MARKET UPDATE - Office Real Estate Remains Under Stress Despite REIT Rebound

Important Note:

Tricon Residential (TCN) is going to be acquired by Blackstone (BX) and we are working on an update at the moment. Stay tuned!

=============================

MARKET UPDATE - Office Real Estate Remains Under Stress Despite REIT Rebound

The famous Chrysler Building in New York City is up for sale.

Well, 50% of it anyway.

Austrian real estate investment company Signa has owned its stake in the Chrysler Building for only four years, and now it is looking to sell its 50% stake as it faces insolvency. The problem doesn't really seem to concern the Chrysler Building so much as it does Signa, as the Chrysler Building's vacancy rate of 12.6% is lower than the ~16% vacancy rate of other buildings in the Grand Central area.

That said, while iconic and beautiful, the Chrysler Building is also old and out of date and has also lost a significant amount of value over time.

In 2008, a 90% stake in the building traded hands for $800 million. In 2019, Signa bought a 50% stake for $150 million. The building's outdated amenities and rising ground lease rent have significantly eroded the building's value.

While ground leases have historically acted as a convenient way for NYC landlords to free up capital (about 11% of NYC office buildings sit on ground leases), the contractually rising ground lease rents -- typically 10% every 5 years -- are pressuring building owners who now face falling occupancies, rising capex, increasing concessions, and looming debt maturities.

To illustrate this, consider that the owner of the other 50% of the Chrysler Building, RFR Holding, has been trying to negotiate lower ground lease rent to free up cash for modernization renovations of the nearly 100-year-old building.

The Chrysler Building is not an exceptional case. In fact, the only thing exceptional about it is its relatively high occupancy rate.

We urge office REIT investors to remain cautious even as this sector of REITdom leads the resurgence in stock prices.

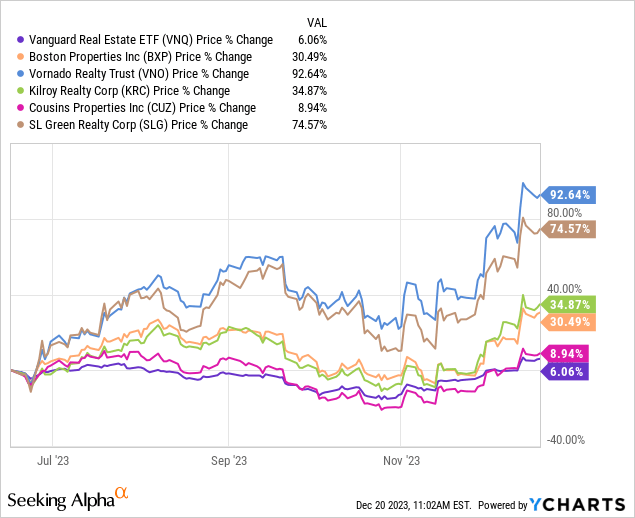

In the last 6 months, the most beaten down names in the office REIT space have soared the most, far outperforming the real estate index (VNQ) in most cases.

This makes sense as a short-term valuation rebound. Office REITs were simply oversold, and their discounts to NAV were overdone.

But we would look at the current rebound as an opportunity to trade these names for a short-term profit (much of which has already come) rather than invest in them on a long-term basis.

Since we are long-term investors who own REITs with the mindset of a landlord, we have not been persuaded to take a position in any office REIT, despite their ostensible discounts and high dividend yields.

We think there is more bad news to come, and we are not convinced that there will be another major bull market to follow the near-term difficulties.

Let's dive in for an update on the office real estate market.

Office Buildings: Short-Term Pain, Long-Term... Pain?

CBRE estimates that the peak-to-trough real estate price decline for US office properties will be around 40%, and the trough will come sometime in 2024.

The combination of poor investor sentiment and a wave of debt maturities coming amid a time of higher interest rates and tighter lending standards does not signify the beginnings of a recovery like office REIT prices do.

