MARKET UPDATE - The Overlooked Macro Trend That Strongly Favors REITs

A very important topic that has received surprisingly little attention is the potential deflationary impact of the AI revolution. Most of today’s market narrative focuses on AI’s productivity gains, its infrastructure needs, and the companies supplying chips or building data centers. But few investors have considered the second-order effects, and in my opinion, the biggest one is this:

AI is likely to become one of the most powerful deflationary forces of the century.

And if that is true, it has profound implications for interest rates, inflation, and the relative attractiveness of long-duration assets such as REITs.

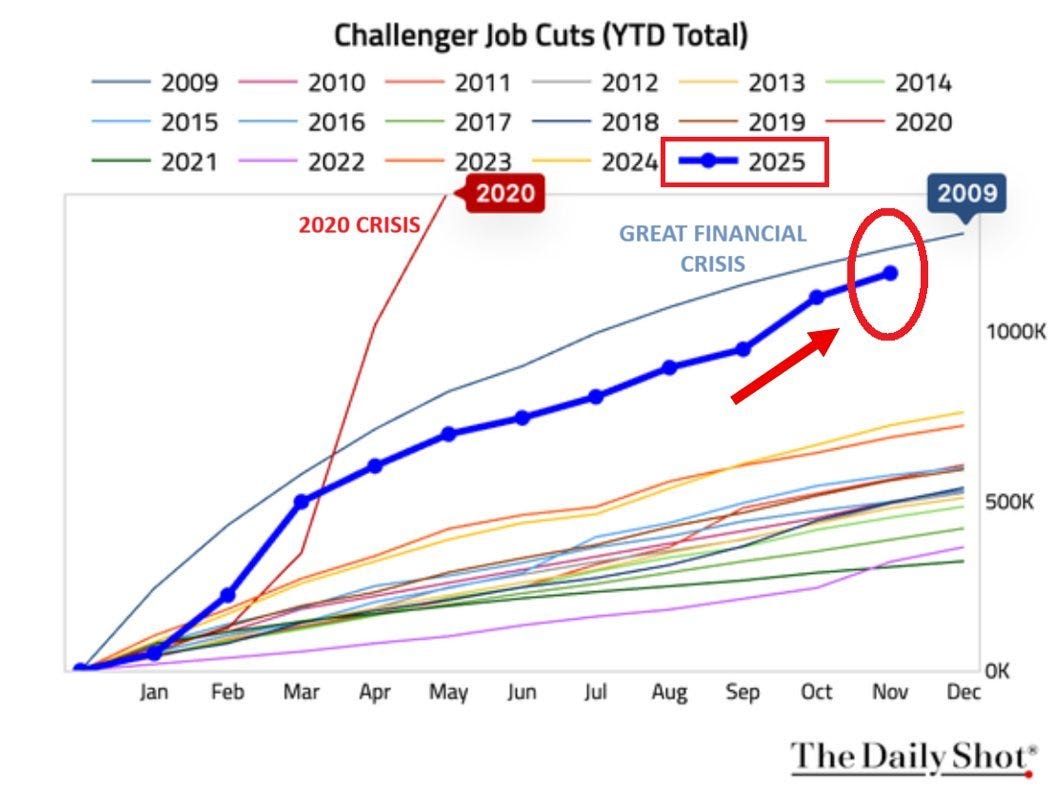

We are already seeing early signs of this. Companies across nearly every sector are announcing large layoffs as AI tools replace or streamline work once performed by humans. This trend is only in its infancy, yet the magnitude of announced job cuts is unprecedented outside of recessions. The layoffs announced this year are on par with those experienced during the Great Financial Crisis, and this is why the Fed is cutting interest rates:

As AI automates more functions, business costs will decline, productivity will rise, and wage pressure will ease. All of this points toward structurally lower inflation. Even major employers like Amazon have now stated that they expect to sharply reduce their labor needs over the coming years as they accelerate the use of robotics, automated logistics systems, and AI-driven workflow optimization.

When companies of this scale transition millions of work hours from humans to automation, the long-term deflationary effect across the broader economy is substantial.

This is not a fringe view anymore.

Elon Musk, for example, has repeatedly said that AI and robotics will eventually create a world of extreme abundance, with goods and services becoming nearly free at the margin. He may be taking the most extreme version of this argument, but the direction he describes seems valid.

