Interview With Whitestone REIT (Strong Buy Reaffirmed)

Important Note

Before going into today's article, I wanted to let you know that we will soon conduct interviews with the management teams of the following REITs:

Farmland Partners (FPI)

Easterly Government Properties (DEA)

NewLake Capital Partners (OTCQX:NLCP)

BSR REIT (HOM.U:CA / OTCPK:BSRTF)

Safehold (SAFE)

Canadian Net REIT (NET.UN:CA)

Let me know if you have any questions for them and I will make sure to ask them for you. You can put your questions in the comment section below.

Thanks!

=============================

Interview With Whitestone REIT - Strong Buy Reaffirmed

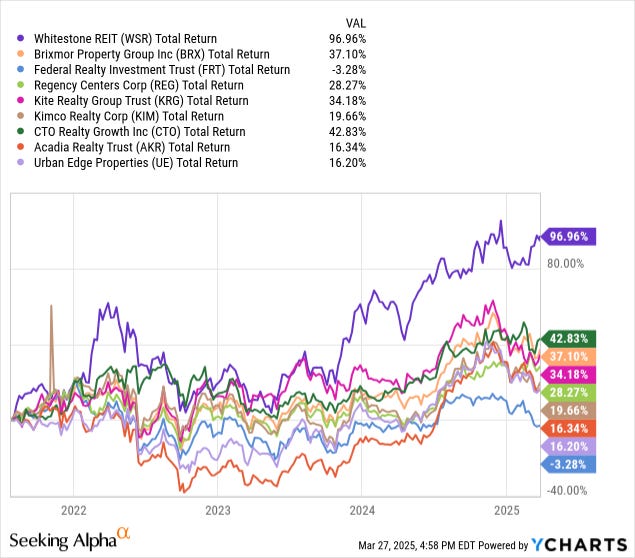

On the 26th of July, 2021, we sold our position in Brixmor Property Group (BRX) and reinvested the proceeds into Whitestone REIT (WSR).

We then repeatedly bought the dips whenever the opportunity presented itself, and today, we are happy to look back and see that our patience paid off as Whitestone has massively outperformed its peers and nearly doubled our money:

The reason why we favored Whitestone REIT for our Core Portfolio is because:

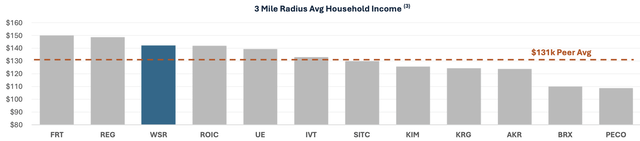

(1) It owns mostly service-oriented neighborhood centers in some of the most affluent and fastest-growing Sunbelt markets. Its two biggest markets are Phoenix and Austin, which we expect to be some of the best-performing retail property markets over the long run. Limited new supply, coupled with significant new demand, is a recipe for strong performance.

(2) Its properties are mostly anchored by grocery and other essential services, increasing their resilience to e-commerce and recessions.

(3) Its leases are relatively short at about 4 years on average, and its rents are below market, providing an opportunity to hike rents as its leases gradually expire. In the past years, it has consistently managed to hike the rents of its expiring leases by ~15-20%, resulting in sector-leading same-property NOI growth. Also unique to Whitestone is that most of its leases are triple-net, and as a result, its capex has been the lowest in its peer group. Finally, it also enjoys 3% annual rent escalations in its leases.

(4) Despite owning some of the most desirable assets in its peer group, the company has historically traded at a discount, largely due to legacy issues with its previous management and a weaker balance sheet, which it is today rapidly reinforcing.

(5) We believe that as the company keeps reinforcing its balance sheet and the management builds a longer track record of superior performance, the market will eventually reward it with a premium valuation, resulting in market-beating returns. This has already been happening in recent years, but there is more to be done.

But what now?

Is it still a good opportunity after all of this upside?

To answer this question, we reached out to the management for an exclusive interview.

Below, I first share my main takeaways and I then share the transcript of our interview.