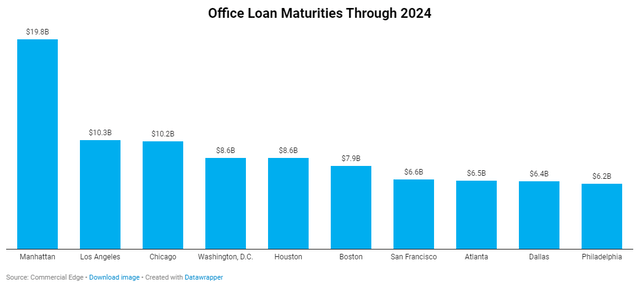

There are a lot more old office towers with loans maturing in the next year.

And while we expect the Fed to shift toward accommodative policy in 2024, we don't think this will translate into an equivalent easing in credit availability and pricing for office landlords.

What about the recovery on the office tenant side?

In the last few years, office real estate has enjoyed a recovery from the combination of office-using job growth and return-to-office mandates.

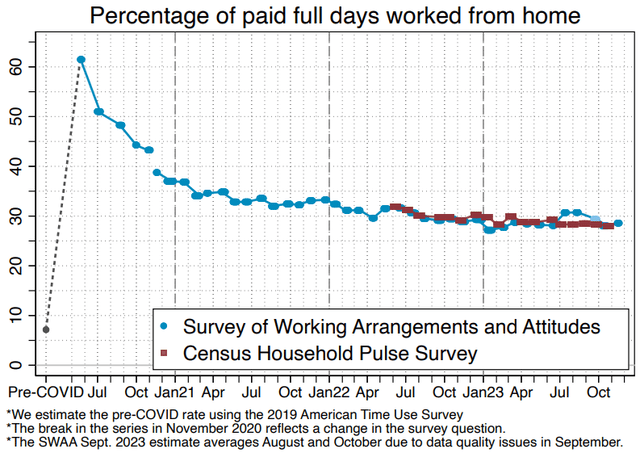

But job growth has slowed significantly this year, while the percentage of days worked from home appears to have plateaued at roughly 30%.

That is up from about 7% of days worked from home prior to COVID-19!

We can corroborate this data from multiple sources.

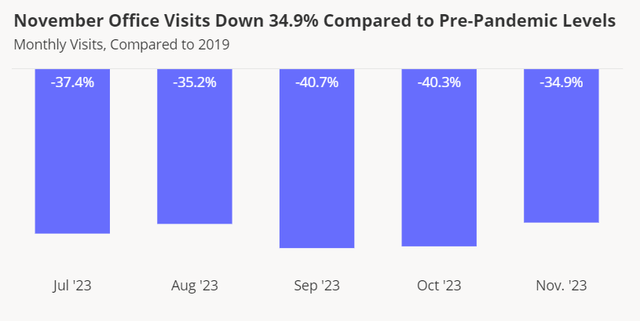

For example, CommercialEdge, which uses data from Yardi Matrix, shows in its November Office Report that office utilization has plateaued at 50-60% of pre-COVID levels. According to that report, nationwide office vacancy reached a new high in November of 18.2%, up 190 basis points YoY.

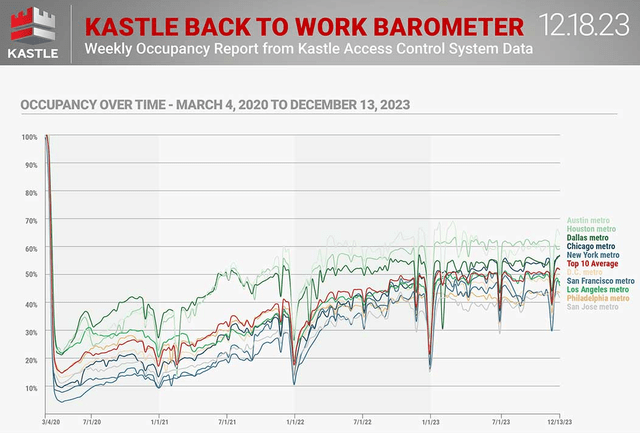

Likewise, Kastle Systems' "Return To Office Barometer," which uses keycard data, shows that the top 10 office markets in the US have been flat at about 50% office utilization, give or take a few percentage points, for the entirety of 2023.

