MARKET UPDATE - No, Inflation Is Not "Sticky" Or "Reaccelerating"

Please note that this is a free article of High Yield Landlord. If you find it valuable, consider joining our service for a 2-week free trial. You'll gain immediate access to my entire REIT portfolio, real-time trade alerts, exclusive REIT CEO interviews, and much more.

MARKET UPDATE - No, Inflation Is Not "Sticky" Or "Reaccelerating"

The January 2024 CPI report came out on Tuesday, February 13th, and it put the market in a tizzy.

The common theme of the news headlines about January inflation seems to be "hotter than expected."

This reinforces the narrative that inflation is and will remain "sticky" at rates above the Fed's 2% target, which in turn means that the Fed will have to hold their key policy rate at its current level for longer.

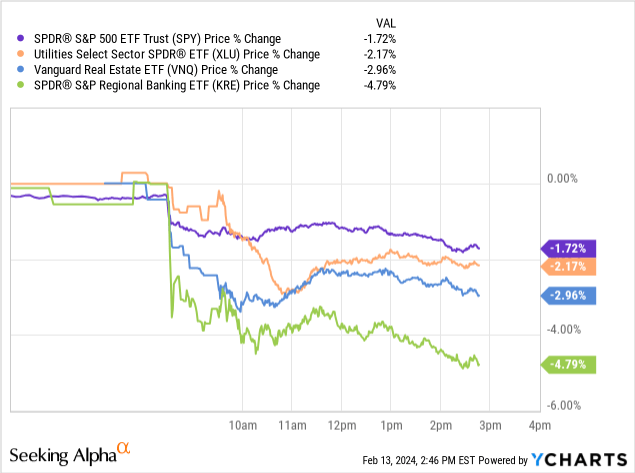

Hence the selloff in stocks, especially rate-sensitive sectors like utilities (XLU), REITs (VNQ), and regional banks (KRE).

We have argued many times, though, that the trajectory of inflation continues to be downward.

For example, look at Truflation, which we believe is a better representation of real-time inflation than the Bureau of Labor Statistics' CPI metrics.

Compared to the CPI's reported 3.1% YoY inflation in January, Truflation reports a mere 1.39%!

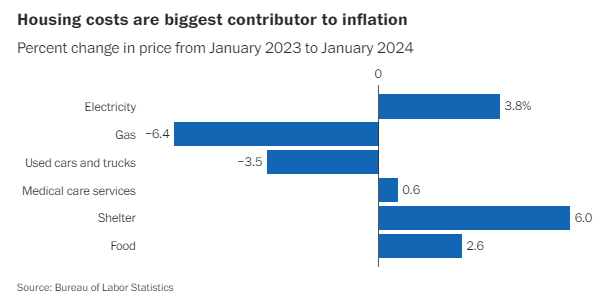

The single largest contributor to the increase in the CPI in January was the "shelter" component, accounting for over 2/3rds of the increase. In January, the CPI reported a year-over-year shelter price increase of 6%.

The CPI's shelter component is made up primarily of "rent of primary residence" and "owners equivalent rent."

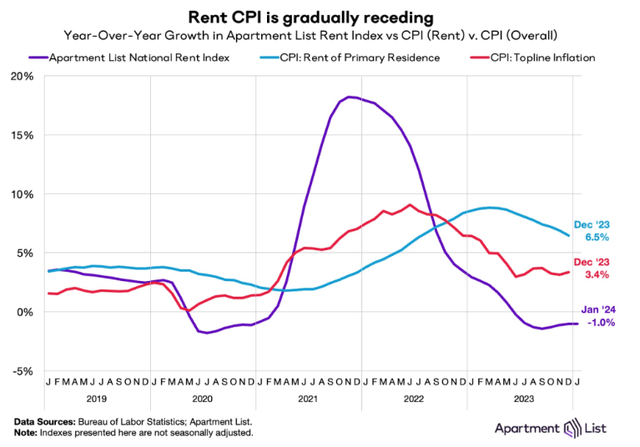

In January 2024, the CPI showed "rent of primary residence" still up 6.1% YoY. Compare that to Apartment List's -1.0%, Redfin's 1.1%, and Zillow's 3.4%.

