My Biggest Losses Of 2025 & Lessons

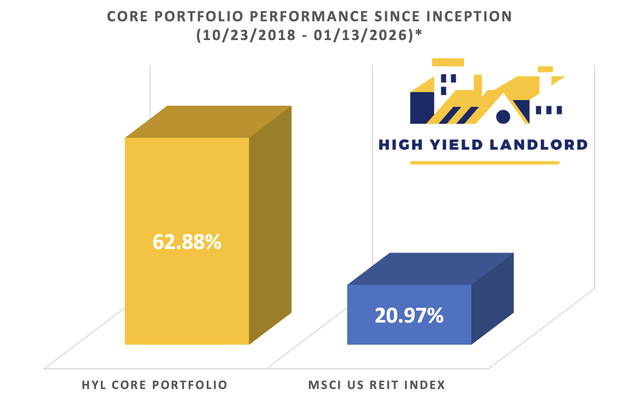

Overall, we have done quite well over the long run.

Our Core Portfolio was launched in late 2018, and despite REITs enduring a quasi-bear market for much of the past five years, it has still generated a total return of 63%. That performance is particularly notable given the challenging backdrop of rising interest rates, valuation compression, and prolonged sector underperformance.

For comparison, our REIT benchmark returned just 21% over the same period. In other words, the portfolio delivered roughly three times the market’s return during one of the most difficult stretches in recent REIT history.

This outperformance is the result of us picking far more winners than losers relative to our benchmark over the long run. Good examples of that include IWG, EPR, EPRT, STOR, MAC, SPG, AIRC, TCN, ACC, BRX, SRC, IRT, etc.

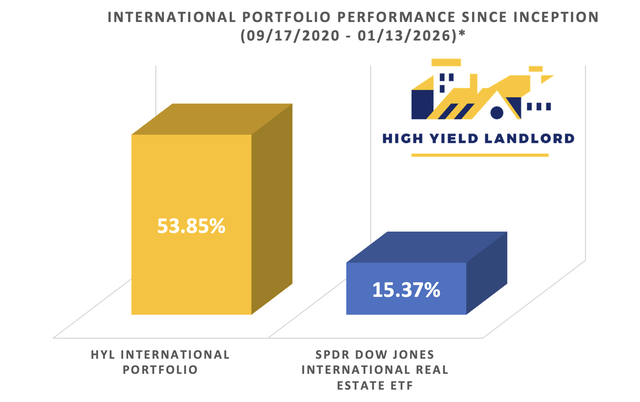

Our International Portfolio was launched in late 2020 and has enjoyed even greater outperformance relative to our passive benchmark:

(Because the objective of the Retirement Portfolio is to maximize safe long-term income rather than total return maximization, we do not actively track or optimize its total return performance.)

That said, long-term performance does not mean that every investment decision works out. Active investing requires taking risks, and with risk comes the possibility of losses. In some cases, external risk factors materialize. In others, our own assumptions prove incorrect.

With 2025 now behind us, this is a good moment to step back and review the portfolio’s weakest performers over the past year. The goal is not to dwell on mistakes, but to extract lessons that can improve decision-making going forward.

Alexandria Real Estate (ARE)

Alexandria Real Estate turned out to be our worst REIT investment of 2025, and not because the company suddenly became poorly run or financially reckless. Rather, a combination of deteriorating demand and policy-driven uncertainty pushed the life science sector into a much deeper and longer downturn than we had anticipated. This is a case where the timing of our entry mattered far more than asset quality.

What went wrong

The life science property sector was already dealing with oversupply when we initiated the position, and that risk was well understood. What changed materially in 2025 was the demand outlook. A series of unpredictable policy actions and proposals created an environment in which biotech and pharmaceutical companies could no longer plan confidently. Funding slowed sharply, IPO activity dried up, and R&D budgets were cut or delayed.

As a result, leasing activity weakened further at exactly the wrong time. Oversupply that we expected to normalize within a few years instead became entrenched, extending the downturn and putting pressure on occupancy, rents, and cash flows.

What we misjudged

In hindsight, we underestimated how sensitive life science demand is to policy stability. Long lease terms and a strong balance sheet provided some insulation, but they could not fully offset a sudden collapse in tenant confidence. We also bought too early, underestimating how Alexandria’s development pipeline would lead to substantial capex requirements in an increasingly uncertain environment.

That miscalculation ultimately forced Alexandria to reassess its capital allocation. The subsequent dividend cut, while prudent from a balance sheet perspective, marked a clear turning point in how the market viewed the stock and contributed to its sharp underperformance.

Key lesson

Even the highest-quality REITs can become vulnerable when demand is policy-driven rather than purely economic. In sectors like life science, government actions can materially delay recoveries and extend downcycles well beyond initial expectations. Going forward, we will place greater emphasis on demand-side visibility, especially where public funding and regulation play a central role.

Where things stand today

Alexandria has transitioned from a perceived defensive blue-chip into a higher-risk, higher-reward special situation. Near-term fundamentals remain challenged, and management now expects a multi-year recovery rather than a quick rebound. That said, the company is using this period to strengthen its balance sheet, recycle capital, and concentrate its portfolio around its highest-quality megacampus assets.

The stock now trades at the lowest valuation in its history, even lower than during the Great Financial Crisis. If demand eventually normalizes and vacant space is re-leased, the upside could be very significant. That outcome will require patience and a tolerance for volatility, but I view it as likely, given that the life-science industry is still in its infancy, and the AI revolution promises to unleash a golden age of healthcare innovation.

Alexandria was clearly a loser for us in 2025. It is also a reminder that being early can look indistinguishable from being wrong for long periods of time. Whether this investment ultimately remains a mistake or evolves into a long-term success will depend on how the life science cycle unfolds over the coming years. I have not lost hope and expect Alexandria to make a strong comeback.

RCI Hospitality (RICK)

RCI Hospitality was one of our biggest losers of 2025, but it is important to start with context. The entire consumer discretionary space has been under heavy pressure. Restaurants, apparel brands, entertainment companies, travel, and leisure have all sold off sharply as concerns around a weakening consumer and labor market intensified. Even large, globally recognized brands such as Nike (NKE) and Chipotle (CMG) have lost more than half of their value over the past several years.

Against that backdrop, it is not surprising that RCI Hospitality performed even worse. Nightclubs sit at the very end of the discretionary spending spectrum. When consumers feel uncertain about their income or job security, spending on premium nightlife and entertainment is often among the first items to be cut. As a small-cap company with highly discretionary exposure, RICK was always going to be more volatile than the broader market if and when the consumer weakened.

That macro weakness explains part of the decline, but not all of it.

What went wrong

RICK’s underperformance was compounded by a major, company-specific shock. In 2025, the company was indicted in New York on state charges related to alleged underpayment of sales taxes tied to its club-issued voucher system, as well as allegations of bribery involving a state tax auditor. Regardless of the ultimate outcome, this introduced a level of legal and reputational risk that the market was not prepared to tolerate.

The headline risk alone was enough to materially reset investor expectations. What had already been a cyclical downturn for discretionary spending quickly turned into a crisis of confidence around governance, compliance, and management credibility.

What we misjudged

In hindsight, we underestimated how severely a legal overhang could impair valuation, even if the underlying business remains cash generative. While the alleged tax exposure itself appears manageable relative to the company’s earnings power and asset base, the presence of criminal allegations, particularly related to bribery, fundamentally changed the risk profile of the investment.

We also underestimated how unforgiving the market would be toward a small-cap company operating in a controversial industry once trust in management was questioned. In such cases, valuation can compress far beyond what fundamentals alone would justify.

Key lesson

Highly discretionary businesses with regulatory exposure carry asymmetric downside risk. Even when assets are valuable and cash flows are strong, legal and governance issues can overwhelm fundamentals for extended periods of time. Going forward, we will apply an even higher margin of safety and position sizing discipline when investing in businesses where management conduct and regulatory scrutiny are central risk factors.

Where things stand today

Despite the damage to sentiment, RCI Hospitality’s assets and cash-generation ability have not disappeared. The company continues to produce substantial free cash flow, and the estimated value of its owned real estate alone exceeds its current market capitalization. The legal case is serious, but it appears to be narrowly focused on a small subset of operations in one state, rather than a systemic issue across the business.

It is also worth adding some longer-term perspective. RCI Hospitality was once my single best investment ever. My initial purchases were made at around $15 per share, and the stock rose to nearly $100 just a few years later. That outcome was driven by disciplined club acquisitions executed at enormous spreads, aggressive share repurchases, and steady free cash flow growth.

Today, the stock trades closer to $30, despite the fact that the company has materially expanded its asset base since then through additional club acquisitions completed at attractive prices. In other words, while sentiment has clearly deteriorated, fundamental value creation has continued.

Management behavior supports this view. Over recent months alone, RCI has repurchased roughly 12% of its outstanding equity, an unusually aggressive pace by any standard. Management has also indicated that buybacks will remain a top capital allocation priority for as long as the stock trades at what they view as deeply discounted levels.

None of this eliminates the elevated legal and governance risk, and that risk is precisely why the stock trades where it does today. However, it does help explain why we are not panic-selling at these levels. The market is pricing in an extremely negative outcome, while the company continues to generate cash, retire shares, and own hard assets with meaningful underlying value.

RCI Hospitality is also a reminder that volatility cuts both ways. Stocks that once deliver exceptional returns can later become deeply out of favor, even after years of fundamental progress. Whether RICK ultimately remains a mistake or turns into another long-term recovery story will depend heavily on the resolution of the legal situation and the restoration of confidence in management. We expect a better outcome than what is currently priced by the market.

Caesars Entertainment (CZR)

Caesars Entertainment was another notable detractor in 2026, and much like RCI Hospitality, the starting point here is the broader environment. The market has aggressively repriced consumer discretionary businesses as fears of a weakening economy have intensified. Restaurants, apparel brands, entertainment companies, and travel-related stocks have all been hit hard. Even large, globally recognized consumer brands have lost 50% or more from prior highs.

Casinos sit among the most cyclical of all discretionary categories. When consumers feel pressure from job insecurity, slowing wage growth, or higher living costs, spending on travel, gambling, and entertainment is often reduced. Against that backdrop, it is not surprising that Caesars Entertainment saw its share price fall sharply as investors grew increasingly concerned about a potential recession.

That cyclical pressure was further amplified by Caesars’ exposure to Las Vegas and international tourism.

What went wrong

As economic concerns mounted, Las Vegas experienced a softer period, particularly over the summer. While hotel occupancy rates remained high, traffic declined and visitor spending moderated. International visitation weakened meaningfully as well. Tourists from Canada, Mexico, Europe, and parts of Asia reduced travel to the US, adding another layer of uncertainty to near-term demand.

Importantly, this has not been purely cyclical. A growing share of international travelers are actively boycotting trips to the US in response to the current administration’s policies and repeated political attacks on foreign governments and institutions. The US has suffered a noticeable reputational hit abroad, and there is little reason to expect this dynamic to reverse quickly. For destinations like Las Vegas that rely heavily on international tourism, this has become a real and potentially persistent headwind.

These concerns weighed heavily on sentiment just as the market was already fleeing cyclical stocks. Caesars’ leverage magnified those fears. Although the company has no major debt maturities until 2029, investors worried that a prolonged slowdown could delay deleveraging plans and pressure cash flows in the interim. The result was a sharp reset in valuation.

What we misjudged

We underestimated how quickly sentiment could swing against casino operators once recession fears took hold, and how long those fears could persist. While Caesars’ assets and long-term earnings power remain intact, the market became singularly focused on near-term risks rather than long-term value creation.

We also misjudged the timing of value recognition for Caesars’ digital business. Despite strong operational progress and accelerating profitability, the stock continued to trade as if the company were solely a legacy, highly cyclical casino operator, with little credit given to its fastest-growing and highest-multiple segment.

Key lesson

In highly cyclical industries, valuation can disconnect from fundamentals for extended periods of time. Macro-driven sentiment can overwhelm company-specific progress, particularly when leverage and discretionary demand are involved. Even when a business is executing well internally, patience is required for value to surface.

Where things stand today

While the market remains focused on a potential slowdown in Las Vegas, Caesars’ underlying business has continued to evolve. Most notably, its digital segment has reached a clear inflection point. Management now expects the digital business to generate $500+ million of adjusted EBITDA in 2026, up dramatically from recent years. On a standalone basis, that level of profitability could support a valuation that rivals or exceeds Caesars’ entire current market capitalization.

This growth is not accidental. Caesars benefits from the largest loyalty program in the casino industry, allowing it to scale its digital platform with far lower customer acquisition costs than digital-only competitors. The integration between physical casinos and online gaming creates powerful cross-selling synergies that competitors struggle to replicate.

Beyond digital, Caesars owns a substantial real estate portfolio that remains largely unrecognized in the current share price. Over time, we expect the company to monetize additional assets through sale-leaseback transactions, using proceeds to reduce debt and repurchase shares, particularly as interest rates decline.

At today’s valuation, the market is effectively pricing Caesars as if its digital business has little value and its physical assets are permanently impaired. We believe that view is overly pessimistic. Even assuming continued near-term volatility, the gap between price and intrinsic value has become unusually wide.

Caesars was clearly a loser for us in 2025, driven largely by macro concerns, cyclical fear, and geopolitics rather than operational failure. However, unlike some past disappointments, the company has continued to create value beneath the surface. If consumer conditions stabilize and the digital segment continues to scale as expected, Caesars has multiple paths to materially higher equity value over the coming years.

This remains a higher-risk investment, but at current levels, we believe the long-term reward potential more than compensates for the uncertainty, which is why Caesars remains a Core Portfolio holding despite its short-term underperformance.

Closing Note

Not every investment works out, and this review is a reminder of why diversification and discipline matter. While individual positions can disappoint, portfolio-level results are driven by process, risk management, and long-term thinking.

In the next article, I will review the portfolio’s biggest winners over the past year and highlight what went right. Stay tuned!

Finally, please note that we have exceptionally posted this article without a paywall. If you found it valuable, consider joining High Yield Landlord for a 2-week free trial.

We expect to share a Trade Alert with our paid members tomorrow, and by starting your free trial today, you will also gain access to it. You will also get immediate access to my entire REIT portfolio, our exclusive REIT CEO interviews, and much more. We are the largest and highest-rated REIT investment newsletter online, with over 2,000 paid members and more than 500 five-star reviews.

We spend thousands of hours and over $100,000 per year researching the market for the most profitable investment opportunities, and we share the results with you at a tiny fraction of the cost.

Get started today - the first 2 weeks are on us:

Analyst’s Disclosure: I/we have a beneficial long position in the shares of all companies held in the CORE PORTFOLIO, RETIREMENT PORTFOLIO, and INTERNATIONAL PORTFOLIO either through stock ownership, options, or other derivatives. We also own a position in FarmTogether. High Yield Landlord® (’HYL’) is managed by Leonberg Research, a subsidiary of Leonberg Capital. All rights are reserved. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. The newsletter is impersonal and subscribers/readers should not make any investment decision without conducting their own due diligence, and consulting their financial advisor about their specific situation. The information is obtained from sources believed to be reliable, but its accuracy cannot be guaranteed. The opinions expressed are those of the publisher and are subject to change without notice. We are a team of five analysts, each contributing distinct perspectives. Nonetheless, Jussi Askola, the leader of the service, is responsible for making the final investment decisions and overseeing the portfolio. We do not always agree with each other, and an investment by Jussi should not be taken as an endorsement by other authors. Past performance is no guarantee of future results. Our portfolio performance data is provided by Interactive Brokers and believed to be accurate but its accuracy has not been audited and cannot be guaranteed. Our portfolio may not be perfectly comparable to the relevant index. It is more concentrated and may at times use margin and/or invest in companies that are not typically included in REIT indexes. Finally, High Yield Landlord is not a licensed securities dealer, broker, US investment adviser, or investment bank. We simply share research on the REIT sector.