Interview With VICI Properties

Please note that this is a free article of High Yield Landlord. If you find it valuable, consider joining our service for a 2-week free trial. You'll gain immediate access to my entire REIT portfolio, real-time trade alerts, exclusive REIT CEO interviews, and much more.

Interview With The CEO, CFO, and SVP of VICI Properties

I recently attended the NAREIT REITweek conference in NYC and got to meet with many REIT management teams. This includes VICI Properties (VICI), which is the biggest casino REIT in the world.

We have long held a position in our Core Portfolio because we believe that it is well-positioned to earn slightly above-average returns with below-average risk - making it an ideal portfolio anchor. It owns many trophy assets such as the Caesars Palace, MGM Grand, and the Venetian in Las Vegas:

This was already my third time meeting VICI's management in person. This meeting was attended by Ed Pitoniak, the company's CEO, David Kieske, its CFO, and Moira McCloskey, Senior Vice President of Capital Markets.

To be fully transparent, they gave me a VICI backpack as a gift. I don't think that this affects my judgment in any way but wanted to disclose it anyway:

Here are the takeaways from my talks with them. In case you are not familiar with the company, we recommend that you first read our investment thesis by clicking here.

My Takeaways From The Interview:

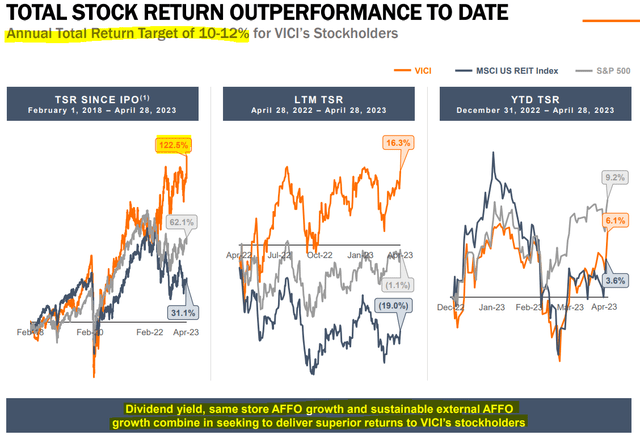

I pushed them on the concern that their big size could be a detriment to their future growth. They openly admit that their period of explosive growth is likely over. They went from their IPO to becoming a S&P500 REIT in just 5 years, which is truly exceptional. They managed to grow their FFO per share by >8% per year on average and that may not be sustainable. But they seemed confident that they should be able to keep growing their FFO per share by >6% per year for a long time to come. This is because their properties enjoy superior internal growth prospects: they are true triple-net, enjoy CPI-based rent adjustments, and also offer reinvestment opportunities. Moreover, they are still just getting started with acquisitions in foreign markets and other experiential properties.

Ed Pitoniak, the CEO of the company, went on to explain that the management's compensation at VICI is largely a function of two things: their ability to grow their FFO per share by at least 6% per year over a 2-year rolling period and reaching at least 10% compounded annual total returns for shareholders over a 3-year period. If they fail to grow their FFO per share by >6%, they don't get their bonuses. Historically, they have managed to easily reach these targets despite having a much higher cost of equity for most of their history and also going through the pandemic. Their cost of equity has come down as cap rates compressed in the US for trophy casinos and the market became more comfortable with this asset class. This should help them going forward as they now also start to consolidate higher cap rate casinos abroad and also expand into other experiential properties. As a reminder, the last time I met VICI's management, they talked about amusement parks and I suspected that they could be interested in doing a major sale and leaseback deal with Six Flags (SIX).

VICI's enterprise value is now over $50 billion and that's concerning many investors who think that the REIT may be getting too big for its own good. But if you look at the size of the REIT based on how many properties it actually owns, it is small with just 50 properties. The reason why it has such a big enterprise value is because the average rent per asset is nearly $60 million. They specialize in big-ticket investments with few potential buyers. This should mitigate some of the concerns related to the size of the REIT because there are still many opportunities in the US and abroad for casinos and that does not even consider the opportunities for other experiential properties.

We talked a lot about their expansion plans abroad. They have now completed their first deals in Canada and they expect to do many more such deals in the future. What many people appear to ignore is that Canada is a big market for gambling. It is about 1/3 of the US and its casino real estate is today mostly untouched, offering a big opportunity for sale and leaseback transactions at attractive cap rates.