If you average the rent indices of Apartment List, Redfin, and Zillow, you get 1.2% YoY rent growth for January. That is a far cry from the CPI's reported 6.1% YoY rent growth!

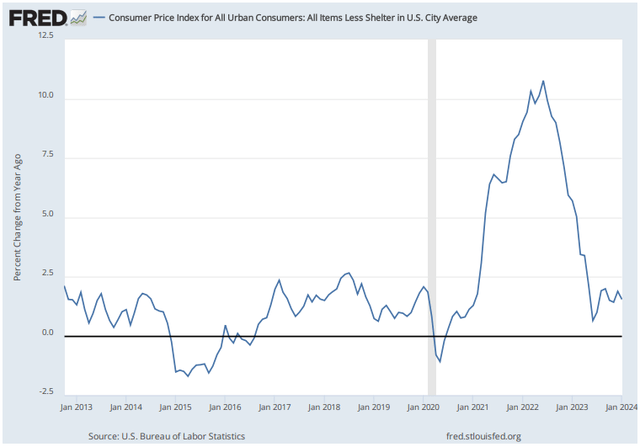

To illustrate what a huge difference shelter is making in the CPI right now, consider that the overall CPI rate excluding shelter would have been 1.54% in January.

CPI Ex Shelter YoY:

This was the 8th consecutive month that CPI ex-shelter was below 2%.

If instead of the CPI's shelter metrics you plugged in the above-average of real-time rent changes of 1.2%, January's headline CPI rate would fall to 1.4%.

As you can see in the Apartment List chart above, CPI rent (as well as owners equivalent rent) are now on the downward slide, but they have been falling at an arduously slow, gradual pace.

Of course, home prices have rebounded to about 5% YoY, but the CPI (rightfully) does not take home prices into account. People do not buy homes every month, or even on a somewhat regular basis. It is a rare, extremely big-ticket purchase that is almost always financed by debt or some other "OPM" (other people's money) like a gift from family members.

The actual monthly cost of homebuying has to incorporate mortgage rates, which have declined considerably in recent months.

Truflation's housing inflation data attempts to get at the true, real-time costs of both home ownership and renting (as well as "other lodging" which includes AirBnB and certain hotels).

Again, if instead of the CPI's 6% YoY increase for shelter you plugged in Truflation's 3.7% number, the headline CPI would be 2.2% in January.

Given the fact that the shelter component of the CPI lags real-time rent changes by about a year, we should expect YoY shelter CPI growth to continue its gradual, downward slide for the next 6 months or so. It will likely bottom sometime this Summer or Fall.

Our guesstimate is that it will bottom around 1.5% for the overall shelter component and about 1.75% to 2% for the "rent of primary residence" item. But, given the fact that real-time rent growth is expected to remain muted this year due to the large amount of supply coming to market, YoY shelter CPI should likewise remain muted for an extended period thereafter.

We have made this point many times now, but we will repeat it again:

Unless non-shelter inflation makes a resurgence, both headline and core inflation should continue to decline over the course of 2024. With lower inflation, the Fed will have the room to cut rates.

That is exactly what we expect to happen.

Non-Shelter Contributors To Inflation

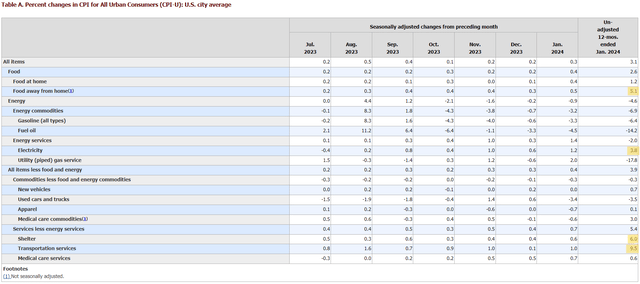

Speaking of the non-shelter components of inflation, what are those items in the CPI that are contributing the remaining 1/3rd of the increase in the YoY CPI rate?

There are three.

Apologies for how incredibly small this is. I could not figure out how to make it larger font.

The three notable items, aside from shelter, are "food away from home" at 5.1% YoY, "electricity" at 3.8% YoY, and "transportation services" at 9.5% YoY.