If robots can produce physical goods with almost no labor requirement, and AI can perform intellectual work with no incremental cost, the economic system becomes radically deflationary. Prices fall, output increases, and the cost of living declines. Even if reality lands only twenty percent of the way toward Musk’s vision, the downward pressure on inflation would still be enormous. It is that powerful.

Lower inflation eventually means lower interest rates. Central banks raise interest rates to suppress demand and keep prices stable. But if structural deflation dominates over cyclical inflation, the long-term equilibrium rate of interest moves significantly lower. The future then looks less like the 1970s and more like the early 2000s and 2010s, when technology quietly suppressed inflation while output continued to grow.

Only this time, the effect will likely be far more extreme. During those earlier decades, technology improved efficiency at the margins. AI and robotics, by contrast, automate the core of both intellectual and physical work. Instead of reducing costs by ten or twenty percent, they have the potential to erase entire expense categories altogether. This is a fundamentally different magnitude of deflationary pressure, and one that the market may not have yet begun to fully appreciate.

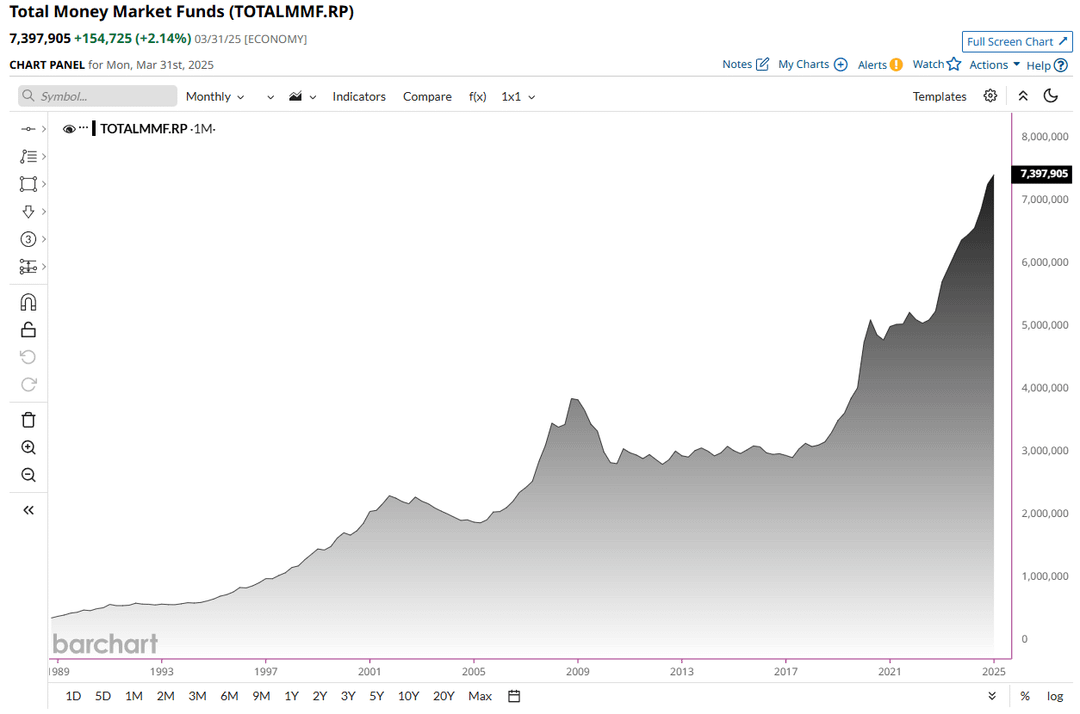

And lower interest rates are historically one of the strongest tailwinds for REIT valuations. Real estate is a long-duration asset. When discount rates fall, valuations expand. Cap rates compress. Financing costs decline. Cash flows grow and become more valuable. The spread between REIT yields and government bond yields widens, attracting capital back into real assets. This shift is amplified by the fact that there is today a record $7.4 trillion sitting in money-market funds, happily earning a 4% yield. If we eventually move back toward a yieldless world, some of this massive pool of capital will begin searching for higher income opportunities, and REITs are one of the primary beneficiaries of that reallocation. The entire asset class stands to benefit from a structural move to a lower rate environment.

These ideas are also beginning to appear in the commentary of some of the most respected investors in the world.

Bruce Flatt, the CEO of Brookfield and one of the most successful real asset investors of the past generation, recently highlighted the disruptive potential of AI and robotics in his investor letter.

