Our Largest REIT Investment – An Update

Our Largest REIT Investment – An Update

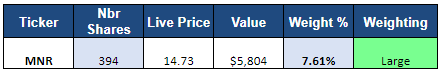

In March of this year, we added Monmouth Real Estate (MNR) to our Core Portfolio and gradually built it into our single largest position today:

The reason why we bought so much of it is because it appeared to be grossly mispriced for a fast growing REIT with defensive characteristics in a late cycle economy.

The market saw it as a “risky small cap” REIT due to negative headline news. We saw it as a “lower risk blue-chip” company after assessing its fundamentals and interviewing the CEO.

Lately, the shares have rebounded and put us ahead of the broader REIT sector. Our investment is up by nearly 15% over the past 7 months. Given that this is our largest holding, now is a good time to take a step-back and reassess whether MNR remains an attractive investment for our newest members who do not own it yet.

(Note that anything can happen over short-time periods and so this is by no means to be taken as a “victory lap”. MNR could be down by 10% and it would not affect our thinking.)

The Fundamental Story is Unchanged

Industrial real estate is one of our favorite property types for long term investments. This is because it possesses many of the same advantages as office properties, but typically requires less CAPEX over time, may be bought at higher cap rates, and with even longer lease terms.

The tenants of office buildings are generally very picky about the design of the property, including small things such as the wallpaper, the color of the carpet, and the age of the elevator. After all, this is where the executives are working and where numerous client meetings will take place.

However, they are not nearly as picky about their industrial property. As long as the property is able to fulfill its purpose, the tenant is likely to stay in there for a very long time. The property will require significantly less capex to maintain, which ultimately leaves more cash flow to the landlord. “If it ain’t broken, don’t fix it.”

Industrial properties are also very popular among investors because they profit from two mega-trends: the growth of e-commerce and globalization. This has led to rapidly growing demand for industrial space and allowed owners to push for material rent increases year-after-year.

Unfortunately, this is now well-known to everyone. These properties have attracted a lot of capital in the recent years and cap rates are down to new historic lows. Similarly, industrial REITs have seen their valuations expand to ~25x FFO on average. While we agree that industrial properties are attractive, we are uncomfortable investing at such high multiples.

Fortunately, there still exist one exception that allows us to gain exposure to industrial real estate at much lower price. And that is Monmouth Real Estate (MNR). MNR is an industrial REIT that saw its FFO multiple compress and then stagnate around 15x FFO over the past year. That is a ~30% discount relative to its closest peers – which implies that MNR must be an inferior REIT with significant challenges.

Interestingly, we find the opposite to be true and believe that MNR actually has one of the best (if not, the best) combinations of: (1) quality portfolio, (2) conservative balance sheet, (3) and well-aligned management teams in its sector.

High Quality Portfolio

MNR owns a Class A portfolio that beats its peers on almost every front. Its portfolio is the youngest and most modern among all Industrial REITs. The average building age of MNR is just 9 years compared to 15 to 32 years for closest peers. This means that MNR’s properties are more modern and better adapted for the future growth of the e-commerce. This is also well reflected in the occupancy rate which is the highest of all industrial REITs at 98.9%.

The average remaining lease term of MNR is also the longest of its sector at 8 years with the lowest amount of maturities in the near term. Therefore, even if we went into a recession tomorrow, the cash flow would be highly secure for many years to come.

Unlike many of its peers, MNR favors “triple net” lease structures with its tenants. What this means is that the tenant is responsible for all property expenses (including taxes and maintenance) during its lease term. The tenant bares the risk of expense volatility and MNR is in a stronger position to earn highly consistent cash flow.

Finally, MNR also enjoys the highest exposure to investment grade tenants of all industrial REITs at 80%. This includes tenants such as FedEx (FDX), Amazon (AMZN), Anheuser – Busch (BUD), Coca -Cola (KO) and Home Depot (HD).

Conservative Balance Sheet

Most private equity real estate investors would finance long-let industrial facilities with 50-65% debt. Likely, closer to the higher end of this range for Class A facilities with investment grade tenants.

In comparison, MNR’s loan to value is currently at only 35%. Given the high quality of its assets and the durability of its cash flow, this is quite conservative and leaves room for leverage expansion if desired.

