MARKET UPDATE - Tariff-Induced Inflation Offers Long-Term Investors A Buying Opportunity

Dear Landlords,

I want to extend a warm welcome to all our new members!

As a reminder, our most recent "Portfolio Review" was shared with the members of High Yield Landlord on July 7th, 2025. You can read it by clicking here.

You can also access our three portfolios on Google Sheets:

New members can start researching positions marked as Strong Buy and Buy while considering the corresponding risk ratings.

============================

MARKET UPDATE - Tariff-Induced Inflation Offers Long-Term Investors A Buying Opportunity

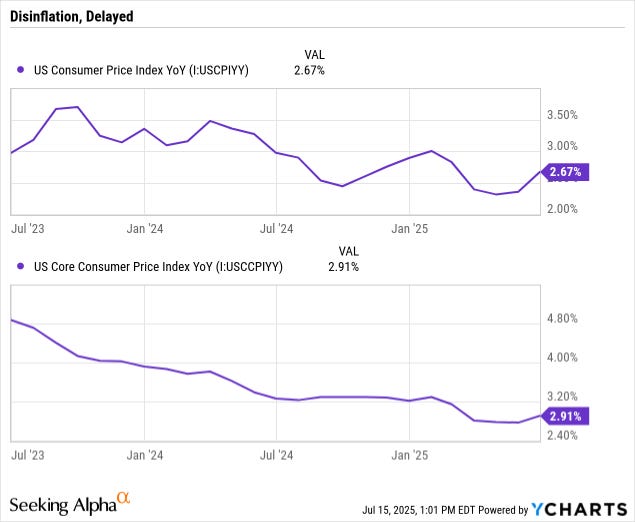

This year, we have been arguing that the structural disinflationary trend remains in place and will likely continue for years to come, but also that tariffs will bleed through into consumer prices and cause some amount of bounce in the CPI.

The recently released June CPI report lends support to that thesis.

Both the headline and core CPI rates rebounded in June:

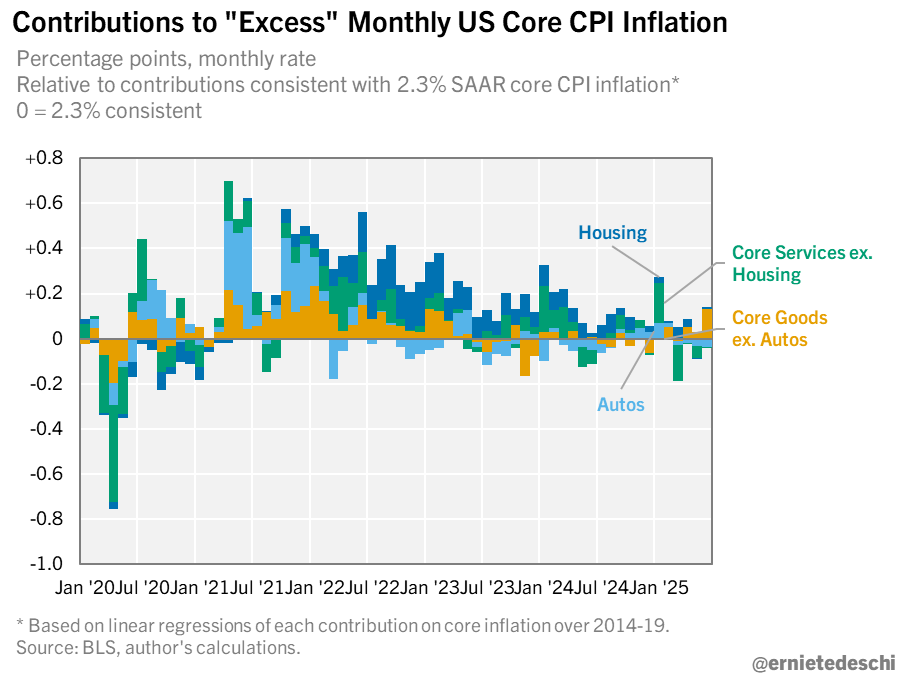

While disinflation continues in the shelter segment of the CPI, the primary catalyst for the bounce in both headline and core CPI in June was "core goods ex-autos" (excluding food, energy commodities, and autos).

As of June, core goods ex-autos are contributing by far the most to "excess" monthly CPI -- or annualized inflation rates higher than the Fed's 2% target.

Housing, most food items, energy, car insurance, and autos are all consistent with low inflation, but core goods such as appliances, furniture, clothes, and imported foods (such as coffee) are seeing rising prices.

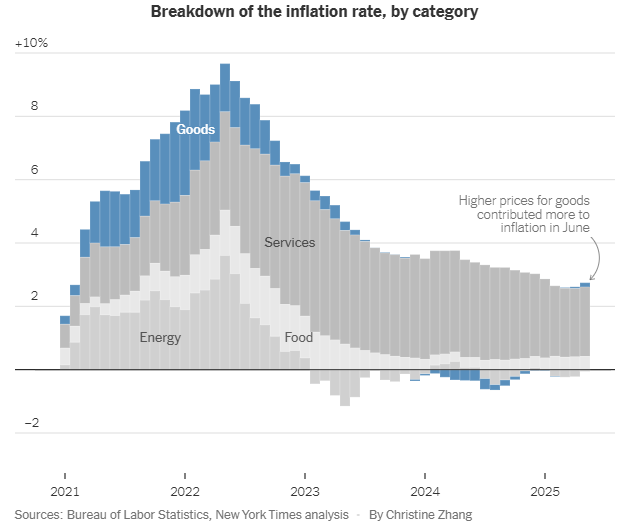

Here's another visual breakdown from the New York Times:

While small (at least for now), the June bounce in core goods (ex. autos) prices was the first time this category contributed to higher CPI since early 2023.

In fact, the calculation of an economist from MetLife found that in June, goods broadly contributed the most to core inflation (ex. food and energy) since 2022. For example, window and floor coverings (an overwhelmingly imported category of goods) increased 4.2% month-over-month in June, the biggest increase for that category of goods on record.

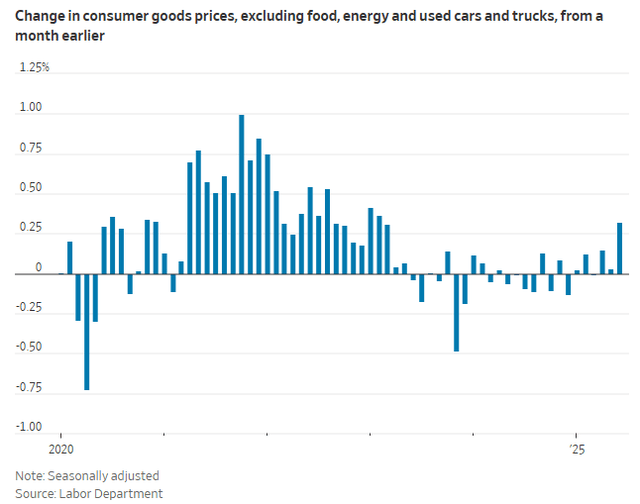

Here's another helpful chart from the Wall Street Journal to illustrate this:

To be fair, though, the data is not strong enough to be conclusive about the extent of tariff-induced inflation still to come or how much it will impact the overall CPI.

To quote the Wall Street Journal: