Singapore. Clever sponsors can usually find ways to improve rents through asset enhancement initiatives. So retail REITs are currently my primary focus.

9. What’s one real estate–related opportunity in Asia that you think most global investors are overlooking right now?

The Philippines is an undervalued market, in my view. And that goes for property stocks, too. The local property market has suffered since 2022 when interest rates started rising. But eventually, interest rates are going to come down, and mortgages are going to become more affordable again.

I haven’t dug into the local property developers yet, but when you can find blue chip companies such as Ayala Land trading at 10x P/E, that smells like an opportunity to me. Ayala Land owns large parts of the key central business districts in Manila: Makati CBD and Bonifacio Global City (BGC). The management is top-notch and incredibly savvy. I think they’ll come out of the downturn stronger than ever. The stock has historically traded above 30x P/E, so I doubt it’ll stay at these levels forever.

10. Where can readers go to learn more about you and your service?

I focus on my Substack Asian Century Stocks full-time. There is an About Page describing the service, but in short, I provide at least 20x deep-dive reports per year, on top of monthly portfolio disclosures and other types of posts intended to help with idea generation. So subscribe if you’re interested in Asian stocks.

And thanks for the opportunity to share some ideas, Jussi! I really appreciate it.

Analyst's Disclosure: I/we have a beneficial long position in the shares of all companies held in the CORE PORTFOLIO, RETIREMENT PORTFOLIO, and INTERNATIONAL PORTFOLIO either through stock ownership, options, or other derivatives. High Yield Landlord® ('HYL') is managed by Leonberg Research, a subsidiary of Leonberg Capital. All rights are reserved. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. The newsletter is impersonal and subscribers/readers should not make any investment decision without conducting their own due diligence, and consulting their financial advisor about their specific situation. The information is obtained from sources believed to be reliable, but its accuracy cannot be guaranteed. The opinions expressed are those of the publisher and are subject to change without notice. We are a team of five analysts, each contributing distinct perspectives. Nonetheless, Jussi Askola, the leader of the service, is responsible for making the final investment decisions and overseeing the portfolio. We do not always agree with each other and an investment by Jussi should not be taken as an endorsement by other authors. Past performance is no guarantee of future results. Our portfolio performance data is provided by Interactive Brokers and believed to be accurate but its accuracy has not been audited and cannot be guaranteed. Our portfolio may not be perfectly comparable to the relevant index. It is more concentrated and may at times use margin and/or invest in companies that are not typically included in REIT indexes. Finally, High Yield Landlord is not a licensed securities dealer, broker, US investment adviser, or investment bank. We simply share research on the REIT sector.