Moreover, MNR also enjoys an exceptionally long average mortgage maturity of 11.8 years. This is one of the longest debt maturity schedules of the entire REIT marketplace. Therefore, MNR has a very flexible balance sheet with substantial liquidity and access to capital.

Well-aligned Management Team

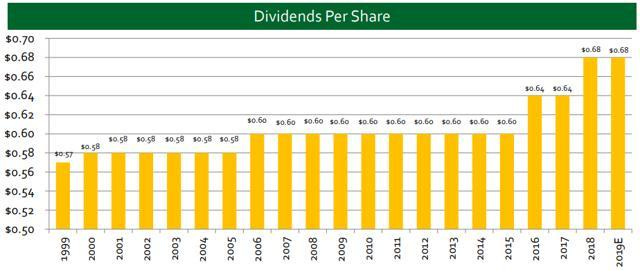

MNR is generally known from investors for two things: (1) it is one of the oldest REITs in the world and (2) it was one of few REITs to not cut its dividend during the great financial crisis.

Both reflect very well on the quality of the management. This is a company that has been building shareholder value since 1968, survived every crisis, and paid dividends for 27 years in a row without interruptions.

MNR ranks #1 in total returns in its sector and in the Top 15 of all REIT sectors over the past 10 years. The focus has always been on consistent shareholder value creation with a disciplined approach over a full-market cycle.

Finally, MNR has a long history of being an outstanding corporate citizen. Management owns a substantial stake in the company and its corporate governance policies are often regarded as the gold standard.

“Blue-Chip” Characteristics are Overshadowed

As demonstrated above, MNR has the portfolio, balance sheet, and management of a blue-chip REIT. Yet, the company trades at a ~30% discount because all of this is overshadowed by two issues:

Fedex Concentration:

MNR targets properties that are heavily exposed to e-commerce. These are the properties that enjoy the fastest demand growth in the long run. However, it has led to rampant tenant concentration risk, particularly with Fedex Ground which makes up half of the company’s total annual rent.

The public market is punishing MNR for this concentration. It is quite interesting to us because private market investors would gladly pay a premium to have Fedex as their main tenant:

Fedex is a premier organization – operating a near oligopoly business with UPS (UPS).

It is a wide-moat business and duplicating its international transportation and logistics network is nearly impossible. Ray Merola has written a great article on how even Amazon is unlikely to ever become a significant threat.

It has an investment grade rating, healthy balance sheet and is stuck in long term leases with MNR.

It operates in a high growth industry. Short term issues are inevitable to any company, but the long-term outlook remains overwhelmingly positive.

Finally, Fedex leases Top-Class properties that are modern and well-located. Therefore, even if Fedex end up vacating some properties, we would not expect MNR to have significant issues releasing the space to other tenants. Industrial real estate is in high demand and Fedex occupies some of the best properties in the market.

We agree that tenant concentration is a risk to keep an eye on, but we believe that the market fails to realize that this concentrated exposure has also great advantages. We view the tenant concentration as a net positive because Fedex is one of the world’s largest and most successful e-commerce driven operations.

Securities Portfolio:

Secondly, the market does not like MNR’s securities portfolio. Today, 7% of MNR’s assets are invested in a diversified pool of REIT securities. We believe that the market is overreacting here because:

7% is not material to this thesis. We could value this portfolio at 0 and MNR would still be undervalued in our opinion.

Historically, the portfolio has outperformed REIT indexes during most time periods and served as a good source of liquidity.

MNR is the #1 ranked industrial REIT performer over the past 10 years. The market hates the securities portfolio, but the results are in the numbers, and it has worked out well for them.

The market argues that the securities portfolio is a distraction and poor use of capital. The management argues that it allows them to hold greater liquidity while earning a higher rate of return than on cash. (Keep in mind that the management is one of the largest shareholders of MNR so they are not just trying to play portfolio managers for fun…)

The truth is likely somewhere in the middle as there are positives and negatives to this approach, but to heavily discount the entire REIT because of this factor is unreasonable in our opinion.