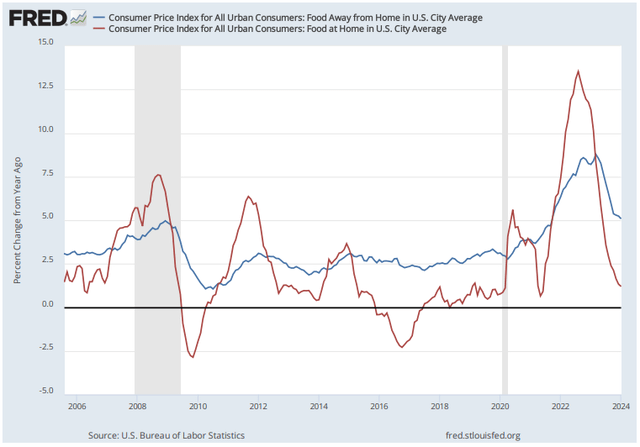

As you can see in the chart below, food away from home (restaurants) price growth peaked much later than food at home (groceries). That is because of the post-COVID "revenge spending" that consumers wanted to do.

CPI Food Away From Home (Blue Line) & Food At Home (Red Line) YoY:

But, as you can see, both are solidly in disinflationary mode. Growth in prices for groceries / food at home has fallen back to a very low level, while growth in prices for restaurants / food away from home is steadily coming down but still has a ways to go to reach its pre-COVID average level.

Of course, it is useful to remember that this chart shows the level of price growth, not the absolute level of prices or the cumulative growth in prices since the beginning of COVID-19. Grocery and restaurant prices are almost certainly not going back to pre-COVID levels and will instead likely continue to creep up, albeit at a slower pace than the last few years.

While food away from home did contribute to the increase in the CPI in January, its contribution should steadily decline over the course of this year as restaurant disinflation continues.

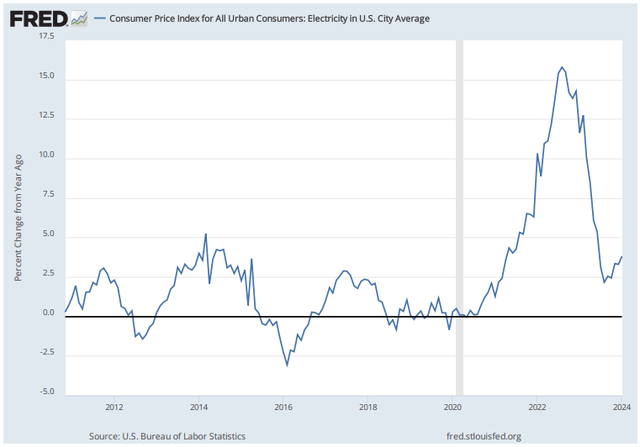

Next up is the rise in electricity prices. After bottoming out in 2023, electricity price growth appears to be on the upswing again.

CPI Electricity YoY:

Since the prices of coal and natural gas have slid over the last few years, the most likely culprit for rising electricity prices is higher interest rates. Regulated utility companies' allowed return on equity rates allow them to pass through higher interest costs to customers via rate increases.

Paradoxically, to the degree that higher interest rates are pushing up electricity prices, it would actually be disinflationary for the Fed to push down interest rates.

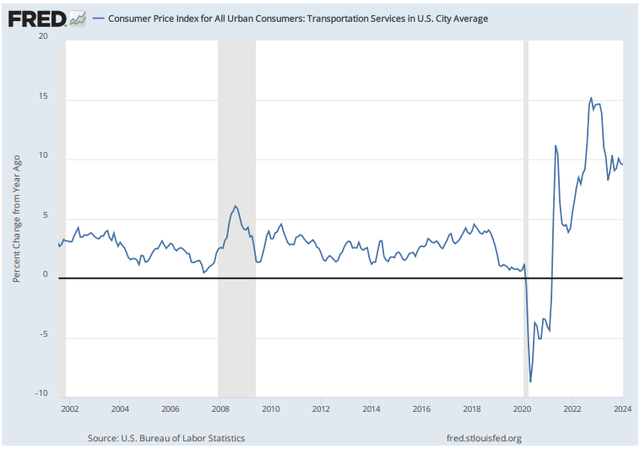

Lastly, the biggest non-shelter contributor to the increase in the CPI was transportation services.