Kastle's data shows that Texas markets like Austin, Houston, and Dallas enjoy higher utilization of about 60%, while certain coastal markets (especially in the West) average around 40-45%.

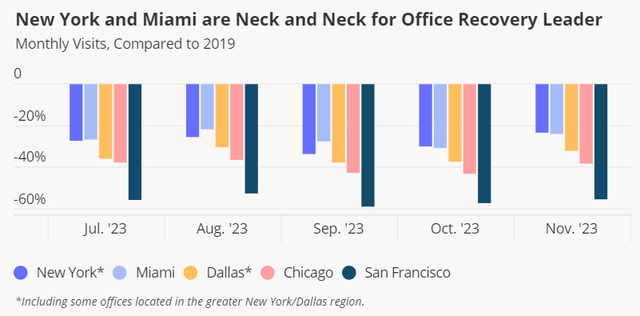

On the other hand, Placer.ai's mobile phone geolocation data shows nationwide office utilization down only ~35% from pre-COVID levels.

Again, this level is pretty stable and does not show a trend of rising office utilization this year.

The discrepancy in Kastle's data and Placer.ai's data could come down to the markets being surveyed. While Kastle's data is concentrated in the 10 largest office markets in the US, Placer.ai's data covers many more markets, including much smaller ones.

After all, not all office markets perform the same.

Placer.ai shows NYC and Miami as being some of the better markets for a rebound in office utilization, while San Francisco is by far the worst.

This directionally comports with Kastle's data, albeit with minor differences here and there. For example, Kastle shows Dallas with slightly more recovery in utilization than NYC, while Placer.ai shows NYC doing slightly better than Dallas.

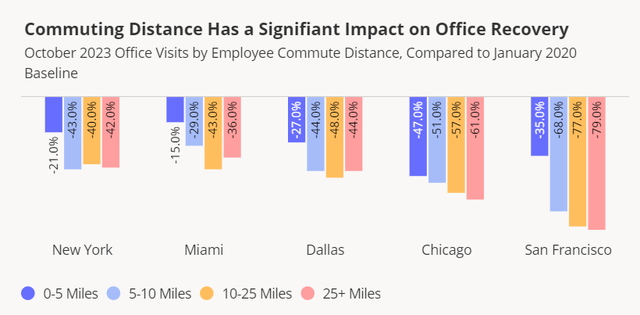

Overall, the theme in Placer.ai's data seems to be that cities with longer average commutes have worse office utilizations.

This is a major reason we believe Armada Hoffler Properties' (AHH) office segment retains such a high occupancy rate of 96% as of Q3 2023. Its offices are mostly located in secondary markets with shorter commute times, often situated in mixed-use centers where workers may even live in the same vicinity in which they work.

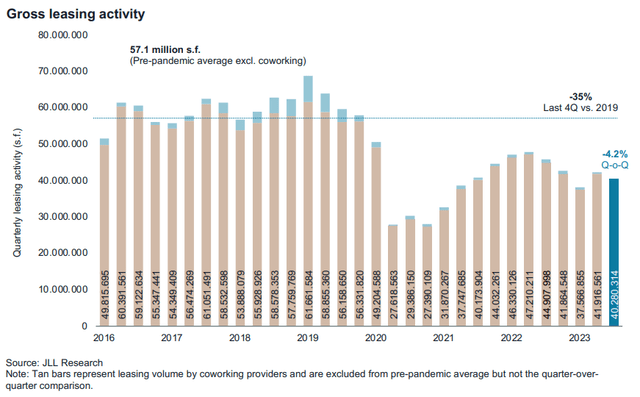

If office tenants believed that this data on office utilization was merely temporary and that they would be successful in consistently bringing their workers back into the office, you would expect to see leasing activity increasing back toward pre-pandemic levels.

Instead, since peaking in the first half of 2022 at about 20% below pre-pandemic levels, office leasing activity has since slumped to about 35% below pre-pandemic levels.

Again, given slowing job growth and plateauing office utilization, we don't see a catalyst for office leasing volume to meaningfully increase anytime soon.

