My Largest HYI Investment For 2023

I am very bullish on REITs because they essentially allow you to buy high-quality real estate that's professionally managed at a heavily discounted price.

If you were offered to buy real estate at 50 cents on the dollar, you would probably jump on the opportunity, but somehow, because REITs are publicly traded, a lot of investors are reluctant to buy them.

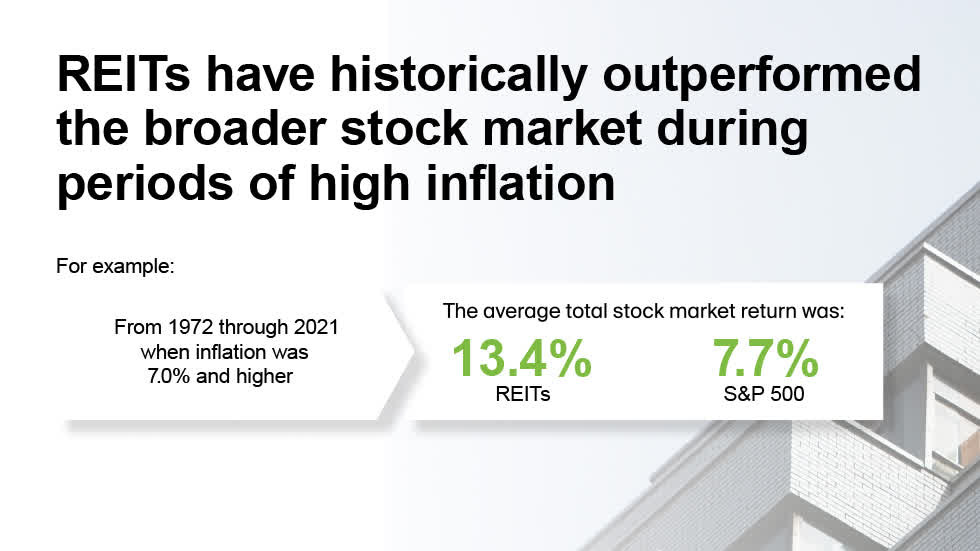

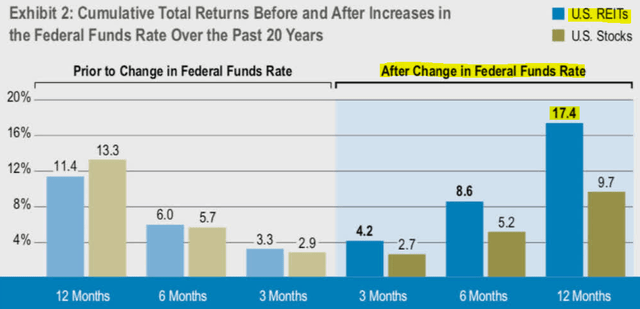

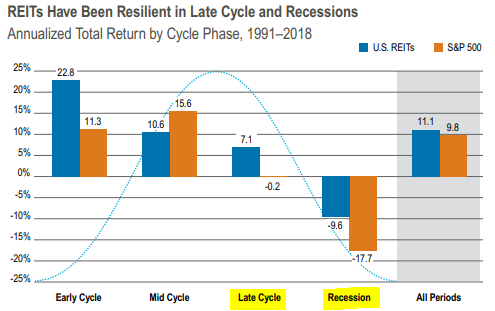

Yes, there is uncertainty at the moment with high inflation, rising interest rates, and the risk of a near-term recession; but REITs have strongly outperformed in the past when faced with similar headwinds:

Chart #1 - REITs outperform when inflation is high because it leads to rapidly rising rents:

Chart #2 - REITs outperform following interest rate hikes because they use little debt, interest rates are fixed, and maturities are long:

Chart #3: REITs outperform in late cycles and recessions because they generate steady rental income from long-term leases in most cases:

Despite all of that, REITs are today priced at historically low valuations and offer high dividend yields and future upside potential.

So I am very bullish and invest heavily in REITs... But that does not mean that I invest 100% of my capital into them.

Diversification is the only free lunch and you don't want to have all your capital tied into one sector, which could become the victim of a black swan event. The pandemic was a great example as it had a much worse impact on REITs than Tech stocks for instance.

For this reason, I invest about 50% of my capital into the REITs that are highlighted at High Yield Landlord, and I invest the other 50% in a portfolio of high-yielding stocks and bonds, which we cover at our sister service, High Yield Investor:

More than half of you (~1,300 out of 2,500 HYL subscribers) have already joined us at High Yield Investor and know what it is all about, but for the rest of you, we wanted to give a quick overview of our sister service, highlighting its performance as well as my largest investment.

If you think that this is something that could make sense for you, I would like to also invite you to join our sister service for a 2-week free trial to access all our largest investments for 2023. We have asked Seeking Alpha to add a 75% discount to your account, which is exclusively reserved for members of High Yield Landlord, in case to decide to stay with us for the long run.

I am shamelessly promoting our sister service a bit because I think that this is a great deal for HYL members and as you will see shortly, those who joined us early have reaped the rewards and it is largely thanks to these investments that my portfolio has outperformed in 2022. If you aren't interested in this additional service, you will still get value by learning more about my largest HYI investment. Thank you for your consideration!

2-Year Anniversary Performance Review

Our Core Portfolio went live two years ago on December 3rd, 2020. Since then, the markets have been very volatile with strong market tailwinds during much of 2021 followed by significant turbulence in 2022.

Thankfully, despite the rapidly evolving and very volatile macro conditions due to soaring inflation, rising interest rates, growing calls for a recession, and the war in Eastern Europe, our Core Portfolio has continued to meaningfully outperform both the broader high yield U.S. equities sector (as represented by the Super Dividend ETF (DIV)) as well as the S&P 500 since our portfolio's inception 24 months ago, with a 52.03% cumulative total return over a two-year period:

HYI Core Portfolio52.03%Global X Super Dividend ETF (DIV)30.91%S&P 500 (SPY)14.24%

In addition to the overall outperformance being encouraging to us, we are also very glad to see that our portfolio has outperformed quite consistently over that period. In our first year, our portfolio generated a 32.98% total return against a 25.39% total return for SPY and 24.98% total return for DIV. Over the past year, our portfolio has continued to generate very attractive returns while SPY has generated meaningful losses and DIV has generated only modest positive total returns, giving our portfolio its current substantial alpha relative to the high yield sector and the broader stock market.

My Largest HYI Investment

High Yield Investor covers the non-REIT portion of my portfolio, which is mainly invested in:

Simple businesses: underwear manufacturer, utilities, asset managers… and even a few tech firms – all with high dividends.

High-yielding preferred shares and baby bonds.

Business development companies.

MLPs, Yield Cos, and other infrastructure investments.

Etc…

Just like at High Yield Landlord, there are three portfolios and they include a total of 49 investments:

Core Portfolio: 19 investments

Retirement Portfolio: 22 investments

International Portfolio: 8 investments

Out of those, my single largest holding is Patria Investment (PAX).

Over the past year, it has gotten a lot cheaper as its share price declined even as it grew at a rapid pace. As a result, I kept accumulating more shares and it now represents about 5% of my overall net worth and it is my 4th largest investment overall.

In what follows, I will present the company, explain what makes it so attractive, and present the bull case for significant returns going forward:

Patria Investment: a Mini-Blackstone of Latin America

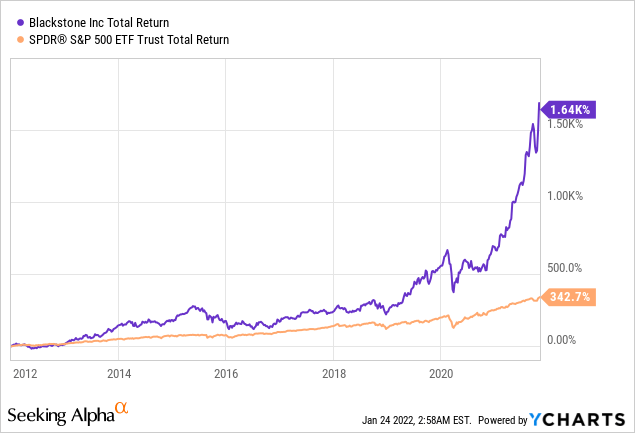

Blackstone (BX) has been one of the most rewarding investments of the past decade. $100,000 invested in 2012 would have resulted in nearly $2 million a decade later if you had reinvested dividends:

Blackstone was so incredibly rewarding to its shareholders because of three key reasons:

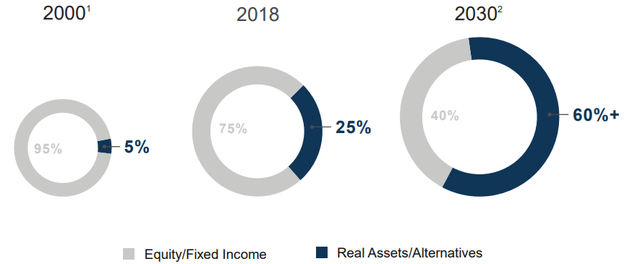

#1) The demand for alternative investments grew significantly: private equity, infrastructure, credit, commercial real estate and other alternative investments have become mainstream asset classes that all investors want to include in their portfolios. Institutional investors used to invest just 5% of their portfolios in these assets back in 2000. Today, it is closer to 25%.