Flatt argues that governments across the developed world are now facing debt burdens that are mathematically impossible to service at current interest rate levels, which will eventually require policymakers to guide interest rates materially lower.

In parallel, he notes that AI applied to the real economy is just getting started, creating significant productivity and efficiency gains that will help address structural labor shortages. He specifically emphasizes humanoid robotics as one of the most important technologies of the coming decades, capable of performing general tasks in human-built environments and driving transformative productivity improvements across industries. In his view, this combination of high public debt, lower future interest rates, and rising productivity driven by AI will create a highly favorable environment for real assets, including REITs, which benefit from lower financing costs and produce stable, inflation-linked cash flow supported by hard assets.

His perspective aligns closely with the idea that structural AI-driven efficiency gains will reinforce the long-term downward pressure on interest rates and create an exceptionally attractive backdrop for real estate investors.

Few investors are connecting these dots yet.

Most are focused on the short-term noise, recession fears, and temporary consumer weakness, while ignoring a powerful long-term macro shift quietly forming in the background.

Productivity gains from AI are already materializing, and we are only at the very beginning. Corporate earnings calls across nearly every sector mention efficiency improvements driven by AI. What is not being discussed is what these efficiency improvements ultimately imply for the macro environment. When businesses can produce more with less labor, wage pressure softens. When labor costs flatten or decline, inflation trends lower. When inflation trends lower, interest rates follow.

We think REIT investors stand to benefit significantly from this transition, even as it will destroy a lot of value across many other sectors of the market. We have discussed this topic in more detail in a separate article that you can read by clicking the link below:

Important Warning: AI Is Coming For Your Portfolio — Unless You Own Real Estate

I know that it is difficult to see this today after suffering through a 4-year-long bear market, but conditions can shift far more quickly than most investors expect.

If AI truly pushes us back toward a yieldless world, capital will once again search for resilient long-duration real assets with safe and predictable cash flow. REITs fit that description better than almost any other asset class. What feels out of favor today could soon become one of the most sought-after segments of the entire market as investors recognize the value of stability in an increasingly unpredictable environment.

And if this scenario plays out, I would expect our holdings to become far more valuable, potentially already over the coming years.

I think that this scenario is far more plausible than what the market seems to be realizing today.

I will happily keep accumulating larger positions in some of our favorite discounted REITs in the meantime.

Finally, please note that we have exceptionally posted this article without a paywall. If you found it valuable, consider joining High Yield Landlord for a 2-week free trial.

You will also gain immediate access to my entire REIT portfolio, real-time trade alerts, exclusive REIT CEO interviews, and much more. We are the largest and highest-rated REIT investment newsletter online, with over 2,000 paid members and more than 500 five-star reviews.

We spend thousands of hours and over $100,000 per year researching the market for the most profitable investment opportunities, and we share the results with you at a tiny fraction of the cost.

Get started today - the first 2 weeks are on us:

Analyst’s Disclosure: I/we have a beneficial long position in the shares of all companies held in the CORE PORTFOLIO, RETIREMENT PORTFOLIO, and INTERNATIONAL PORTFOLIO either through stock ownership, options, or other derivatives. We also own a position in FarmTogether. High Yield Landlord® (’HYL’) is managed by Leonberg Research, a subsidiary of Leonberg Capital. All rights are reserved. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. The newsletter is impersonal and subscribers/readers should not make any investment decision without conducting their own due diligence, and consulting their financial advisor about their specific situation. The information is obtained from sources believed to be reliable, but its accuracy cannot be guaranteed. The opinions expressed are those of the publisher and are subject to change without notice. We are a team of five analysts, each contributing distinct perspectives. Nonetheless, Jussi Askola, the leader of the service, is responsible for making the final investment decisions and overseeing the portfolio. We do not always agree with each other, and an investment by Jussi should not be taken as an endorsement by other authors. Past performance is no guarantee of future results. Our portfolio performance data is provided by Interactive Brokers and believed to be accurate but its accuracy has not been audited and cannot be guaranteed. Our portfolio may not be perfectly comparable to the relevant index. It is more concentrated and may at times use margin and/or invest in companies that are not typically included in REIT indexes. Finally, High Yield Landlord is not a licensed securities dealer, broker, US investment adviser, or investment bank. We simply share research on the REIT sector.

Great article. Thank you.

That is why I also own Amazon.

Elon Musk on the other hand is just hot air.