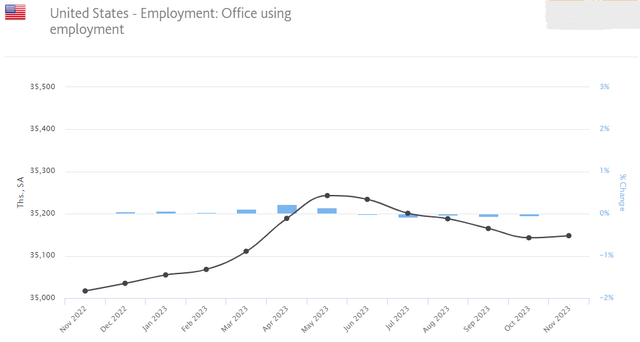

In fact, according to Bureau of Labor Statistics data, employment for office-using jobs has actually been on the decline since peaking in May 2023.

There was a popular argument that floated around for a while that a recession would quickly bring workers back into the office as they strove to keep their jobs. There may be some validity to this argument, but keep in mind two points:

The job market has already returned to its pre-COVID levels in many ways, wherein there is more of a balance of power between employers and employees, and yet workers are not clamoring back into the office. This has remained the case even after some highly publicized layoff announcements.

A recession would probably also bring with it a lot more layoffs than we've already seen, which translates into fewer office-using workers. Office utilization would have to increase even more in order to offset fewer employed office workers.

Perhaps office utilization will increasing meaningfully from here, but in our view, that belief is founded more on hope than evidence or analysis.

Bottom Line: Tread Carefully

Office REITs have enjoyed a very impressive rebound in recent months, some more than others. This rebound made sense based on the degree to which many office REITs had become oversold and discounted to NAV.

But make no mistake: the office sector of commercial real estate remains challenged and likely will remain so for many years to come. It will take a long time for loans to mature, leases to expire, redevelopment projects to get underway, and so on.

And the amount of power office tenants still hold ensures that significant rent concessions, tenant improvement allowances, and added amenities will greatly pressure landlords' NOI margins for many, many years.

This should likewise limit the rebound in office REITs' FFO per share, which in turn limits their stock price upside.

We remain very cautious about office real estate in the US and advise others to do the same, as we do not believe it will provide attractive long-term returns.

There are better opportunities in other property sectors.

Finally, please note that this is a free article from High Yield Landlord. If you found it valuable, consider joining our service for a 2-week free trial. You'll gain immediate access to my entire REIT portfolio, real-time trade alerts, exclusive REIT CEO interviews, and much more. We are the largest and highest-rated REIT investment newsletter online, with over 2,000 paid members and more than 500 five-star reviews.

We spend 1000s of hours and over $100,000 per year researching the market for the most profitable investment opportunities and share the results with you at a tiny fraction of the cost.

Get started today - the first 2 weeks are on us:

Sincerely,

Jussi Askola & Austin Rogers

Analyst's Disclosure: I/we have a beneficial long position in the shares of all companies held in the CORE PORTFOLIO, RETIREMENT PORTFOLIO, and INTERNATIONAL PORTFOLIO either through stock ownership, options, or other derivatives. High Yield Landlord® ('HYL') is managed by Leonberg Research, a subsidiary of Leonberg Capital. All rights are reserved. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. The newsletter is impersonal and subscribers/readers should not make any investment decision without conducting their own due diligence, and consulting their financial advisor about their specific situation. The information is obtained from sources believed to be reliable, but its accuracy cannot be guaranteed. The opinions expressed are those of the publisher and are subject to change without notice. We are a team of five analysts, each contributing distinct perspectives. Nonetheless, Jussi Askola, the leader of the service, is responsible for making the final investment decisions and overseeing the portfolio. We do not always agree with each other and an investment by Jussi should not be taken as an endorsement by other authors. Past performance is no guarantee of future results. Our portfolio performance data is provided by Interactive Brokers and believed to be accurate but its accuracy has not been audited and cannot be guaranteed. Our portfolio may not be perfectly comparable to the relevant index. It is more concentrated and may at times use margin and/or invest in companies that are not typically included in REIT indexes. Finally, High Yield Landlord is not a licensed securities dealer, broker, US investment adviser, or investment bank. We simply share research on the REIT sector.