#2) It led to rapidly growing assets under management: Blackstone captured a large share of this growth because it is a one-stop-shop with a great track record and reputation; and on top of all of its organic growth, it was also able to acquire a bunch of its smaller competitors, integrating them in its platform, and then cross-selling their investment products.

#3) The economics of its business are spectacular: The business of alternative asset management is arguably one of the best in the world because it is capital-light, high-margin, highly scalable, and the fee income is very sticky since these are long-term illiquid investments. Essentially, they allow the asset manager to participate in the returns of different investments without having to put much or any of its own capital.

Even today, I think that Blackstone remains a good investment opportunity because the demand for alternative investments will keep on growing in the long run and Blackstone is well-positioned to benefit from it.

However, Blackstone is now approaching nearly $1 trillion of capital under management and this will inevitably slow down its growth and reduce its future returns. To grow its assets under management by just 5%, it would need to raise ~$50 billion and that would not even account for redemptions and capital outflows. It does not mean that Blackstone's growth is over, far from it, but it will become harder to grow now that it has gotten so big.

This brings us to Patria Investments (PAX).

I believe that Patria is set to replicate Blackstone's exceptional results over the coming decade.

Patria is essentially a mini-version of Blackstone, but it specializes in alternative investments in Latin America. It is commonly perceived to be Latin America's Blackstone because:

It is the market leader in Latin America.

It has an exceptionally strong track record.

It offers very similar products as Blackstone.

It used to collaborate closely with Blackstone.

Blackstone even used to be its biggest shareholder (but it recently exited its investment because Patria refused to sell control to Blackstone).

They even used to have this logo on their investor material:

So it is very similar to Blackstone and if one company has the potential to replicate Blackstone's past success, then it is Patria.

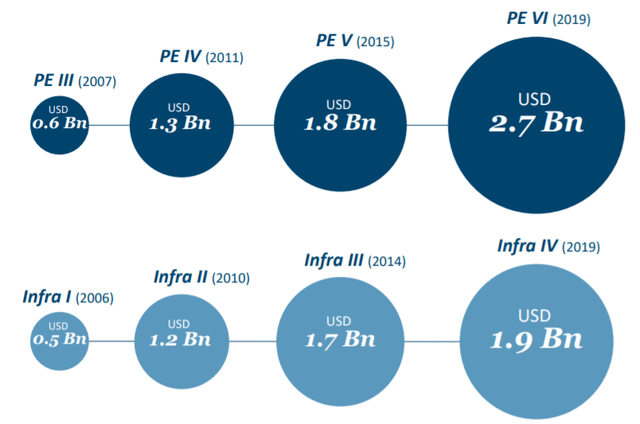

But unlike Blackstone, which has nearly $1 trillion of capital under management, Patria is still just getting started with $27 billion of assets under management.

And Patria is special in that it is the leader in Latin America, which we think will experience a boom in demand for alternative investments over the coming decade. To access these markets, investors will have to partner with a local manager that has boots on the ground, and their partner of choice will be Patria because it is the "Blackstone of Latin America".

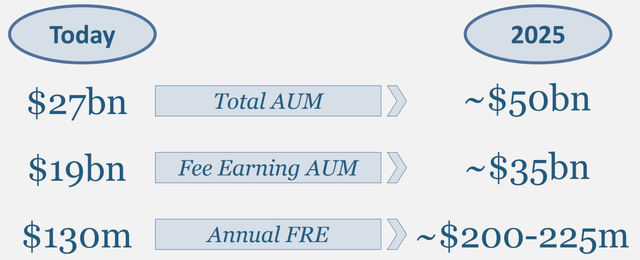

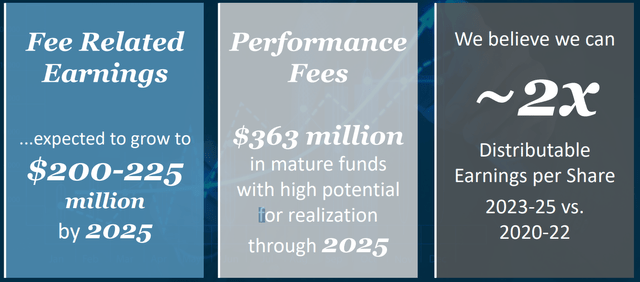

The management of Patria think that they can nearly double their asset under management in the coming two years:

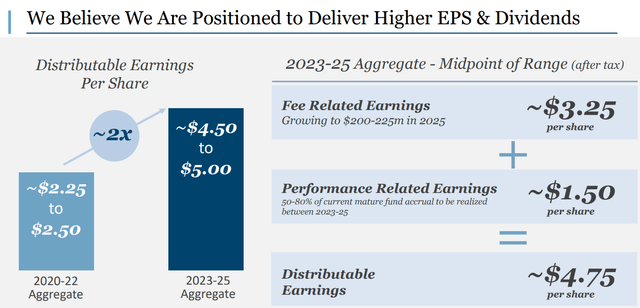

And this should result in a near doubling of their cash flow and dividend per share:

The management has a history of underpromising and overdelivering. Since their IPO two years ago, they have already nearly doubled their assets under management.

But regardless of what exactly happens in the next two years, we are very bullish about Patria's long-term prospects.

Here are three reasons why:

Reason #1: The demand for Latin American alternative investments is set to boom

Today, most investors still focus on alternative investments in developed countries and this is understandable given that alternative investments are still a fairly new thing and they only recently become popular.

Back in the year 2000, institutional investors would only allocate about 5% of their portfolios to alternative asset classes like private equity, infrastructure, and commercial real estate. Today, it is closer to 25% and it is expected to grow up to 60% by 2030:

The reason why alternative investments have become so popular is that they nicely complement a portfolio of stocks and bonds. They allow investors to boost their overall portfolio returns, reduce risks, and boost their income.

But as you can see, this whole change in portfolio allocations is still very recent, and emerging markets are still behind.

Only today are alternative investments becoming competitive in developed markets. Valuation multiples have expanded for private equity and cap rates have compressed for commercial real estate.

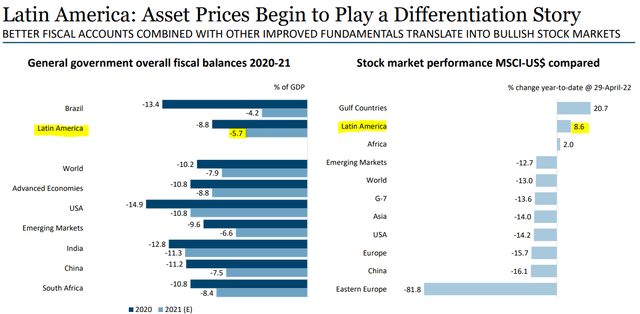

As a result, the future expected returns have also declined and it has pushed investors to look abroad for more rewarding investment opportunities. Asia and Eastern Europe were some of the first choices for most investors. But recently, China's communist party has become increasingly hostile towards foreign investors, and Russia's invasion of Ukraine has caused great instability in Eastern Europe, materially increased commodity prices, and also reminded investors that dictatorships like Russia and China cannot be trusted.

Which regions are the biggest winners from all of this?

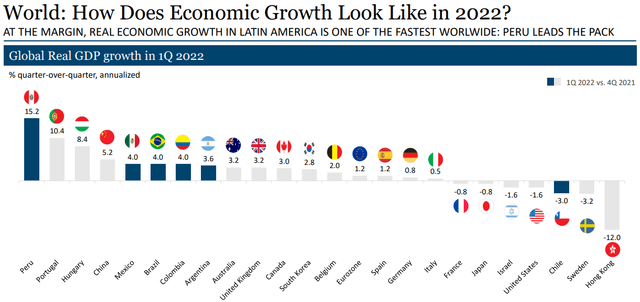

It is arguably Central and Latin America because the headwinds of the rest of the world are their tailwinds:

Near-shoring: As a result of the pandemic and the war in Ukraine, increasingly many companies are now bringing back larger portions of their supply chains closer to the US, far away from tensions. This trend is called near-shoring and it greatly benefits Central and Latin American countries because they are relatively close to the US and far away from geopolitical tensions. Moreover, they have large populations, relatively low labor costs, and a rapidly growing middle class.

Higher commodity prices: A consequence of the war in Ukraine is that commodity prices have risen significantly and while it hurts most countries, it actually benefits Latin America since they are some of the biggest exporters of vital commodities. Their trade balance is now strongly positive as they are the suppliers of most of the commodities that were affected by the war.

