Medical Properties Trust: The Glass Is Half Full

Quick Note

Tomorrow, we will share the next article of our Top Picks for 2026 series. Stay tuned!

----------------------------------------------------------------------

Medical Properties Trust (MPT) has thankfully moved past the period of acute crisis it endured from 2022 through 2024 and stabilized at a new base, but headwinds from high leverage, debt refinancing, a high cost of capital, and tenant financial fragility remain.

For now, the “weak hands” have been washed out, and analysts forecast a steady recovery in FFO per share from here.

Management has initiated a $150 million share buyback program, and the board hiked the dividend by 12.5% in Q4 2025 as a vote of confidence.

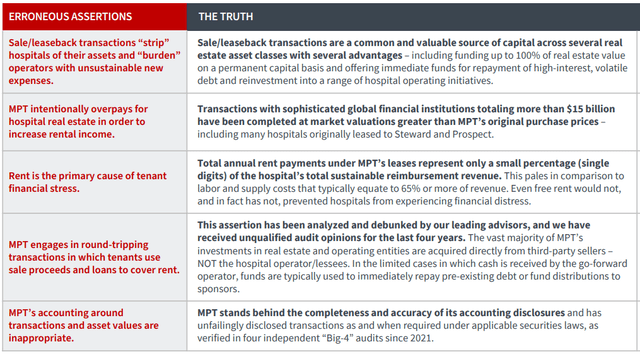

They also put out a 27-page presentation in October to counter many of the fallacious arguments put forward by short sellers.

Overall, we see management’s reaffirmation of their business model and strategy as valid and truthful, but it doesn’t tell the full story.

Let’s look at MPT again as we wade into 2026 to stay apprised of its status and outlook. We start by discussing the bad, and then explain why we remain optimistic.

Update On Medical Properties Trust

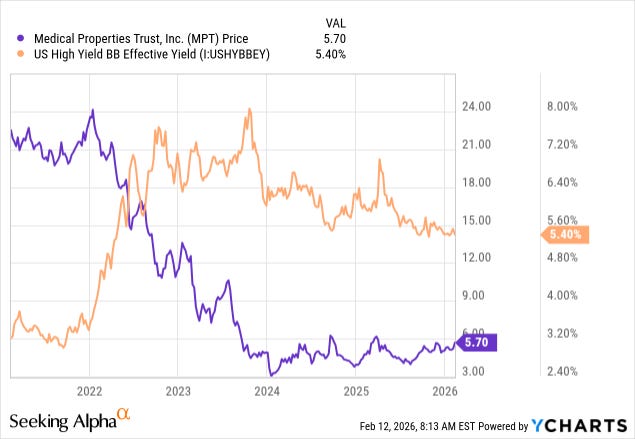

In our view, MPT’s roller coaster ride from the last 4-5 years is overwhelmingly a story about interest rate fluctuations.

In the decade+ era of ultra-low interest rates, the sub-investment grade rated MPT’s business model was to rapidly grow the healthcare real estate portfolio through a combination of debt and equity. As long as interest rates stayed low, this strategy worked swimmingly.

But in 2022, interest rates surged in response to the biggest inflationary spike in decades. Junk bond yields more than doubled from 2021 to 2022.

This spike in cost of debt weighed on MPT in two main ways:

It increased MPT’s interest expenses from floating-rate debt and a steady slate of loan maturities each year.

It put immense financial pressure on its heavily leveraged, private equity-backed tenant-operators.

The combination of these two headwinds smashed MPT’s fundamentals, pushed its largest tenant Steward Health into bankruptcy, and produced huge selling pressure on its stock price.

The final burst of selling came in mid-2023 when MPT roughly halved its dividend. By the time management reduced the dividend by nearly half again in mid-2024, the weak hands had been flushed out.

Even if many of their arguments were exaggerated or specious, the short-sellers were right. MPT’s stock price did go down.

At this point, however, the stock price has stabilized, the Steward Health properties have been re-tenanted or sold, rental revenue from the former Steward properties is ramping back up, most of the bankrupt Prospect Medical’s properties have likewise been sold or re-tenanted, and the slide in interest rates has eased the pressure on both MPT and its tenants.

Even then, MPT continues to face the same two big headwinds: