PORTFOLIO UPDATE – February, 2024

PORTFOLIO REVIEW – February, 2024

Table of Content

Opening Notes

Notable Changes to Our Portfolio Holdings

Notable Changes to HYL Ratings

The Core Portfolio (Our Main Portfolio)

The Retirement Portfolio (Our Secondary Portfolio)

The International Portfolio (Our Optional Portfolio)

Closing Notes

1- Opening Notes

It is time for our annual performance review.

As a reminder, we intentionally share these only once or twice a year because we want you to think like a landlord, not like a trader.

Landlords earn steady rental income and wait patiently for long-term appreciation. That's how REIT investors should behave, but many end up fixating on daily charts and worry way too much about short-term noise.

We openly admit that we cannot time the market and have no clue how REITs will perform over the next month, quarter, or even year. All we know is that our selection of REITs is likely to outperform over a multi-year period so we want you to focus on the long-term prospects.

This is especially true in times like today.

The last two years have been brutal for REIT investors. Even following the recent rally, REITs are still down nearly 30% on average, and many of the smaller and lesser-known REITs in which we invest are down much more than that:

We are not immune to this volatility so our performance is also taking a hit over the short term. But despite that, our multi-year performance has remained relatively strong, all things considered.

We launched High Yield Landlord in August of 2018 and shortly after, we launched our real-money Core Portfolio and initially funded it with $50,000.

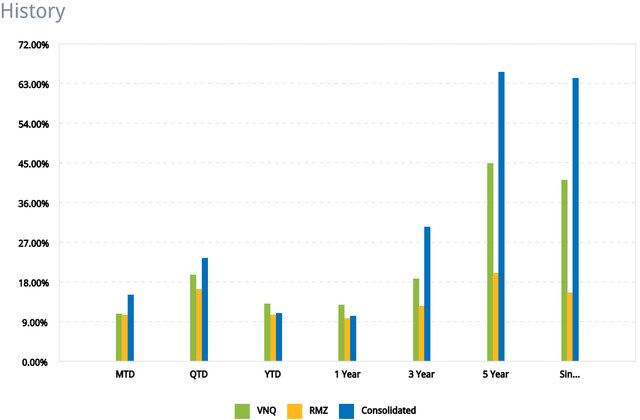

Since then, we have made many other additions, reinvested all dividends, and earned an 64.26% total return, which is roughly 1.5x more than what the Vanguard Real Estate ETF (VNQ) generated over this frame, and 4x more than the MSCI US REIT Index (RMZ). We compare our results to VNQ since it is the largest and most popular real estate ETF, but it also includes real estate companies such as brokers, property managers, and other service providers, and for this reason, most active managers compare their performance to a REIT benchmark such as the MSCI US REIT Index (RMZ):

For the sake of transparency, note that I also own one other account at Interactive Brokers, representing about 10% of my personal holdings. It was launched two years earlier in 2016 and holds today some of our international REIT recommendations. It is the only other account that I own in my name and so these two accounts represent 100% of my REIT holdings. The rest is owned by my company, Leonberg Captial. The results don't change materially if we go back to 2016:

(See other important disclaimers at the end of the article. Past performance is not indicative of future results.)

Again, keep in mind that this is the performance after the crash of the REIT sector. If we went back to before the crash, our performance would look quite a bit stronger, and I expect our performance metrics to improve substantially as the REIT market recovers.

Nonetheless, we remain ahead of our benchmarks even despite suffering some large losses in recent years.

There are many reasons for this.

For one, we avoided most office REITs, mortgage REITs, and externally managed REITs.

For two, we profited from a number of M&A transactions, including Tricon recently, but also American Campus Communities, STORE Capital, MNR Real Estate, and others.

For three, we maintained a well-diversified portfolio, which mitigated the impact of our biggest losers.

Finally, we bet big on our highest conviction holdings, and those generally did a lot better than the average of the REIT sector.

Essential Properties Realty Trust (EPRT) has been our largest holding since September of 2022. Our position size is nearly 2x larger than our other "large" holings and it has massively outperformed the rest of the REIT sector:

STORE Capital (STOR) was our largest holding until September of 2022 and it also massively outperformed the average of the REIT sector during the the duration of our investment:

VICI Properties (VICI) was our next largest holding for most of 2022, and it earned a 13% total return in 2022 even as most other REITs collapsed in value.

EPR Properties (EPR) was our third largest holding for most of the past 2 years, and it also did far better than the average of the REIT sector:

So most of our big investments did relatively well, but those of course get little attention. Our losers, on the other hand, are taking much more of our focus, and we have had quite a few of them in recent years.