Further in the credit tightening cycle: Latin American countries are not as leveraged as most of the rest of the world and it allowed them to take rapid actions on the monetary front to fight inflation. They are now further in their credit-tightening cycle and have a good chance of outperforming as other countries are still behind and forced to keep hiking interest rates.

This explains why the real economic growth of Latin America has been some of the fastest in 2022 and it is expected to continue:

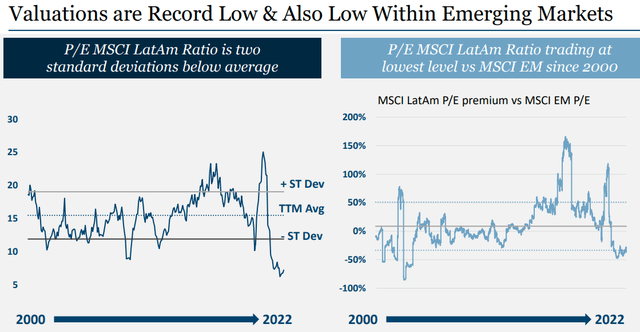

And despite these strong prospects for economic growth, the valuation multiples of alternative investments are today still very low in Latin America because it is an unpenetrated market with relatively few investors and little competition.

That's very compelling for investors because, on one hand, higher economic growth and low competition for investments should lead to higher returns, and on the other hand, the unique position of Latin America in today's world should provide real diversification benefits.

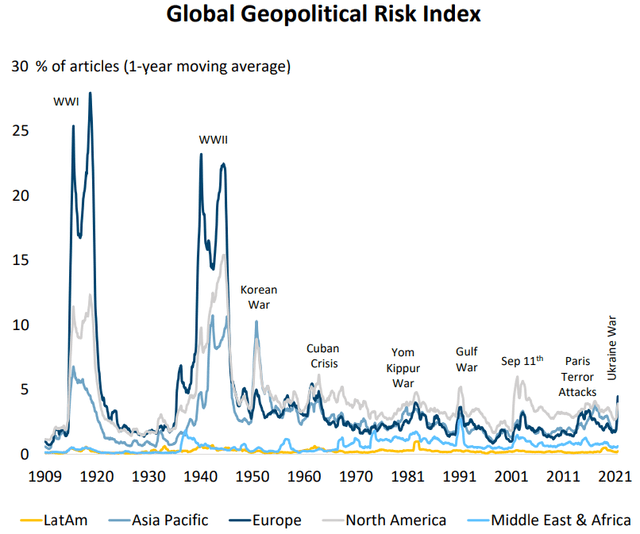

Just take a look at the low geopolitical risk of Latin America when compared to the rest of the world:

Whenever geopolitical risks arise (such as the biggest war in Europe since the second world war...), Latin America emerges as a safe haven, far away from conflicts.

This was true during the second world war, and it is true again today:

I think that this will push a lot of investors to allocate more capital to Latin America because there are growing tensions between the West and the East and Russia's invasion of Ukraine and China's future potential invasion of Taiwan could still turn into a world war.

What's your safe haven if this happens?

Alternative investments in Latin America can be part of the plan because they provide real diversification benefits, are far away from tensions, and they may even benefit from shocks that increase commodity prices.

Despite all of this, investors are today still massively under-allocated to Latin American alternative investments, but this is set to change.

Returns are stronger... the diversification benefits are significant... what's not to like about it?

The most obvious winner of this should be the market leader: Patria.

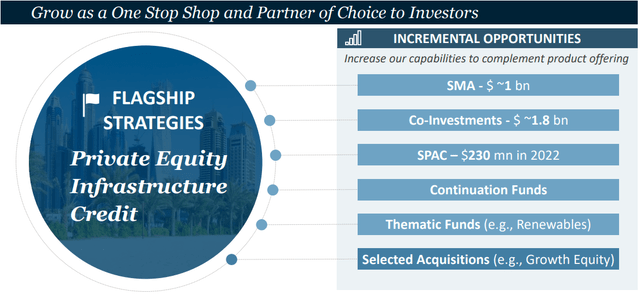

Reason #2: Patria is the partner of choice for major global investors and this should lead to rapid organic growth

To invest in Latin America, you absolutely need to have local partners who know what they are doing and have relationships. It is not like in the US where technically, anyone could just come and start investing in alternative assets on their own.

In Latin America, there is still high corruption, foreigners are often taken advantage of, and a lot of things are still done differently.

It makes Patria even more indispensable for global investors because they simply cannot go there on their own and expect to achieve similar or better results.

Patria is the partner of choice because as we noted earlier, it has established itself as the local Blackstone:

Excellent reputation: Its past affiliation with Blackstone gives it trust and credibility, which is precisely what most local asset managers are missing when dealing with large global investors. They can trust Patria because they know that it used to work closely with Blackstone which brought all the Western best practices to the company.

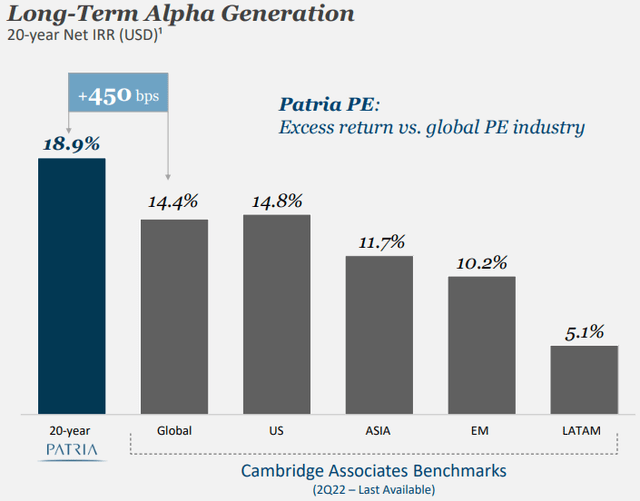

Exceptional track record: Patria has proven itself. It has a multi-decade track record of very significant outperformance across all of its major asset classes including private equity, infrastructure, credit, commercial real estate, and public securities. Most notably, it has generated an 18.9% net IRR in USD over the past 20 years, which is materially more than the global, US, and emerging market averages.

One-stop-shop: Large global investors want a one-stop-shop that they can rely on for all their investment needs in one region to limit complexity risk. This greatly benefits the larger asset managers who keep gaining market share from the smaller players. Patria is one of the only true one-stop shops for alternative investments in Latin America, which makes it uniquely attractive.

All in all, this should position Patria for significant organic growth as it raises ever-growing funds for its existing strategies...

... All while it also launches and scales more products to meet the needs of its clients and cross-sells them across its entire platform:

All of this should position Patria for significant organic growth over the coming years. In an exclusive interview with the management, we learned that they expect to grow organically at 20%+ per year and all of this growth requires very little incremental capex.

In addition to that, they will also grow externally via M&A, which we discuss below:

Reason #3: The fragmented nature and low valuation multiples provide significant M&A opportunities for external growth

Today, the Latin American market is highly fragmented with lots of small asset managers and few big ones.

It provides great opportunities for Patria to consolidate the sector as it buys small asset managers with strong track records and complementary businesses and distribution channels.

Here's what the management told us in a recent interview:

"The overall story is, there's a big opportunity in Latin America because it is such an underpenetrated and fragmented space here. There aren't a lot of big fish here, and there are a lot of smaller fish that fill in really interesting white space in our platform, like real estate or more local distribution capability or geographical competency in Colombia or Mexico or regions where we see a substantial opportunity, but we don't really have boots on the ground today. So, I think there's still a very good opportunity for consolidation and cross-selling across platforms for us to take advantage of."

And since small private companies sell at low multiples in Latin America, Patria is able to buy out its peers in ways that are highly accretive to shareholders...

Patria can issue equity at cost X and buy other asset managers at return Y, earning high positive spreads in between. Moreover, these acquisitions are highly synergetic because they increase their geographic exposure, improve distribution channels, enable cross-selling opportunities, and continue to reaffirm their position as a one-stop shop, which only makes them more desirable for global investors.

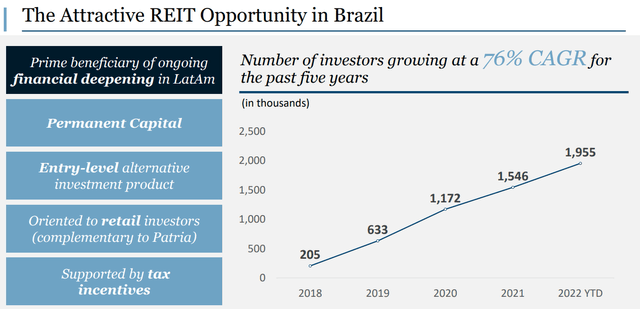

My favorite example is Patria's recent acquisition of VIB Real Estate, which is an asset manager that specializes in REIT investment vehicles in Brazil with ~$1 billion of assets under management.

VIB is the manager of 7 growing REITs in Brazil, they have strong track records, and the concept is now rapidly growing in popularity. The number of REIT investors in Brazil has grown at a 76% CAGR over the past five years and it is already the largest alternative asset class in Brazil:

This is Patria's first move into the REIT business and it is highly complementary to its platform as it will now be able to scale these vehicles and replicate new ones in other Latin American countries. The potential for growth is massive in this one sector alone! It is still very early days for REITs in Latin America and Patria is set to become a pioneer in this space.

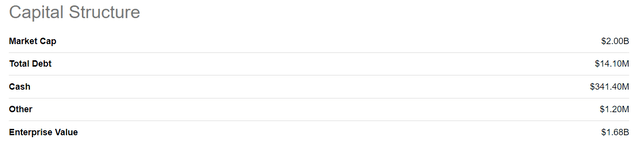

Debt-Free Balance Sheet To Push For Growth

Today, Patria has practically no debt on its balance sheet and it has significant cash at a little over ~$100 million to keep acquiring new asset managers and expanding its existing strategies (It's a bit confusing because they raised a SPAC and there's $230 million of cash for the stock on their balance sheet):

To give you another example, Patria just recently announced that it was going to acquire Igah Ventures, which is a pioneer of venture capital in Latin America. It expands its offering into venture capital, which is highly synergetic to its private equity business. Igah is still small in size with just $320 million of assets under management, but it is growing rapidly, has a strong track record, and will now benefit from Patria's platform and investor base.

With no debt on its balance sheet and plenty of cash on hand, Patria can keep acquiring such companies without even having to access the public equity markets, which makes its future growth even more predictable.

It also lowers risks and provides additional capacity for growth if someday it decided to add some debt to its balance sheet.

Shareholder-Friendly Management That's Focused on "Per Share" Growth

If you study Patria's investor material, you will quickly notice that they strongly focus on growing the company in a way that benefits shareholders.

They don't want growth just for the sake of growth.

They want to grow on a "per share" basis.

And that's understandable when you consider that the insiders of Patria own a significant chunk of the equity in the company and they also have a 5-year lock-up from the recent IPO.

Discounted Valuation

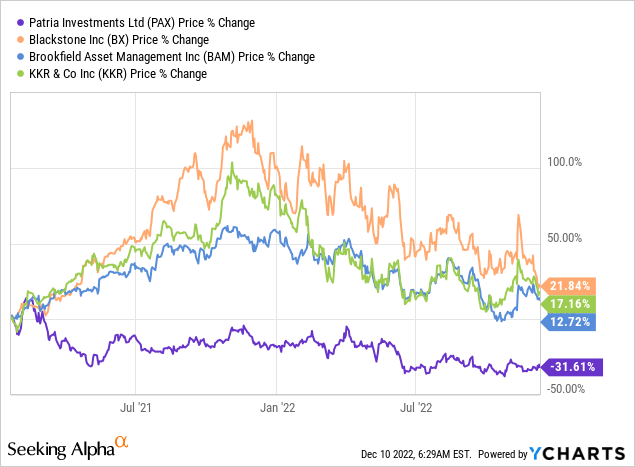

Major alternative asset managers have experienced significant growth in their assets under management over the past years and the market has rewarded them accordingly. Even after seeing their valuations cut in half in 2022, most major asset managers are still up by ~20% over the past two years.

The only exception is Patria (PAX), which is down 30%, and that's despite growing even faster than some of its peers:

I think that this poor stock price performance is mainly the result of Blackstone exiting its stake. As we noted earlier, Blackstone used to own a large chunk of Patria, and it wanted to acquire a controlling stake in it, but Patria refused and they eventually agreed to do an IPO to allow Blackstone to exit their stake since it didn't make sense for them to hold on to a non-controlling stake.

Here is what the management told us on this topic in our exclusive interview:

"I think the IPO was a path to liquidity for them. For a big firm like Blackstone, we had a great partnership for 10 years. I think strategically, they never developed the interest in really making Latin America a big part of their global strategy. And Patria's leadership really saw a big growth opportunity and wanted to be fully in the driver's seat of that. So, we fully expect them to exit that position because it just doesn't make sense for a firm of Blackstone's size to have a minority stake in a firm like Patria on its balance sheet. It's just not a strategic focus. And it would just be something that's kind of there without a real strategic purpose...

At that point it could potentially help our stock. For some people, Blackstone's impending exit has been kind of an overhang as there's been a concern that a substantial block of stock could be dumped on the open market at any point. And so, at that point, I think it will be a positive when they're fully out because any perception of an overhang I think will be gone and it also is helpful for liquidity, because we've got big chunks of stock that are kind of locked up with them.

Now, we think the concern about an overhang is not really justified. When they exited their first two blocks in private transactions, it was spread among a number of investors. Our largest investor is, now if you look at the 13 F filings to see who the largest investor in our float is, Capital Group. They were able to acquire big pieces of their stake through Blackstone's initial exits from our stock...

But it's important to know, Blackstone, they were a great partner for Patria for a number of years. They are not at all part of the business operationally today in any way. There's nothing that Blackstone is doing for us and when we were partners with them, there were certain ways that we leveraged their platform, not for fundraising, but just operationally, but that's fully detached at this point. So, there's no business operation dependence on Blackstone whatsoever."

This unusual situation provides us an opportunity to buy shares at an exceptionally low valuation.

As Blackstone exited its stake, it increased the supply of shares and depressed the share price. Moreover, since investors knew about this, many were reluctant to buy shares until Blackstone was done selling, reducing the potential demand for its shares.

But this is now behind and Patria is still heavily discounted, but for how long?

Net of unrealized accumulated performance fees, it is priced at just $11 right now, which equals to 13x its annualized FRE. That's quite exceptional when you consider that the company has grown its FRE per share by 54% in 2022 and this does not give any credit for any additional performance fees that they will accumulate over time.

In comparison, Blackstone trades at ~20x their annualized FRE and that's despite growing at a slower pace and facing greater headwinds. Also, earlier this year, Blackstone traded at closer to ~30x FRE and we think that this was more reflective of its fair value.

Since both companies are very similar, have a shared past, and even have the same dividend policy of paying out 85% distributable earnings, the discount in valuation is very obvious.

Should Patria trade at the same valuation?

I believe that it should.

Yes, it is smaller and the Latin American markets are riskier. But it also enjoys far better long-term growth prospects, and most of its investments are in defensive industries like consumer staples, infrastructure, and real estate. Moreover, the Latin American risk is also mitigated as they invest in many different countries and aren't reliant on a single one.

At the very least, you would probably agree that the discount is excessive.

If you priced Patria at the same multiple as Blackstone (which is itself heavily discounted right now), Patria would trade at a 50%+ higher level. If it traded at where Blackstone traded earlier this year, then Patria would need to more than double.

But I am not focused on the near-term upside from repricing.

What really interests me about Patria is its long-term growth prospects because if it can grow as fast as I expect it to grow, the upside will be much greater in the long run. As a reminder, Blackstone earned a 1,600%+ return over the last decade as it scaled its assets under management.

Patria could be set to replicate that:

Shareholder-Friendly Dividend Policy

Another reason why I like Patria so much is that asset management is a capital-light business and it allows it to pay out 85% of its distributable earnings to shareholders in the form of dividends.

That results in a 5%+ dividend yield based on its recurring fee-related earnings alone and that ignores any additional performance fees that they will earn along the way. Once you include the performance fees, the management expects the dividend yield to average around 10% in the coming few years.

Moreover, since Patria is structured in the Cayman island, there shouldn't be any withholding tax on the dividend, which is rare for a foreign stock.

Risks

The biggest risk in Patria is its geographic focus.

Latin America is a lot shakier than the USA. There is more corruption, crime, higher inflation, and economic growth is more volatile.

All of that presents risks but also opportunities because this is why big players have largely skipped the region.

The greater complexity, boots-in-the-ground, relationships, reputation, and track record give Patria a greater moat.

Over its three decades of experience, Patria has also proven its ability to raise and allocate capital throughout different environments, some good and some bad.

The debt-free balance sheet and superior management also add additional safety to the thesis. So while we are not overlooking this risk, we think that Patria is an ideal vehicle in terms of risk-to-reward to gain diversified exposure to the region.

Bottom Line

It really boils down to this day:

I think that asset management businesses are some of the best businesses in the world because they are capital-light, high-margin, highly-scalable businesses with sticky earnings.

And Patria happens to be one of the best assets managements businesses out there because its geographic focus provides significant barriers to entry, it has a clear moat in its brand, it has significant pricing power, lots of M&A potential, and huge organic growth ahead of it. Besides, it also has no debt, an excellent management team, and a shareholder-friendly dividend policy.

Despite that, it is priced at a heavily discounted valuation and offers significant repricing potential from multiple expansions alone, and it is set to double earnings per share over the coming 2 years on top of that:

While you wait, you are also set to earn a ~10% average annual dividend yield in the years ahead. It is hard to find more compelling than that and this is why Patria is currently my largest investment from the High Yield Investor portfolio.