MARKET UPDATE – The State Of The REIT Market In October 2019 – Interview With Global Head Of Securities At Timbercreek (REIT Investor With +$10 Billion Of AUM)

MARKET UPDATE – The State Of The REIT Market In October 2019 – Interview With Global Head Of Securities At Timbercreek (REIT Investor With +$10 Billion Of AUM)

Our investment thesis throughout 2018 and 2019 has been that interest rates are peaking, and global economic growth is slowing down. We cannot predict a recession, but risks are on the rise, and now is a good time to prepare for an eventual cyclical turn.

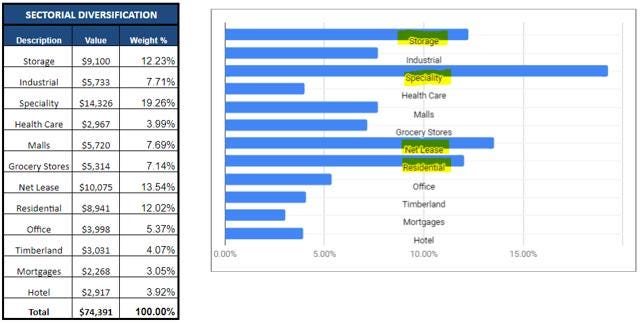

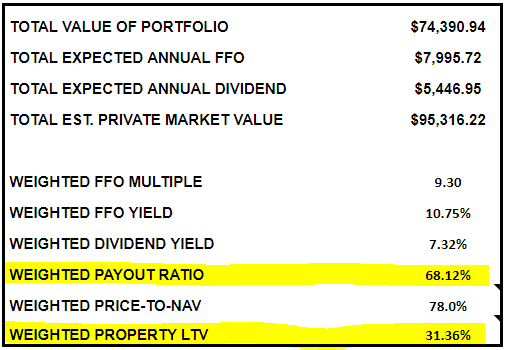

Throughout 2018 and the first half of 2019, we fortified our portfolio by increasing exposure to more defensive sectors: Storage, Specialty, Net Lease and Residential REITs.

We are now heavily concentrated on quality companies with defensive cash flow, low payout ratios and conservative balance sheets:

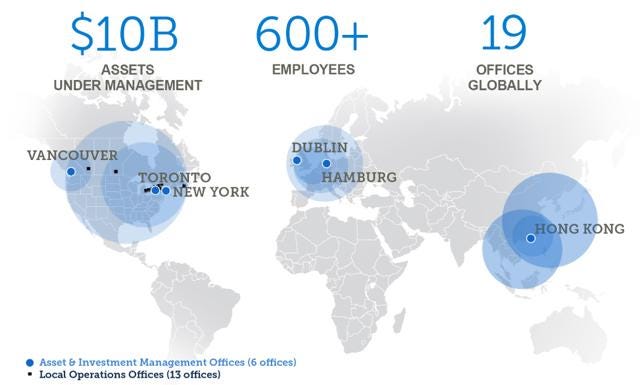

Today, in an effort to achieve even stronger conclusions on the state of the REIT market, we reach out to Corrado Russo, CFA, MBA - Global Head of Securities at Timbercreek.

For those of you who have never heard of Timbercreek, it is one of the biggest REIT investment institutions in the world. It is a global investment boutique with over $10 billion of assets under management and a strong focus on real estate and REIT investing.

We are lucky to have a relationship with Mr. Russo and so we occasionally get to pick his brain. Mr. Russo, CFA, MBA is responsible for managing the Timbercreek Global Real Estate Income Fund and the Timbercreek Four Quadrant Global Real Estate Partnership. Mr. Russo has over 20 years of experience in the investment management field, having held positions in portfolio management, equity research and direct real estate investments.

Needless to say that he is someone worth listening to. Below we share our exclusive interview and present the main take-aways. If you have any questions, please feel free to post them below in the comment section or on the chat.

Interview with Corrado Russo, Global Head of Securities at Timbercreek:

1. With volatility returning to the US REIT market, where do you see the best opportunities at the moment?

Historically, REITs typically outperform equities as volatility increases and economic growth slows. So far in 2019, public market valuations have expanded and institutions continue to allocate more capital to real estate both in the private and public sphere. Global REITs have thus far proved more resilient than general equities year-to-date and the combination of greater earnings stability and multiple expansion propelled Global REIT total returns higher in the first half of 2019.

Timbercreek believes triple net lease REITs focused on owning gaming properties are well positioned to outperform in the latter half of 2019. Gaming property ownership is often tied to families or local operators creating a highly fragmented ownership landscape that is ripe for consolidation as families look to unlock generational wealth Over the last 18 months we have seen over USD $8 billion of acquisitions from public REITs, all of which have been conservatively financed and are accretive to future earnings growth. In addition, REITs also enjoy a competitive advantage over its private equity peers as they can utilize operating partnership units to solve complex tax situations deferring tax gains for families or local operators.

2. Hospitality REITs and Retail REITs have heavily sold off due to recession fears. Do you believe that these sectors are currently priced for future outperformance or do you foresee more pain ahead?