CPI Transportation Services YoY:

Drilling down further into transportation services, we find that the primary causes of this surge in costs in recent years has been vehicle insurance and maintenance/repairs.

According to a Bankrate report, auto insurance premiums soared a remarkable 26% YoY in January.

The good news is that this increase in insurance rates is mainly a ripple effect from the prior spike in new and used car prices.

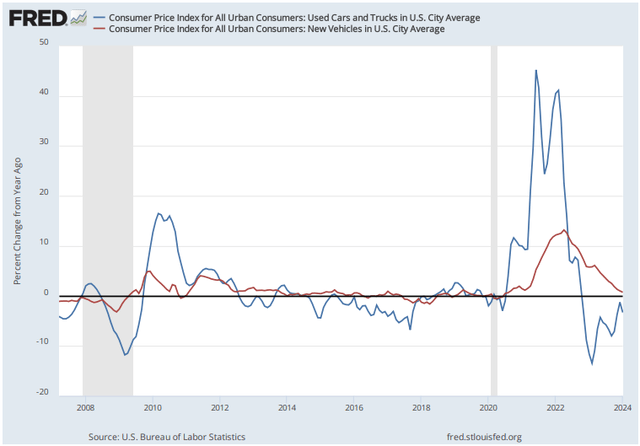

CPI Used Vehicles (Blue Line) and New Vehicles (Red Line) YoY:

Today, both new and used vehicle prices are no longer growing. Used vehicles are even seeing some mild deflation. (Again, though, car prices will likely never return to their pre-COVID levels because of the huge step-up increase in the money supply.)

Aside from the prices of vehicles themselves pushing up auto insurance premiums, the rising costs of vehicle maintenance and repairs is also contributing to the problem.

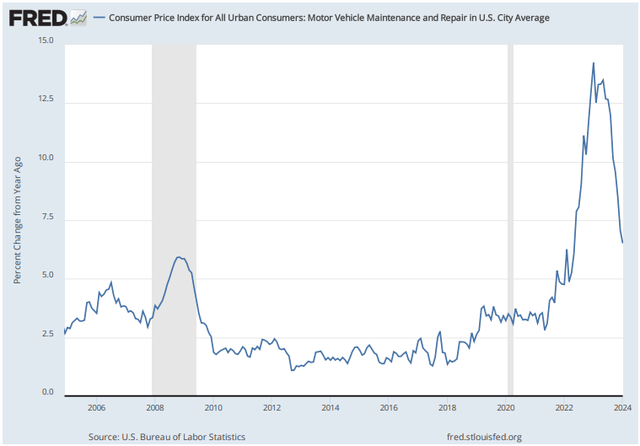

The good news here is that after peaking in the Spring months of 2023, vehicle maintenance and repair price growth has been sharply declining.

CPI Vehicle Maintenance & Repair YoY:

In January 2024, vehicle maintenance and repairs still showed a 6.5% YoY increase, which fed into a higher overall CPI rate for the month. But car maintenance and repair price growth is dropping quickly back toward pre-COVID levels.

Disinflation in motor vehicle maintenance/repairs should facilitate further disinflation in the headline and core inflation metrics going forward.

Bottom Line

The "hotter than expected" CPI number for January certainly roiled the markets and caused a sharp selloff in many of our REIT holdings. This is always disappointing to see play out.

But remember that this is a short-term phenomenon. Our long-term view remains that disinflation will continue over the course of 2024, even if that disinflation is coming painfully slowly.

With disinflation should come multiple Fed rate cuts, which should in turn fuel a strong rally in REITs for the balance of 2024.

Finally, please note that this is a free article from High Yield Landlord. If you found it valuable, consider joining our service for a 2-week free trial. You'll gain immediate access to my entire REIT portfolio, real-time trade alerts, exclusive REIT CEO interviews, and much more. We are the largest and highest-rated REIT investment newsletter online, with over 2,000 paid members and more than 500 five-star reviews.

We spend 1000s of hours and over $100,000 per year researching the market for the most profitable investment opportunities and share the results with you at a tiny fraction of the cost.

Get started today - the first 2 weeks are on us:

Sincerely,

Jussi Askola & Austin Rogers