The Market Had it Wrong (And Still Does)

It did not take too long for the market to realize that it was mispricing MNR. The shares are up by ~12% over the past seven months. In our initial thesis, we noted that MNR had 22-35% upside, so this would leave us another 10-23% of upside potential.

We believe however that this base case scenario underestimates the upside potential because the yield environment has materially changed. Our initial thesis was written in March when the 10-year treasury was at 2.7%. Today, the same yield is down to 1.9% - and the valuation of the income-producing investments has greatly expanded.

Back in March, we used a range of 17x to 18.5x FFO multiples as an estimate of fair value. We applied a healthy discount to the average of the sector (25x FFO) to account for the concentration risk and securities portfolio.

Today, we believe that 18.5x FFO would be on the low side and closer to 20x FFO would be where fair value is at. This suggests that there would still be 22-30% upside potential from the current share price:

In Fall of 2018, MNR traded for $17.51 when the 10-year treasury was at close to 3%. Today, the 10-year treasury is below 2% and so this upside case appears very realistic to us.

M&A activity has also sharply risen. Over the past months alone, the private equity giant Blackstone (BX) announced two massive acquisitions of Industrial portfolios:

There has never been this much capital chasing industrial properties before. Cap rates are now below 5% for quality assets and should MNR remain this discounted, we would not be surprised if it gained interest from private equity players.

Exceptional Risk-to-Reward

There are a lot of REITs offering higher dividend yields and greater upside potential than MNR. (A great example of that is MAC: click here for your thesis).

However, very few REITs offer a better combination of risk-to-reward than MNR. MNR is a lower risk REIT with defensive cash flow, conservative balance sheet and superior track record. To prove that to you, consider the two following charts:

During the great financial crisis, MNR held up very well when most other REITs were dropping like rocks:

MNR has maintained or increased its dividend for 27 years in a row. It did not even cut its dividend during the great financial crisis:

Despite being a defensive REIT with recession-proof income, it has the potential to generate very attractive total returns over the coming years. Expected returns can be roughly estimated with the following equation:

Dividend Yield + Cash Flow Growth + Repricing Return = Total Return

Relative to broader REIT indexes, MNR enjoys superior return prospects on all three fronts:

(1) Higher Dividend Yield: MNR currently pays a 4.6% dividend yield which compares favorably to the REIT indexes that yield ~3.5%.

(2) Higher Growth Rate: MNR has grown its AFFO per share by 14% per year over the past five years. This growth rate has recently slowed down due to temporary reasons – but the average remains well above the broader REIT market averages.

(3) Higher Upside in FFO Multiple Expansion: The broader REIT market trades today at 19x FFO and MNR’s direct peer group trades at 25x FFO. Priced at just ~15x FFO, MNR is relatively undervalued relative to its peer group.

Return Modeling:

We make conservative assumptions for the next three years:

No dividend increases.

3x lower growth rate than past five-year average.

Repricing to 20x FFO which is still ~20% below average.

Dividend yield: 4.6% per year

Growth rate: 5% per year

Repricing return: ~8% per year (15x FFO to 20x FFO in 3 years)

Total: 4.6% + 5% + 8% = 17.6% annual return potential

The correction of the mispricing over a 3-year period would result in significant outperformance and the company would still be priced at a discount to peers.

Bottom Line

MNR is our largest position because we believe that it combines lower risk with higher reward potential as compared to REIT indexes.

The dividend yield is above average, the growth rate is superior and there is a lot of room for FFO multiple expansion. At the same time, the company owns a sector-leading portfolio, is conservatively financed, and led by a management team that keeps buying more shares week after week:

MNR is up quite a bit since our initial investment, but we maintain a Strong Buy rating and expect to keep holding on to our outsized position for years to come.

We currently own a $5,804 position in MNR - representing ~7.5% of our Core Portfolio:

Good investing from your HYL Research Team,

Jussi Askola

Disclaimer: High Yield Landlord® ('HYL') is managed by Leonberg Capital - All rights are reserved. The newsletter is impersonal and does not provide individualized advice or recommendations for any specific subscriber or portfolio, as we do not have knowledge of the investor's individual circumstances. Subscribers/readers should not make any investment decision without conducting their own due diligence, and consulting their financial advisor about their specific situation.