First, with respect to hospitality, we believe that if economic growth slows further, so will RevPAR growth. Slower or potentially negative RevPAR growth will pressure revenue and EBITDA and ultimately weigh on future earnings, so we see more pain ahead for the lodging sector. Second, we believe high-quality retail centers surrounded by superior demographics such as high household income, rising population growth and growing population density is well situated to grow market share and experience solid demand amongst retailers leading to more resilient occupancy rates. But not all retail is created equal and those centers located in inferior catchment arears surrounded by weakening demographics or in secondary markets will experience tougher operating conditions should economic growth slow further causing consumer confidence to wane.

3. With interest rates heading back to new lows and more rate cuts expected in the near term - do you anticipate cap rate compression and if so, in what property sector?

Assuming economic growth remains positive, we anticipate cap rates to remain flat and potentially compress in some instances depending on property type, market and country. We’re already starting to see companies look to take advantage of the decline in interest rates and spreads by issuing new corporate bonds at very low coupons, which is helping to extend debt maturity schedules well into the future and refinance older bond issues at higher rates.

4. We recently highlighted Gaming REITs as one of the best property sectors for future outperformance. Is this a sector in which you are currently investing?

Yes, we are currently invested in the Triple Net Lease sector, which includes a number of REITs that own gaming properties. We believe this sector has outsized growth potential, notably in the U.S. as publicly traded REITs look to consolidate the market through acquisition. We believe the key is to look for REITs that have excellent balance sheets, and a track record of successfully executing on deals.

5. What is your favorite investment idea among REITs in Singapore at the moment?

Singapore delivered the best performance in the second quarter, gaining 7 percent (in SGD). Singapore is quickly becoming the preeminent data center hub in Asia and we believe Keppel DC REIT is especially well-positioned here to take advantage of growing demand for space. Timbercreek sees a lot of opportunity in data centers, as artificial intelligence and machine learning occupy a growing role in business investment while the explosion in mobile data usage is requiring hyperscale cloud service providers and enterprise companies to seek additional space to fulfill their data storage needs.

Important Take-aways for “High Yield Landlord” Members

Resilience in Late Cycle: REITs generally outperform in late cycles when interest rates are peaking and growth is slowing down. Moreover, they also outperform during most recessions because they enjoy stable cash flow from long term leases. Cohen & Steers finds that REITs outperformed the S&P 500 by 7% annually in late-cycle periods since 1991 and have offered meaningful downside protection in recessions. With this in mind, we are happy to hold an outsized allocation in REITs in 2019:

Hotels to Remain Under Pressure: Hotel REITs are cyclical and at greater risk than most other REITs in today’s market. If and when the cycle finally turns, they will be first in line to suffer from declining cash flow (and dividend cuts) given that they do not enjoy long lease terms. Businesses delay trips and individuals increase their savings. Because of this reason, we limit our Hotel exposure to only one position in our Portfolio. Hersha (HT) is our Top Pick. (Ratings: Strong Buy / Small Allocation / High Risk). Ritz Carlton Georgetown – Property owned by Hersha:

Class A Urban Malls Have a Bright Future: Timbercreek is bullish on highly urban class A properties in the mall sector. Russo argues that the superior locations will allow them to keep growing cash flow as a result of demographic growth and densification. Interestingly, he also argues that the superior locations will allow to maintain high occupancy rates - even in recessions. Class A urban assets such as those owned by Macerich (MAC) remain in high demand and rents are on the rise. (Ratings: Strong Buy / Large Allocation / Average Risk). Santa Monica Place – Property owned by Macerich:

Timbercreek’s Favorite Sector: Gaming REITs (also known as Casino REITs) are among their favorite REITs in the US right now. Russo argues that risks are fairly low and the run-way for growth is very attractive for REITs with strong balance sheets. Coincidently, we just published a bullish report on VICI which is the Casino REIT with the strongest balance sheet. We appear to agree that there is a significant opportunity there. (Ratings: Strong Buy / Large Allocation / Average Risk). Caesars Palace – Property owned by VICI:

New Catalyst for REIT: The recent drop in interest rates serves as a strong catalyst for REITs because it helps on three separate fronts: (1) REITs are able to refinance at a lower rates and extend maturities to boost cash flow; (2) Cap rates may compress due to increased demand for real estate (this then results in further appreciation); (3) The market sentiment for REITs is improving and FFO Multiples are expanding. As we recently discussed in our latest Portfolio Review, the value of our Portfolio is reaching new all times highs.

Top Pick Among REITs in Singapore: Finally, because I am currently in Asia to uncover the best Asian REIT opportunities, I was interested to learn more about their favorite idea among REITs in Singapore – which is the REIT Capital of the continent. Russo shares that the demographics of the continent are particularly bullish for data center REITs. They are investing in Keppel DC REIT – a 3.5% yielding data center REIT with rapid growth potential. We are currently working on a full report on the company and I expect to meet the management team in November to produce an interview for members of High Yield Landlord. Stay tuned!

Bottom Line

We are well on our way for solid performance in 2019 and beyond. Even market experts who manage billion of dollars appear to agree that our approach is the right one in today’s market environment.

It is very encouraging, but we must make an active effort to not take this interview as a “confirmation” of our previous thoughts. We must remain completely independent in our thinking to potentially outperform in the long run.

We suggest all members to set some cash aside as we expect to present several new opportunities in the near term; including at least a few Asian REITs.

Good investing from your HYL Research Team,

Jussi Askola