The big one was Medical Properties Trust (MPW), which cost us a lot of performance.

Will it recover from here?

We like our odds, but we have been wrong so far.

This is also a good reminder that we shouldn't expect to only have winners. We take risks to earn returns, and at times, those risk factors will play out, and at other times, we will also make mistakes.

Legendary investor Howard Marks talked about this in a recent interview. He said that:

"Because of the imprecision, you fail a lot... Warren Buffett always talks about Ted Williams who batted 400. That means 60% of the time, he was out. The great investors are right 60% of the time, maybe 70-80% of the time. If you are the kind of investor who needs to be right 100% of the time, you shouldn't be in investing."

The goal is to have more winners than losers (relative to your benchmark) and so far, we have succeeded at that and this explains why our portfolio is pulling ahead.

The last years have been rough for REIT investors but at the exception of a few companies that may face permanent losses, we think that most of this is temporary, and as REITs recover, our performance should materially improve in the coming years.

These are not just empty words as I have around 50% of my net worth invested in the REITs that we highlight at High Yield Landlord and I continue to accumulate more of them every month that passes.

While I can't predict how our portfolio will do in any given month, quarter, or even year, I think that it is well-positioned to compound at 12-15% per year in the long run.

Just by combining the yield and the growth, our portfolio should return 8-12% in most years, and if you then add some upside from correctly selecting undervalued companies, we should be able to push that closer to 15% on average.

To take the example of EPR Properties (EPR): It pays an 8% dividend yield, has a path to ~5% annual growth, and should experience multiple expansion, adding another ~5% per year over the next 3-5 years as its market sentiment gradually improves. So EPR has a clear path to ~15-20% annual returns and it is by no means an exception:

Dividend yield: ~8%

Cash flow growth: ~5%

Appreciation from FFO multiple expansion: ~5%

Total Return: ~15-20% per year

Assuming that a handful of our positions materially underperform our expectations, we should still end up earning 12-15% annual returns in the long run and we would be happy with that.

But that's not an easy task.

We invest heavily in our research and we will only double down on our efforts in 2024 to make sure that we don't miss out on any potential opportunities.

We expect to soon present 1-2 new investment opportunities that I have been researching. We are still done with our due diligence, but as we make any new investment decisions, you will be the first to know. Stay tuned for our next “TRADE ALERTS” and if we can help with anything in the meantime, please let us know!

2- Notable Changes to Our Portfolio Holdings

Exclusive to members of High Yield Landlord

3- Notable Changes to The HYL Ratings

Exclusive to members of High Yield Landlord

4- The Core Portfolio (Our Main Portfolio)

Exclusive to members of High Yield Landlord

5- The Safe-Haven Portfolio (Our Secondary Portfolio)

Exclusive to members of High Yield Landlord

6- The International Portfolio (Our Optional Portfolio)

Exclusive to members of High Yield Landlord

Ready to get started? Join Us Today Before The Price Increase!

We are currently sharing all our Top Picks with members of High Yield Landlord, and you can get access to them for free with our 2-week free trial! We are so confident in what we offer that we allow you to join us and decide within your free trial whether this service is something for you or not.

Relevant disclosure to presented performance: past performance is not indicative of future results. Our portfolio may not be perfectly comparable to the relevant index. It is more concentrated, includes international REITs, and may at times invest in companies that are not typically included in REIT indexes. The performance of our portfolio is underrepresented because it is affected by withholding taxes on all dividends. At times, I may temporarily use margin if I am missing cash to executive new purchases. It is a consolidation of two accounts that I own personally: the Core Portfolio, which makes up about 90% of the capital, and a separate account, which includes some of my international REIT investments. The data is provided by Interactive Brokers and is believed to be correct, but its accuracy cannot be guaranteed and has not been audited. Time periods: 10/23/2018 - 28/12/2023 for the first chart & 11/09/2016 - 28/12/2023 for the second chart. High Yield Landlord® ('HYL') is managed by Leonberg Capital - All rights are reserved. The newsletter is impersonal and does not provide individualized advice or recommendations for any specific subscriber or portfolio, as we do not have knowledge of the investor's individual circumstances. Subscribers/readers should not make any investment decision without conducting their own due diligence, and consulting their financial advisor about their specific situation. The information is obtained from sources believed to be reliable, but its accuracy cannot be guaranteed. The opinions expressed are those of the publisher and are subject to change without notice.