They are also doing a lot of work on other foreign markets as they prepare for future acquisitions. VICI's CFO, David Kieske, explained that he recently spent 2 weeks in Australia with a colleague to study their market and make new relationships. There are big casinos in Australia. He explained that they are also looking at Japan, Singapore, and some of the smaller islands that have big casinos. They are not interested in Macau or other jurisdictions with weaker property rights or poorer rule of law. They are also looking at Europe. As an example, they looked at a deal with Hard Rock in Spain. My feeling is that they are more interested in focusing on Canada right now, but they are simply preparing their expansion plan for the coming years.

VICI is in a better position than ever for sales and leasebacks. A lot of its deals are repeat business with existing tenants that own a lot more properties. Their pipeline has grown a lot thanks to their new relationship with MGM and Century Casinos and these tenants are now interested in sale and leasebacks because their cost of capital has increased significantly.

VICI's track record of collecting 100% of its rents during the pandemic - which was the worst possible crisis for its properties - should go a long way in helping it gain a higher multiple over time. Historically, VICI has been priced at a discount to other REITs due to the fear of what would happen to it in a recession. But even the worst possible crisis couldn't stop the REIT as it hiked its dividend by 11% in 2020 and another 9% in 2021.

Today, VICI is not the most opportunistic REIT in the market, but it is still priced at a discount relative to other S&P500 REITs, especially those that own trophy assets like VICI. The management argues that their trophy assets generate cash flows that are more stable and predictable, but they continue to be priced at a discount. If you exclude offices, malls, hotels, and paper storage facilities - which are quite a bit riskier than VICI's triple net lease casinos - then VICI is the cheapest of all S&P500 REITs:

My Conclusion

I believe that VICI remains an ideal portfolio anchor because it is likely to keep delivering above-average returns with below-average risk.

I would not expect any major upside from it, but the company should be able to keep growing by 5-7% per year, which combined with its near 6% dividend yield, should result in 11-12% total returns.

This is what the management gets paid to achieve for shareholders, they have a very good track record of surpassing that, and they seem to have a good plan to keep delivering it.

As VICI continues to further diversify its portfolio, I would expect the market to become even more comfortable with it and to eventually push its AFFO multiple closer to 16-18x FFO, which would result in 30%+ upside in addition to the 10-12% annual total returns that you should earn from the yield and the growth.

Most importantly, you get good margin of safety, steady growth, and a good yield from a relatively safe investment and this is why I like to own it as an "anchor" in our portfolio.

Finally, please note that this is a free article from High Yield Landlord. If you found it valuable, consider joining our service for a 2-week free trial. You'll gain immediate access to my entire REIT portfolio, real-time trade alerts, exclusive REIT CEO interviews, and much more. We are the largest and highest-rated REIT investment newsletter online, with over 2,000 paid members and more than 500 five-star reviews.

We spend 1000s of hours and over $100,000 per year researching the market for the most profitable investment opportunities and share the results with you at a tiny fraction of the cost.

Get started today - the first 2 weeks are on us:

Sincerely,

Jussi Askola

Analyst's Disclosure: I/we have a beneficial long position in the shares of all companies held in the CORE PORTFOLIO, RETIREMENT PORTFOLIO, and INTERNATIONAL PORTFOLIO either through stock ownership, options, or other derivatives. High Yield Landlord® ('HYL') is managed by Leonberg Research, a subsidiary of Leonberg Capital. All rights are reserved. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. The newsletter is impersonal and subscribers/readers should not make any investment decision without conducting their own due diligence, and consulting their financial advisor about their specific situation. The information is obtained from sources believed to be reliable, but its accuracy cannot be guaranteed. The opinions expressed are those of the publisher and are subject to change without notice. We are a team of five analysts, each contributing distinct perspectives. Nonetheless, Jussi Askola, the leader of the service, is responsible for making the final investment decisions and overseeing the portfolio. We do not always agree with each other and an investment by Jussi should not be taken as an endorsement by other authors. Past performance is no guarantee of future results. Our portfolio performance data is provided by Interactive Brokers and believed to be accurate but its accuracy has not been audited and cannot be guaranteed. Our portfolio may not be perfectly comparable to the relevant index. It is more concentrated and may at times use margin and/or invest in companies that are not typically included in REIT indexes. Finally, High Yield Landlord is not a licensed securities dealer, broker, US investment adviser, or investment bank. We simply share research on the REIT sector.